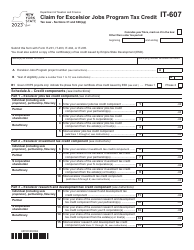

This version of the form is not currently in use and is provided for reference only. Download this version of

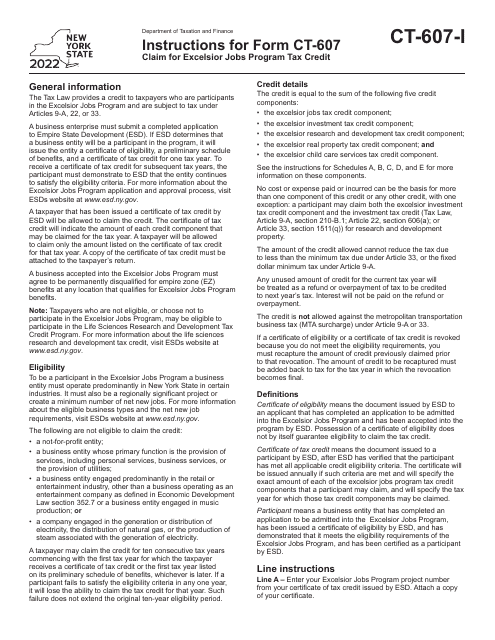

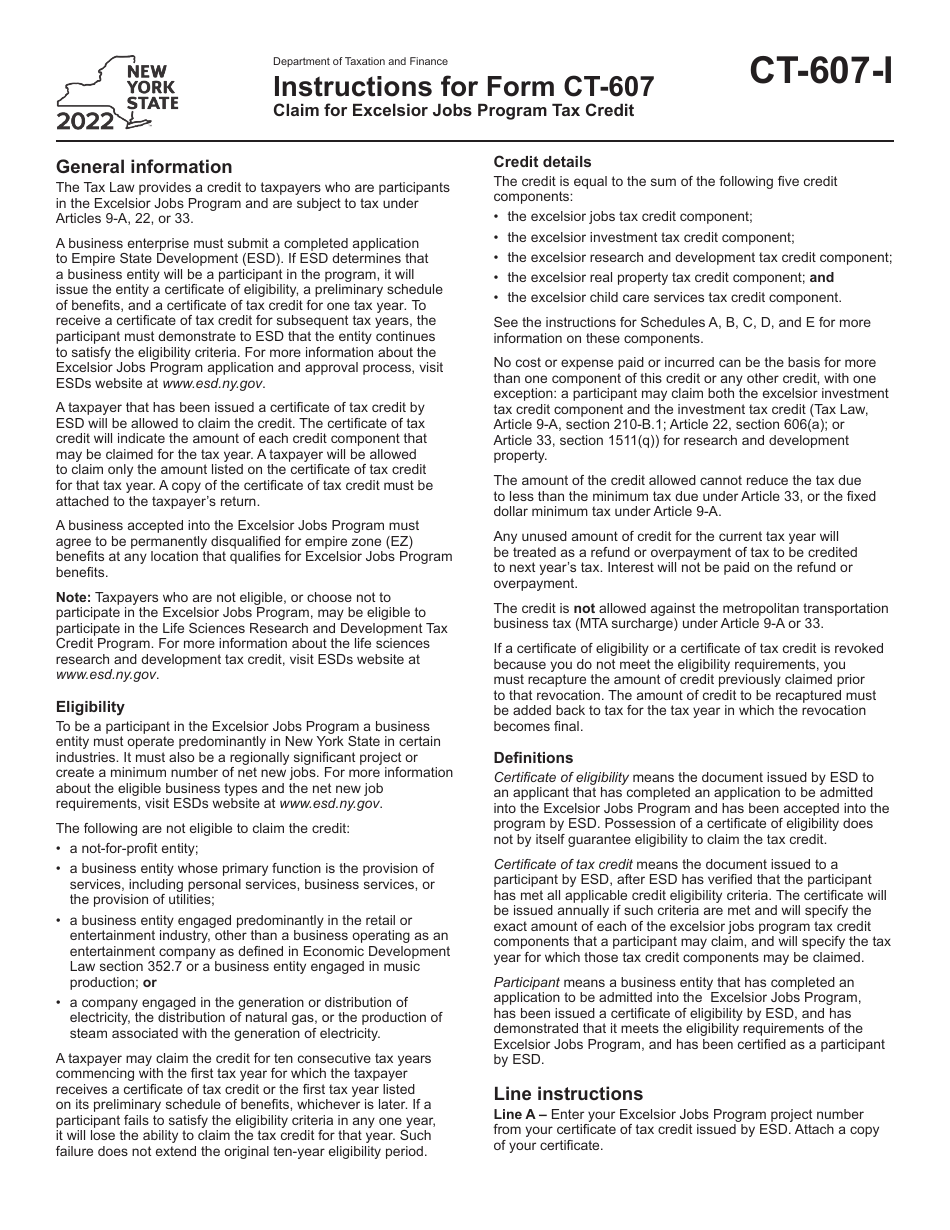

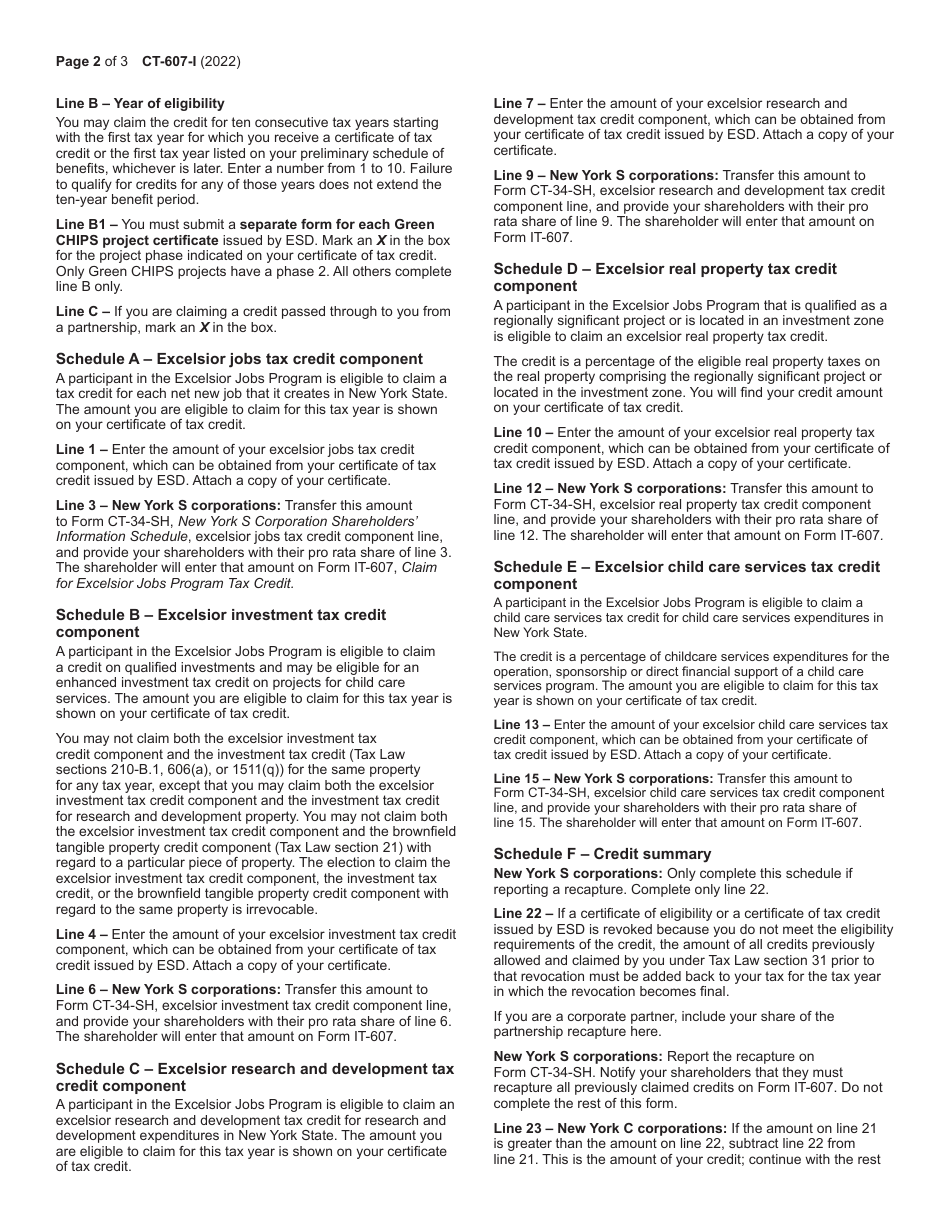

Instructions for Form CT-607

for the current year.

Instructions for Form CT-607 Claim for Excelsior Jobs Program Tax Credit - New York

This document contains official instructions for Form CT-607 , Claim for Excelsior Jobs Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-607 is available for download through this link.

FAQ

Q: What is Form CT-607?

A: Form CT-607 is a form used to claim the Excelsior Jobs Program Tax Credit in the state of New York.

Q: What is the Excelsior Jobs Program Tax Credit?

A: The Excelsior Jobs Program Tax Credit is a tax incentive program provided by the state of New York to encourage job creation and business growth.

Q: Who is eligible to claim the Excelsior Jobs Program Tax Credit?

A: Eligibility for the Excelsior Jobs Program Tax Credit depends on various factors, including the type of business and the number of jobs created.

Q: How do I fill out Form CT-607?

A: Form CT-607 requires detailed information about the business and the jobs created. It is important to carefully review the instructions and provide accurate and complete information.

Q: Are there any deadlines for filing Form CT-607?

A: Yes, the deadlines for filing Form CT-607 may vary. It is important to refer to the instructions and follow the specified deadlines.

Q: What documentation should I attach to Form CT-607?

A: The required documentation may vary depending on the specific circumstances. It is recommended to review the instructions and provide any necessary supporting documents.

Q: How long does it take to receive the Excelsior Jobs Program Tax Credit?

A: The processing time for the Excelsior Jobs Program Tax Credit can vary. It is advisable to contact the New York State Department of Taxation and Finance for more information.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.