This version of the form is not currently in use and is provided for reference only. Download this version of

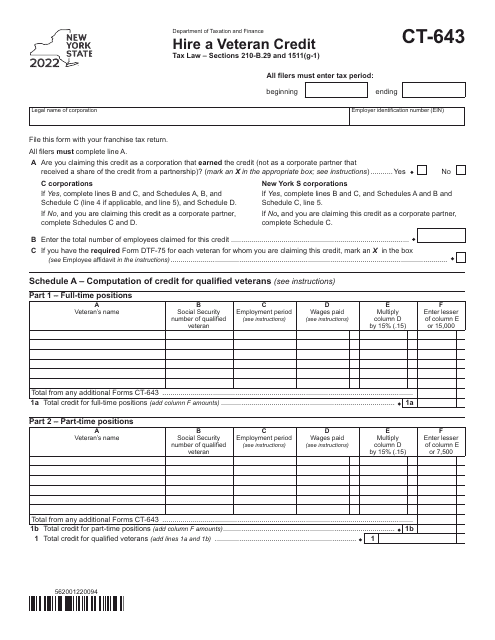

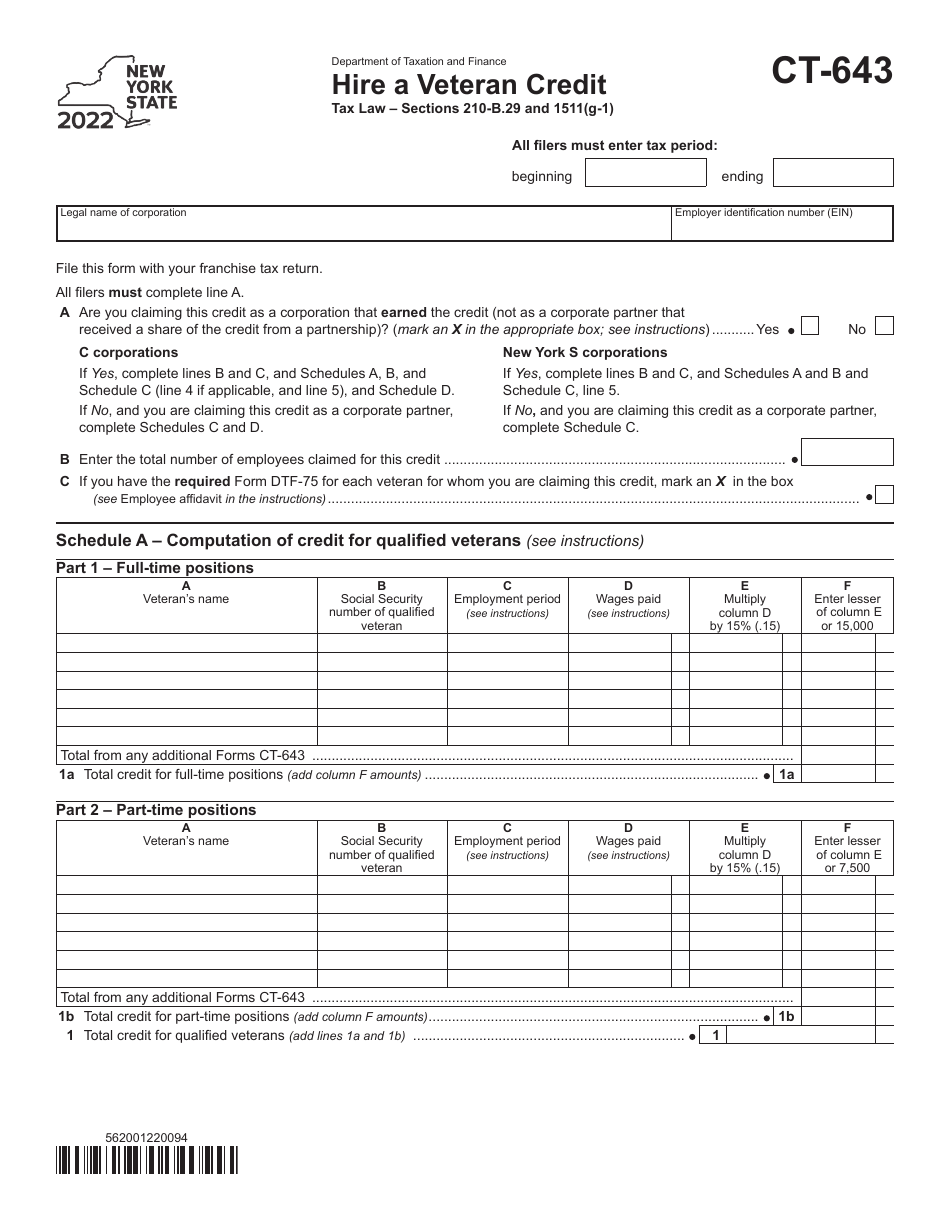

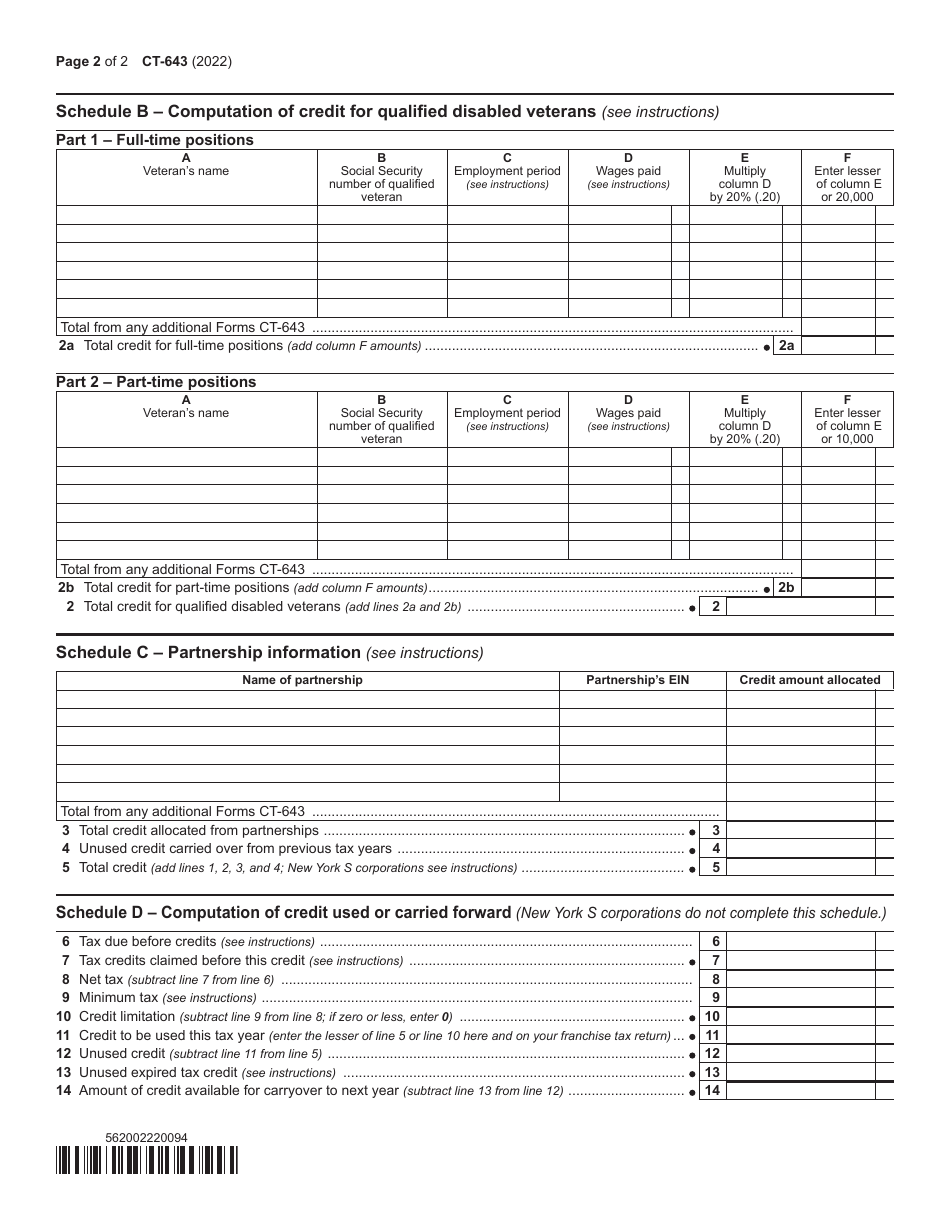

Form CT-643

for the current year.

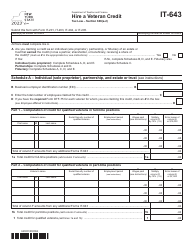

Form CT-643 Hire a Veteran Credit - New York

What Is Form CT-643?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-643?

A: Form CT-643 is a tax form used in the state of New York to claim the Hire a Veteran Credit.

Q: Who can claim the Hire a Veteran Credit?

A: Businesses in New York that have hired eligible veterans can claim the Hire a Veteran Credit.

Q: What is the purpose of the Hire a Veteran Credit?

A: The purpose of the Hire a Veteran Credit is to encourage businesses to hire qualified veterans and provide them with employment opportunities.

Q: How much is the credit?

A: The credit is equal to 10% of the wages paid to eligible veterans during the tax year, up to a maximum of $5,000 per veteran.

Q: What are the eligibility requirements for veterans?

A: To be eligible, a veteran must have served on active duty in the U.S. Armed Forces for at least 181 consecutive days or have been discharged or released from active duty due to a service-connected disability.

Q: How do I claim the Hire a Veteran Credit?

A: To claim the credit, you need to complete Form CT-643 and attach it to your New York state tax return.

Q: Is there a deadline to claim the credit?

A: Yes, the deadline to claim the credit is the same as the deadline to file your New York state tax return.

Q: Are there any other requirements or considerations?

A: Yes, there may be additional requirements or considerations depending on your specific situation. It's recommended to consult with a tax professional or refer to the official instructions for Form CT-643.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-643 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.