This version of the form is not currently in use and is provided for reference only. Download this version of

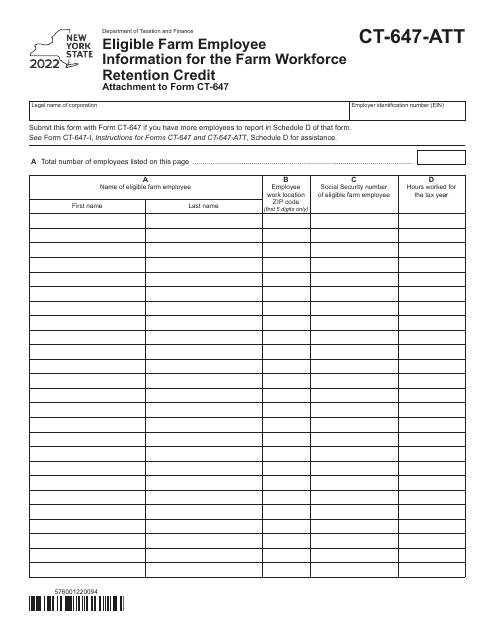

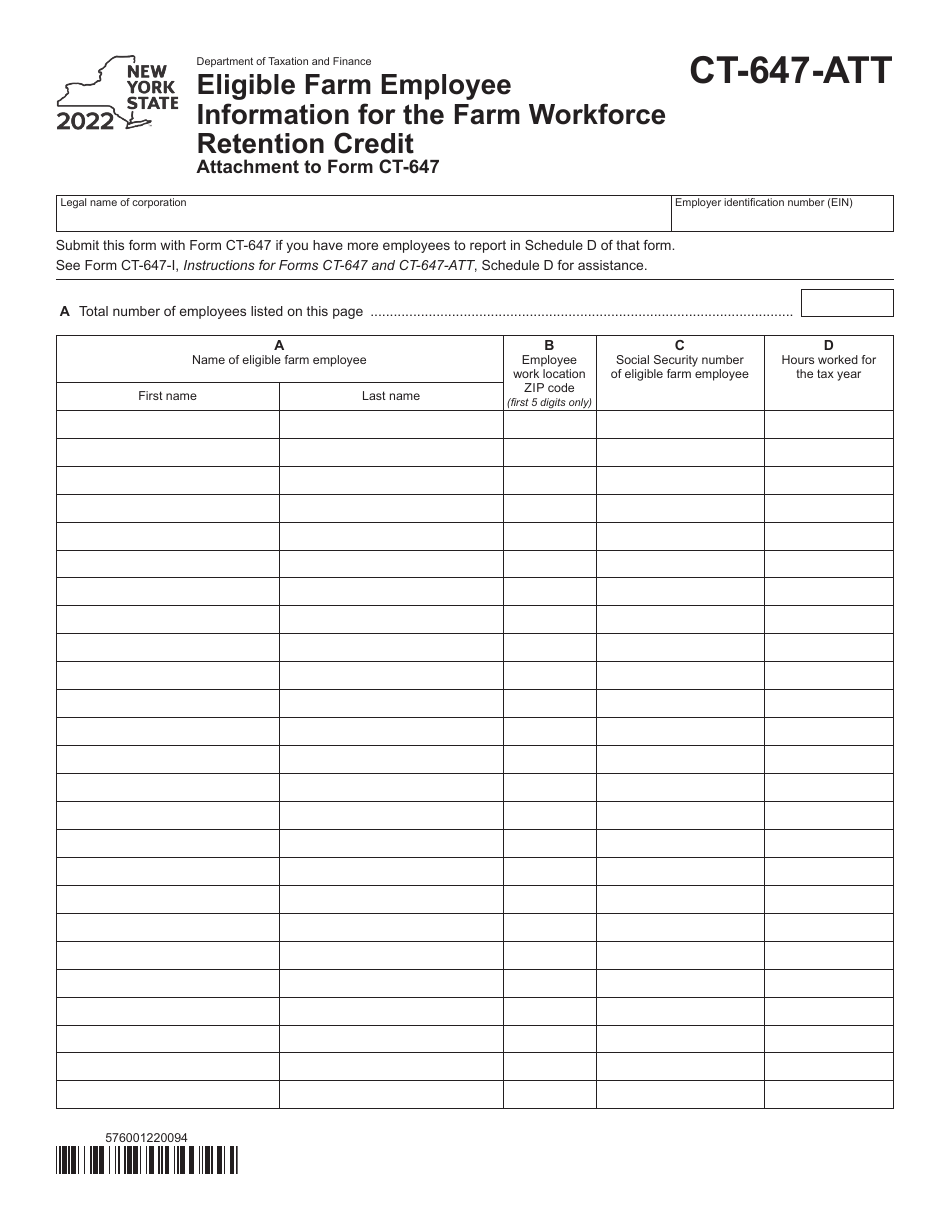

Form CT-647-ATT

for the current year.

Form CT-647-ATT Eligible Farm Employee Information for the Farm Workforce Retention Credit - New York

What Is Form CT-647-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-647-ATT?

A: Form CT-647-ATT is the Eligible Farm Employee Information for the Farm Workforce Retention Credit for New York.

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a credit available to eligible farms in New York to help offset the costs of retaining their workforce.

Q: Who is eligible for the Farm Workforce Retention Credit?

A: Eligible farms in New York are eligible for the Farm Workforce Retention Credit.

Q: What information is required on Form CT-647-ATT?

A: Form CT-647-ATT requires information on eligible farm employees, including their names, social security numbers, and employment dates.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-647-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.