This version of the form is not currently in use and is provided for reference only. Download this version of

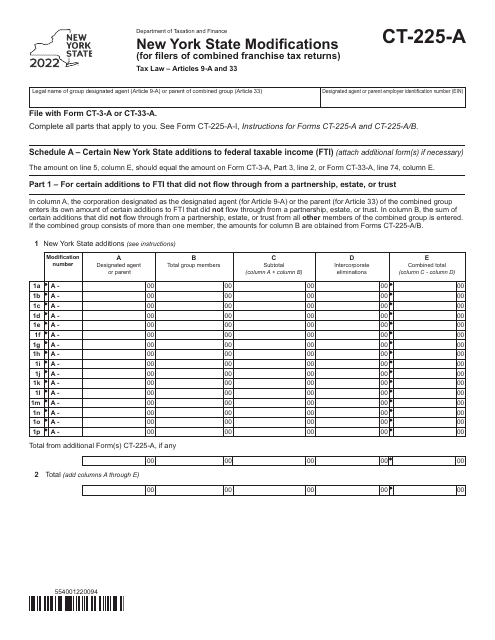

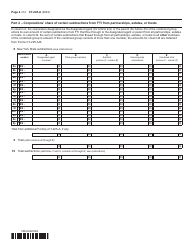

Form CT-225-A

for the current year.

Form CT-225-A New York State Modifications (For Filers of Combined Franchise Tax Returns) - New York

What Is Form CT-225-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-225-A?

A: Form CT-225-A is a form for filers of combined franchise tax returns in New York State.

Q: Who needs to file Form CT-225-A?

A: Form CT-225-A is for taxpayers who are filing combined franchise tax returns in New York State.

Q: What are New York State modifications?

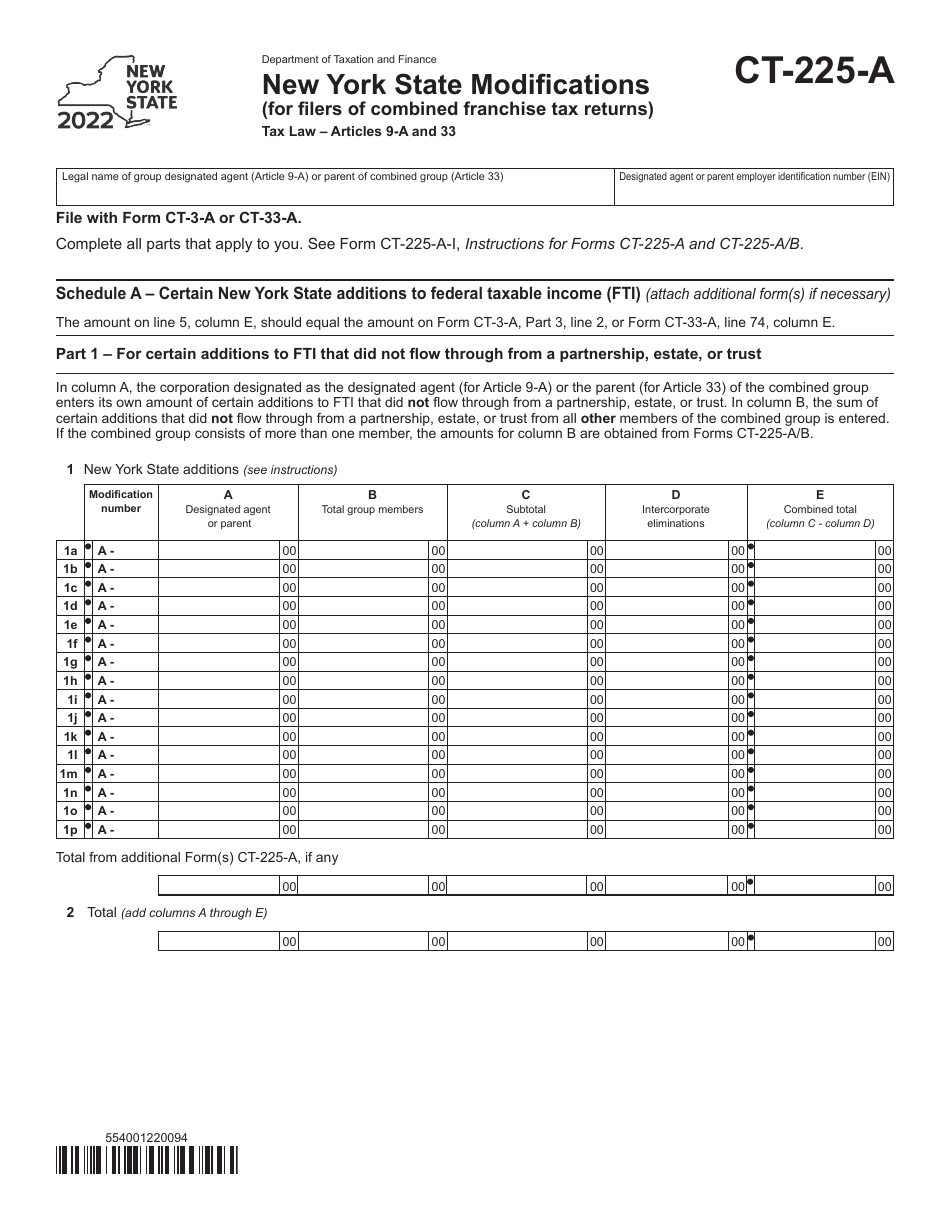

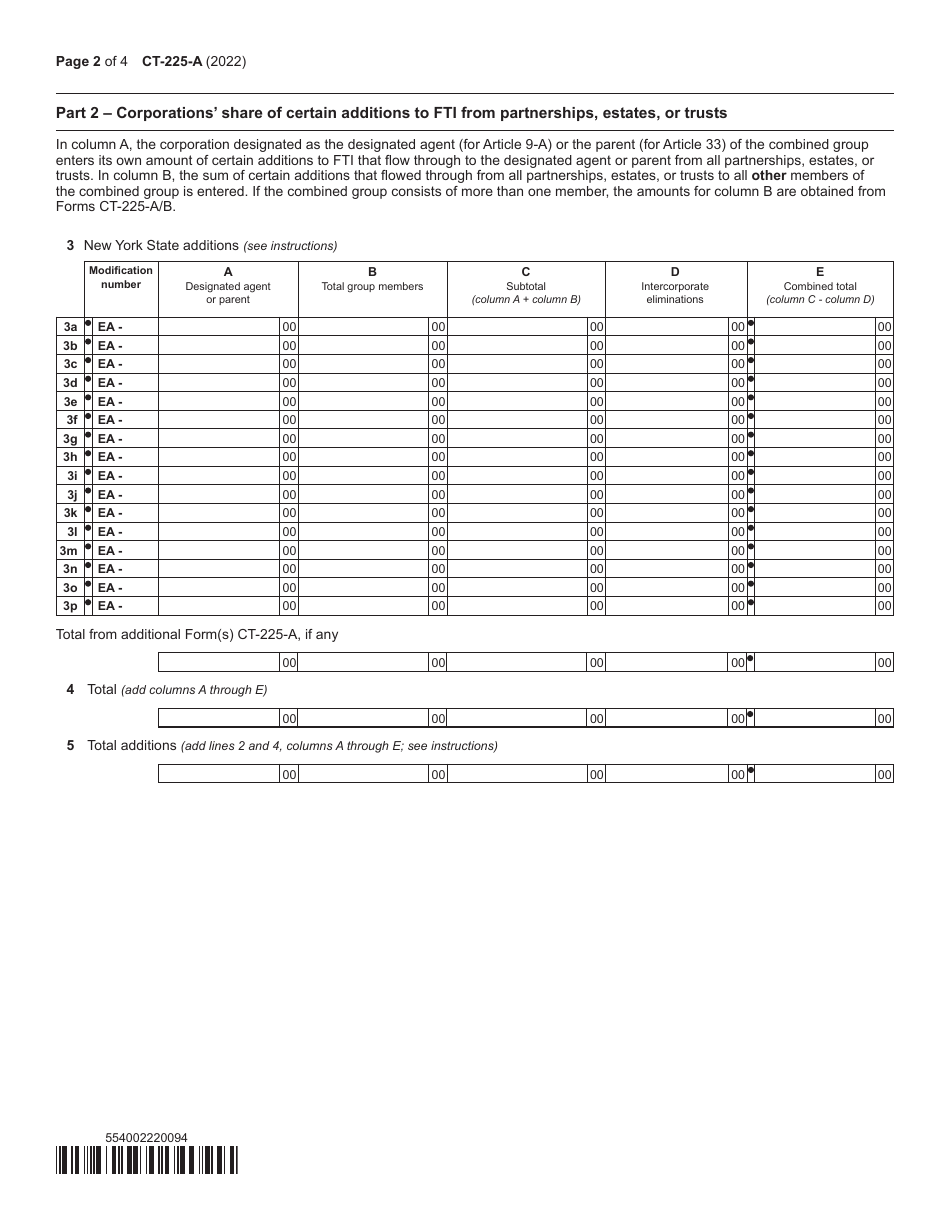

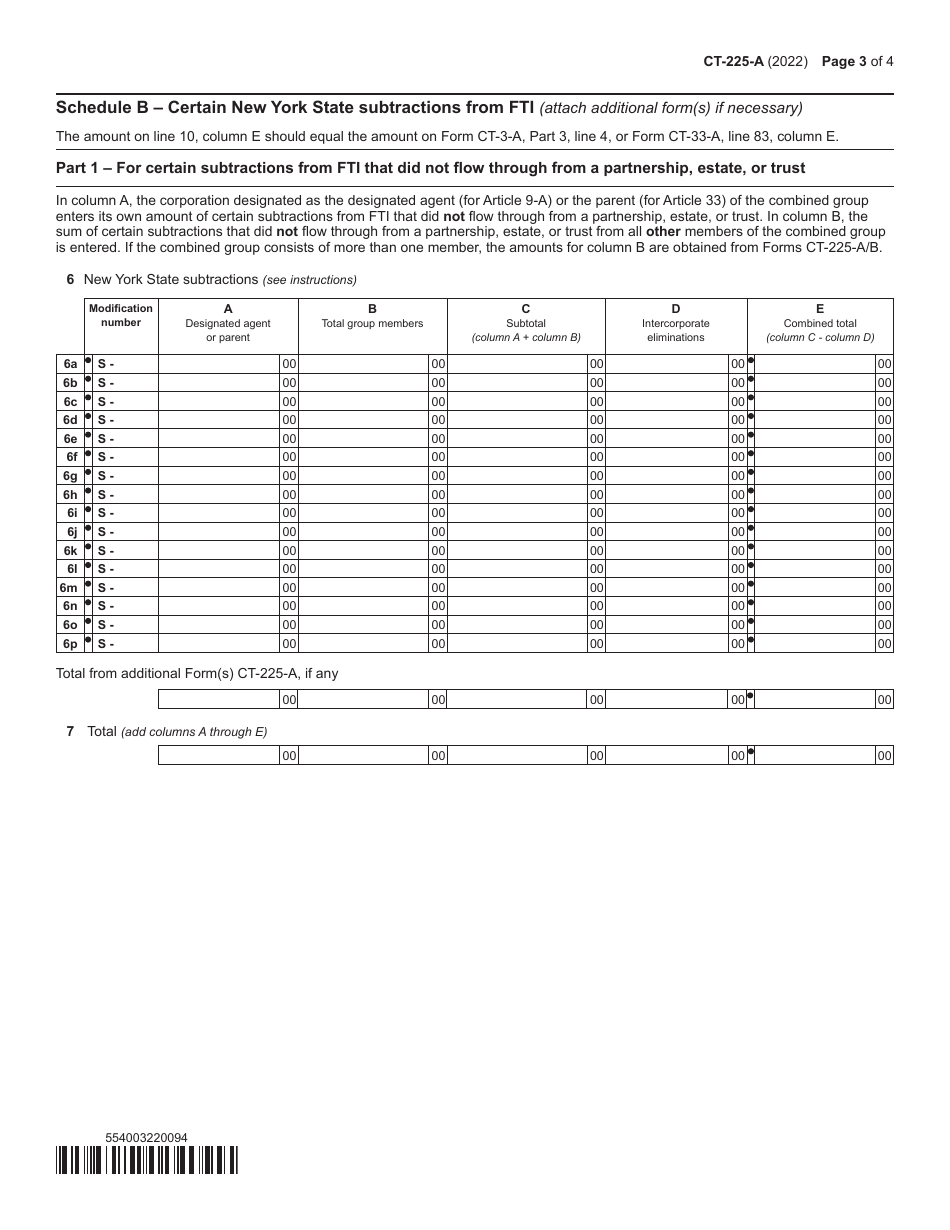

A: New York State modifications are adjustments made to the federal taxable income of combined franchise tax filers.

Q: Why do I need to file Form CT-225-A?

A: You need to file Form CT-225-A to report and calculate the New York State modifications for your combined franchise tax return.

Q: When is the deadline to file Form CT-225-A?

A: The deadline to file Form CT-225-A is the same as the deadline for filing your combined franchise tax return in New York State.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-225-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.