This version of the form is not currently in use and is provided for reference only. Download this version of

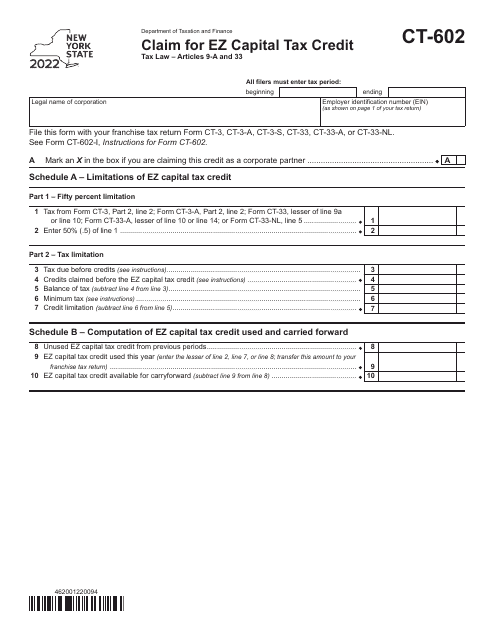

Form CT-602

for the current year.

Form CT-602 Claim for Ez Capital Tax Credit - New York

What Is Form CT-602?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-602?

A: Form CT-602 is a claim form for the EZ Capital Tax Credit in New York.

Q: Who can use Form CT-602?

A: This form is for businesses that qualify for the EZ Capital Tax Credit in New York.

Q: What is the EZ Capital Tax Credit?

A: The EZ Capital Tax Credit is a tax incentive program in New York that encourages investment in designated areas.

Q: What information do I need to provide on Form CT-602?

A: You will need to provide information about your business, the amount of qualified investment, and other supporting documentation.

Q: Is there a deadline for filing Form CT-602?

A: Yes, the deadline for filing Form CT-602 is determined by the New York State Tax Department.

Q: Can I claim the EZ Capital Tax Credit if I am not located in a designated area?

A: No, the EZ Capital Tax Credit is only available for businesses located in designated areas in New York.

Q: Are there any restrictions on the use of the EZ Capital Tax Credit?

A: Yes, there are restrictions on the use of the EZ Capital Tax Credit, such as limitations on the amount that can be claimed and requirements for maintaining the qualified investment.

Q: Can I claim the EZ Capital Tax Credit for investments made in previous years?

A: No, the EZ Capital Tax Credit can only be claimed for investments made in the current tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-602 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.