This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-635

for the current year.

Form CT-635 New York Youth Jobs Program Tax Credit - New York

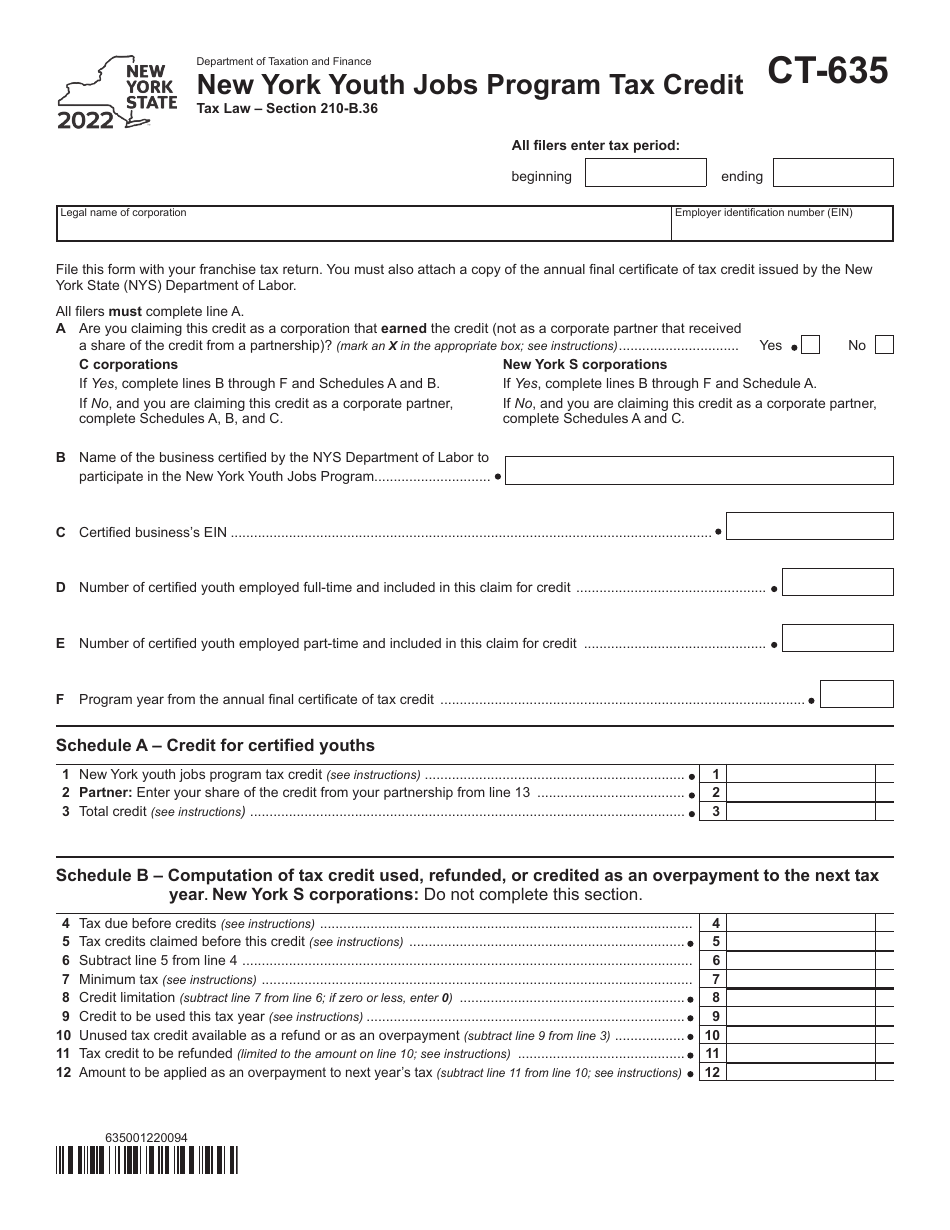

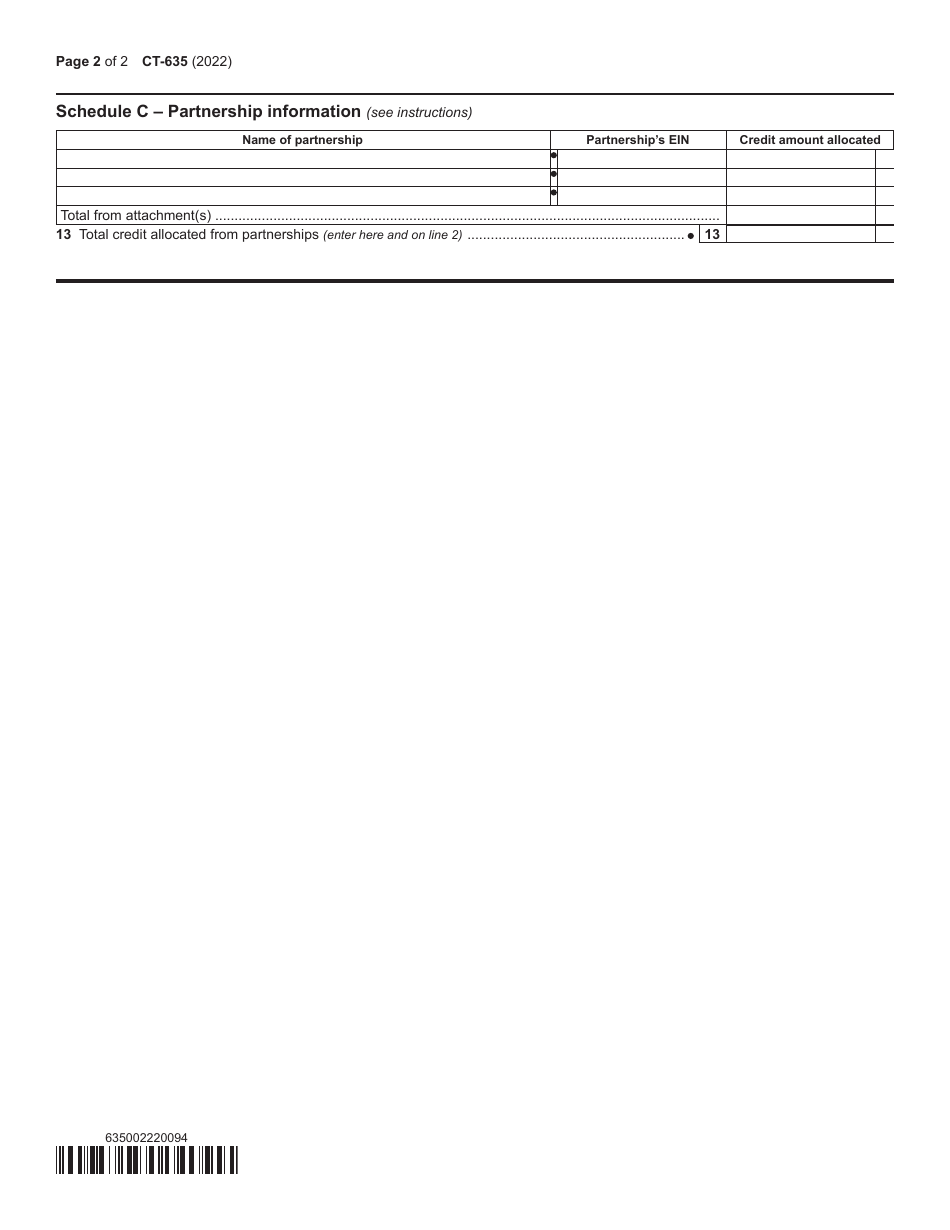

What Is Form CT-635?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-635?

A: Form CT-635 is a tax form used in New York to claim the Youth Jobs ProgramTax Credit.

Q: What is the New York Youth Jobs Program Tax Credit?

A: The New York Youth Jobs Program Tax Credit is a tax credit for employers who hire eligible unemployed youth.

Q: Who is eligible for the New York Youth Jobs Program Tax Credit?

A: Eligible individuals are unemployed youth between the ages of 16 and 24.

Q: How much is the New York Youth Jobs Program Tax Credit?

A: The tax credit is equal to 85% of the wages paid to eligible youth employees.

Q: How do I claim the New York Youth Jobs Program Tax Credit?

A: You can claim the tax credit by completing and filing Form CT-635 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for filing Form CT-635?

A: Yes, the form must be filed by the due date of your New York State income tax return for the taxable year the credit is claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-635 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.