This version of the form is not currently in use and is provided for reference only. Download this version of

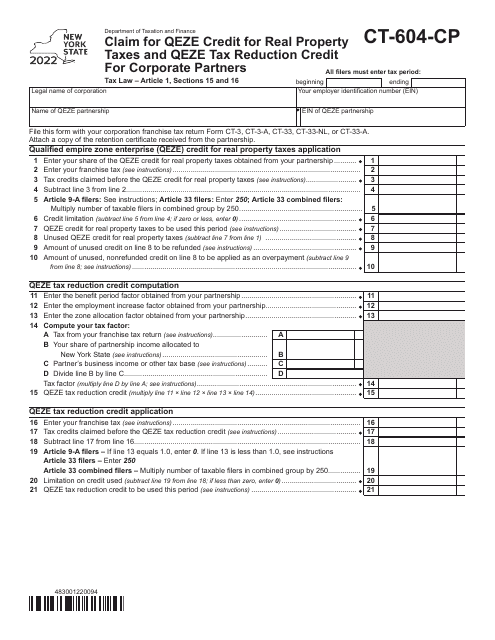

Form CT-604-CP

for the current year.

Form CT-604-CP Claim for Qeze Credit for Real Property Taxes and Qeze Tax Reduction Credit for Corporate Partners - New York

What Is Form CT-604-CP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

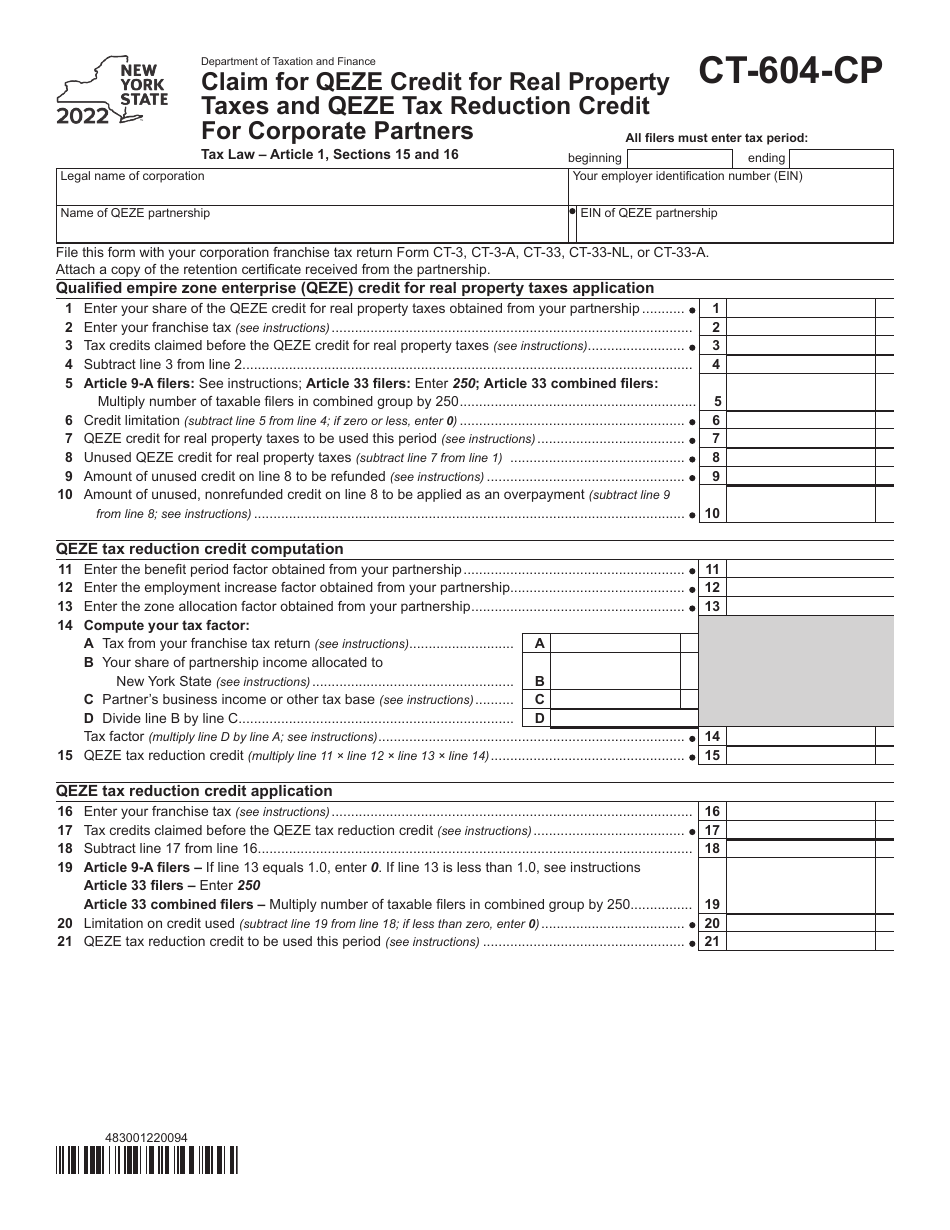

Q: What is Form CT-604-CP?

A: Form CT-604-CP is a claim for QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit for Corporate Partners in New York.

Q: What is the purpose of Form CT-604-CP?

A: The purpose of Form CT-604-CP is to claim the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit for Corporate Partners in New York.

Q: Who can use Form CT-604-CP?

A: Form CT-604-CP can be used by corporate partners who are eligible for the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit in New York.

Q: What is the QEZE Credit for Real Property Taxes?

A: The QEZE Credit for Real Property Taxes is a tax credit available to corporate partners for qualified empire zones in New York.

Q: What is the QEZE Tax Reduction Credit?

A: The QEZE Tax Reduction Credit is a tax credit available to corporate partners for qualified empire zones in New York.

Q: How do I claim the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit?

A: You can claim the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit by filling out and submitting Form CT-604-CP to the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form CT-604-CP?

A: Yes, the deadline for filing Form CT-604-CP is determined by the New York State Department of Taxation and Finance. You should check the instructions for the form or contact the department for the specific deadline.

Q: Are there any eligibility requirements for the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit?

A: Yes, there are eligibility requirements for the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit. You should refer to the instructions for Form CT-604-CP or contact the New York State Department of Taxation and Finance for more information.

Q: What should I do if I have questions about Form CT-604-CP and the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit?

A: If you have questions about Form CT-604-CP and the QEZE Credit for Real Property Taxes and QEZE Tax Reduction Credit, you should contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-604-CP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.