This version of the form is not currently in use and is provided for reference only. Download this version of

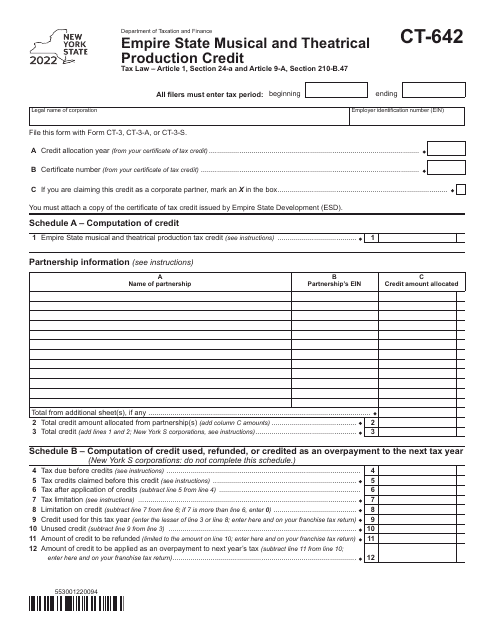

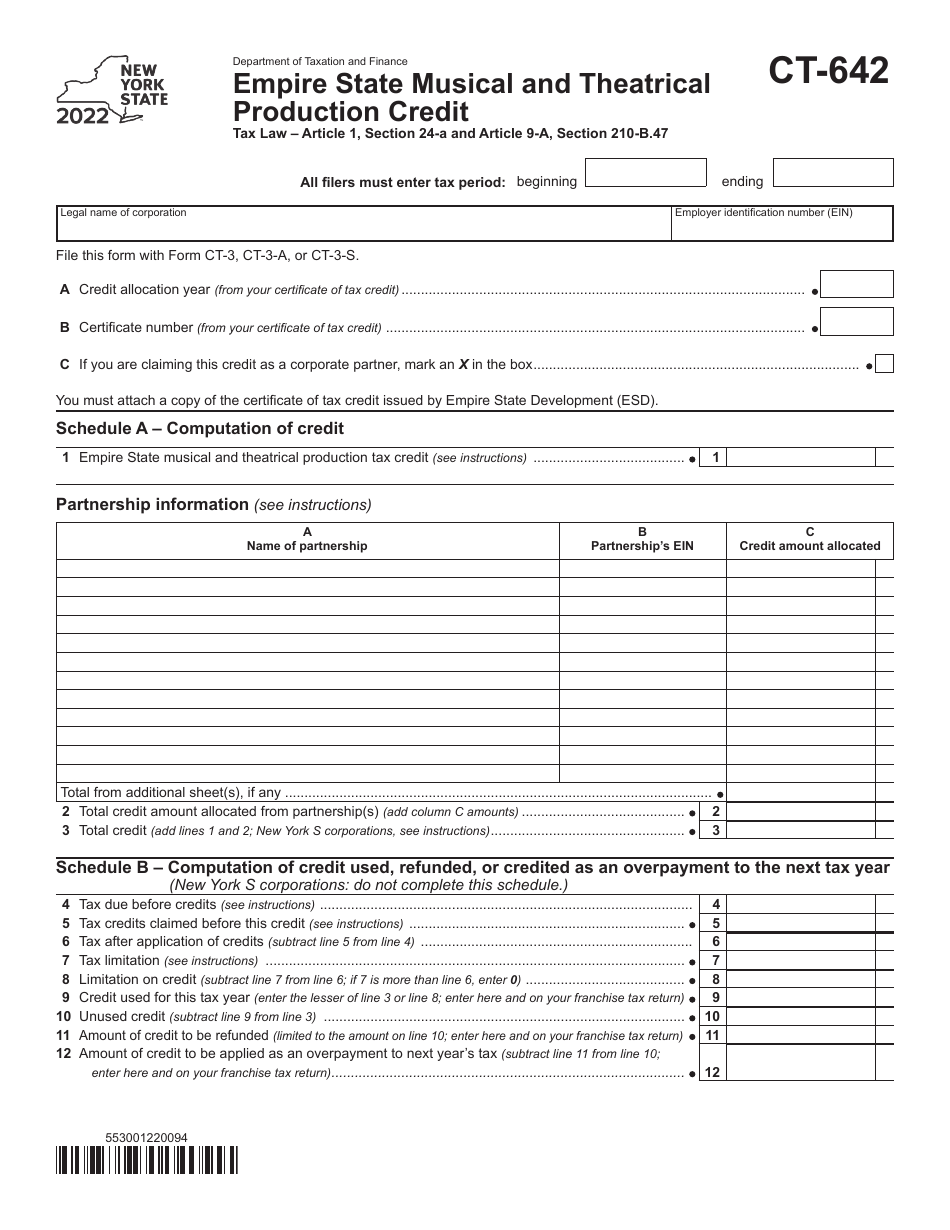

Form CT-642

for the current year.

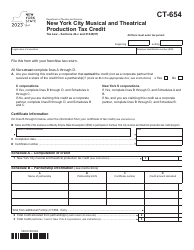

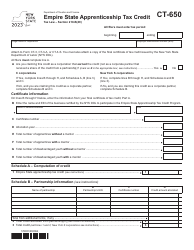

Form CT-642 Empire State Musical and Theatrical Production Credit - New York

What Is Form CT-642?

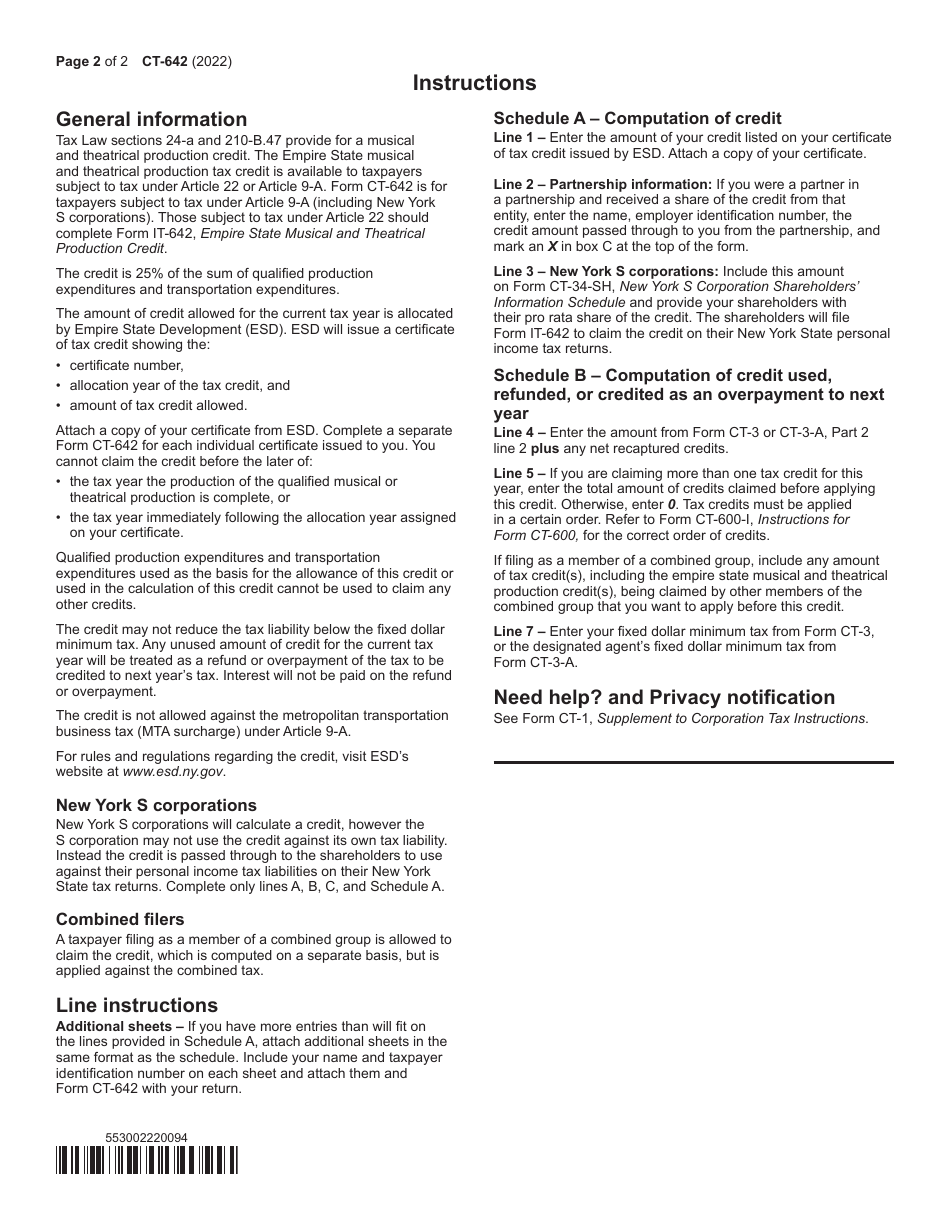

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-642?

A: Form CT-642 is the Empire State Musical and Theatrical Production Credit for New York.

Q: What is the purpose of Form CT-642?

A: The purpose of Form CT-642 is to claim the Empire State Musical and Theatrical Production Credit for eligible production companies in New York.

Q: Who is eligible to claim the Empire State Musical and Theatrical Production Credit?

A: Eligible production companies, including film, television, and commercial production companies, are able to claim the Empire State Musical and Theatrical Production Credit.

Q: What expenses are eligible for the Empire State Musical and Theatrical Production Credit?

A: Expenses related to the production of qualified musical and theatrical productions in New York are eligible for the credit.

Q: How much is the Empire State Musical and Theatrical Production Credit?

A: The credit is equal to a percentage of qualified production costs incurred in New York, up to a maximum credit amount.

Q: How do I file Form CT-642?

A: Form CT-642 must be filed with the New York State Department of Taxation and Finance along with the required supporting documentation.

Q: Are there any deadlines for filing Form CT-642?

A: Yes, the form must be filed within the time specified on the form or within the extended due date granted by the Department of Taxation and Finance.

Q: Can the Empire State Musical and Theatrical Production Credit be carried forward or refunded?

A: Yes, any unused credit can be carried forward for up to three years, or it may be eligible for a refund under certain circumstances.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-642 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.