This version of the form is not currently in use and is provided for reference only. Download this version of

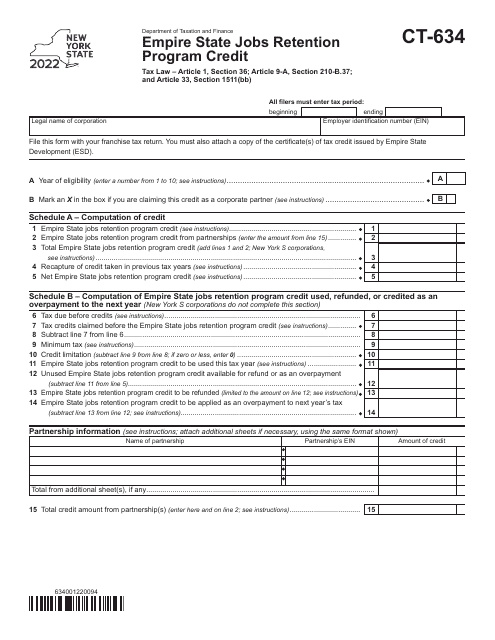

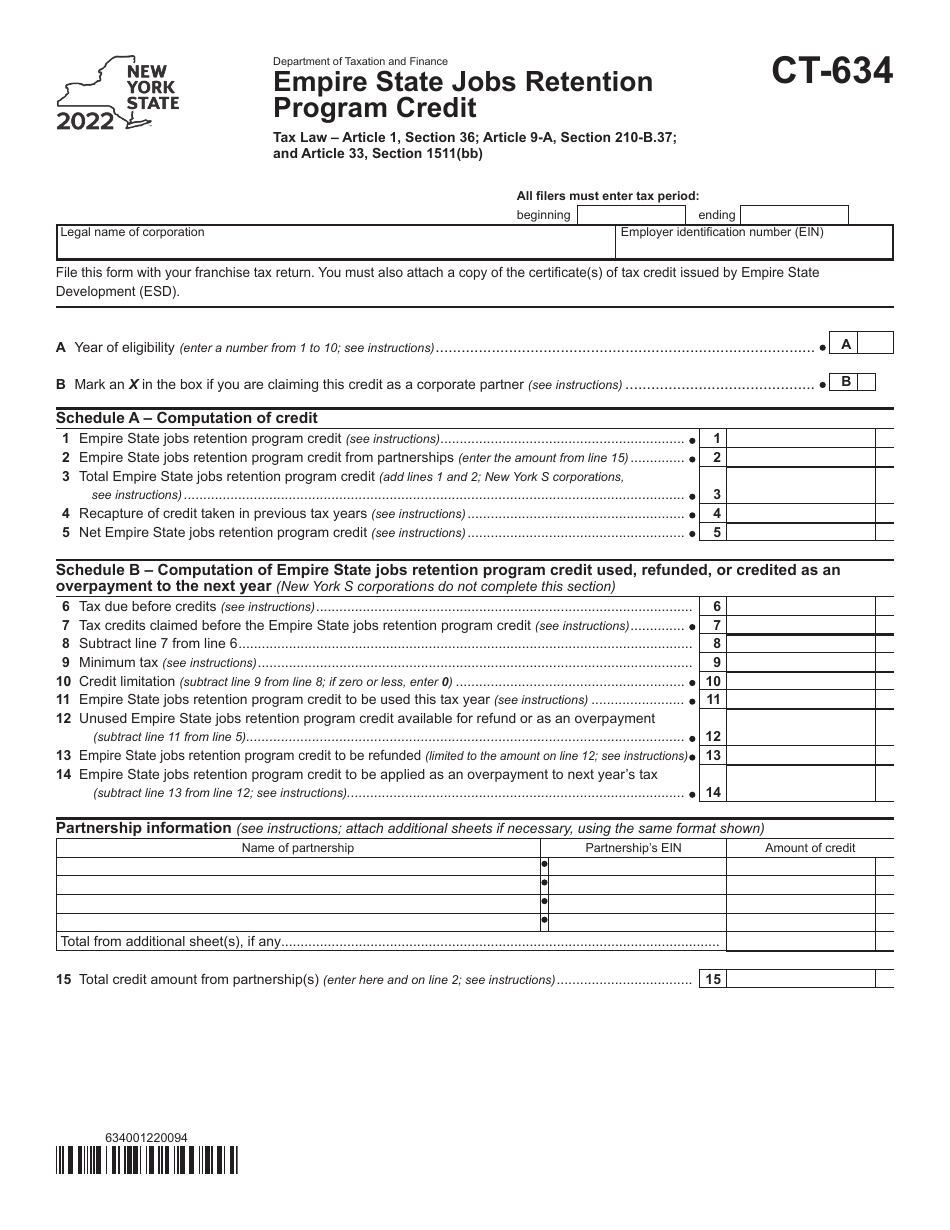

Form CT-634

for the current year.

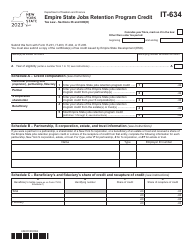

Form CT-634 Empire State Jobs Retention Program Credit - New York

What Is Form CT-634?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-634?

A: Form CT-634 is a tax form used in New York to claim the Empire StateJobs Retention Program Credit.

Q: What is the Empire State Jobs Retention Program Credit?

A: The Empire State Jobs Retention Program Credit is a tax credit available to eligible businesses in New York that are engaged in qualified activities.

Q: Who can claim the Empire State Jobs Retention Program Credit?

A: Eligible businesses in New York engaged in qualified activities can claim the Empire State Jobs Retention Program Credit.

Q: What are qualified activities?

A: Qualified activities include manufacturing, agriculture, processing of agricultural products, and scientific research and development.

Q: How do I claim the Empire State Jobs Retention Program Credit?

A: To claim the credit, businesses must complete and file Form CT-634 with the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form CT-634?

A: Yes, Form CT-634 must be filed on or before the due date of the business's tax return for the tax year in which the credit is being claimed.

Q: Are there any eligibility requirements for the Empire State Jobs Retention Program Credit?

A: Yes, businesses must meet certain criteria, such as being in compliance with all tax obligations and employment laws, to be eligible for the credit.

Q: Can I claim the Empire State Jobs Retention Program Credit if I am not located in New York?

A: No, the credit is only available to businesses located in New York that are engaged in qualified activities.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-634 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.