This version of the form is not currently in use and is provided for reference only. Download this version of

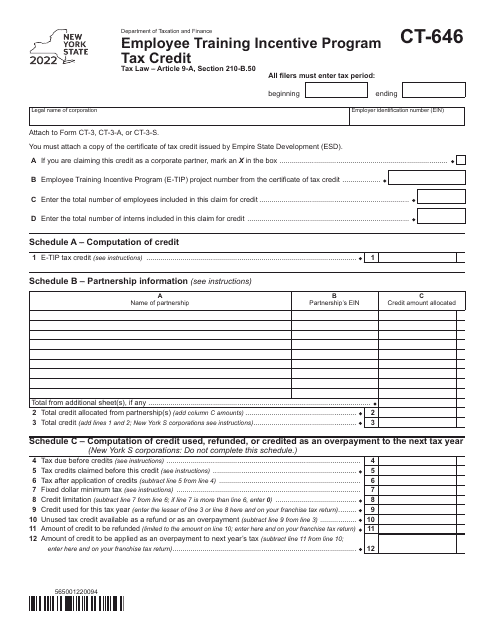

Form CT-646

for the current year.

Form CT-646 Employee Training Incentive Program Tax Credit - New York

What Is Form CT-646?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form CT-646?

A: Form CT-646 is the Employee Training Incentive Program Tax Credit form in New York.

Q: What is the Employee Training Incentive Program Tax Credit?

A: The Employee Training Incentive Program Tax Credit is a program in New York that provides tax credits to businesses that incur costs for employee training.

Q: Who is eligible for the Employee Training Incentive Program Tax Credit?

A: Businesses in New York that provide eligible employee training programs are eligible for this tax credit.

Q: What can businesses claim as eligible employee training programs?

A: Eligible employee training programs include apprenticeships, internship programs, on-the-job training, and other approved training programs.

Q: How much is the tax credit?

A: The tax credit can be up to 50% of eligible training program costs, up to a maximum of $10,000 per employee per year.

Q: How can businesses claim the tax credit?

A: Businesses can claim the tax credit by completing Form CT-646 and attaching it to their New York State tax return.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the tax credit, including a $10 million annual cap and a $10,000 limit per employee per year.

Q: Is there a deadline to file Form CT-646?

A: Yes, the form must be filed within three years from the end of the tax year in which the training program expenses were incurred.

Q: Can businesses claim this tax credit every year?

A: Yes, businesses can claim the tax credit for each tax year in which they incur eligible training program expenses.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-646 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.