This version of the form is not currently in use and is provided for reference only. Download this version of

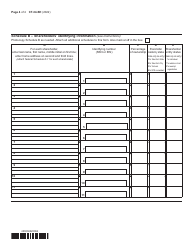

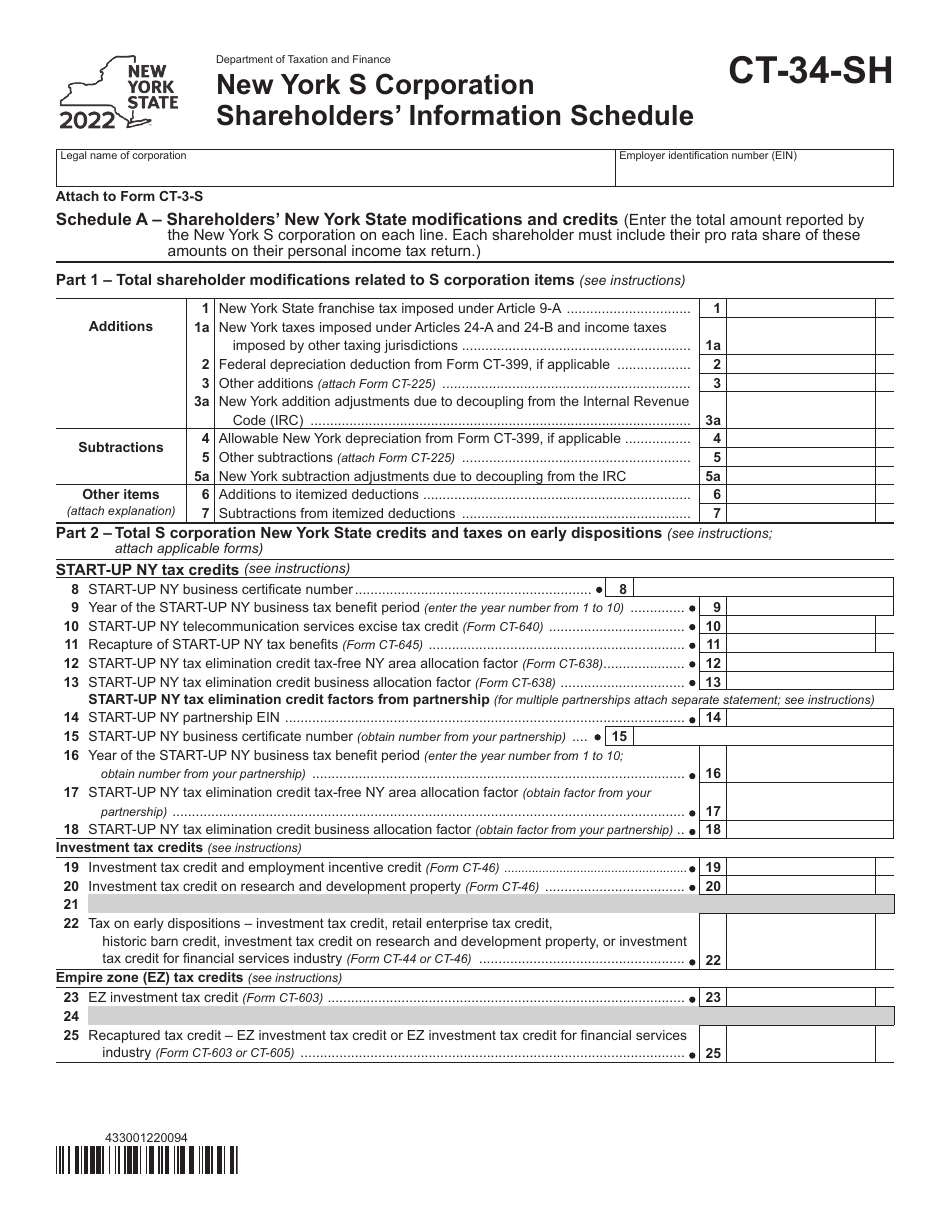

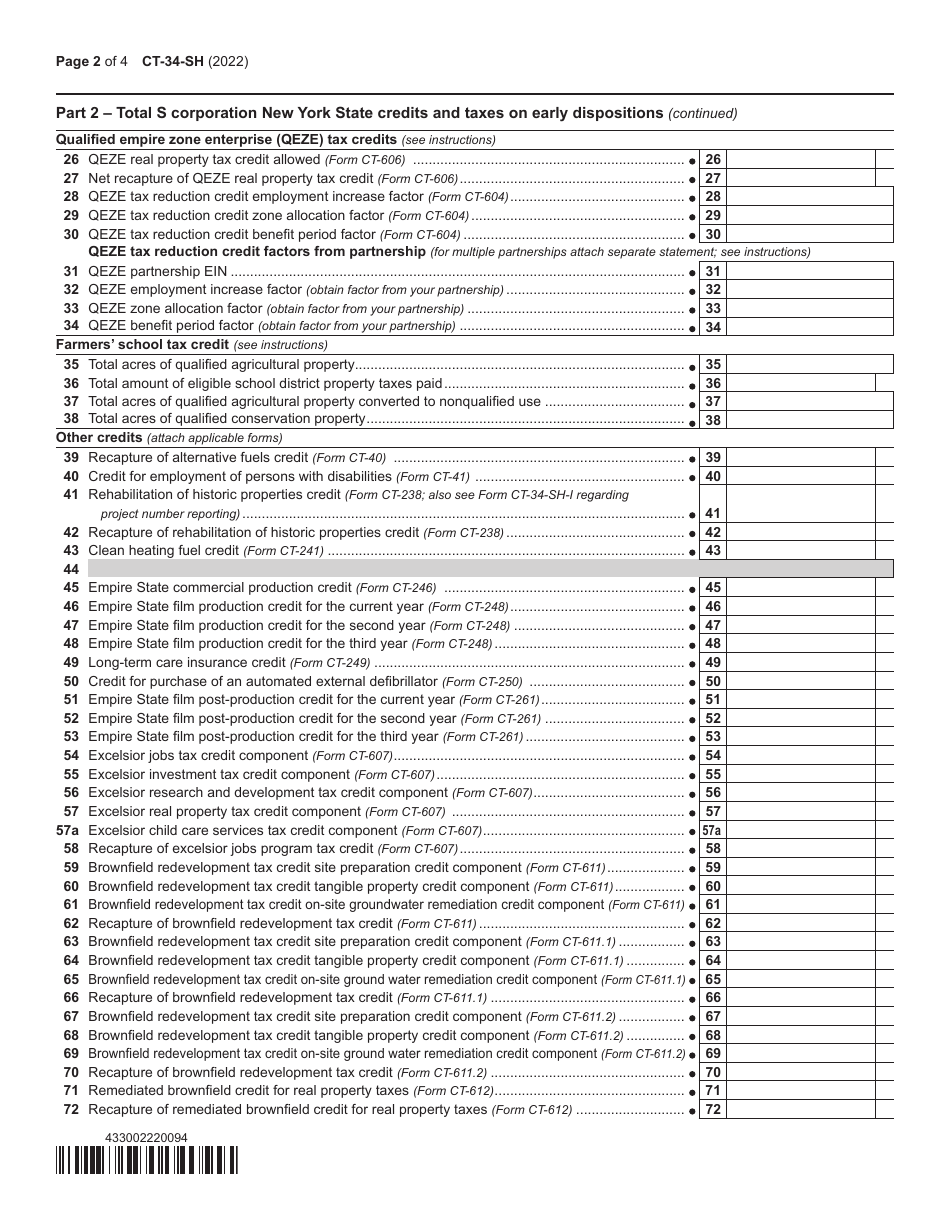

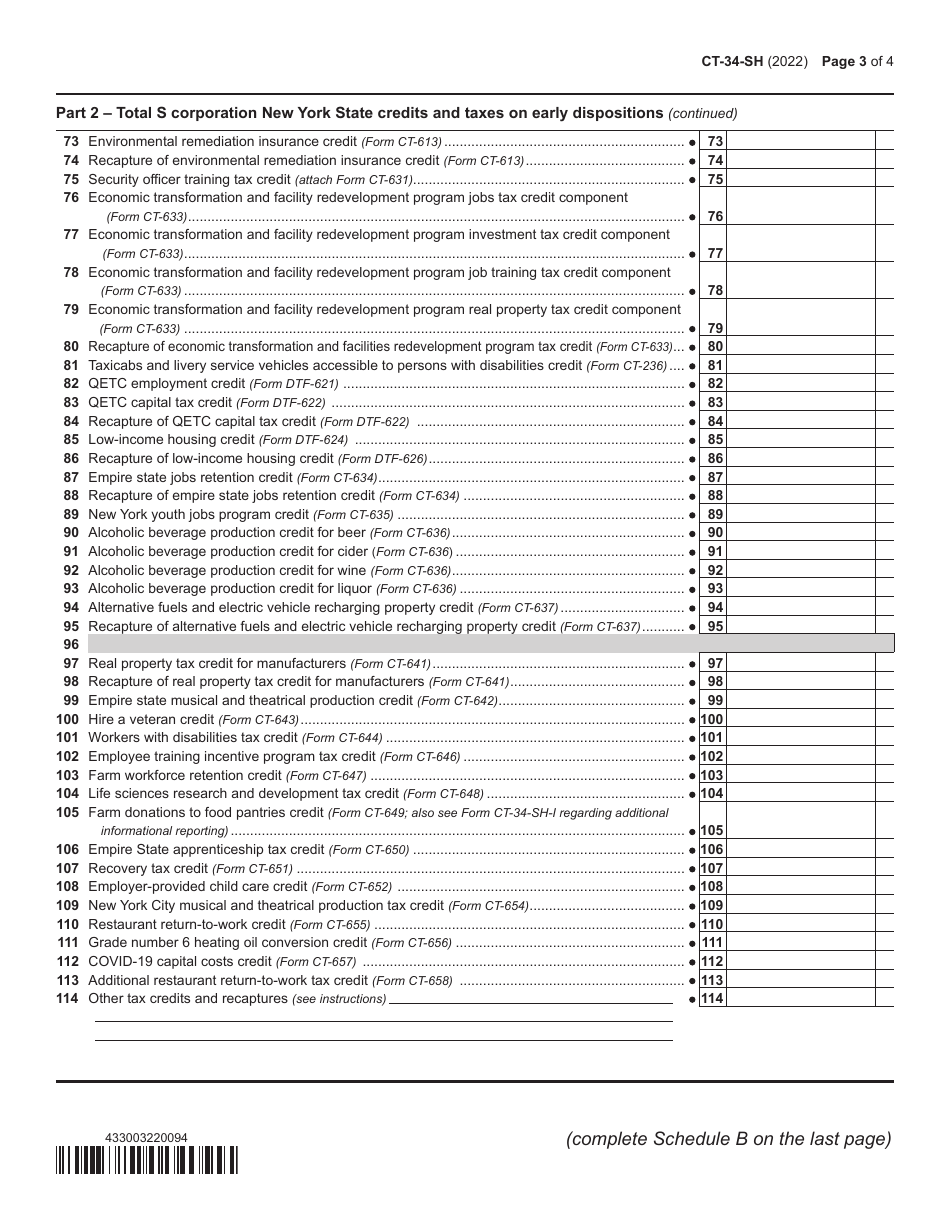

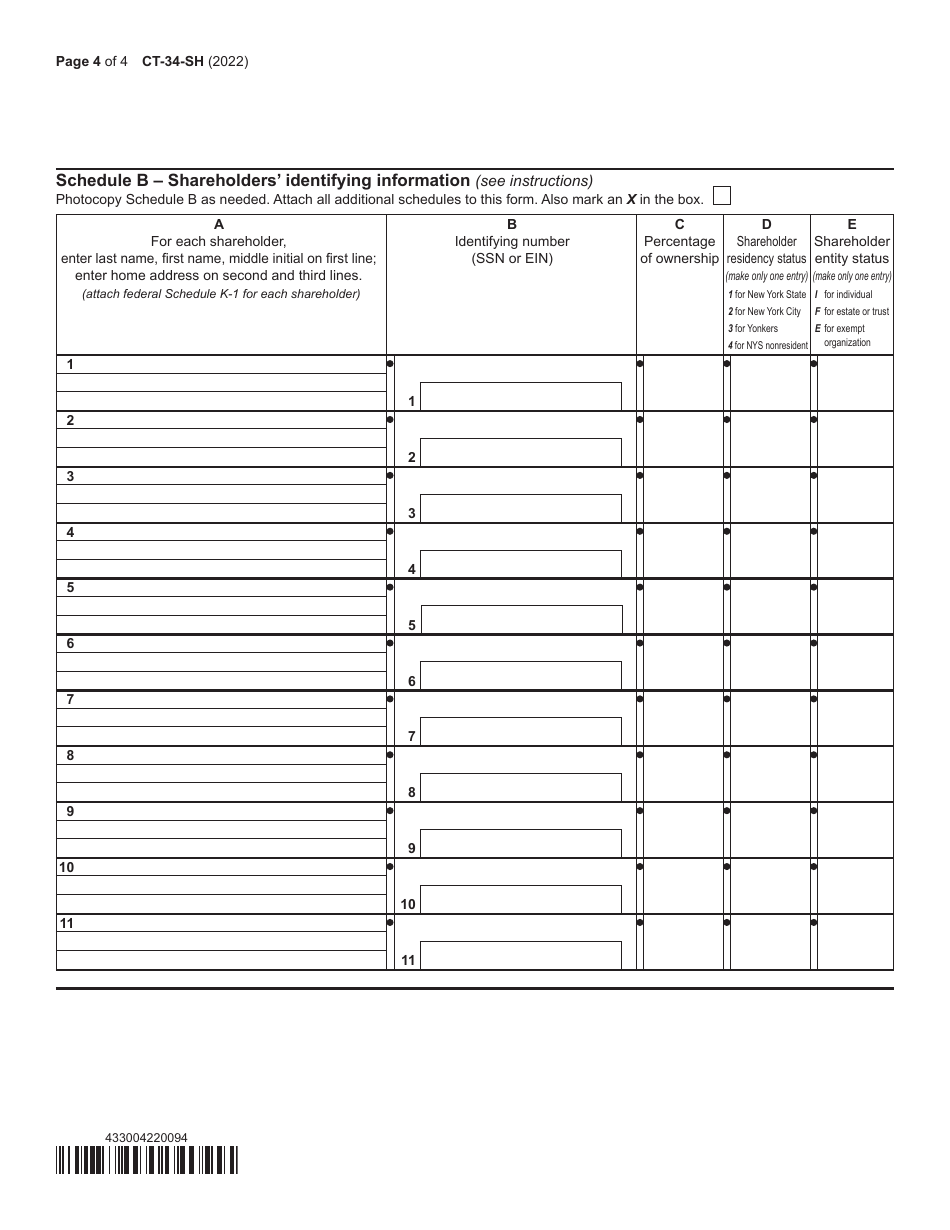

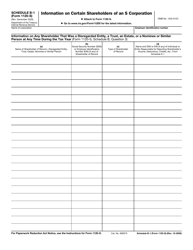

Form CT-34-SH

for the current year.

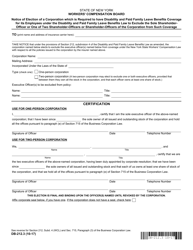

Form CT-34-SH New York S Corporation Shareholders' Information Schedule - New York

What Is Form CT-34-SH?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-34-SH?

A: Form CT-34-SH is the New York S Corporation Shareholders' Information Schedule.

Q: Who needs to file Form CT-34-SH?

A: S corporations in New York need to file Form CT-34-SH.

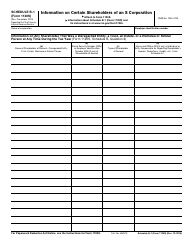

Q: What information is required on Form CT-34-SH?

A: Form CT-34-SH requires information about the shareholders of the S corporation, including their names, addresses, and Social Security numbers.

Q: Is there a filing fee for Form CT-34-SH?

A: No, there is no filing fee for Form CT-34-SH.

Q: When is the deadline to file Form CT-34-SH?

A: The deadline to file Form CT-34-SH is the same as the deadline to file the New York State corporate tax return, which is generally March 15th.

Q: What happens if I don't file Form CT-34-SH?

A: Failure to file Form CT-34-SH may result in penalties and interest.

Q: Can I amend Form CT-34-SH if I need to make changes?

A: Yes, you can amend Form CT-34-SH if you need to make changes to the information provided.

Q: Is Form CT-34-SH only for New York S corporations?

A: Yes, Form CT-34-SH is specifically for S corporations in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-34-SH by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.