This version of the form is not currently in use and is provided for reference only. Download this version of

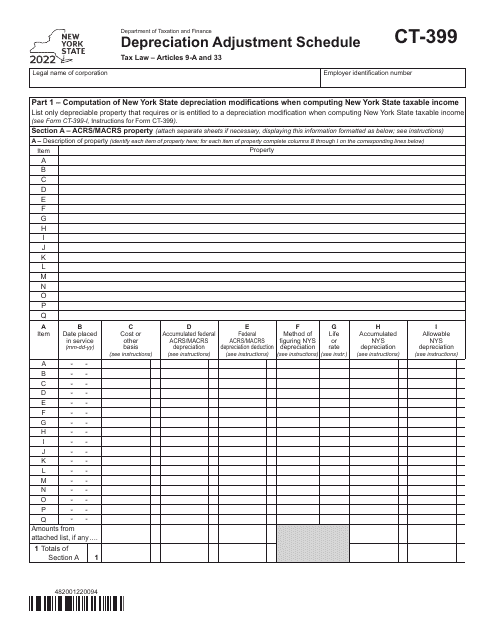

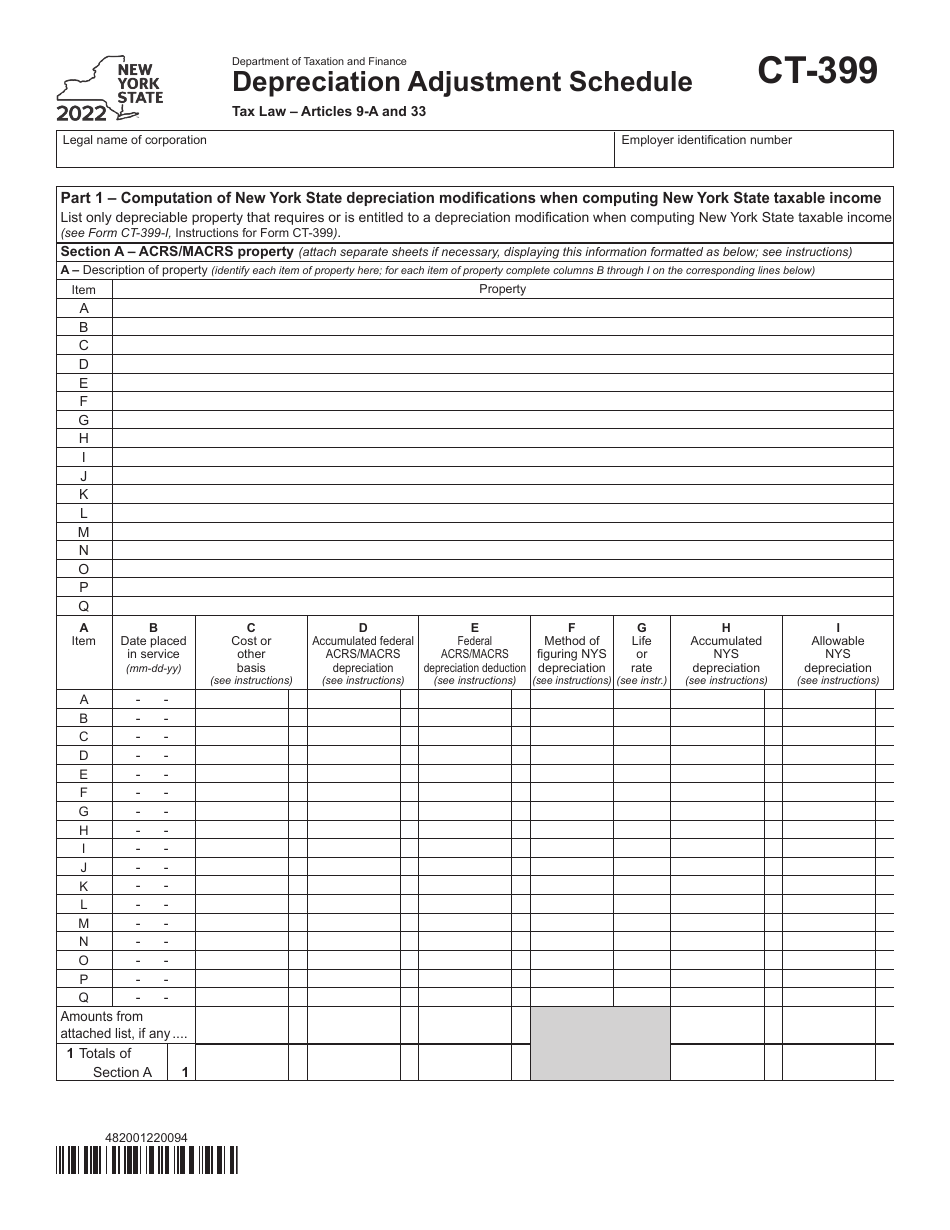

Form CT-399

for the current year.

Form CT-399 Depreciation Adjustment Schedule - New York

What Is Form CT-399?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-399?

A: Form CT-399 is the Depreciation Adjustment Schedule for businesses in New York.

Q: What is the purpose of Form CT-399?

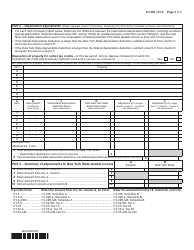

A: The purpose of Form CT-399 is to calculate and report depreciation adjustments for tax purposes.

Q: Who needs to file Form CT-399?

A: Businesses in New York that have depreciable assets and need to adjust their depreciation for tax purposes.

Q: When is Form CT-399 due?

A: Form CT-399 is generally due on the same date as the taxpayer's New York State tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.