This version of the form is not currently in use and is provided for reference only. Download this version of

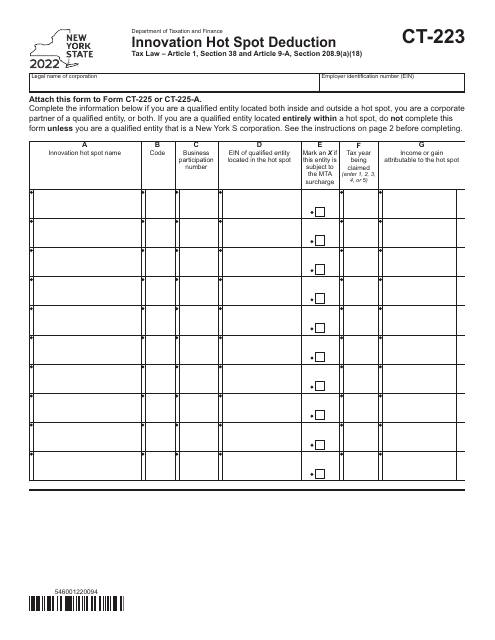

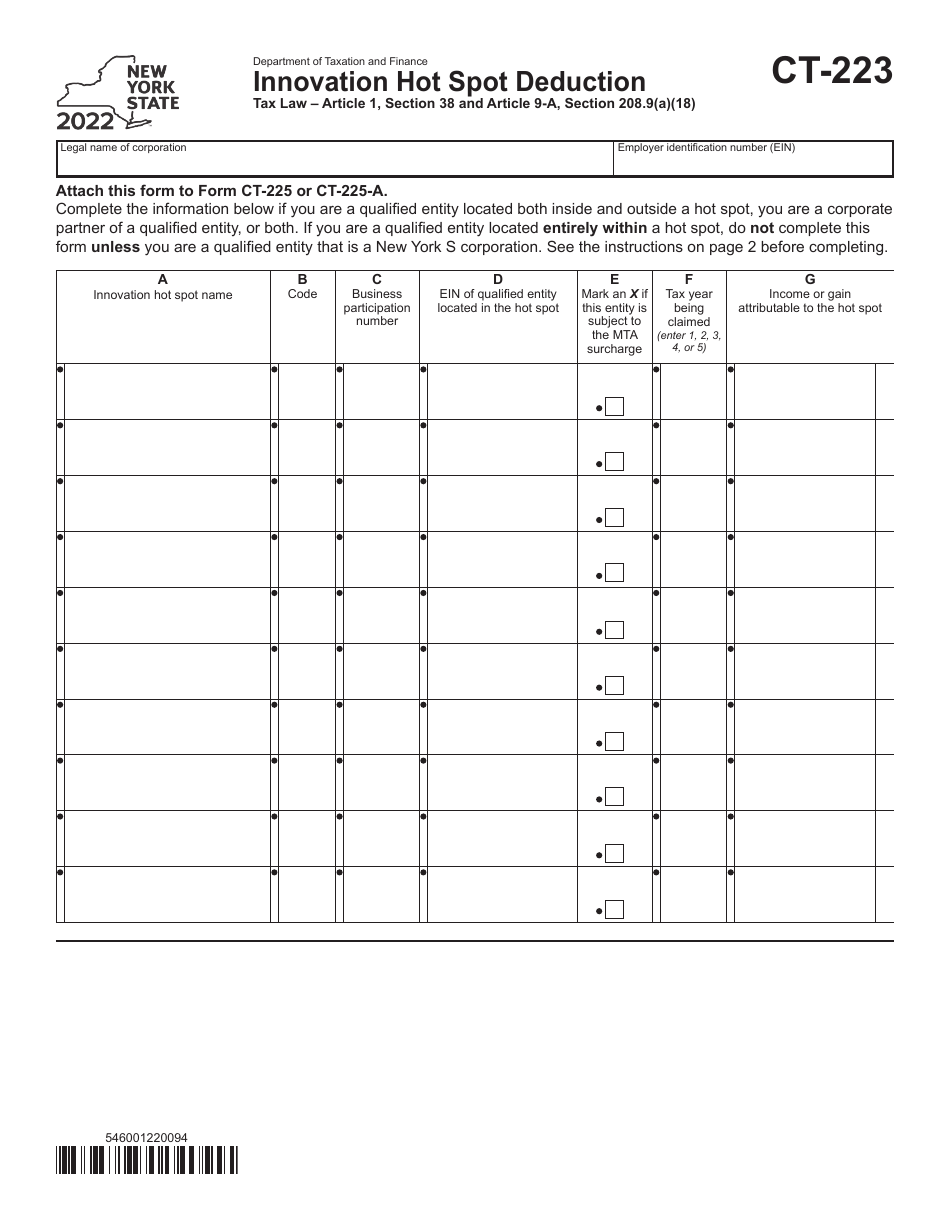

Form CT-223

for the current year.

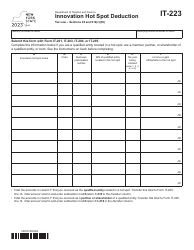

Form CT-223 Innovation Hot Spot Deduction - New York

What Is Form CT-223?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-223 Innovation Hot Spot Deduction?

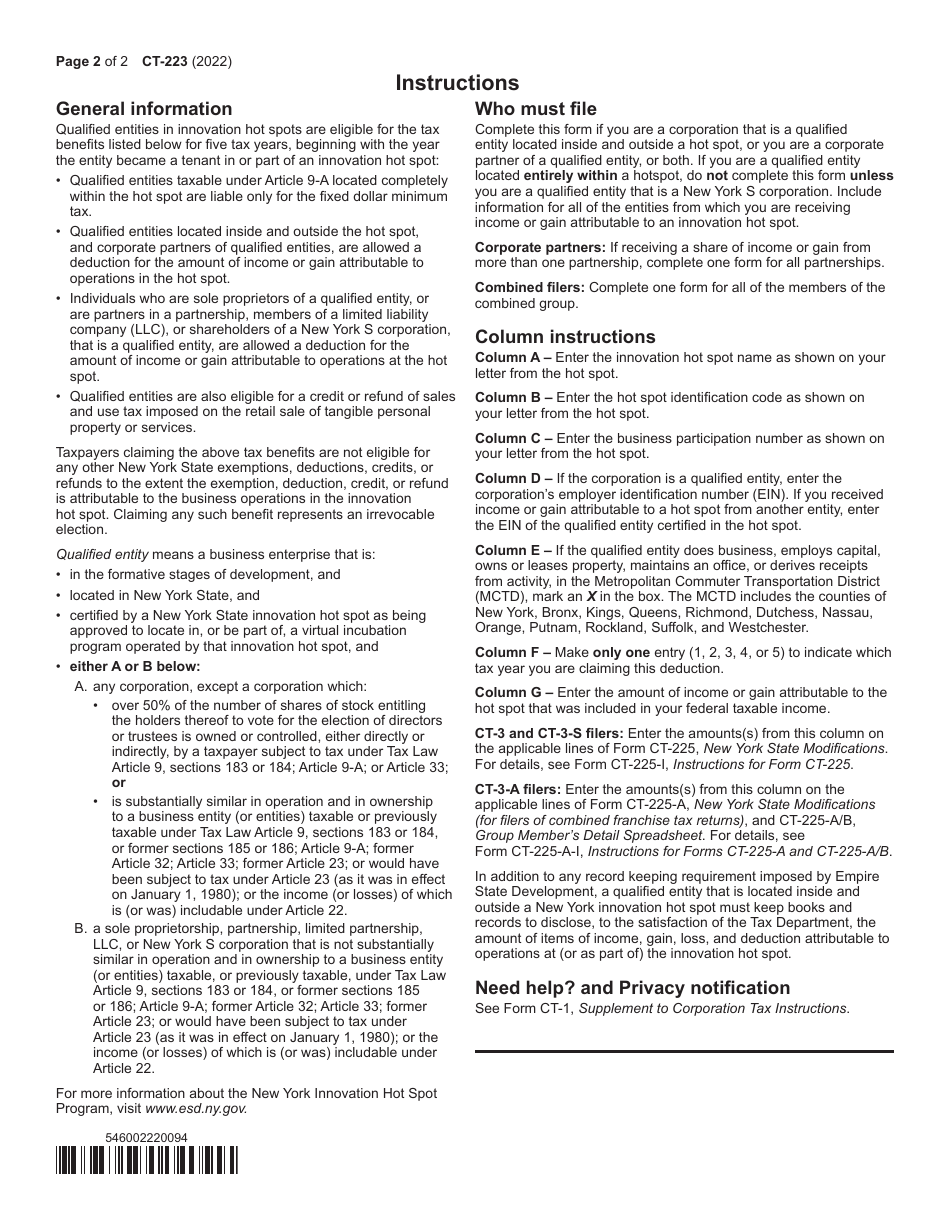

A: Form CT-223 Innovation Hot Spot Deduction is a tax form used in New York to claim a deduction related to innovation hot spots.

Q: Who can use Form CT-223?

A: Form CT-223 can be used by eligible businesses in New York.

Q: What is the purpose of the Innovation Hot Spot Deduction?

A: The purpose of the Innovation Hot Spot Deduction is to encourage and support businesses that are located in designated innovation hot spots in New York.

Q: How do I qualify for the Innovation Hot Spot Deduction?

A: To qualify for the Innovation Hot Spot Deduction, your business must be located in a designated innovation hot spot and meet certain eligibility criteria set by the New York State Department of Taxation and Finance.

Q: What expenses can be deducted using Form CT-223?

A: Expenses related to qualifying research and development activities, job training, and property acquisition within the designated innovation hot spots may be deductible using Form CT-223.

Q: When is the deadline to file Form CT-223?

A: The deadline to file Form CT-223 may vary, so it's important to check the instructions provided with the form or consult with the New York State Department of Taxation and Finance.

Q: Are there any penalties for late filing of Form CT-223?

A: Penalties for late filing of Form CT-223 may apply, so it's important to file the form on time or request an extension if needed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-223 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.