This version of the form is not currently in use and is provided for reference only. Download this version of

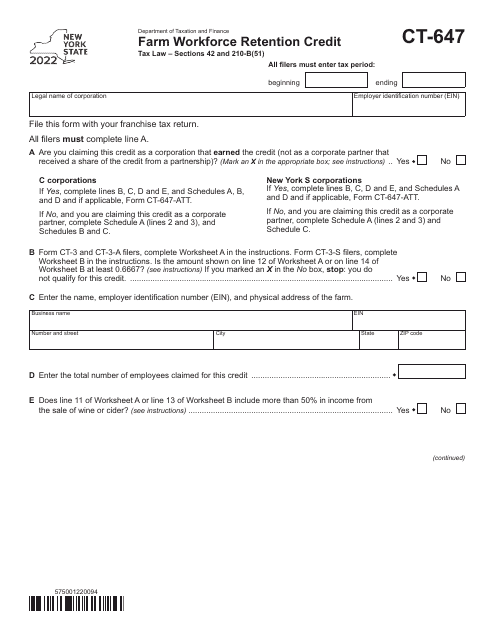

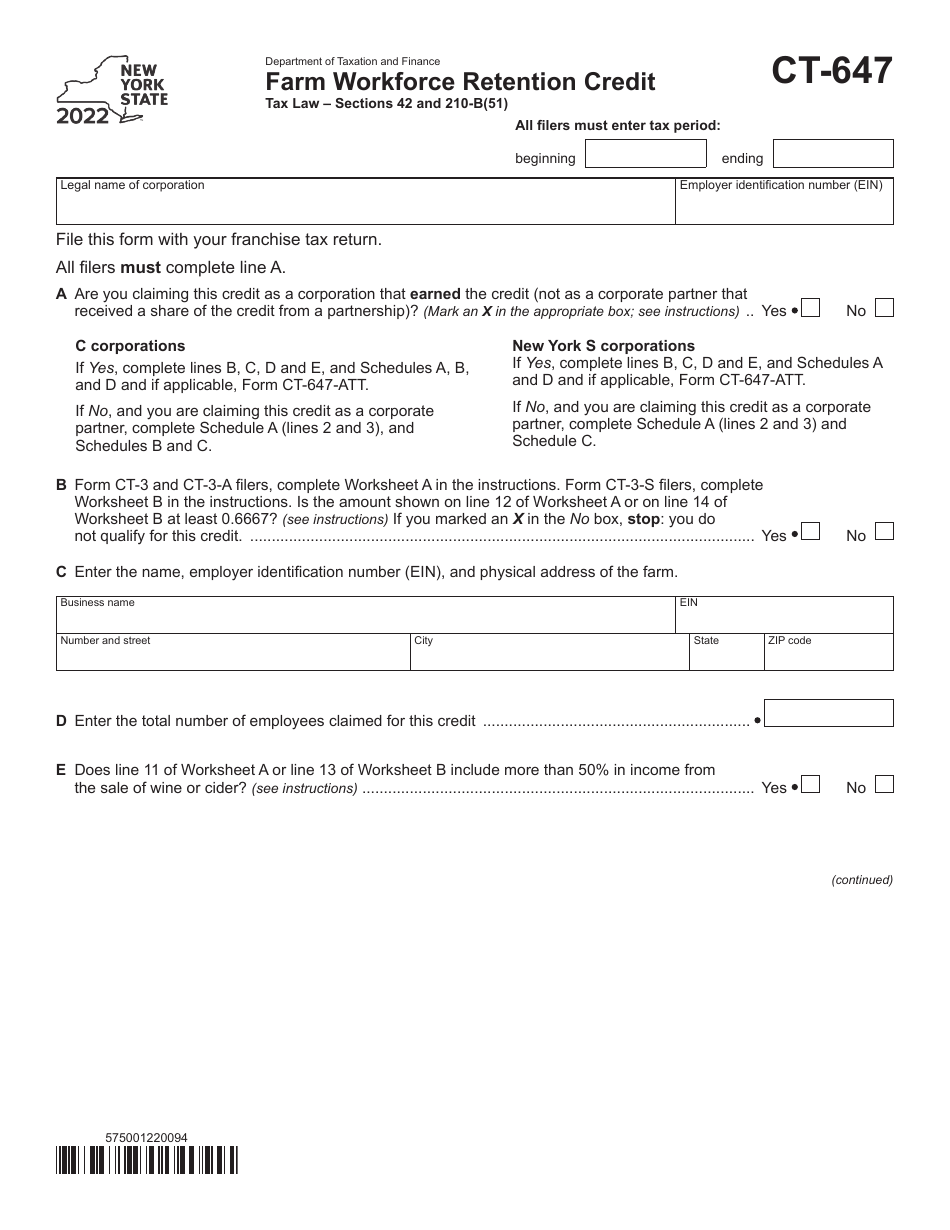

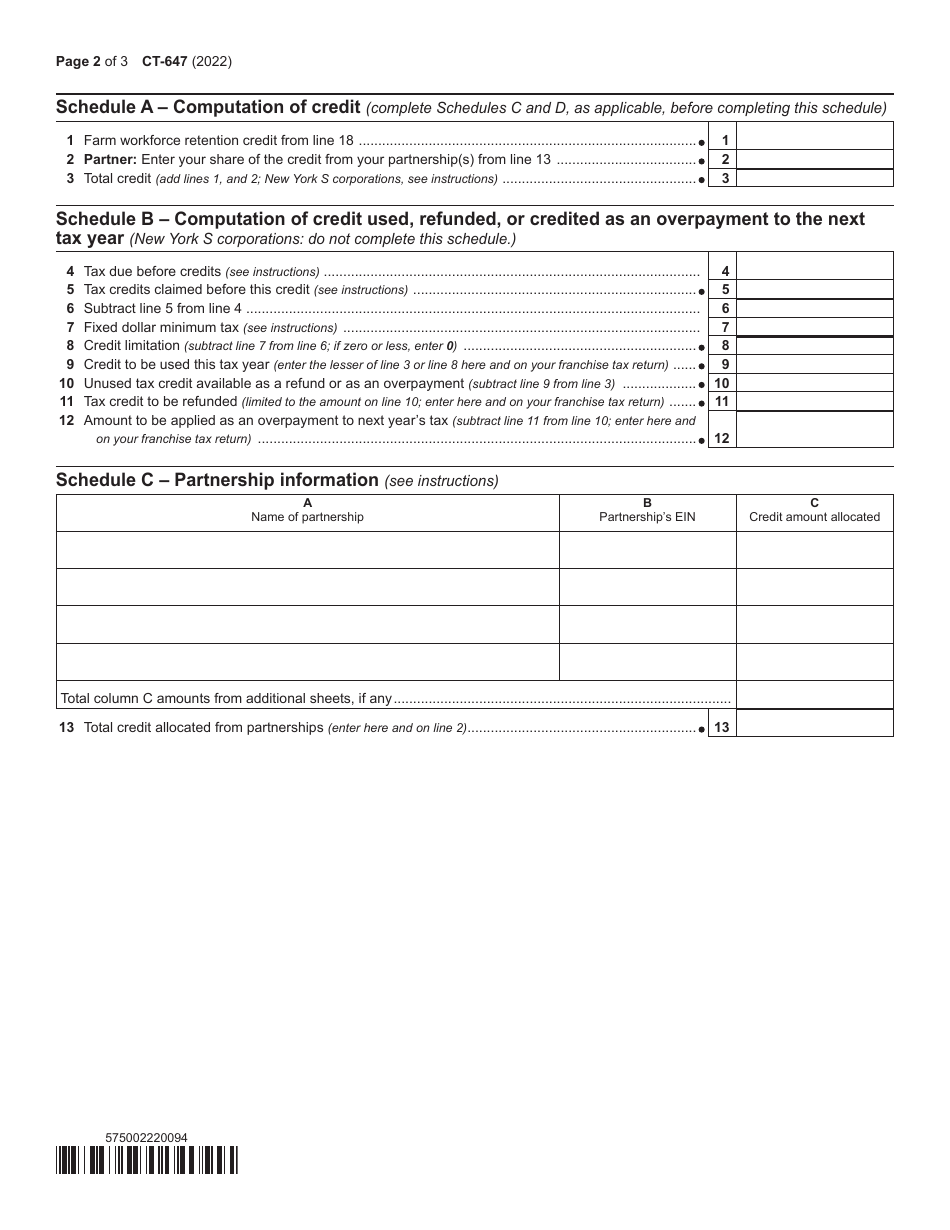

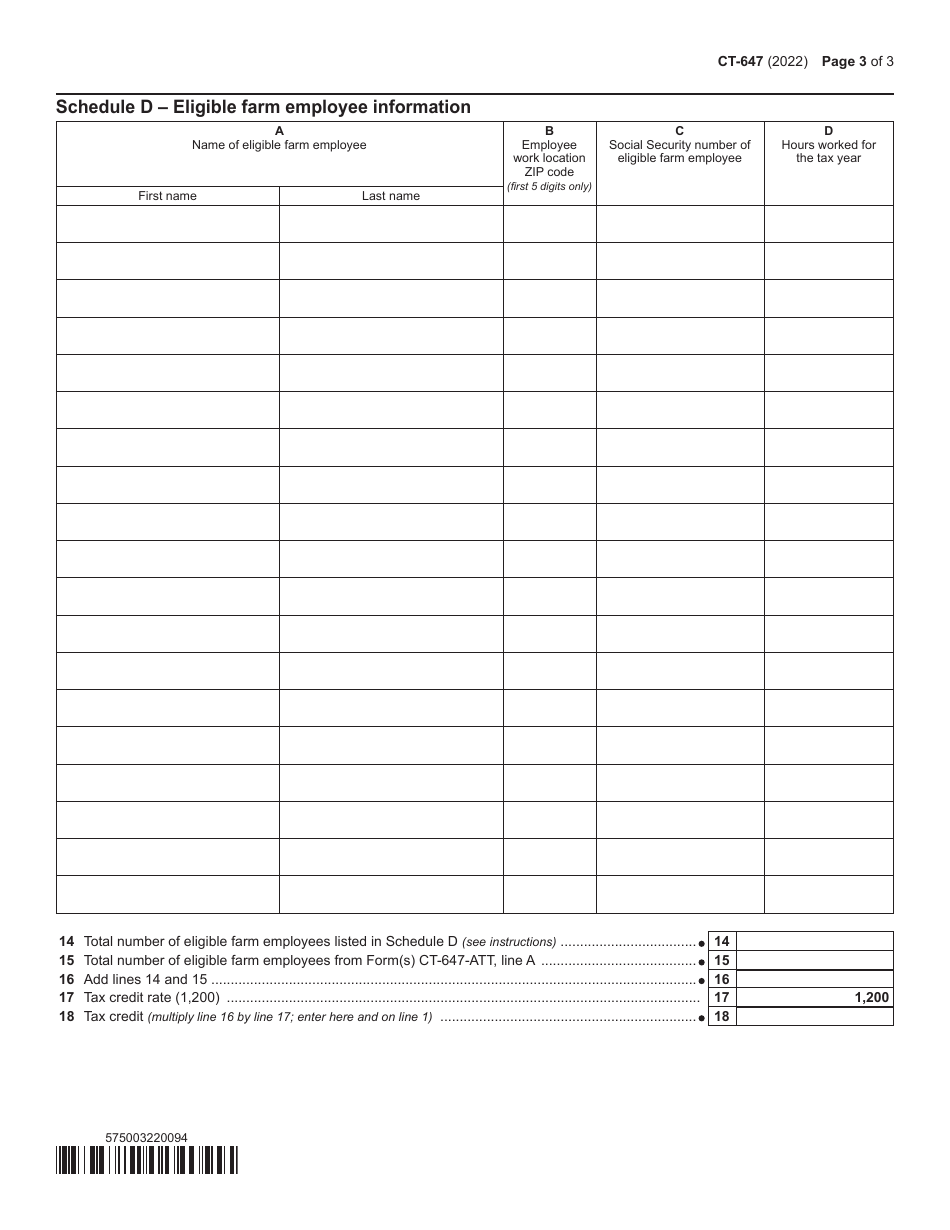

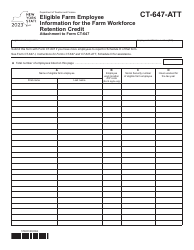

Form CT-647

for the current year.

Form CT-647 Farm Workforce Retention Credit - New York

What Is Form CT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-647?

A: Form CT-647 is the Farm Workforce Retention Credit form for New York.

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to eligible farm employers in New York.

Q: Who is eligible for the Farm Workforce Retention Credit?

A: Farm employers in New York who meet certain requirements are eligible for the credit.

Q: What is the purpose of the Farm Workforce Retention Credit?

A: The credit aims to provide financial assistance to farm employers to help retain their workforce.

Q: How can I claim the Farm Workforce Retention Credit?

A: To claim the credit, you must complete and submit Form CT-647 to the New York State Department of Taxation and Finance.

Q: Are there any specific requirements or criteria for claiming the credit?

A: Yes, there are specific criteria and requirements that farm employers must meet to be eligible for the credit. These are outlined in the instructions for Form CT-647.

Q: Is there a deadline for filing Form CT-647?

A: Yes, the form must be filed by the due date of the farm employer's New York State income tax return, including extensions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.