This version of the form is not currently in use and is provided for reference only. Download this version of

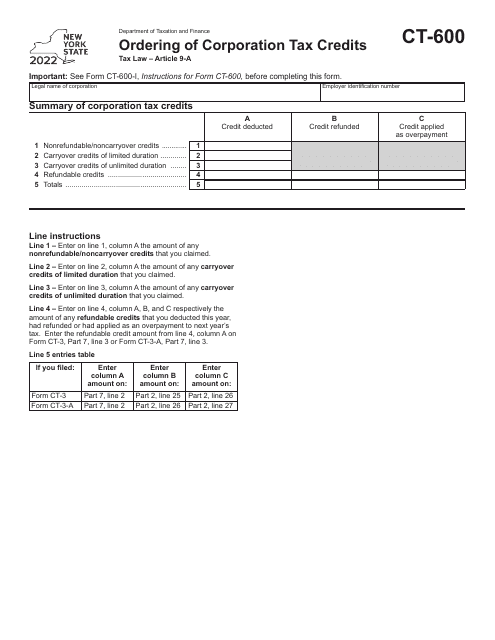

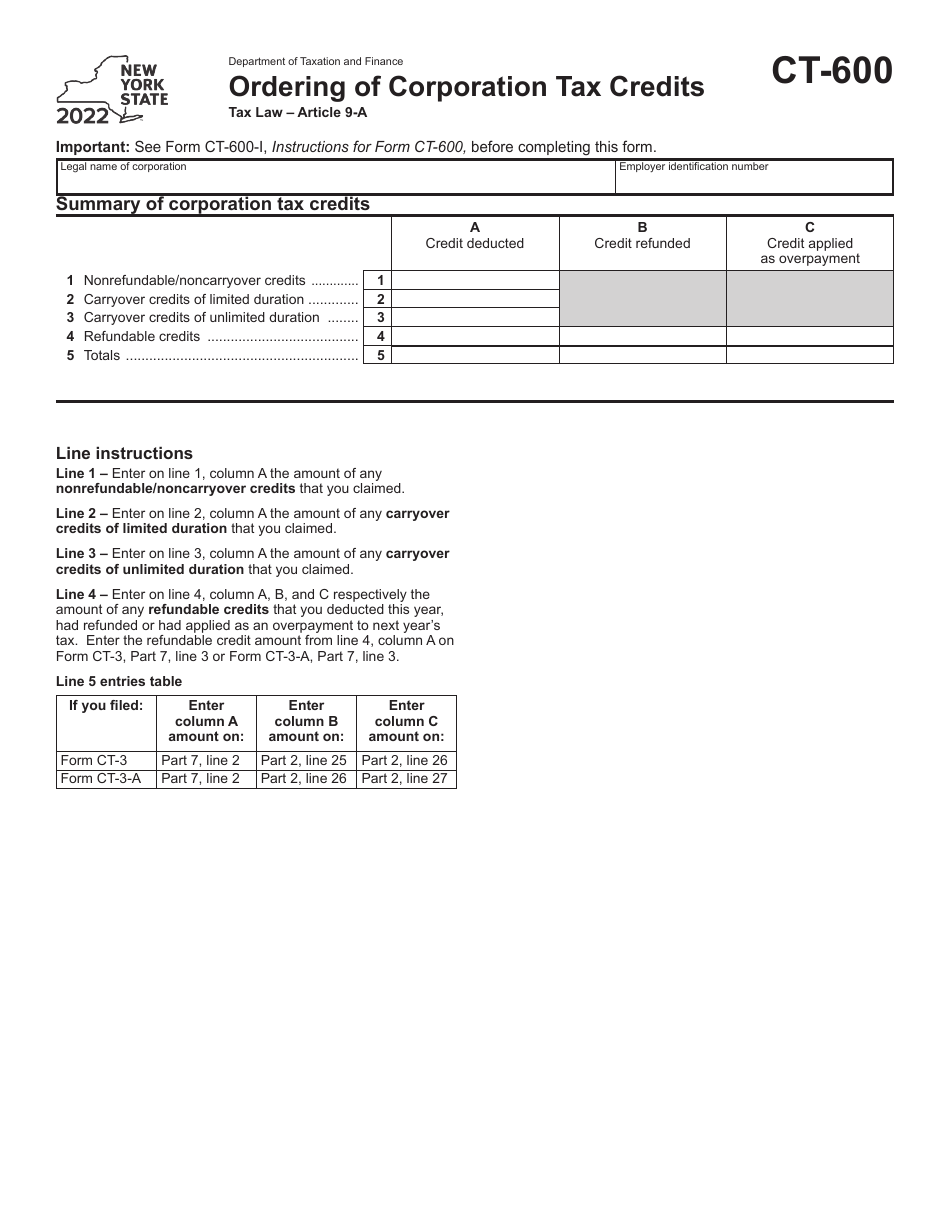

Form CT-600

for the current year.

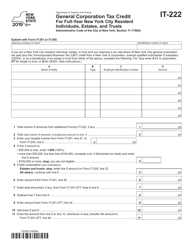

Form CT-600 Ordering of Corporation Tax Credits - New York

What Is Form CT-600?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-600?

A: Form CT-600 is a form used to report and claim corporation tax credits in New York.

Q: Who needs to file Form CT-600?

A: Corporations in New York that have tax credits to report or claim need to file Form CT-600.

Q: What information do I need to complete Form CT-600?

A: You will need information about your corporation's tax credits, including the type and amount of each credit.

Q: When is the deadline to file Form CT-600?

A: The deadline to file Form CT-600 is on or before the 15th day of the fourth month following the end of your corporation's tax year.

Q: Are there any penalties for not filing Form CT-600?

A: Yes, failure to file Form CT-600 or filing it late may result in penalties and interest.

Q: Can I amend Form CT-600 if I made a mistake?

A: Yes, you can file an amended Form CT-600 to correct any errors or omissions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-600 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.