This version of the form is not currently in use and is provided for reference only. Download this version of

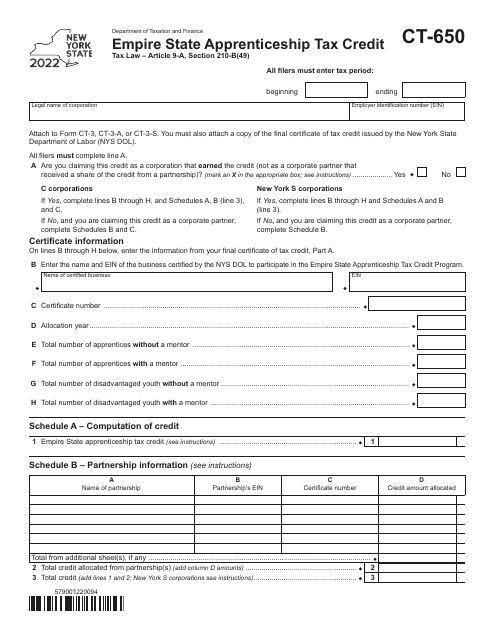

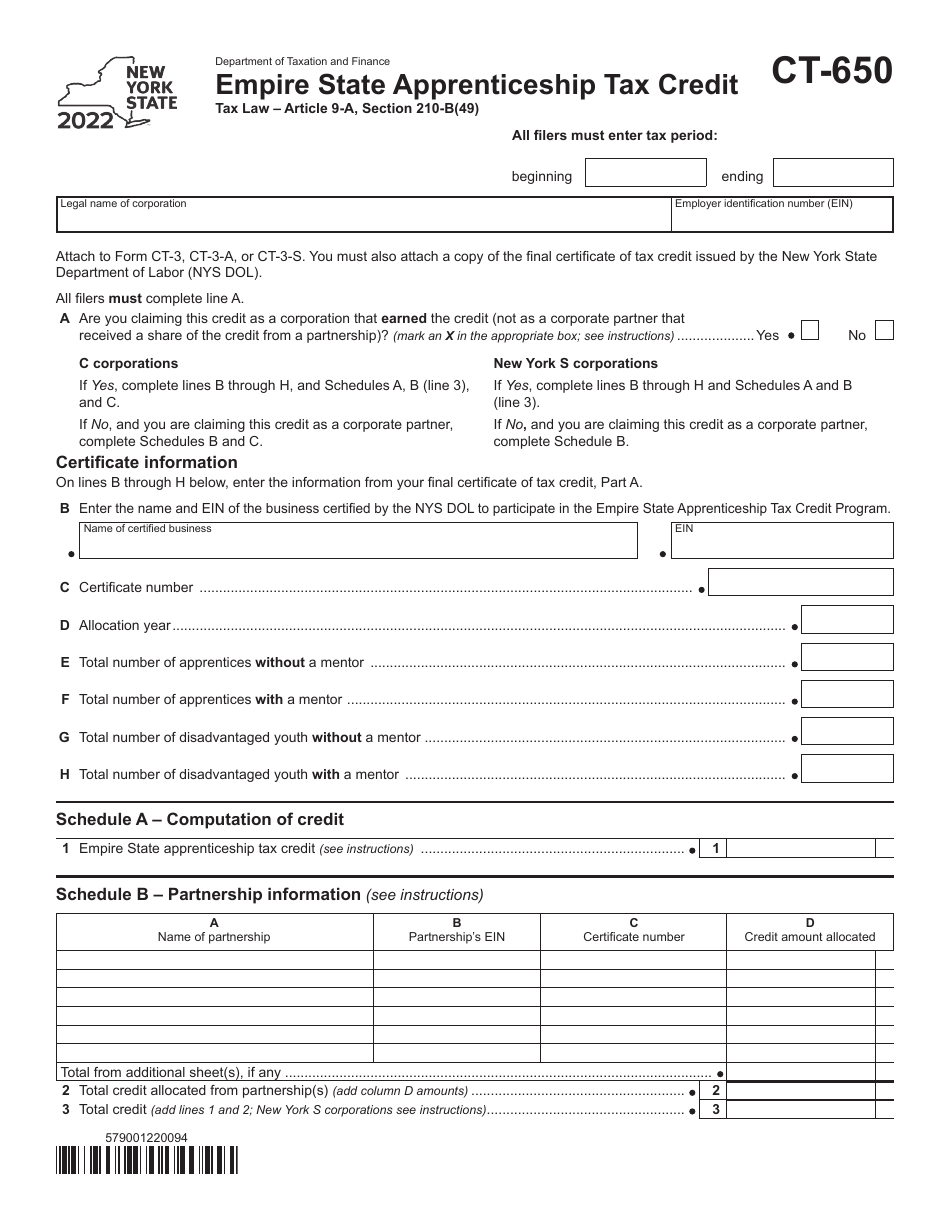

Form CT-650

for the current year.

Form CT-650 Empire State Apprenticeship Tax Credit - New York

What Is Form CT-650?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-650?

A: Form CT-650 is the official tax form used in New York to claim the Empire State Apprenticeship Tax Credit.

Q: What is the Empire State Apprenticeship Tax Credit?

A: The Empire State Apprenticeship Tax Credit is a tax credit available to businesses in New York that hire eligible apprentices.

Q: Who is eligible for the Empire State Apprenticeship Tax Credit?

A: Businesses in New York that hire qualified apprentices registered with the New York State Department of Labor are eligible for the tax credit.

Q: How much is the Empire State Apprenticeship Tax Credit?

A: The amount of the tax credit varies depending on the wages paid to eligible apprentices. The credit can be up to $2,000 per apprentice per year.

Q: When is the deadline to file Form CT-650?

A: The deadline to file Form CT-650 is the same as the deadline for filing the business tax return, which is usually March 15th for calendar year filers.

Q: Are there any other requirements to claim the Empire State Apprenticeship Tax Credit?

A: In addition to hiring eligible apprentices and completing Form CT-650, businesses must also meet certain additional criteria specified by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-650 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.