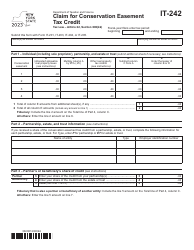

This version of the form is not currently in use and is provided for reference only. Download this version of

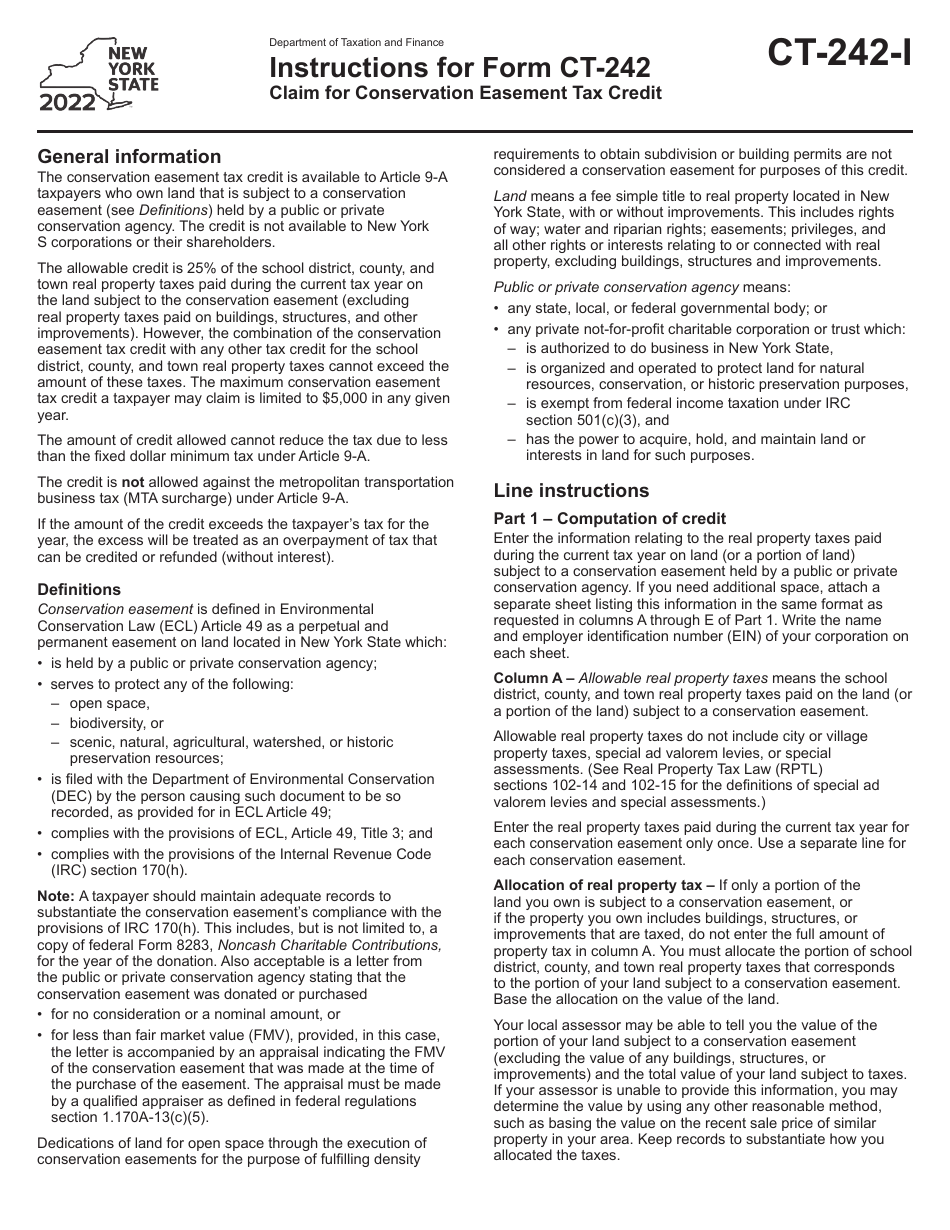

Instructions for Form CT-242

for the current year.

Instructions for Form CT-242 Claim for Conservation Easement Tax Credit - New York

This document contains official instructions for Form CT-242 , Claim for Conservation Easement Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-242 is available for download through this link.

FAQ

Q: What is Form CT-242?

A: Form CT-242 is a form used to claim a Conservation Easement Tax Credit in New York.

Q: What is a Conservation Easement?

A: A Conservation Easement is a legal agreement that restricts development on a property to protect its environmental or cultural values.

Q: What is the purpose of the Conservation Easement Tax Credit?

A: The purpose of the Conservation Easement Tax Credit is to provide a financial incentive for landowners who agree to place a Conservation Easement on their property.

Q: Who is eligible to claim the Conservation Easement Tax Credit?

A: Eligible individuals or entities include landowners who have donated or sold a qualifying Conservation Easement on their property.

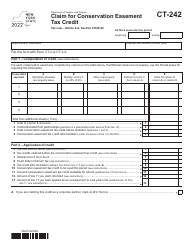

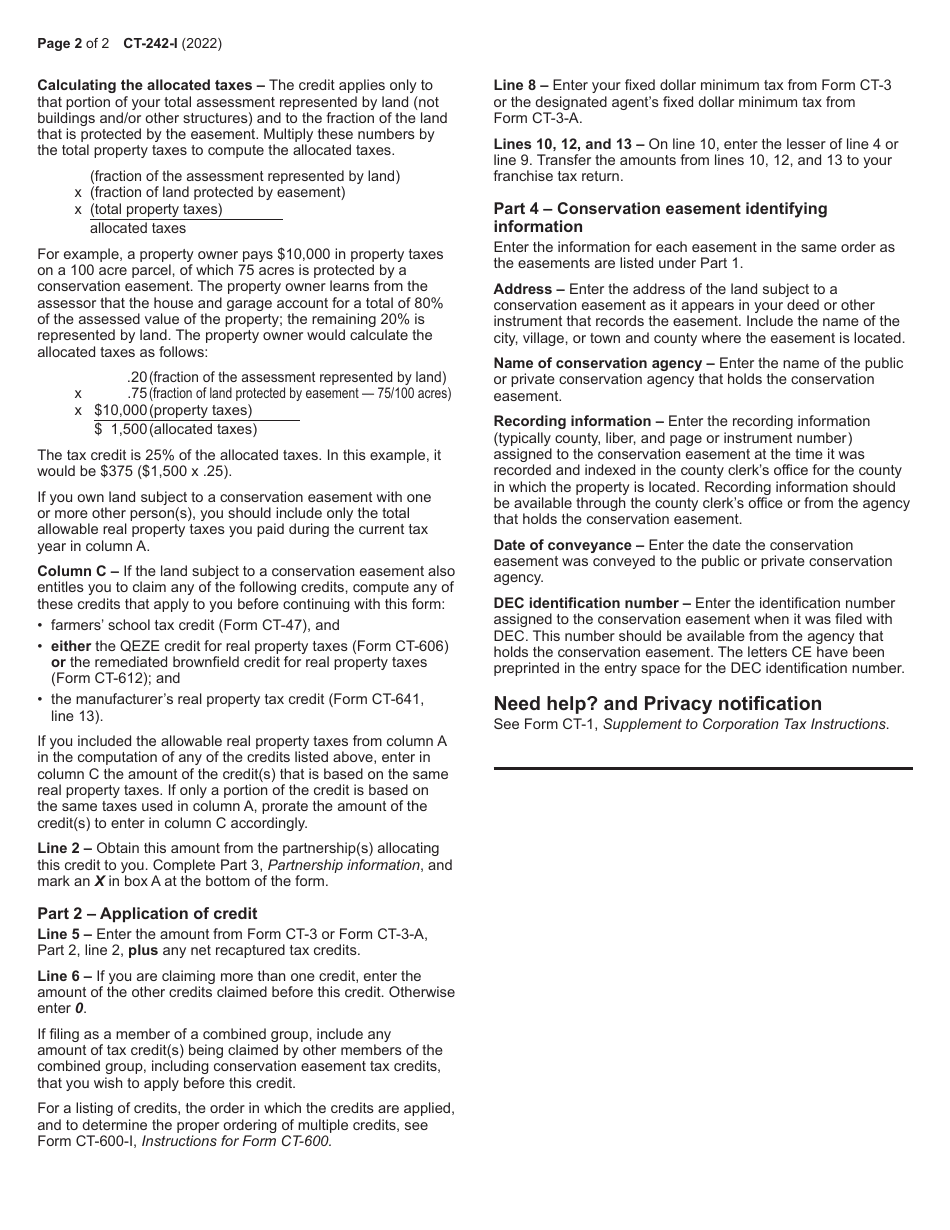

Q: What information is required on Form CT-242?

A: Form CT-242 requires information such as the property owner's name and contact information, a description of the Conservation Easement, and details about the qualified organization that received the easement.

Q: Are there any deadlines for filing Form CT-242?

A: Yes, the deadline for filing Form CT-242 is generally April 15th of the year following the year the Conservation Easement was granted.

Q: Are there any limitations on the amount of the tax credit?

A: Yes, the tax credit for a Conservation Easement is limited to 25% of the appraised value of the easement, or $1,250,000, whichever is less.

Q: Can the tax credit be carried forward or transferred?

A: No, the tax credit for a Conservation Easement cannot be carried forward or transferred to another person or tax year.

Q: Are there any additional requirements for claiming the tax credit?

A: Yes, there are additional requirements such as obtaining a certification from the New York State Department of Environmental Conservation and providing supporting documentation with the tax credit claim.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.