This version of the form is not currently in use and is provided for reference only. Download this version of

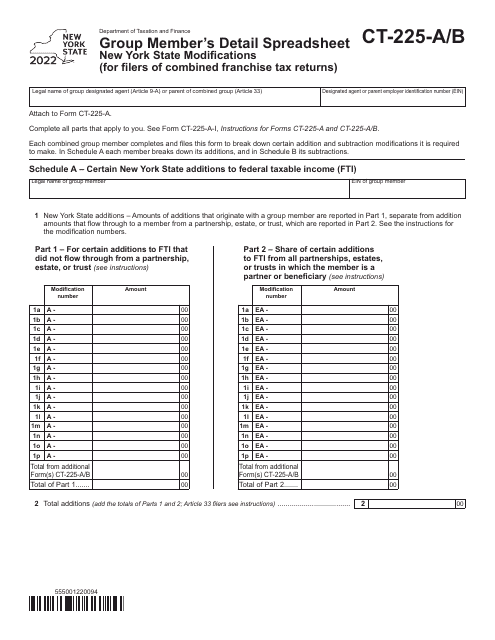

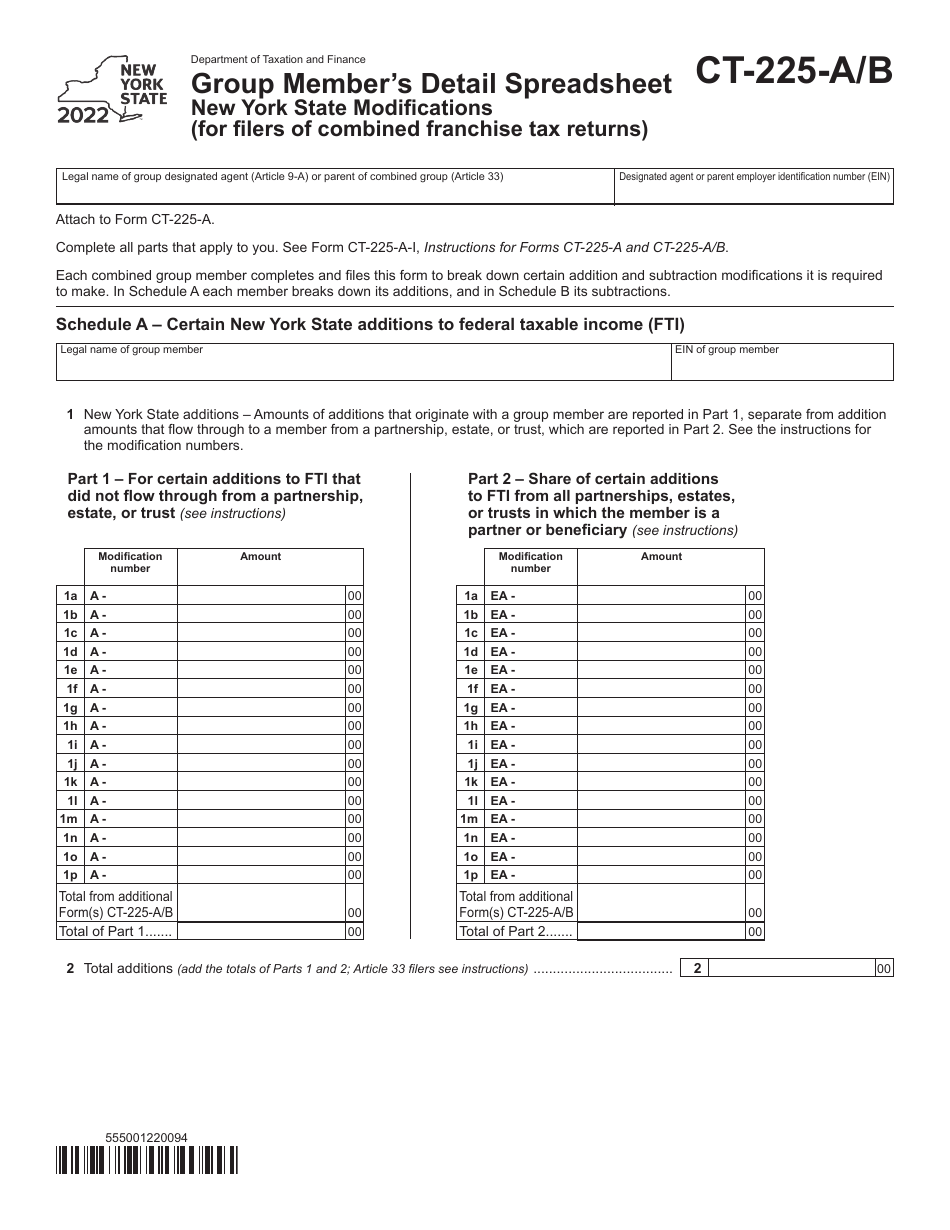

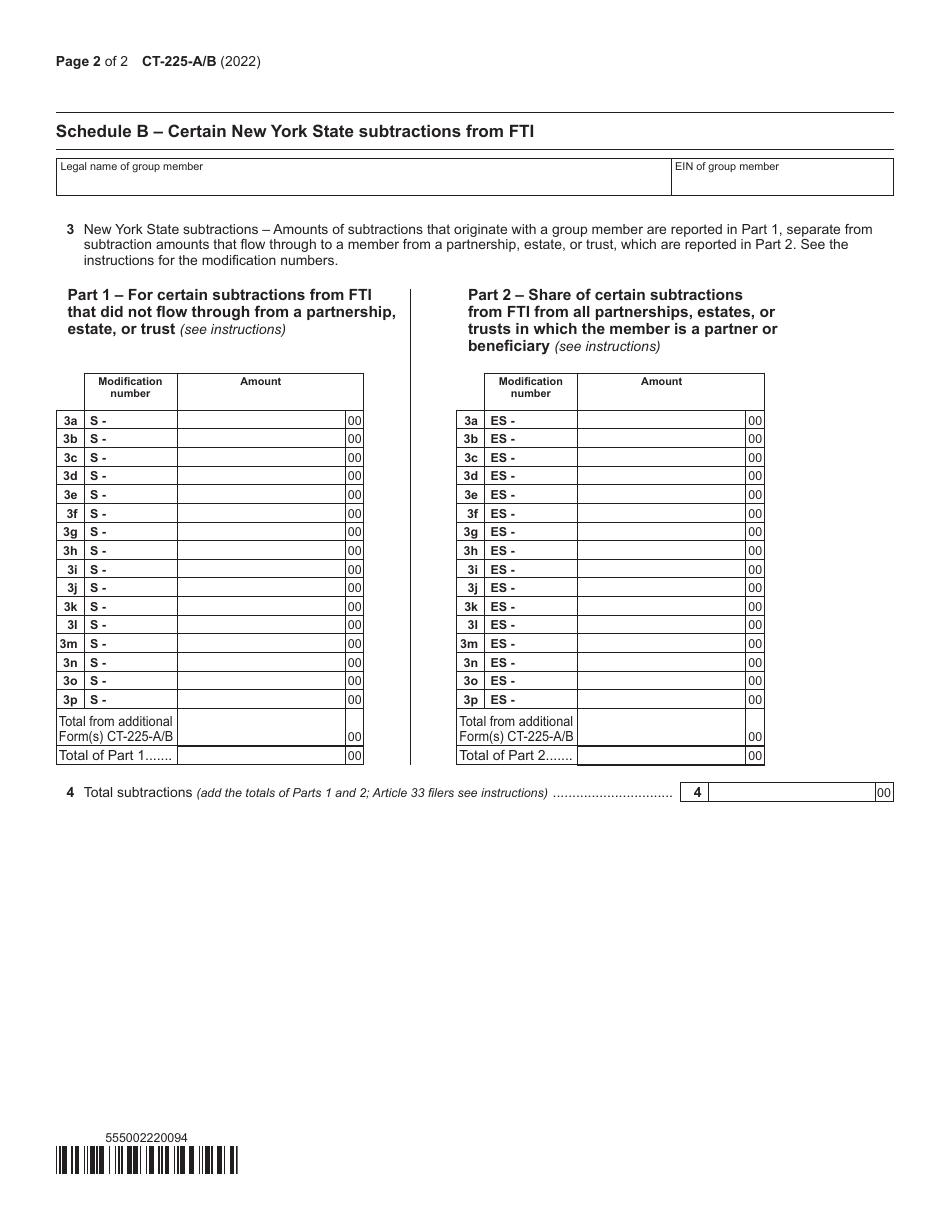

Form CT-225-A/B

for the current year.

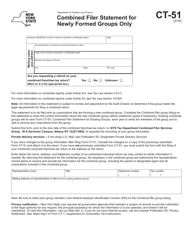

Form CT-225-A / B Group Member's Detail Spreadsheet New York State Modifications (For Filers of Combined Franchise Tax Returns) - New York

What Is Form CT-225-A/B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the purpose of Form CT-225-A/B?

A: Form CT-225-A/B is used to provide detailed information about group members for filers of combined franchise tax returns in New York.

Q: Who needs to file Form CT-225-A/B?

A: Filings of combined franchise tax returns in New York must file Form CT-225-A/B if they have group members.

Q: What information is required on Form CT-225-A/B?

A: Form CT-225-A/B requires detailed information about each group member, including their name, federal employer identification number (FEIN), and New York state modifications.

Q: Is Form CT-225-A/B specific to New York State?

A: Yes, Form CT-225-A/B is specific to filers of combined franchise tax returns in New York State.

Q: Are there any specific deadlines for filing Form CT-225-A/B?

A: The deadline for filing Form CT-225-A/B is the same as the deadline for filing the combined franchise tax return in New York.

Q: Can Form CT-225-A/B be used by individual filers?

A: No, Form CT-225-A/B is specifically for filers of combined franchise tax returns with group members.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-225-A/B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.