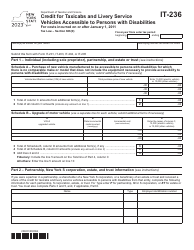

This version of the form is not currently in use and is provided for reference only. Download this version of

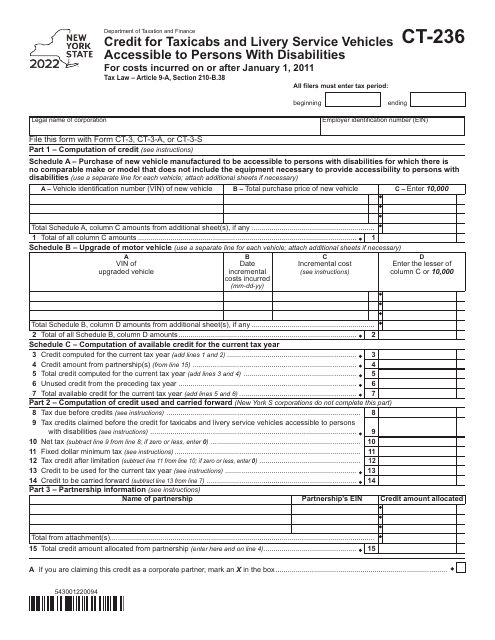

Form CT-236

for the current year.

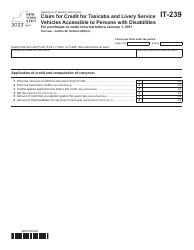

Form CT-236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities for Costs Incurred on or After January 1, 2011 - New York

What Is Form CT-236?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-236?

A: Form CT-236 is a tax form for claiming the Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities.

Q: What does the credit cover?

A: The credit covers costs incurred for taxicabs and livery service vehicles that are accessible to persons with disabilities.

Q: When can the credit be claimed?

A: The credit can be claimed for costs incurred on or after January 1, 2011.

Q: Who is eligible for this credit?

A: Individuals or businesses that incur costs for accessible taxicabs and livery service vehicles in New York may be eligible for this credit.

Q: Is there a deadline for filing this form?

A: The deadline for filing Form CT-236 depends on the individual or business's tax return due date, usually April 15th.

Q: Are there any limitations on the credit?

A: Yes, there are limitations on the credit, such as the maximum credit amount and the requirement for the vehicles to be used predominantly in New York.

Q: How is the credit calculated?

A: The credit is calculated based on eligible costs incurred and the appropriate percentage allowed by the New York Department of Taxation and Finance.

Q: What documentation is required to claim this credit?

A: Documentation such as receipts and records of costs incurred for accessible taxicabs and livery service vehicles may be required to claim this credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-236 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.