This version of the form is not currently in use and is provided for reference only. Download this version of

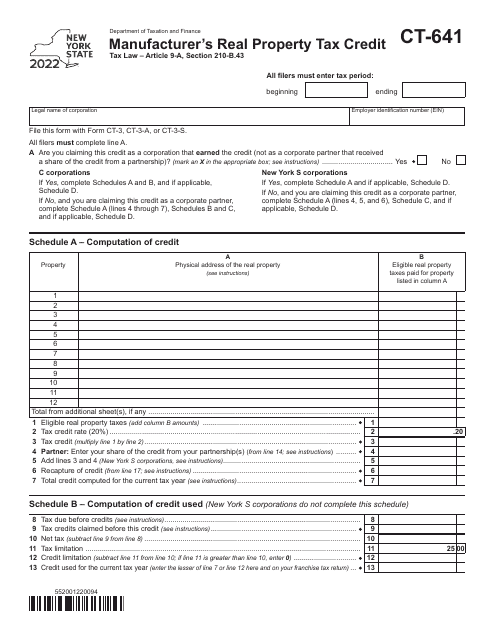

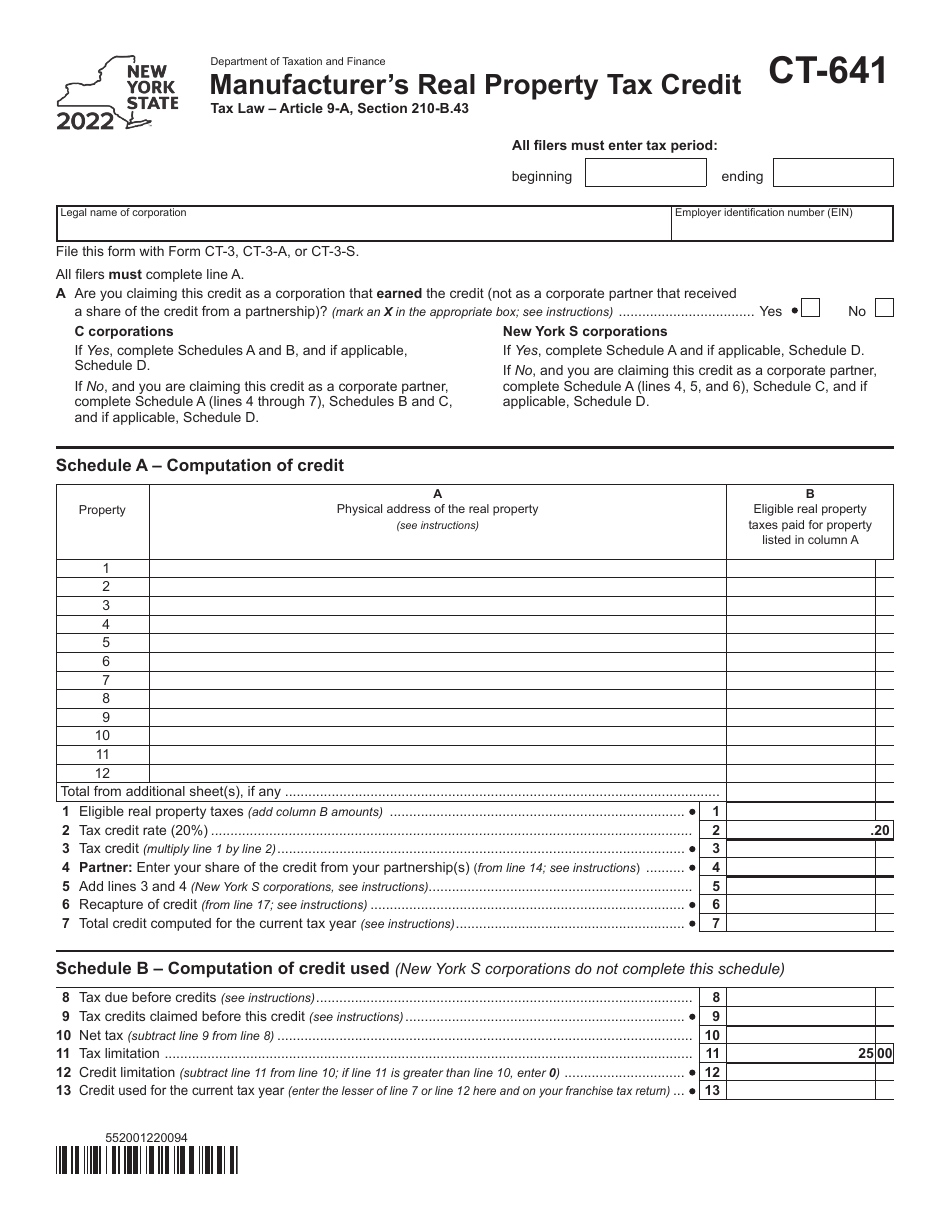

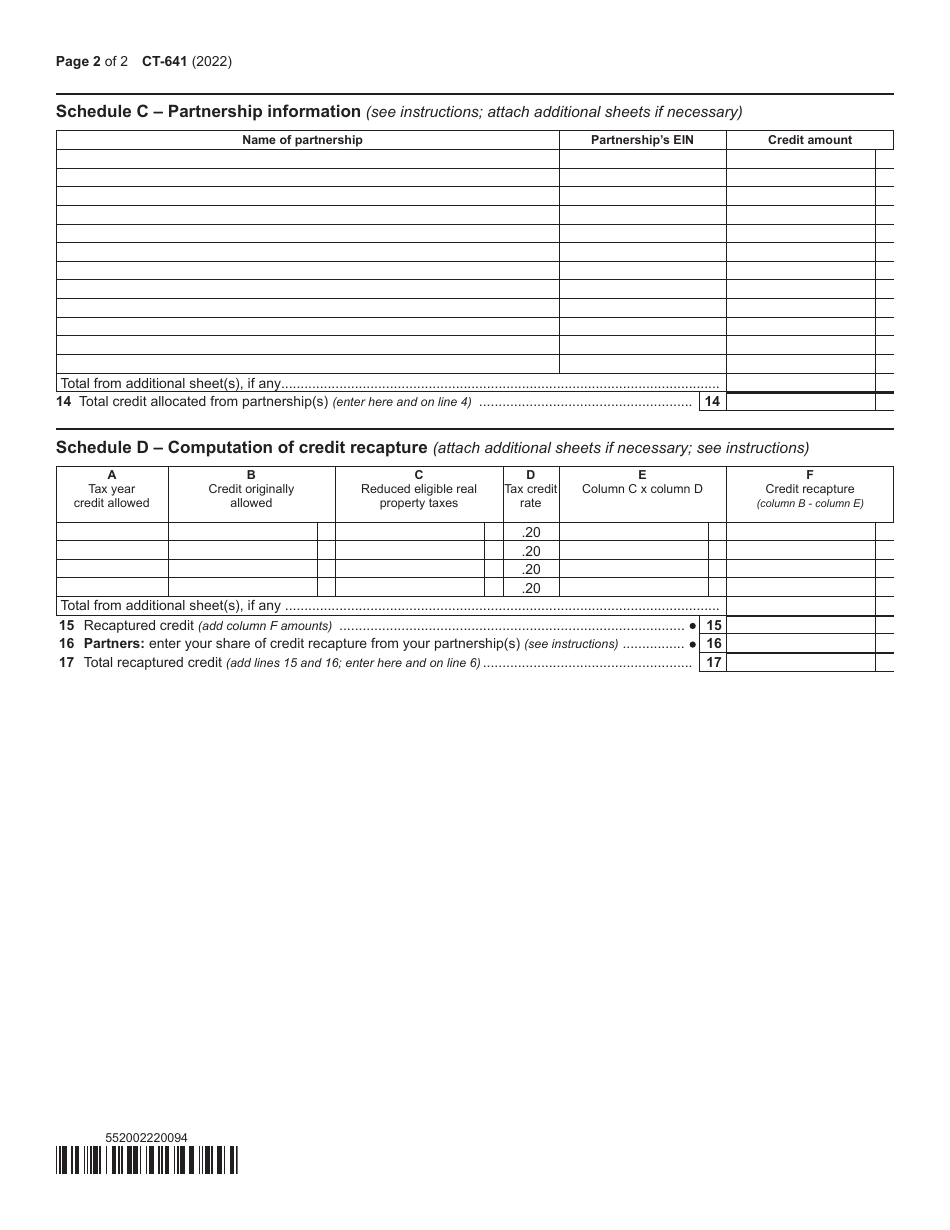

Form CT-641

for the current year.

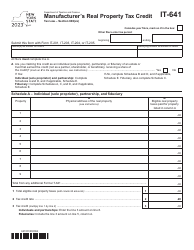

Form CT-641 Manufacturer's Real Property Tax Credit - New York

What Is Form CT-641?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-641?

A: Form CT-641 is a tax form used in New York to claim the Manufacturer's Real Property Tax Credit.

Q: Who is eligible to use Form CT-641?

A: Manufacturers in New York who own or lease real property and pay real property taxes may be eligible to use Form CT-641.

Q: What is the purpose of the Manufacturer's Real Property Tax Credit?

A: The purpose of the credit is to provide tax relief to manufacturers in New York.

Q: How can I claim the Manufacturer's Real Property Tax Credit?

A: To claim the credit, you must complete and file Form CT-641 with the New York State Department of Taxation and Finance.

Q: When is the deadline to file Form CT-641?

A: The deadline to file Form CT-641 is the same as the deadline for filing your New York State corporate tax return, typically March 15th.

Q: Are there any restrictions or limitations for claiming the Manufacturer's Real Property Tax Credit?

A: Yes, there are certain restrictions and limitations. It is recommended to consult the instructions provided with Form CT-641 or seek professional tax advice.

Q: Is the Manufacturer's Real Property Tax Credit available in all counties of New York?

A: Yes, the credit is available statewide in New York for eligible manufacturers.

Q: Can I claim the Manufacturer's Real Property Tax Credit if I am not a manufacturer?

A: No, the credit is specifically designed for manufacturers. Other taxpayers may not be eligible for this credit.

Q: Can I carry forward unused credits from Form CT-641?

A: Yes, you may be able to carry forward unused credits to future tax years. Refer to the instructions for Form CT-641 for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-641 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.