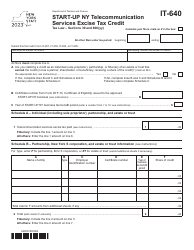

Form CT-640 Start-Up Ny Telecommunication Services Excise Tax Credit - New York

What Is Form CT-640?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-640?

A: Form CT-640 is a tax form used in New York to claim the Start-Up NY Telecommunication Services Excise Tax Credit.

Q: What is the Start-Up NY Telecommunication Services Excise Tax Credit?

A: The Start-Up NY Telecommunication Services Excise Tax Credit is a tax credit available to eligible businesses in New York that provide telecommunication services.

Q: Who is eligible for the Start-Up NY Telecommunication Services Excise Tax Credit?

A: Eligible businesses include those that are registered in the Start-Up NY program and provide telecommunication services in New York.

Q: How can I claim the Start-Up NY Telecommunication Services Excise Tax Credit?

A: To claim the tax credit, you need to complete and file Form CT-640 with the New York State Department of Taxation and Finance.

Q: Is the Start-Up NY Telecommunication Services Excise Tax Credit available in Canada?

A: No, the Start-Up NY Telecommunication Services Excise Tax Credit is only available to businesses operating in the state of New York.

Q: What is the purpose of the Start-Up NY program?

A: The Start-Up NY program aims to encourage the establishment and growth of innovative businesses in New York, particularly in designated tax-free areas.

Q: Are there any other tax credits available under the Start-Up NY program?

A: Yes, in addition to the Start-Up NY Telecommunication Services Excise Tax Credit, there are other tax incentives available to eligible businesses, such as the Start-Up NY Investment Tax Credit and the Start-Up NY Wage Tax Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-640 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.