This version of the form is not currently in use and is provided for reference only. Download this version of

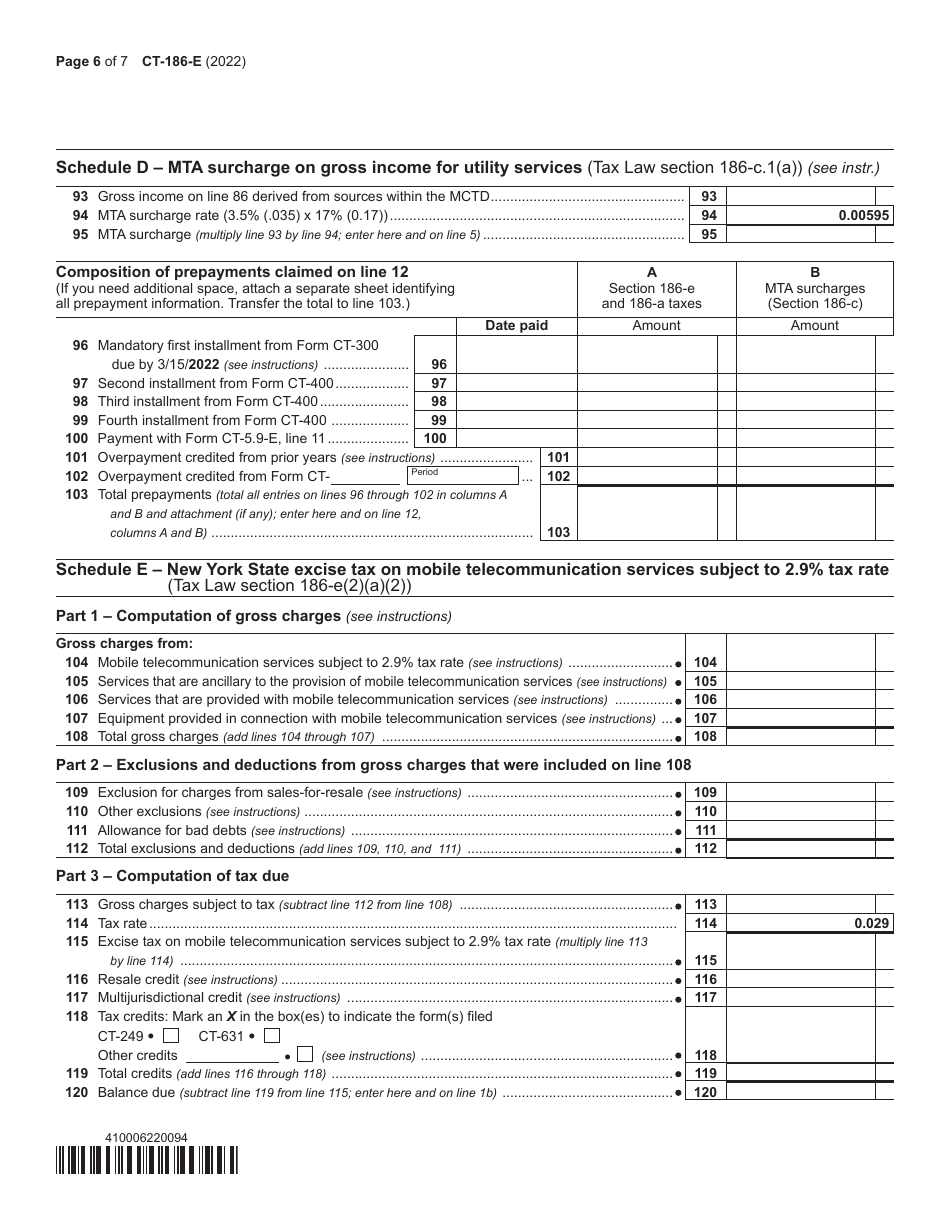

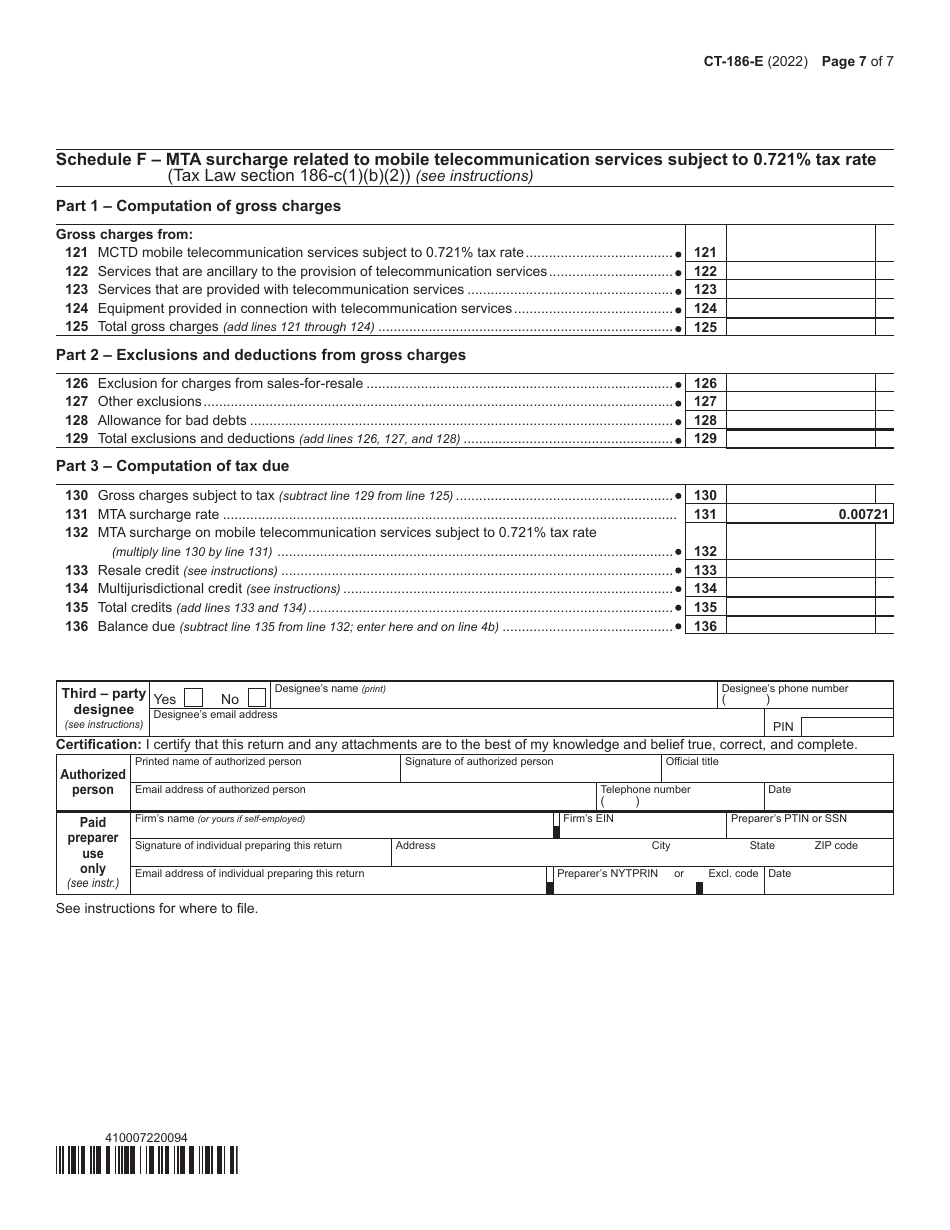

Form CT-186-E

for the current year.

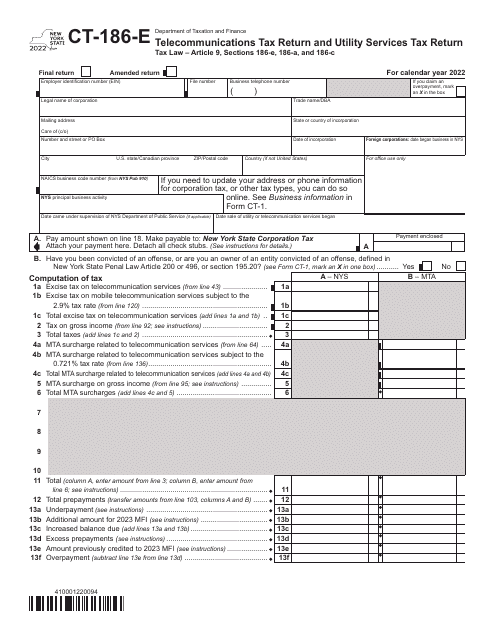

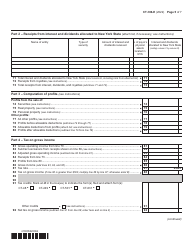

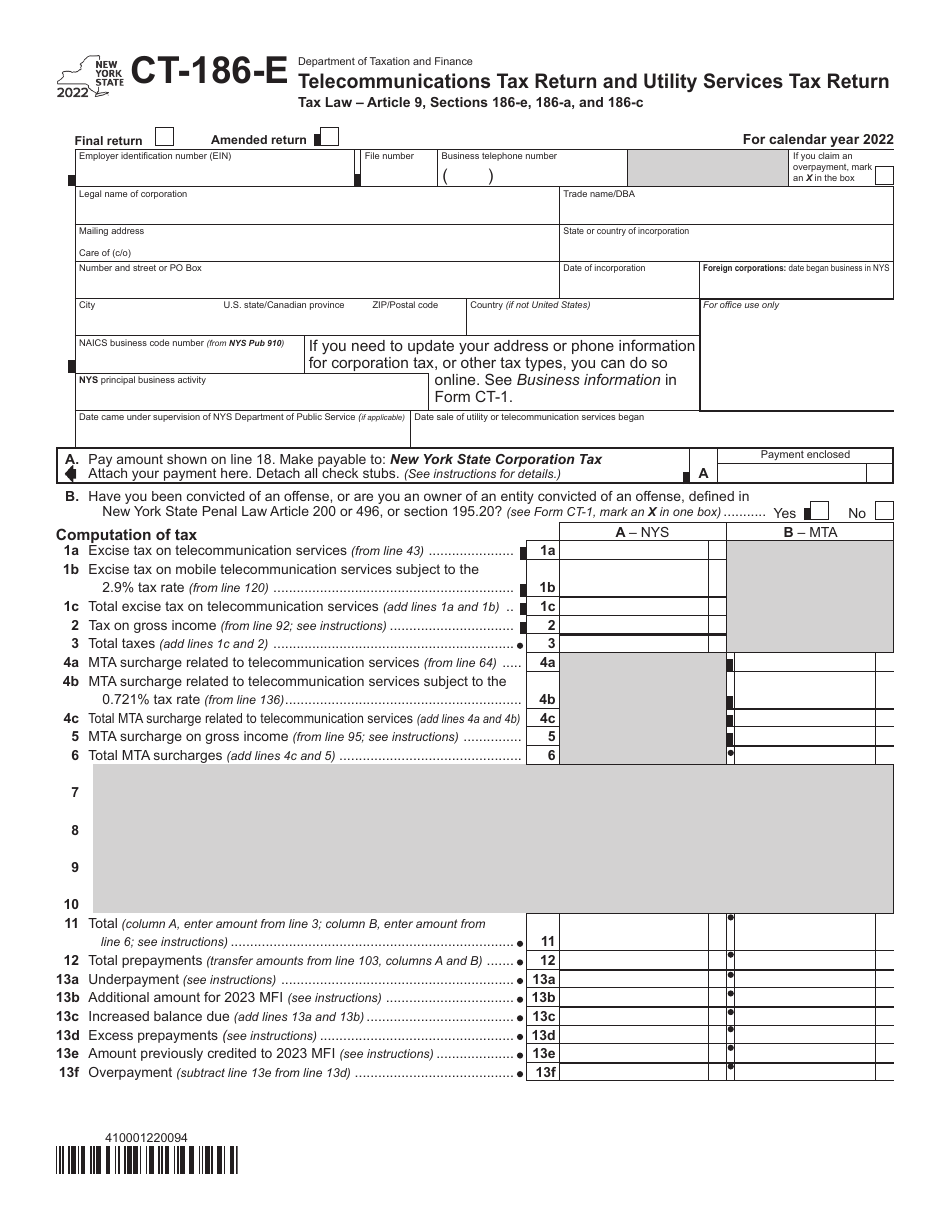

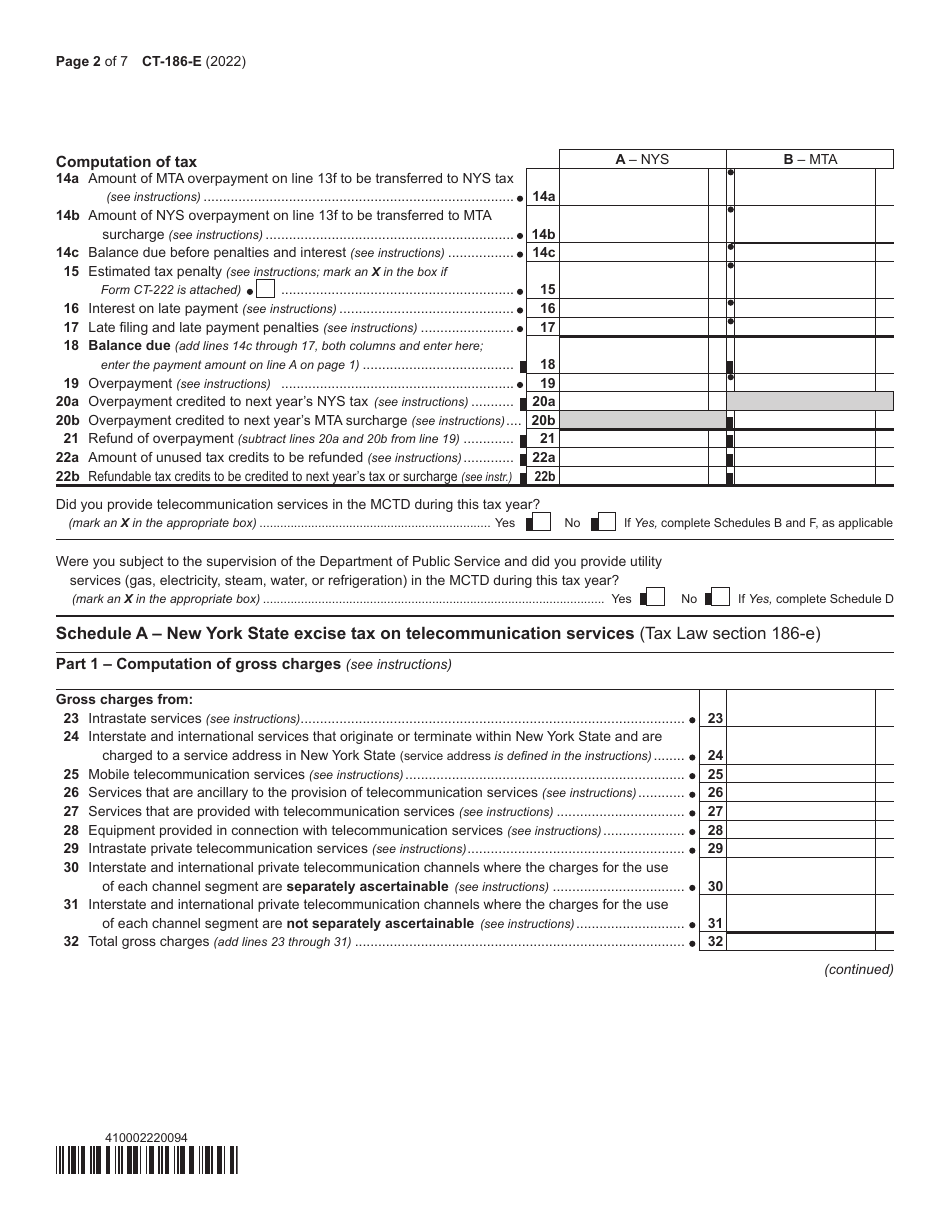

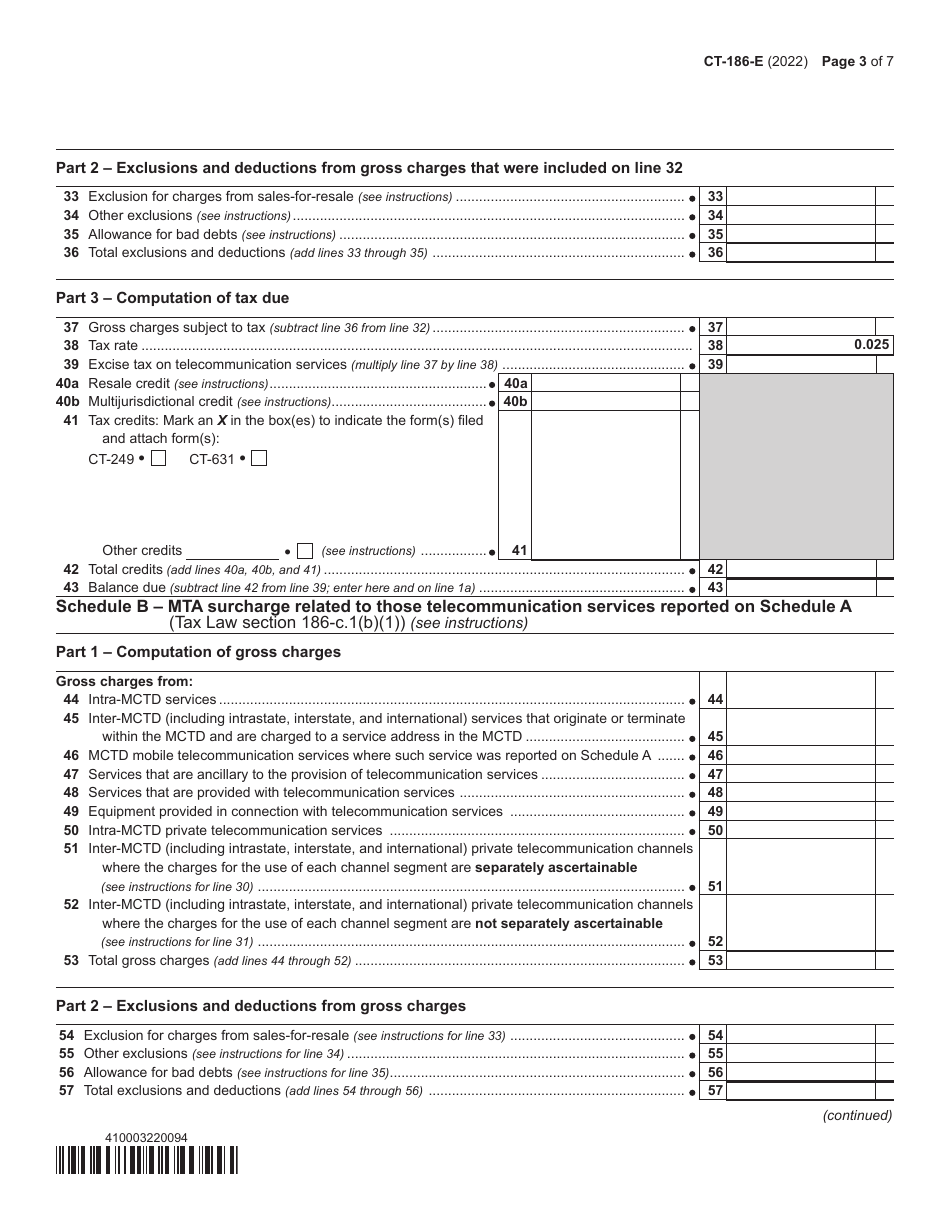

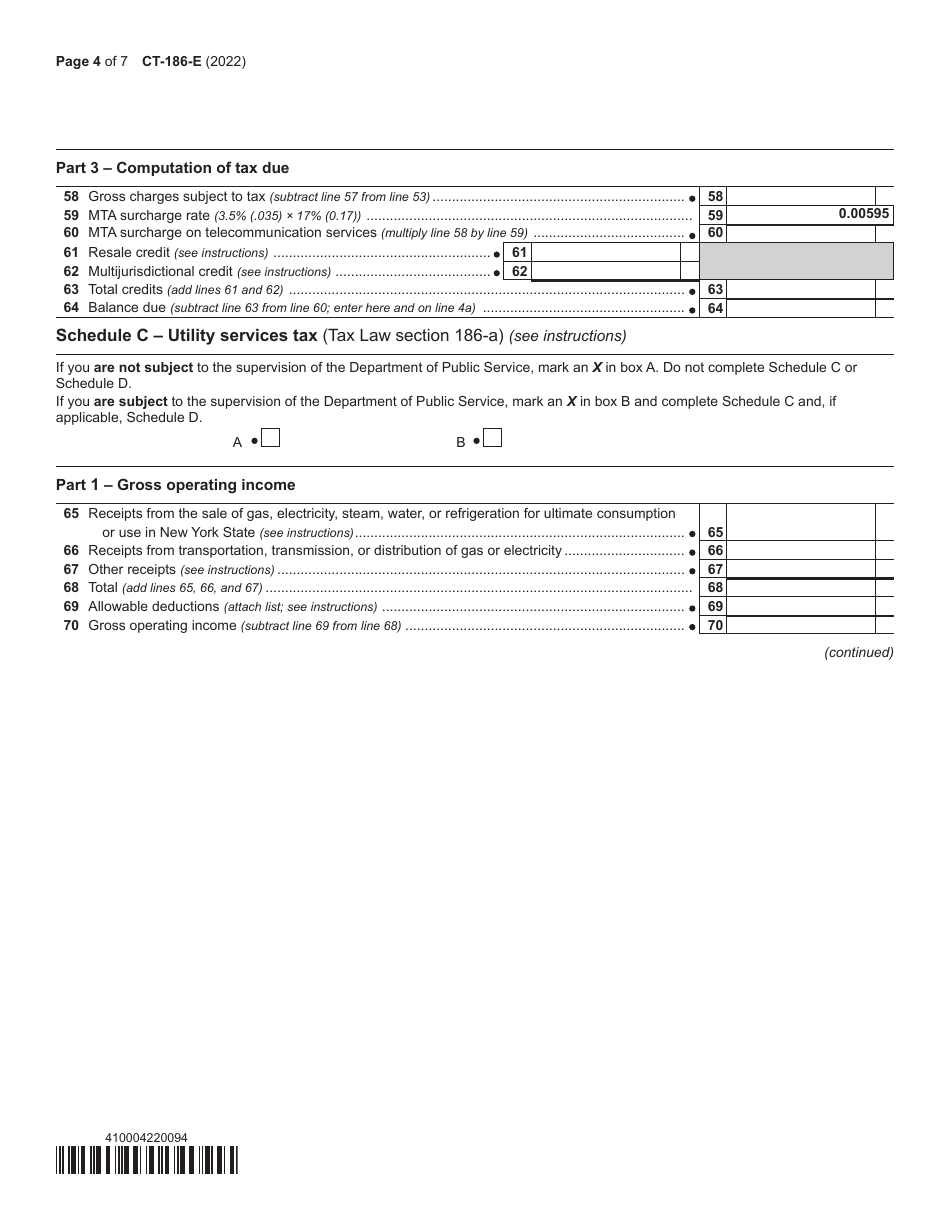

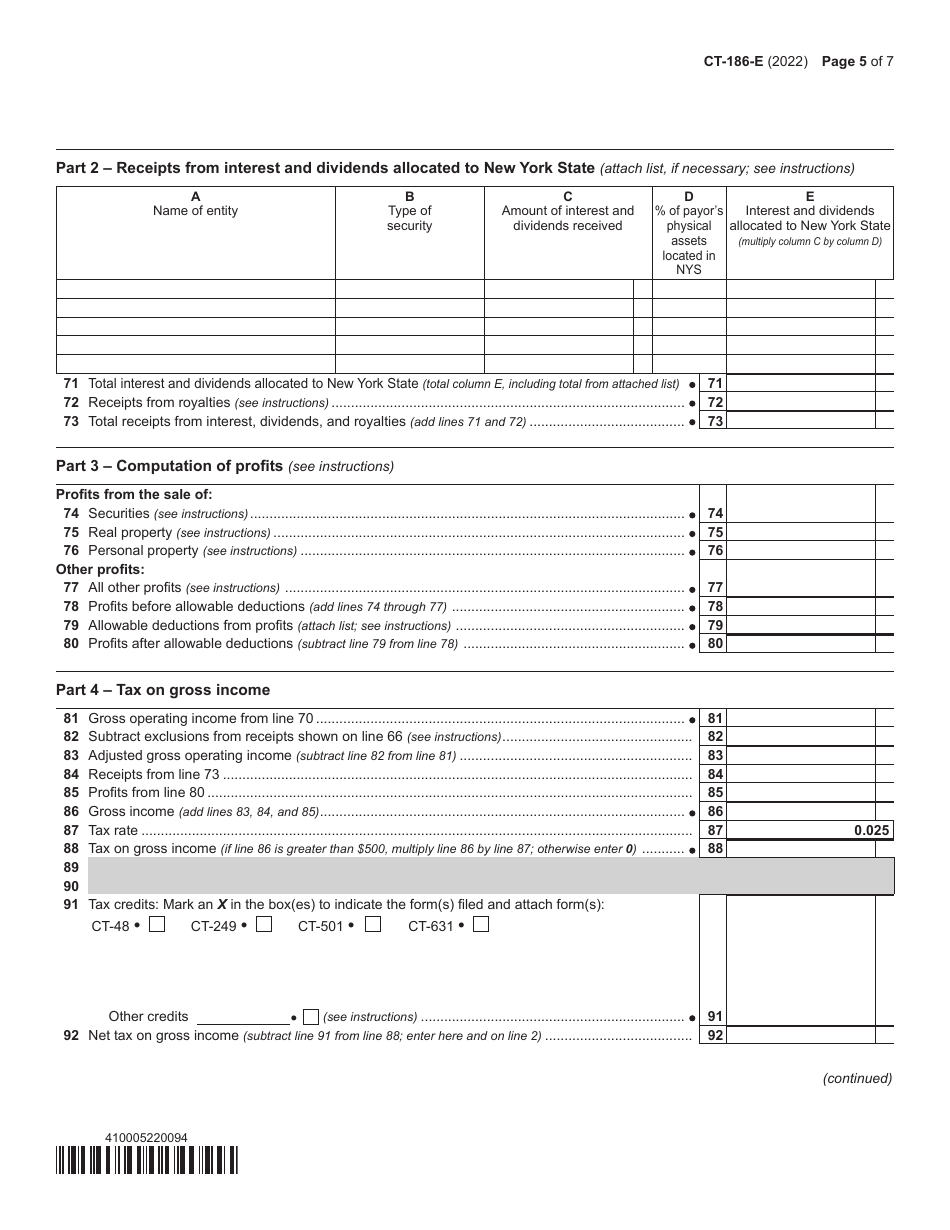

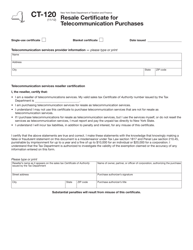

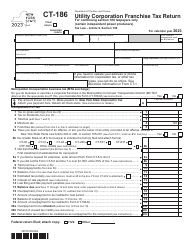

Form CT-186-E Telecommunications Tax Return and Utility Services Tax Return - New York

What Is Form CT-186-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-E?

A: Form CT-186-E is a tax return form used in New York for reporting and paying telecommunications tax and utility services tax.

Q: Who needs to file Form CT-186-E?

A: Businesses in New York that provide telecommunications services or utility services are required to file Form CT-186-E.

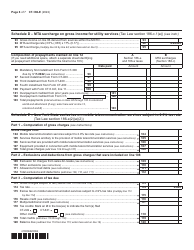

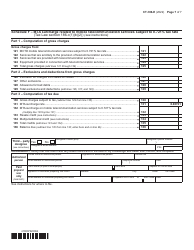

Q: What taxes are reported on Form CT-186-E?

A: Form CT-186-E is used to report and pay telecommunications tax and utility services tax in New York.

Q: How often do I need to file Form CT-186-E?

A: Form CT-186-E is filed annually. The due date is March 20th of each year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-186-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.