This version of the form is not currently in use and is provided for reference only. Download this version of

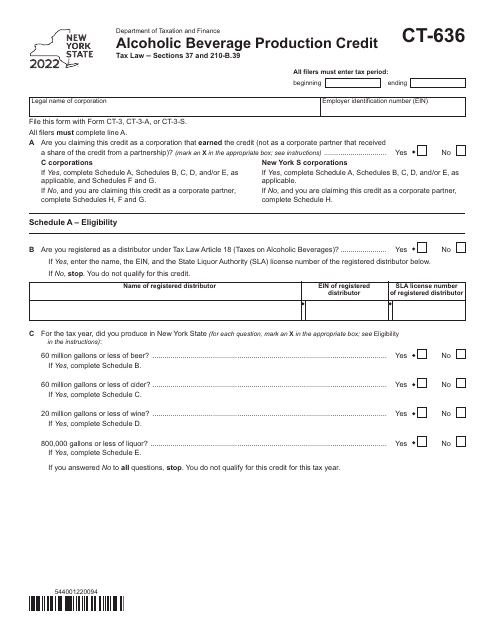

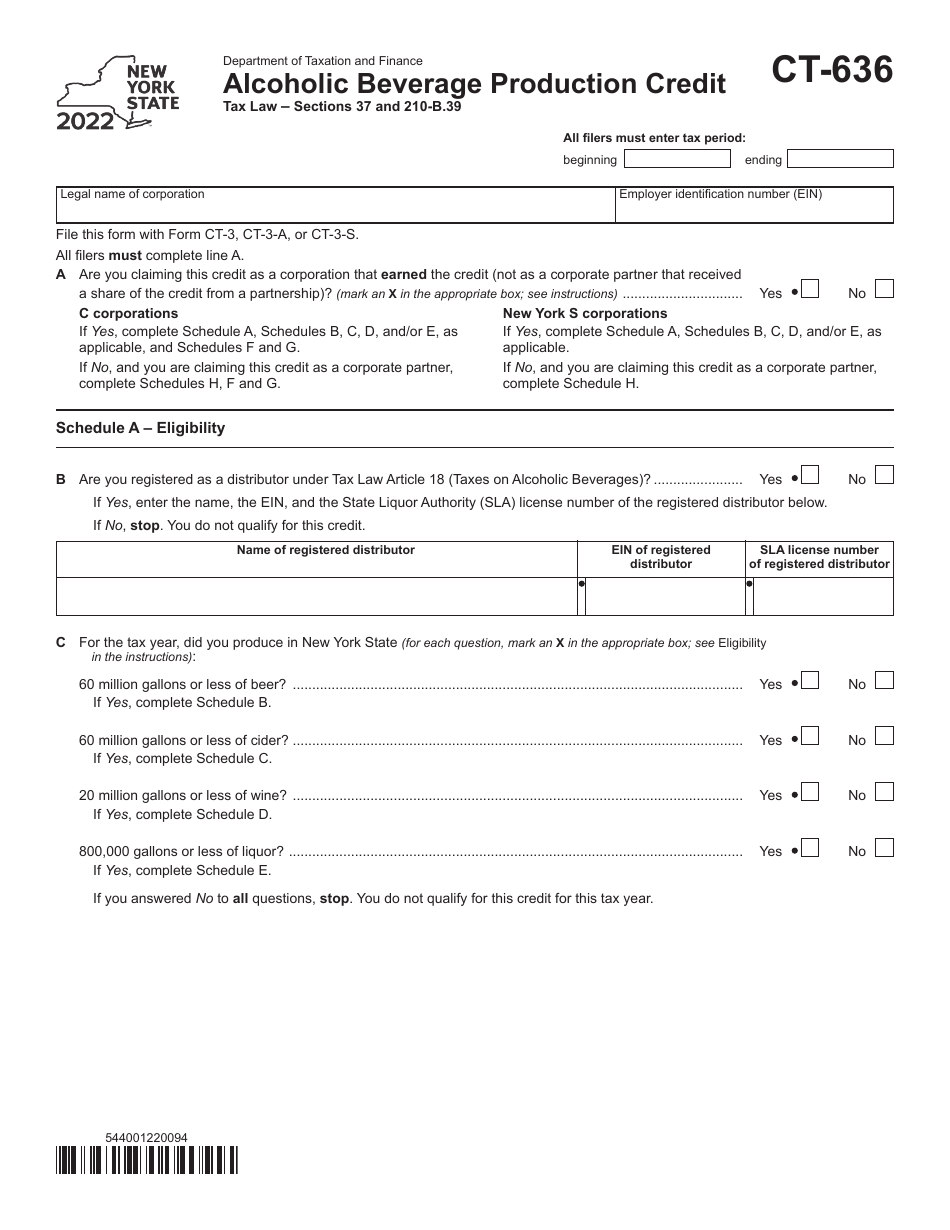

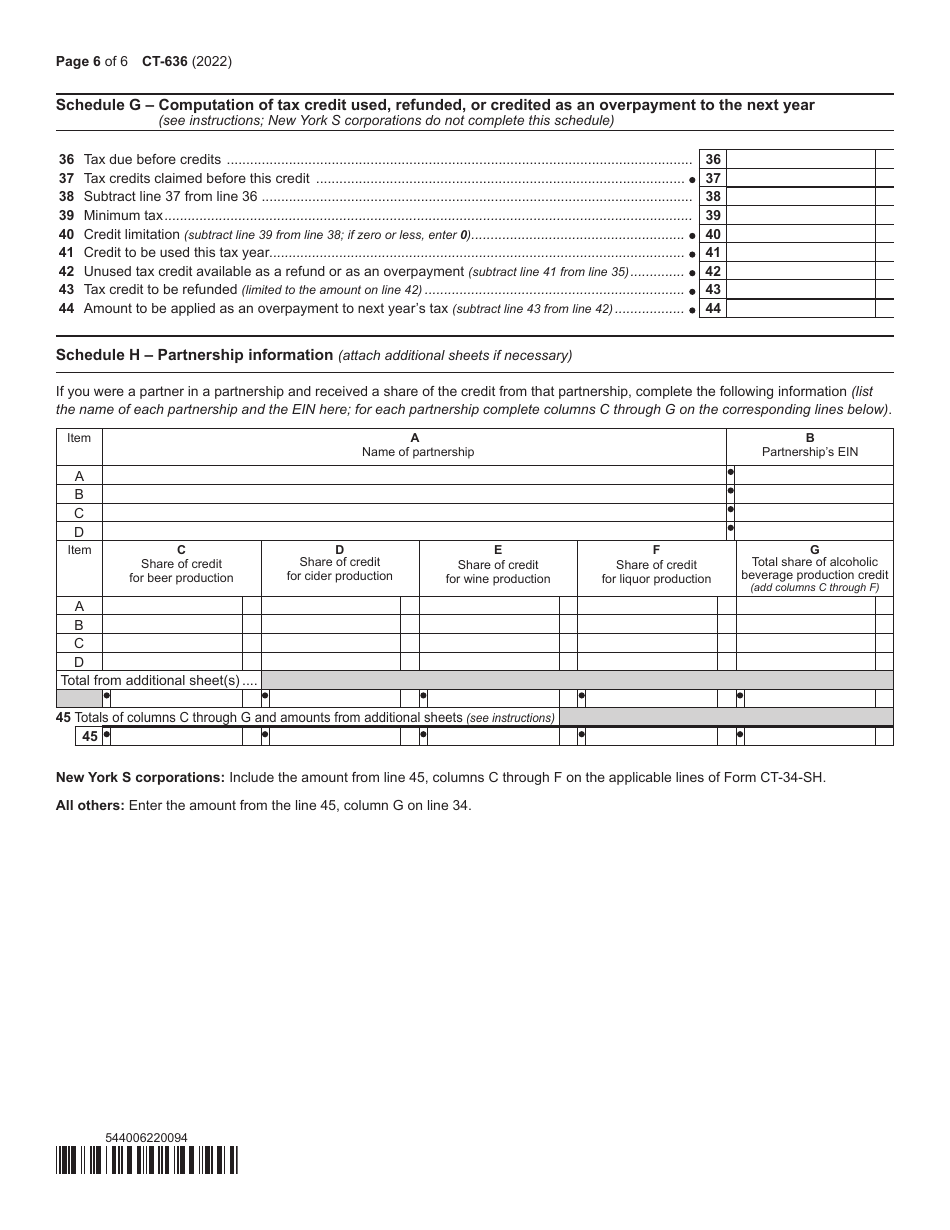

Form CT-636

for the current year.

Form CT-636 Alcoholic Beverage Production Credit - New York

What Is Form CT-636?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

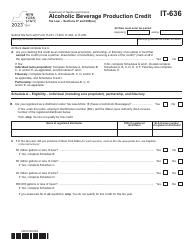

Q: What is Form CT-636?

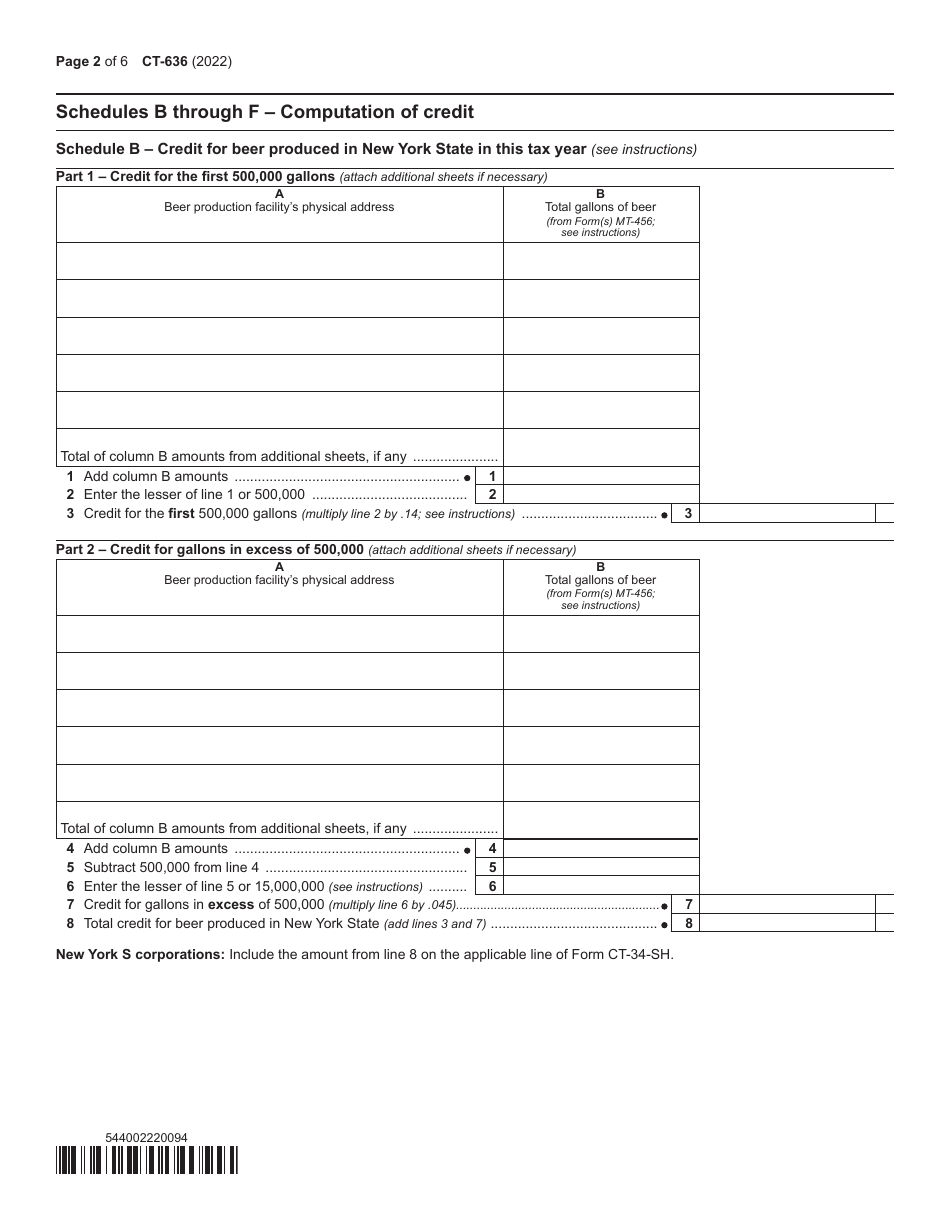

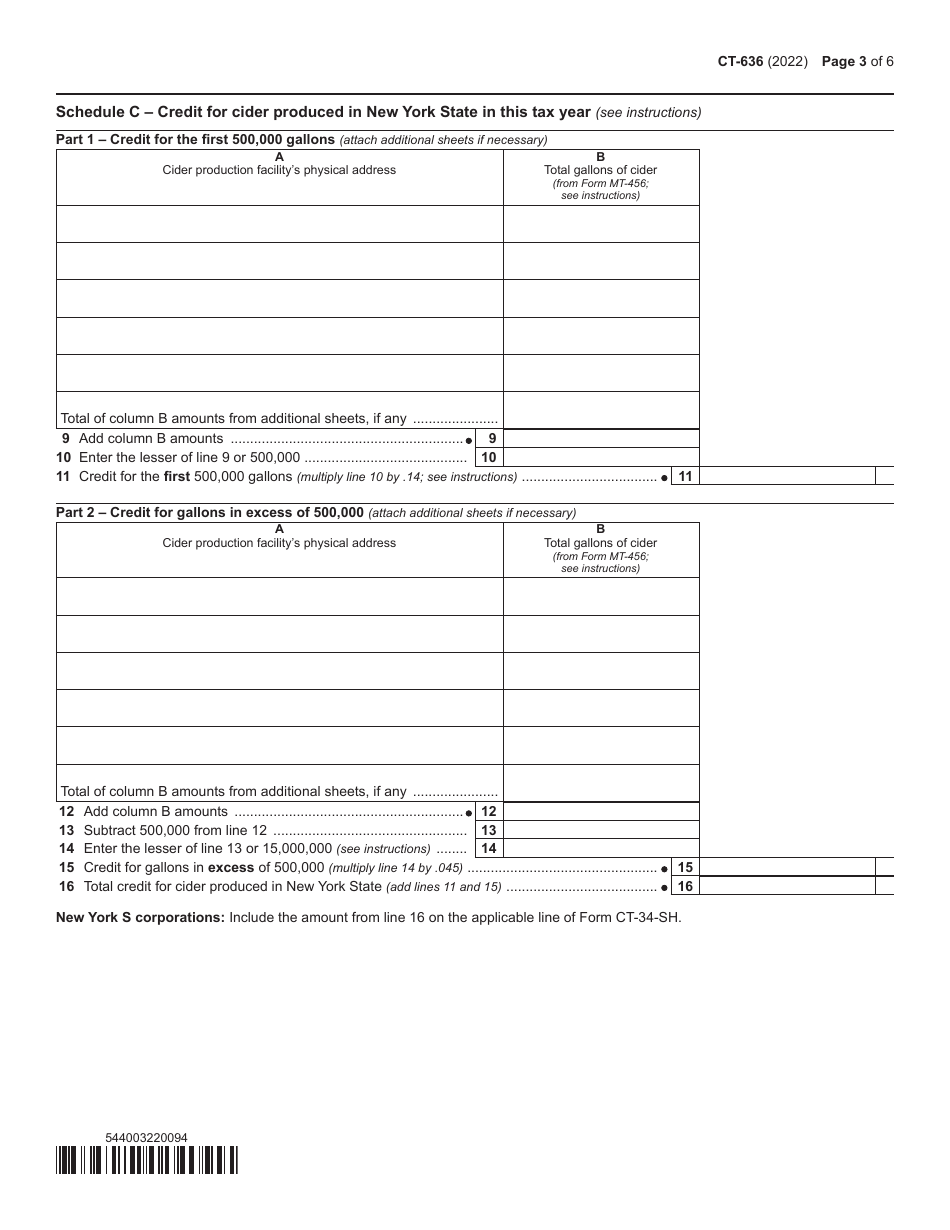

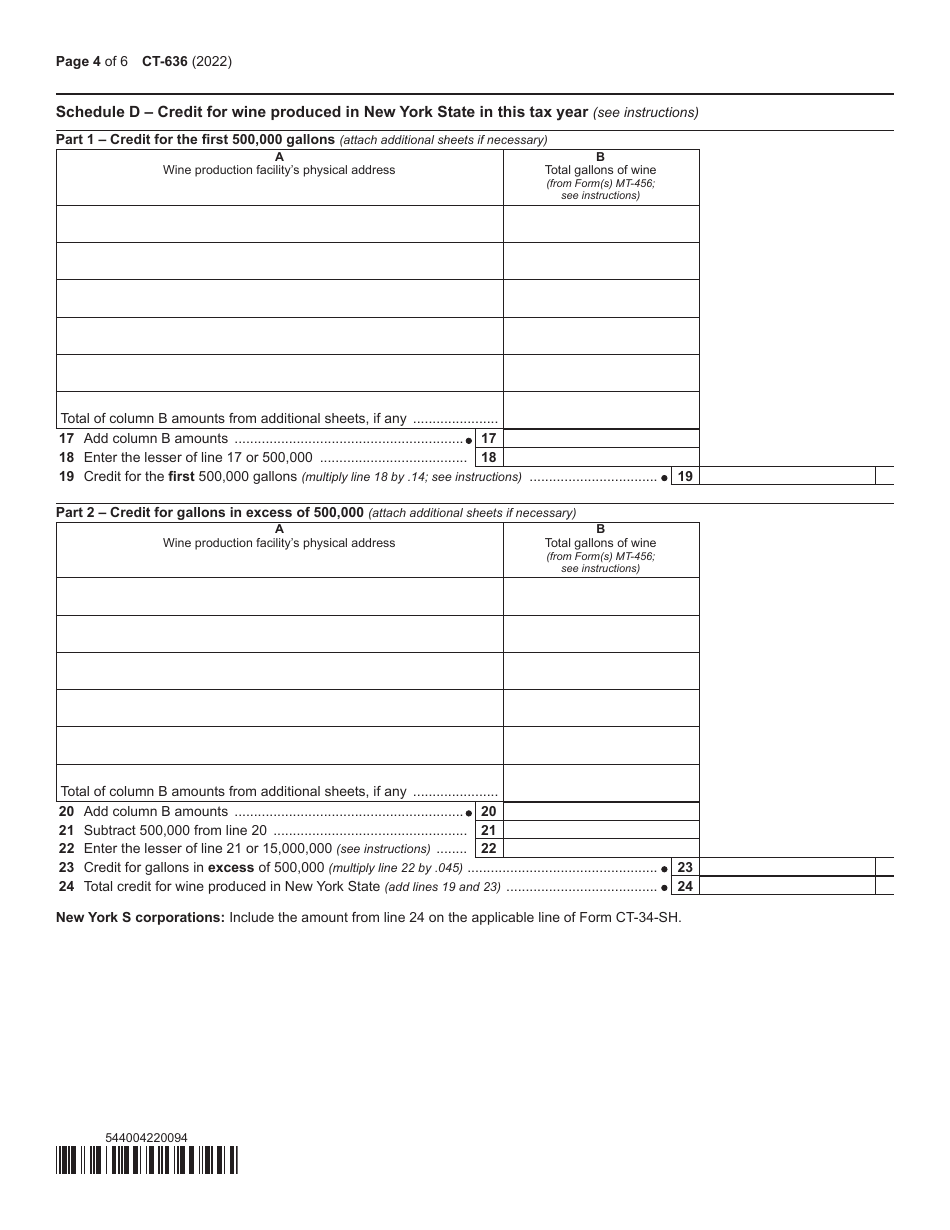

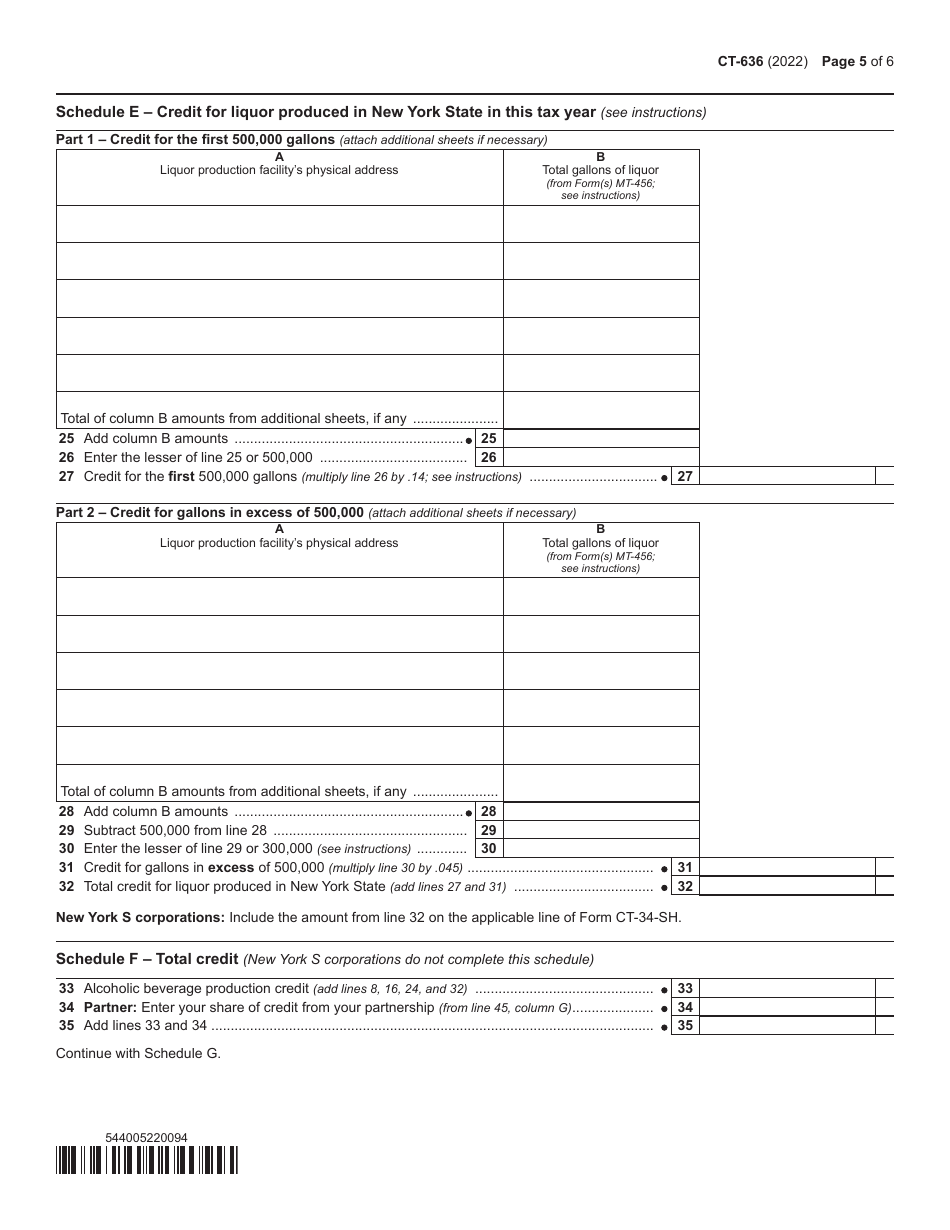

A: Form CT-636 is a tax form used in New York for claiming the Alcoholic Beverage Production Credit.

Q: What is the Alcoholic Beverage Production Credit?

A: The Alcoholic Beverage Production Credit is a tax credit available in New York for producers of beer, cider, wine, and liquor.

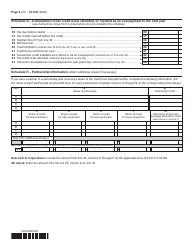

Q: Who can claim the Alcoholic Beverage Production Credit?

A: Producers of beer, cider, wine, and liquor in New York can claim the Alcoholic Beverage Production Credit.

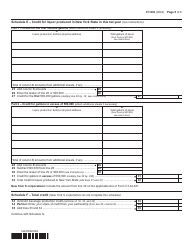

Q: What expenses are eligible for the Alcoholic Beverage Production Credit?

A: Expenses related to the production of beer, cider, wine, and liquor, such as raw materials and processing costs, may be eligible for the Alcoholic Beverage Production Credit.

Q: How do I file Form CT-636?

A: Form CT-636 should be filed annually with the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form CT-636?

A: Yes, Form CT-636 must be filed by the due date of the New York State corporate tax return.

Q: Can I claim the Alcoholic Beverage Production Credit if I am not a producer in New York?

A: No, the Alcoholic Beverage Production Credit is only available to producers in New York.

Q: Are there any limitations on the amount of the Alcoholic Beverage Production Credit?

A: Yes, the amount of the credit is subject to a maximum limit based on the quantity of alcoholic beverages produced.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-636 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.