This version of the form is not currently in use and is provided for reference only. Download this version of

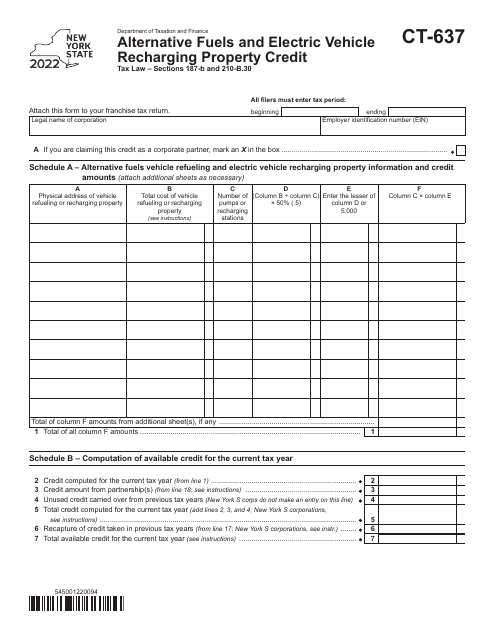

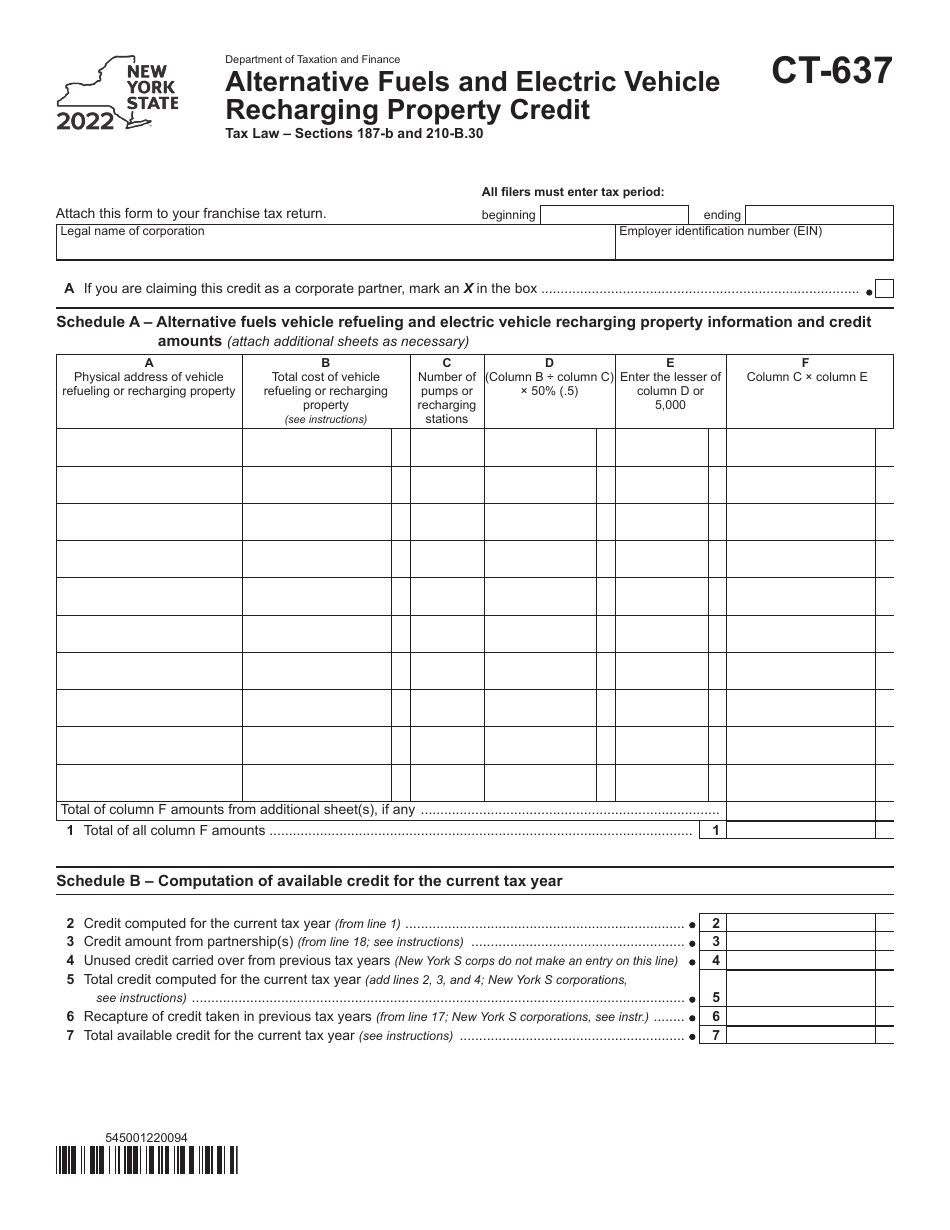

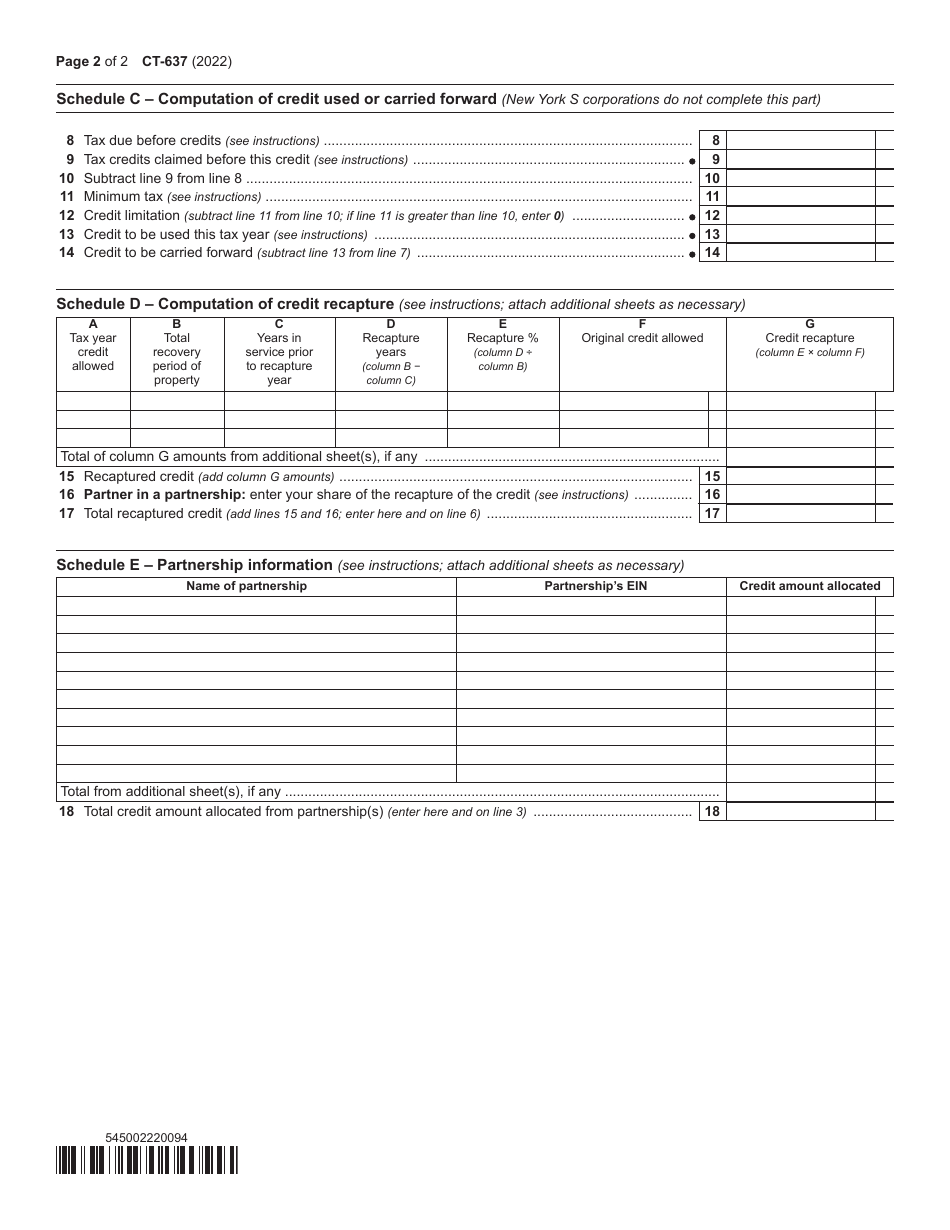

Form CT-637

for the current year.

Form CT-637 Alternative Fuels and Electric Vehicle Recharging Property Credit - New York

What Is Form CT-637?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-637?

A: Form CT-637 is a form used to claim the Alternative Fuels and Electric Vehicle Recharging Property Credit in New York.

Q: What is the Alternative Fuels and Electric Vehicle Recharging Property Credit?

A: The Alternative Fuels and Electric Vehicle Recharging Property Credit is a tax credit available in New York for individuals and businesses who install alternative fuel vehicle refueling or electric vehicle recharging property.

Q: Who is eligible for the credit?

A: Both individuals and businesses in New York who install alternative fuel vehicle refueling or electric vehicle recharging property are eligible for the credit.

Q: What types of property are eligible for the credit?

A: Eligible property includes alternative fuel vehicle refueling property and electric vehicle recharging property.

Q: How much is the credit?

A: The amount of the credit depends on the type of property installed and the amount of property costs. Specific details can be found in the instructions for Form CT-637.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file Form CT-637 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for claiming the credit?

A: Yes, the credit must be claimed in the tax year in which the property is placed in service.

Q: Can the credit be carried forward or back?

A: No, the credit cannot be carried forward or back and must be claimed in the year the property is placed in service.

Q: Is there a limit on the amount of the credit?

A: Yes, there is a maximum credit limit per property. Specific details can be found in the instructions for Form CT-637.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-637 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.