This version of the form is not currently in use and is provided for reference only. Download this version of

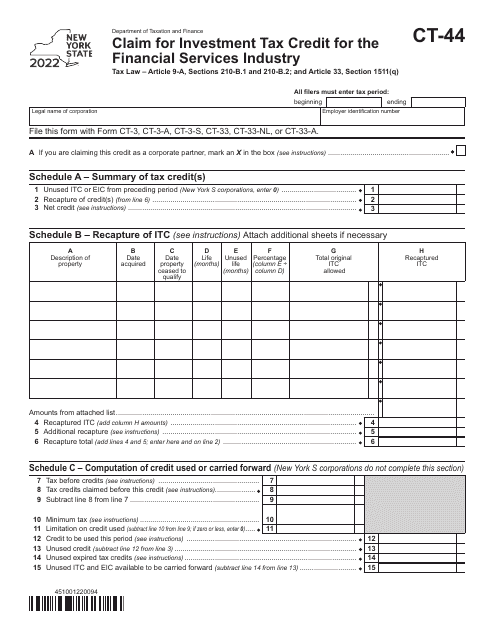

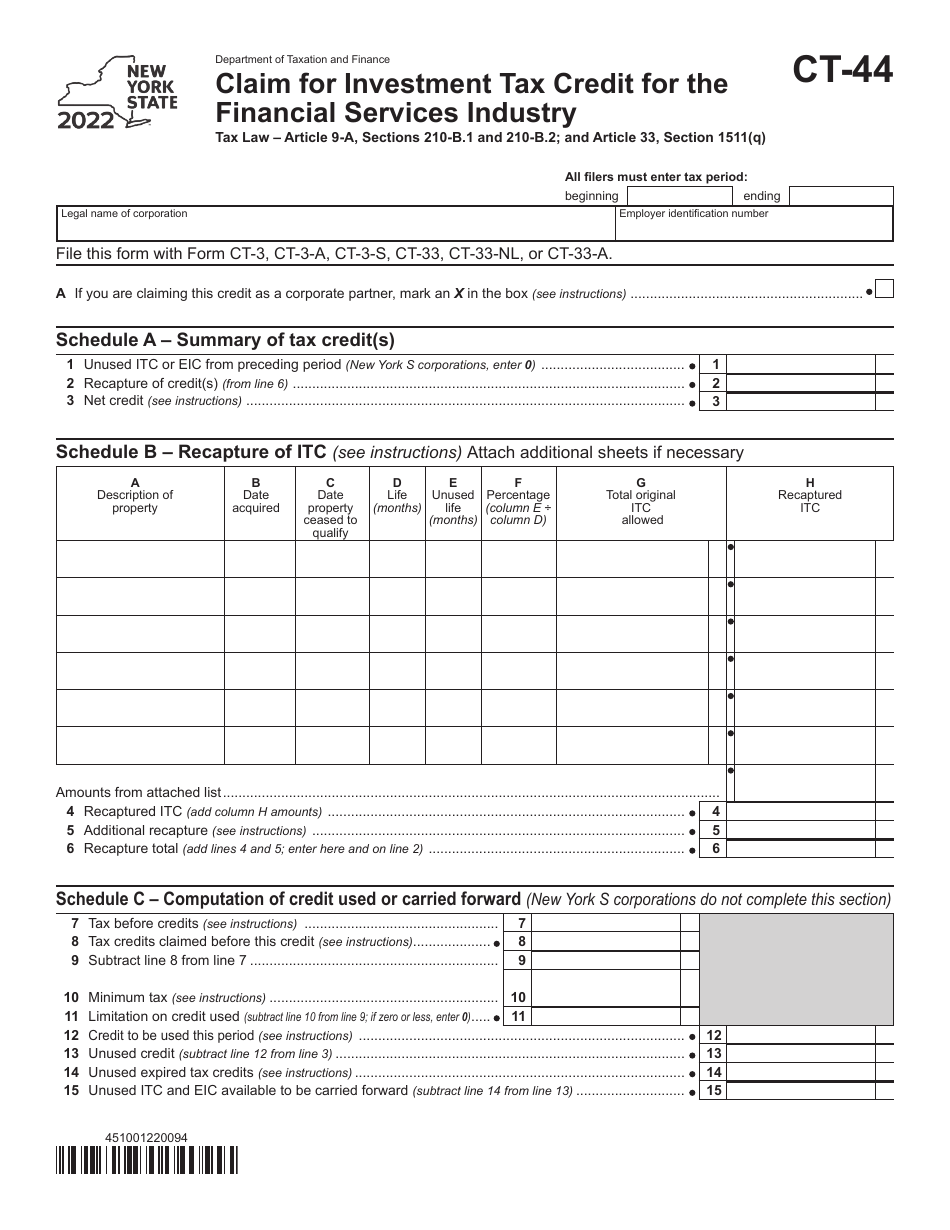

Form CT-44

for the current year.

Form CT-44 Claim for Investment Tax Credit for the Financial Services Industry - New York

What Is Form CT-44?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-44?

A: Form CT-44 is a claim for investment tax credit for the financial services industry in New York.

Q: Who can file Form CT-44?

A: Businesses in the financial services industry in New York can file Form CT-44.

Q: What is the purpose of Form CT-44?

A: The purpose of Form CT-44 is to claim an investment tax credit for qualifying investments in the financial services industry.

Q: What information do I need to complete Form CT-44?

A: You will need information about your qualifying investments in the financial services industry, including the amount invested and the date of investment.

Q: Are there any deadlines for filing Form CT-44?

A: Yes, Form CT-44 must be filed within three years from the date the investment was made.

Q: Is there a fee for filing Form CT-44?

A: No, there is no fee for filing Form CT-44.

Q: Can I claim the investment tax credit for investments made in previous years?

A: No, Form CT-44 can only be used to claim the credit for investments made in the current year.

Q: Is Form CT-44 available for businesses outside of the financial services industry?

A: No, Form CT-44 is specifically for businesses in the financial services industry.

Q: Is there any additional documentation required when filing Form CT-44?

A: Yes, you may need to provide supporting documentation to substantiate your investment claims. It is recommended to review the instructions provided with the form for specific requirements.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-44 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.