This version of the form is not currently in use and is provided for reference only. Download this version of

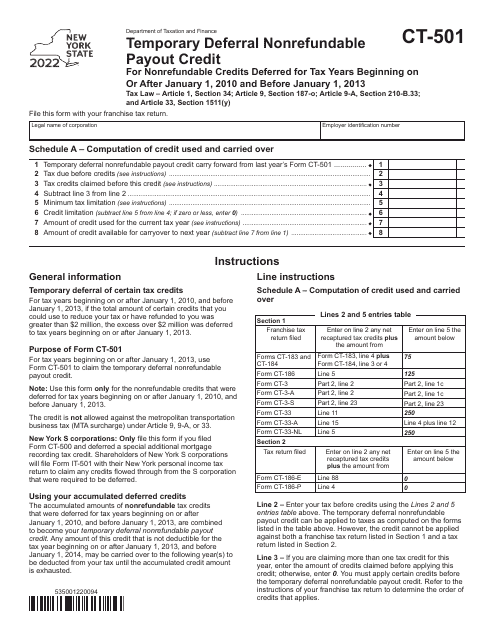

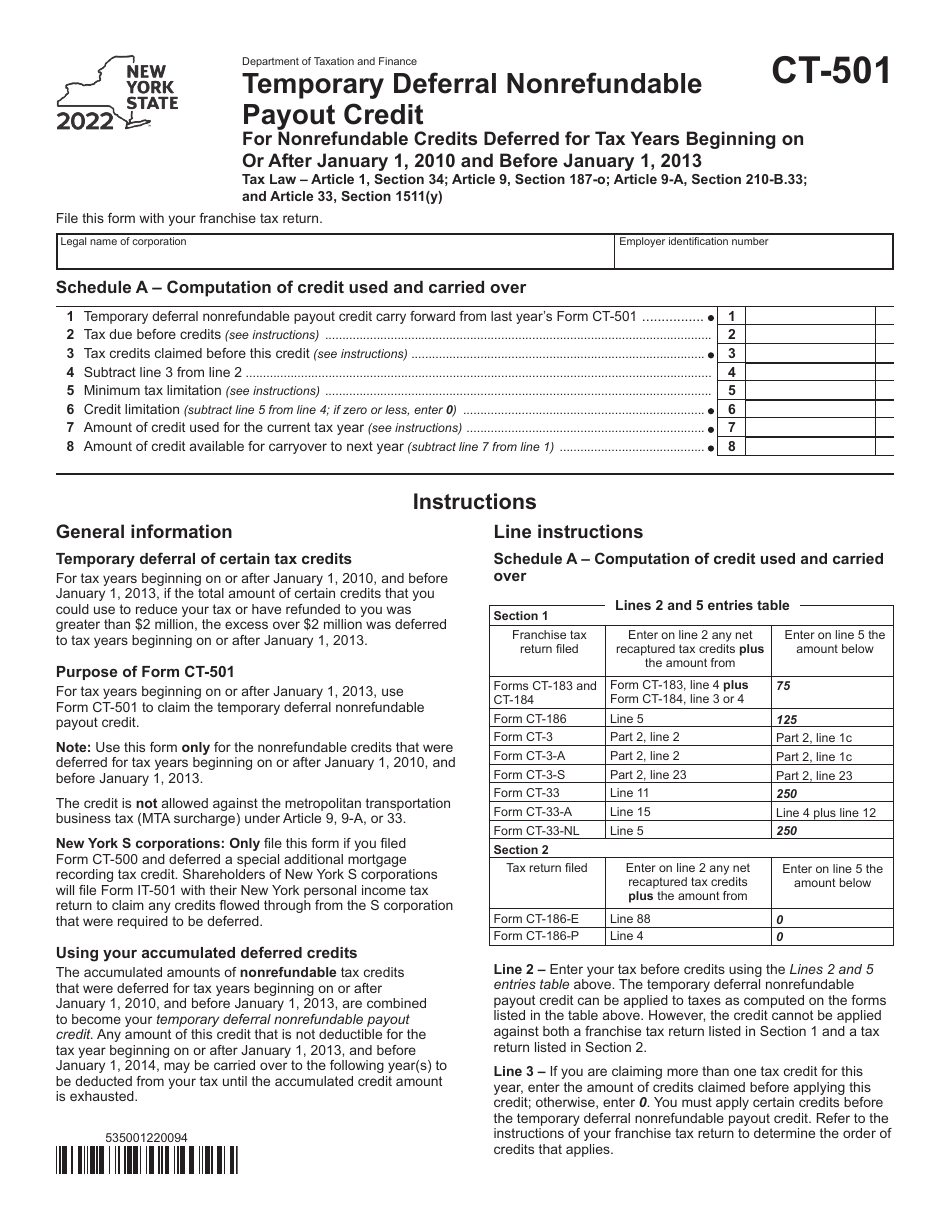

Form CT-501

for the current year.

Form CT-501 Temporary Deferral Nonrefundable Payout Credit - New York

What Is Form CT-501?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-501?

A: Form CT-501 is a document used to claim the Temporary Deferral Nonrefundable Payout Credit in New York.

Q: What is the Temporary Deferral Nonrefundable Payout Credit?

A: The Temporary Deferral Nonrefundable Payout Credit is a tax credit offered in New York.

Q: Who can claim the Temporary Deferral Nonrefundable Payout Credit?

A: Individuals and businesses in New York who meet the eligibility criteria can claim this credit.

Q: What is the purpose of the Temporary Deferral Nonrefundable Payout Credit?

A: The purpose of this credit is to provide temporary financial relief.

Q: Is the Temporary Deferral Nonrefundable Payout Credit refundable?

A: No, this credit is nonrefundable, meaning it cannot be claimed as a refund if it exceeds the tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-501 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.