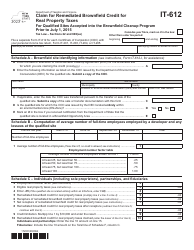

Form CT-612 Claim for Remediated Brownfield Credit for Real Property Taxes - New York

What Is Form CT-612?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

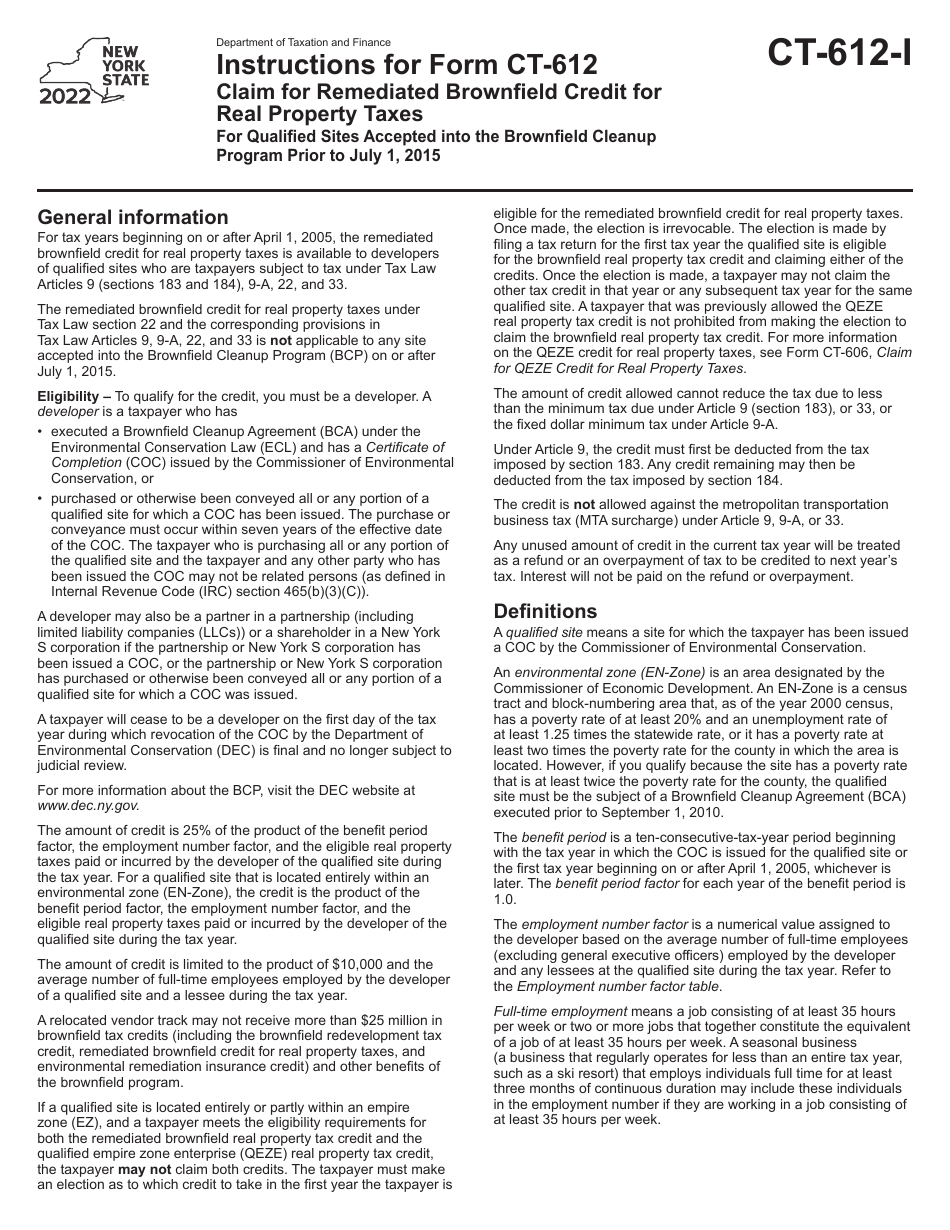

Q: What is Form CT-612?

A: Form CT-612 is a claim for the Remediated Brownfield Credit for Real Property Taxes in New York.

Q: What is the Remediated Brownfield Credit?

A: The Remediated Brownfield Credit is a tax credit available to individuals or businesses who have remediated brownfield sites in New York.

Q: What are brownfield sites?

A: Brownfield sites are abandoned or underutilized properties where redevelopment or reuse may be complicated by the presence of hazardous substances or pollutants.

Q: Who is eligible to file Form CT-612?

A: Individuals or businesses who have remediated brownfield sites in New York and have paid real property taxes on those sites may be eligible to file Form CT-612.

Q: What expenses are eligible for the Remediated Brownfield Credit?

A: Eligible expenses may include costs associated with remediation, demolition, construction, and site preparation.

Q: How much is the Remediated Brownfield Credit?

A: The amount of the credit is based on a percentage of the eligible expenses, up to a maximum credit amount determined by the New York State Department of Taxation and Finance.

Q: What is the deadline for filing Form CT-612?

A: The deadline for filing Form CT-612 is generally three years from the due date of the tax return for the year in which the eligible expenses were paid.

Q: Can the Remediated Brownfield Credit be carried forward or refunded?

A: Yes, unused credits can be carried forward for up to 15 years or refunded in certain circumstances as determined by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-612 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.