This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-612

for the current year.

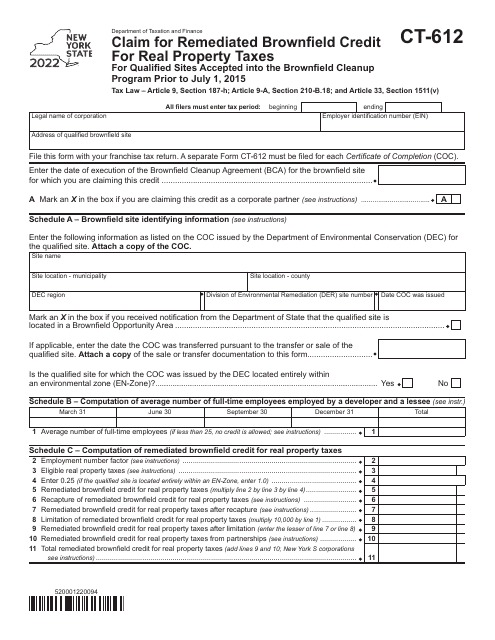

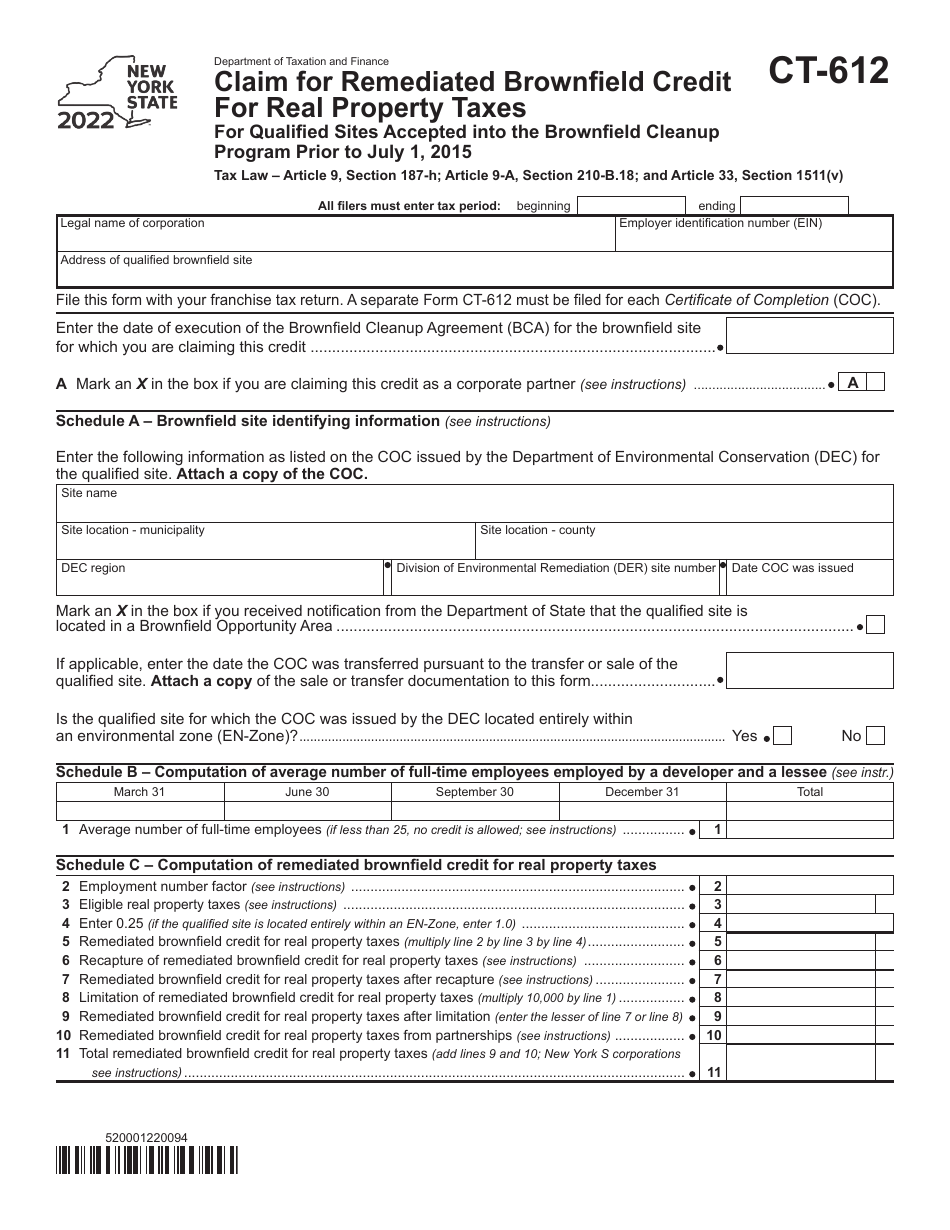

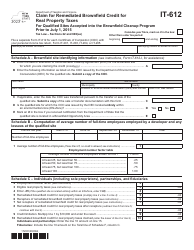

Form CT-612 Claim for Remediated Brownfield Credit for Real Property Taxes for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form CT-612?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-612?

A: Form CT-612 is a claim for the Remediated Brownfield Credit for Real Property Taxes for Qualified Sites Accepted Into the Brownfield Cleanup Program prior to July 1, 2015 in New York.

Q: Who can use Form CT-612?

A: This form can be used by individuals or businesses who have qualified sites accepted into the Brownfield Cleanup Program in New York prior to July 1, 2015.

Q: What is the Remediated Brownfield Credit?

A: The Remediated Brownfield Credit is a tax credit for real property taxes on qualified sites that have been remediated under the Brownfield Cleanup Program in New York.

Q: When should Form CT-612 be filed?

A: Form CT-612 should be filed annually on or before June 1st.

Q: What documents should be attached to Form CT-612?

A: The following documents should be attached to Form CT-612: a copy of the Certificate of Completion from the Brownfield Cleanup Program, proof of ownership, and proof of payment of real property taxes.

Q: Is there a deadline for filing Form CT-612?

A: Yes, Form CT-612 must be filed on or before June 1st.

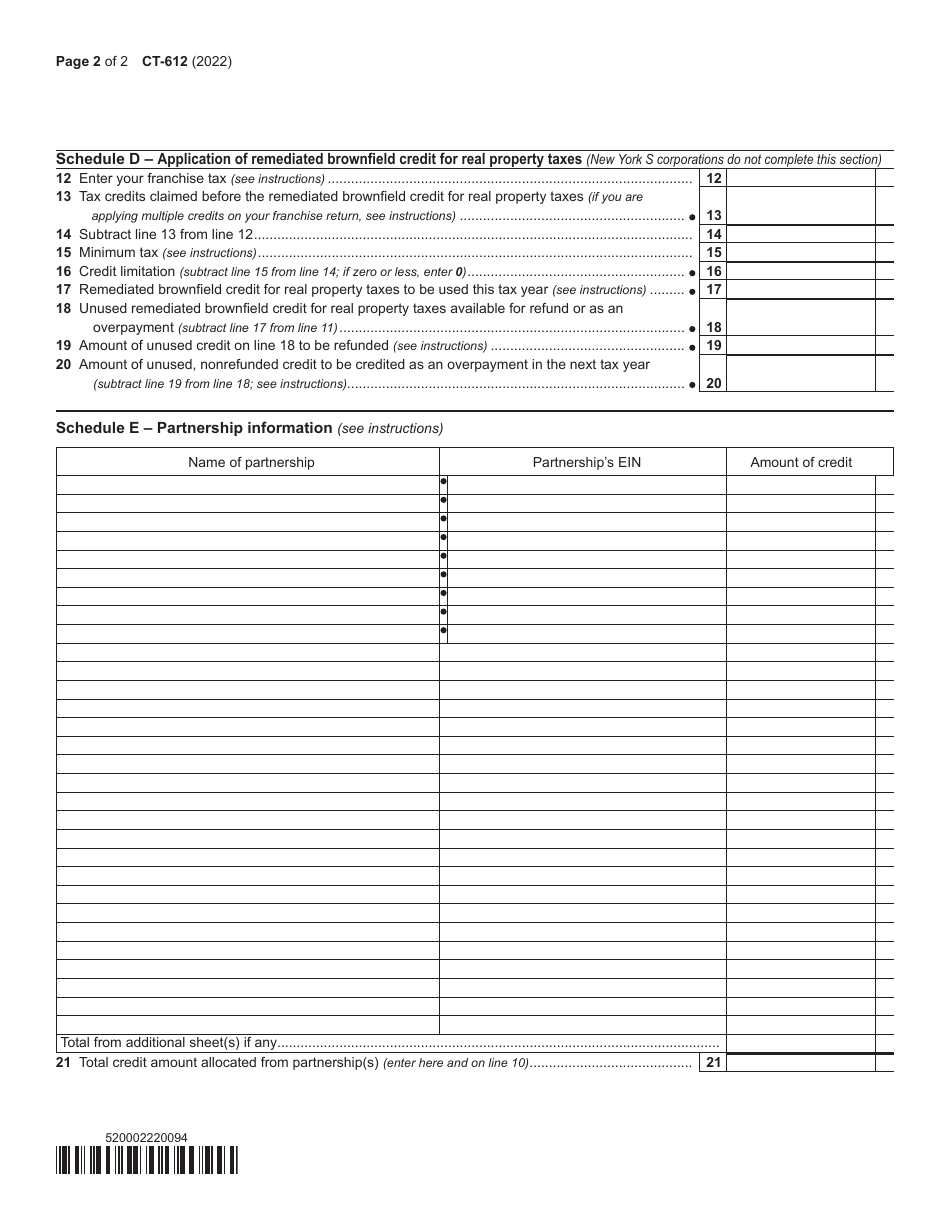

Q: Can the Remediated Brownfield Credit be carried forward?

A: No, the Remediated Brownfield Credit cannot be carried forward.

Q: Is there a maximum amount of the Remediated Brownfield Credit?

A: Yes, the maximum amount of the Remediated Brownfield Credit is $50,000 per year.

Q: Are there any exemptions to the Remediated Brownfield Credit?

A: Yes, certain properties, such as residential properties, are not eligible for the Remediated Brownfield Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-612 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.