This version of the form is not currently in use and is provided for reference only. Download this version of

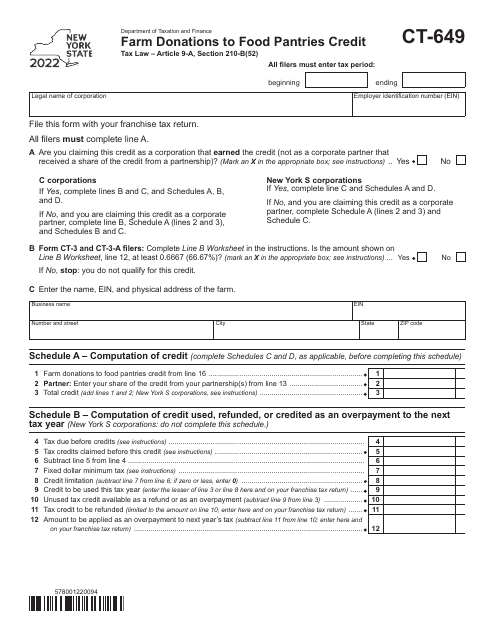

Form CT-649

for the current year.

Form CT-649 Farm Donations to Food Pantries Credit - New York

What Is Form CT-649?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-649?

A: Form CT-649 is a tax form used in New York.

Q: What does Form CT-649 help with?

A: Form CT-649 helps taxpayers claim the Farm Donations to Food Pantries Credit.

Q: Who is eligible for the Farm Donations to Food Pantries Credit?

A: Farmers in New York who donate food to eligible food pantries are eligible for this credit.

Q: What is the purpose of the credit?

A: The purpose of the credit is to incentivize food donations from farmers to help local food pantries.

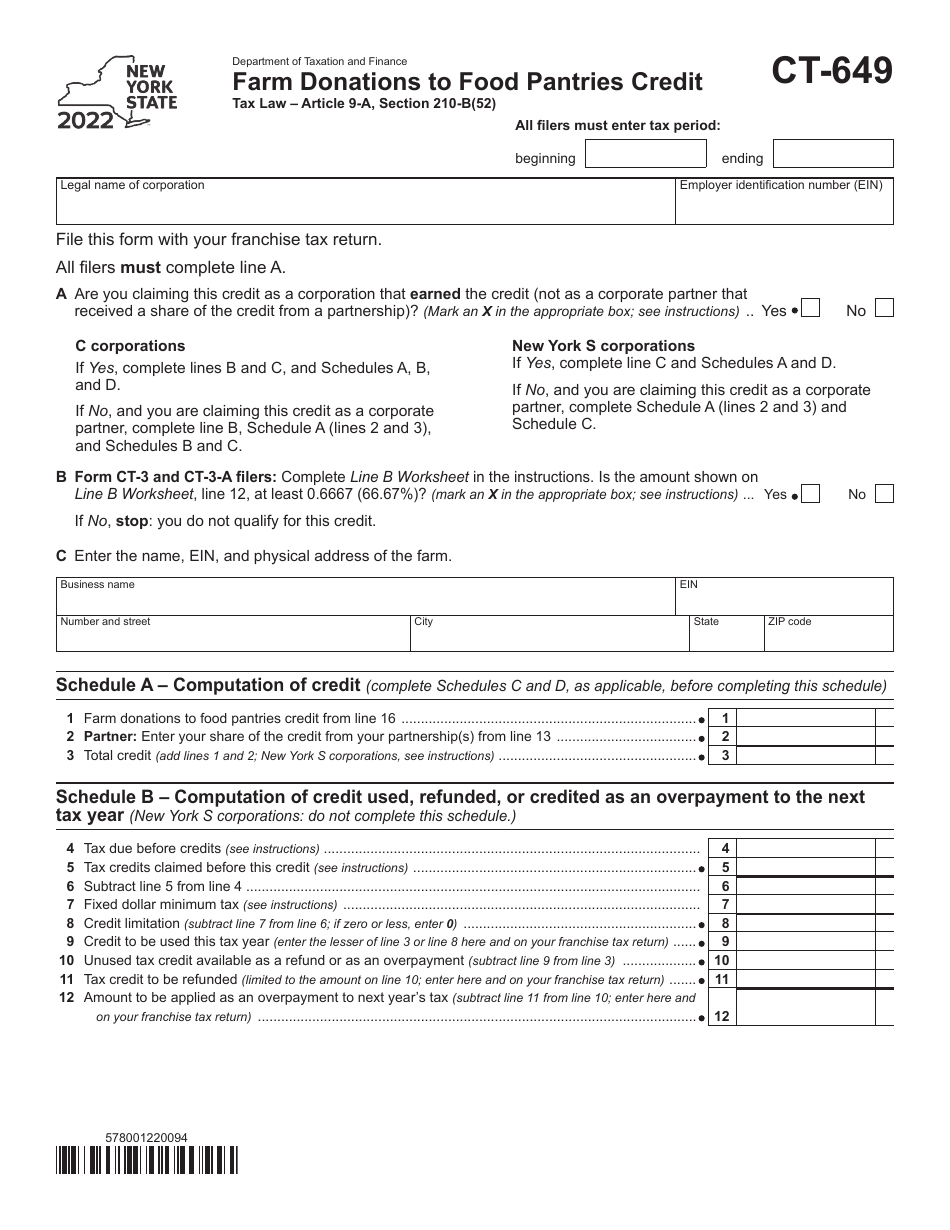

Q: How much is the credit?

A: The credit is equal to 25% of the fair market value of the donated food, up to $5,000 per taxpayer.

Q: Are there any requirements for the donated food?

A: Yes, the donated food must be fresh, wholesome, and fit for human consumption.

Q: Are all food pantries eligible for the credit?

A: No, only food pantries that are exempt from taxation under Section 501(c)(3) of the Internal Revenue Code are eligible.

Q: How do I claim the credit?

A: To claim the credit, you must complete and attach Form CT-649 to your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-649 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.