This version of the form is not currently in use and is provided for reference only. Download this version of

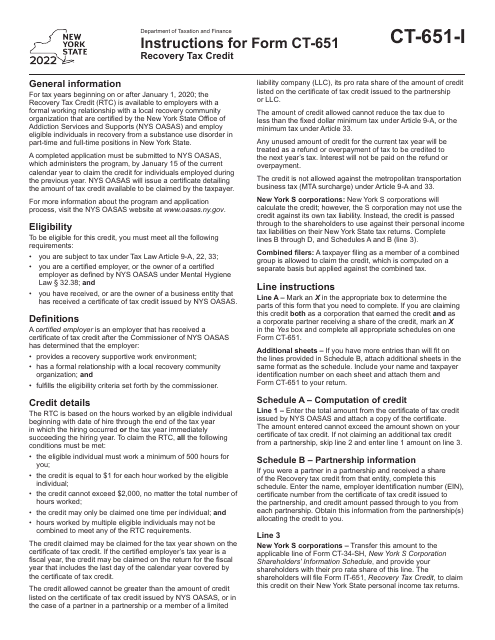

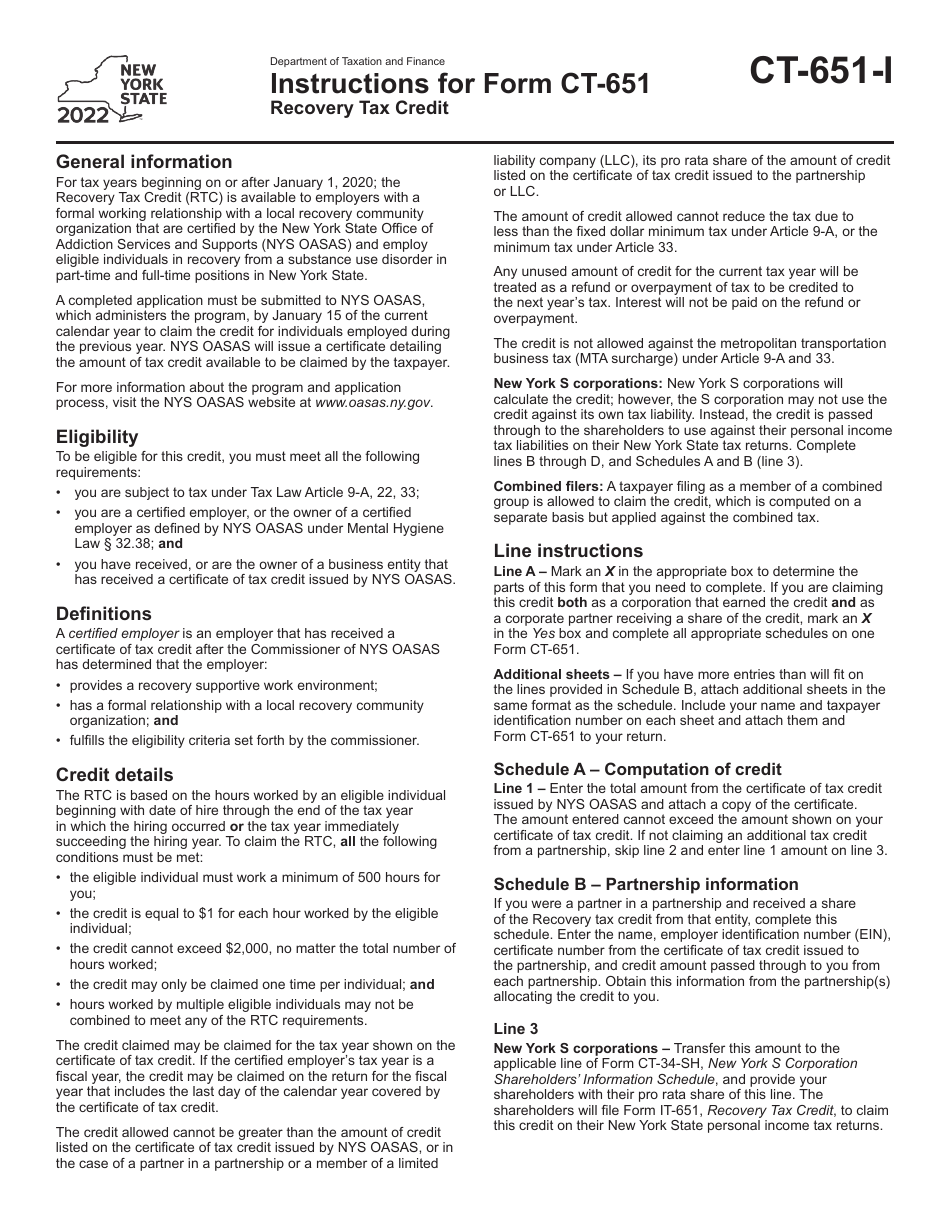

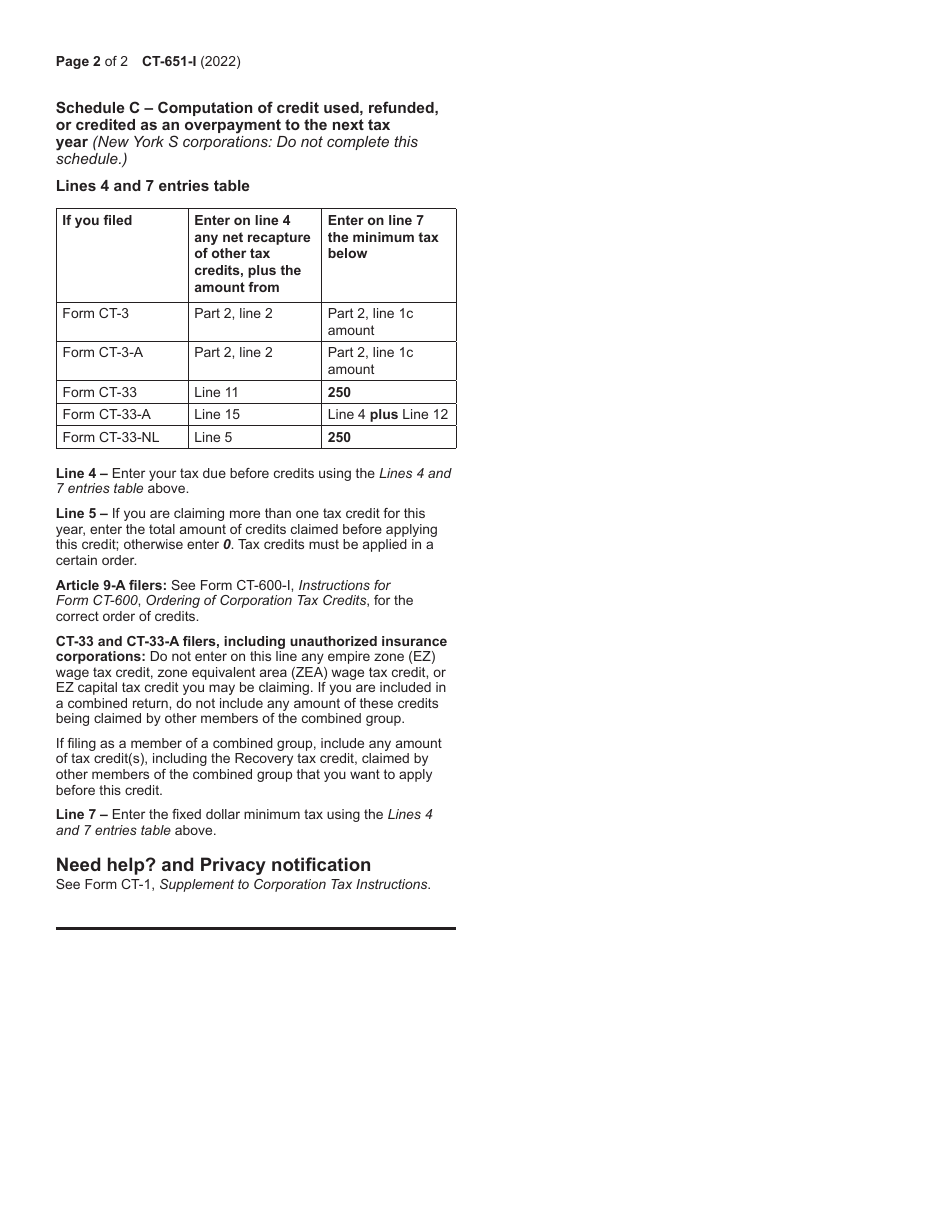

Instructions for Form CT-651

for the current year.

Instructions for Form CT-651 Recovery Tax Credit - New York

This document contains official instructions for Form CT-651 , Recovery Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-651 is available for download through this link.

FAQ

Q: What is Form CT-651 Recovery Tax Credit?

A: Form CT-651 Recovery Tax Credit is a form used in New York to claim a tax credit for recovery of certain assessment costs.

Q: Who can file Form CT-651 Recovery Tax Credit?

A: Property owners in New York who have incurred assessment costs as a result of a major disaster or emergency can file Form CT-651 to claim the recovery tax credit.

Q: What is the purpose of Form CT-651 Recovery Tax Credit?

A: The purpose of Form CT-651 Recovery Tax Credit is to provide financial relief to property owners in New York who have incurred assessment costs due to a major disaster or emergency.

Q: What expenses can be claimed on Form CT-651 Recovery Tax Credit?

A: Expenses that can be claimed on Form CT-651 Recovery Tax Credit include costs incurred for assessment work, engineering evaluations, and necessary repairs or modifications to damaged property.

Q: How do I fill out Form CT-651 Recovery Tax Credit?

A: To fill out Form CT-651 Recovery Tax Credit, you will need to provide information about the property, the assessment costs incurred, and any insurance reimbursement received. You must also attach supporting documentation.

Q: When is the deadline to file Form CT-651 Recovery Tax Credit?

A: The deadline to file Form CT-651 Recovery Tax Credit is usually within one year from the date of the disaster or emergency declaration.

Q: Is there a limit on the amount of tax credit that can be claimed?

A: Yes, there is a limit on the amount of tax credit that can be claimed. The maximum credit amount for each property is $750,000.

Q: Is Form CT-651 Recovery Tax Credit specific to New York?

A: Yes, Form CT-651 Recovery Tax Credit is specific to New York and cannot be used for claiming recovery tax credits in other states.

Q: Can I claim the recovery tax credit if I have already received insurance reimbursement?

A: Yes, you can still claim the recovery tax credit on Form CT-651 even if you have received insurance reimbursement. However, you will need to report the amount of reimbursement received.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.