This version of the form is not currently in use and is provided for reference only. Download this version of

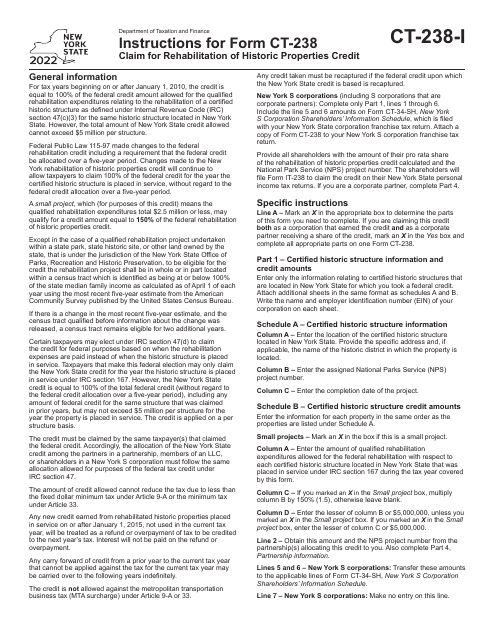

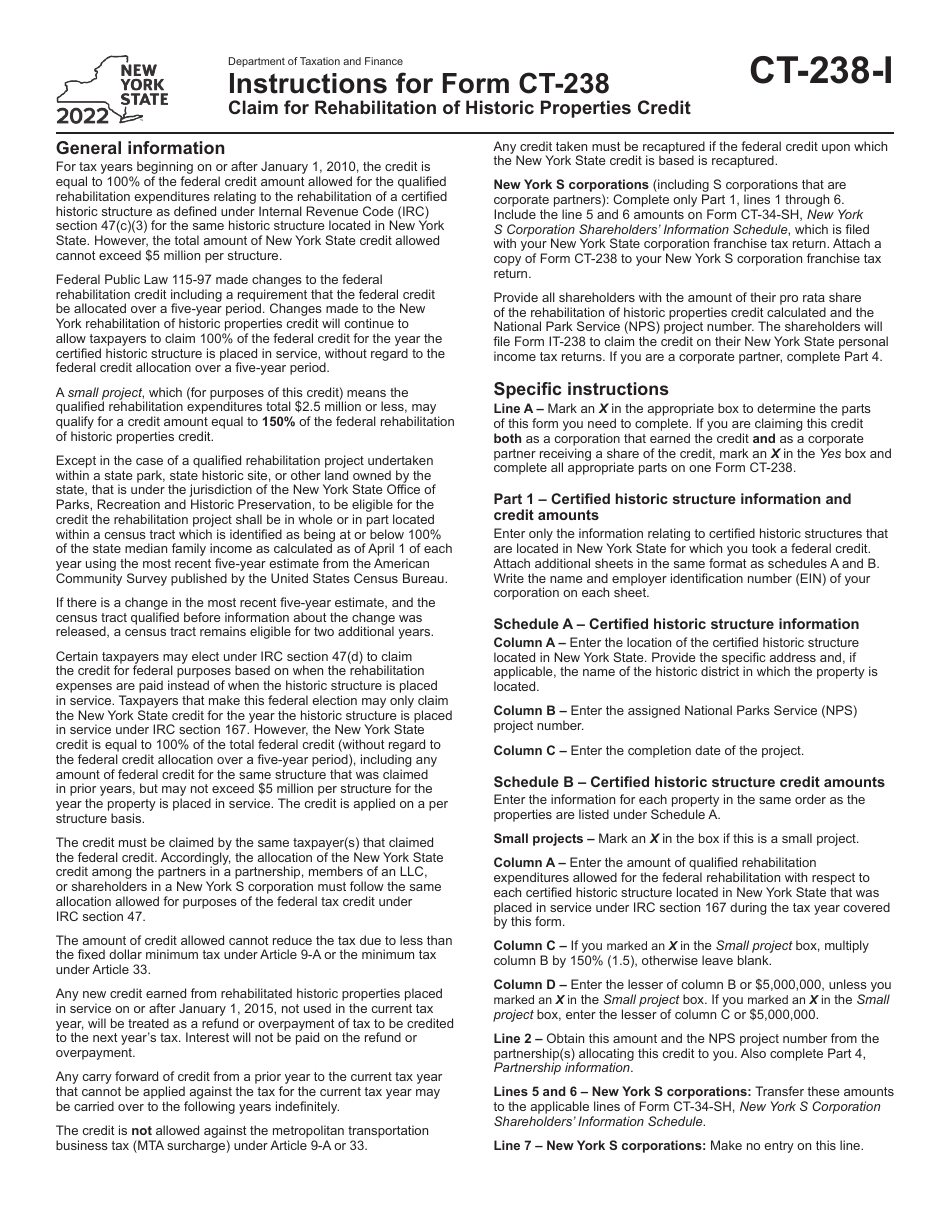

Instructions for Form CT-238

for the current year.

Instructions for Form CT-238 Claim for Rehabilitation of Historic Properties Credit - New York

This document contains official instructions for Form CT-238 , Claim for Rehabilitation of Historic Properties Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-238 is available for download through this link.

FAQ

Q: What is Form CT-238?

A: Form CT-238 is a claim form used to apply for the Rehabilitation of Historic Properties Credit in New York.

Q: What is the Rehabilitation of Historic Properties Credit?

A: The Rehabilitation of Historic Properties Credit is a tax credit offered by New York for the restoration and preservation of historic properties.

Q: Who can file Form CT-238?

A: Any taxpayer who has incurred qualified rehabilitation expenses for a historic property in New York can file Form CT-238.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses are the costs associated with the restoration and preservation of a historic property, such as construction, renovation, and architectural fees.

Q: What information do I need to provide on Form CT-238?

A: You will need to provide information about the historic property, the rehabilitation project, and the expenses incurred. This includes details about the property's location, its historic significance, and the cost of the rehabilitation work.

Q: When is Form CT-238 due?

A: Form CT-238 is due on or before the due date of your New York state tax return, including extensions.

Q: Can I file Form CT-238 electronically?

A: No, Form CT-238 cannot be filed electronically. It must be submitted by mail.

Q: How long does it take to process Form CT-238?

A: Processing times can vary, but generally, you can expect to receive a decision within 90 days after the form is received.

Q: What should I do if I have questions or need assistance with Form CT-238?

A: If you have any questions or need assistance with Form CT-238, you can contact the New York State Department of Taxation and Finance for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.