This version of the form is not currently in use and is provided for reference only. Download this version of

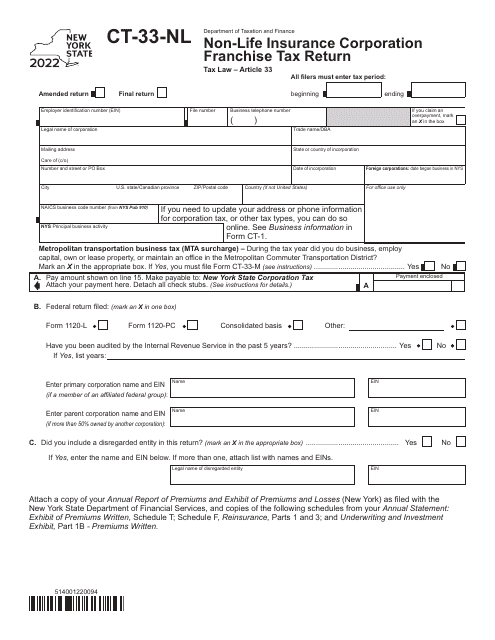

Form CT-33-NL

for the current year.

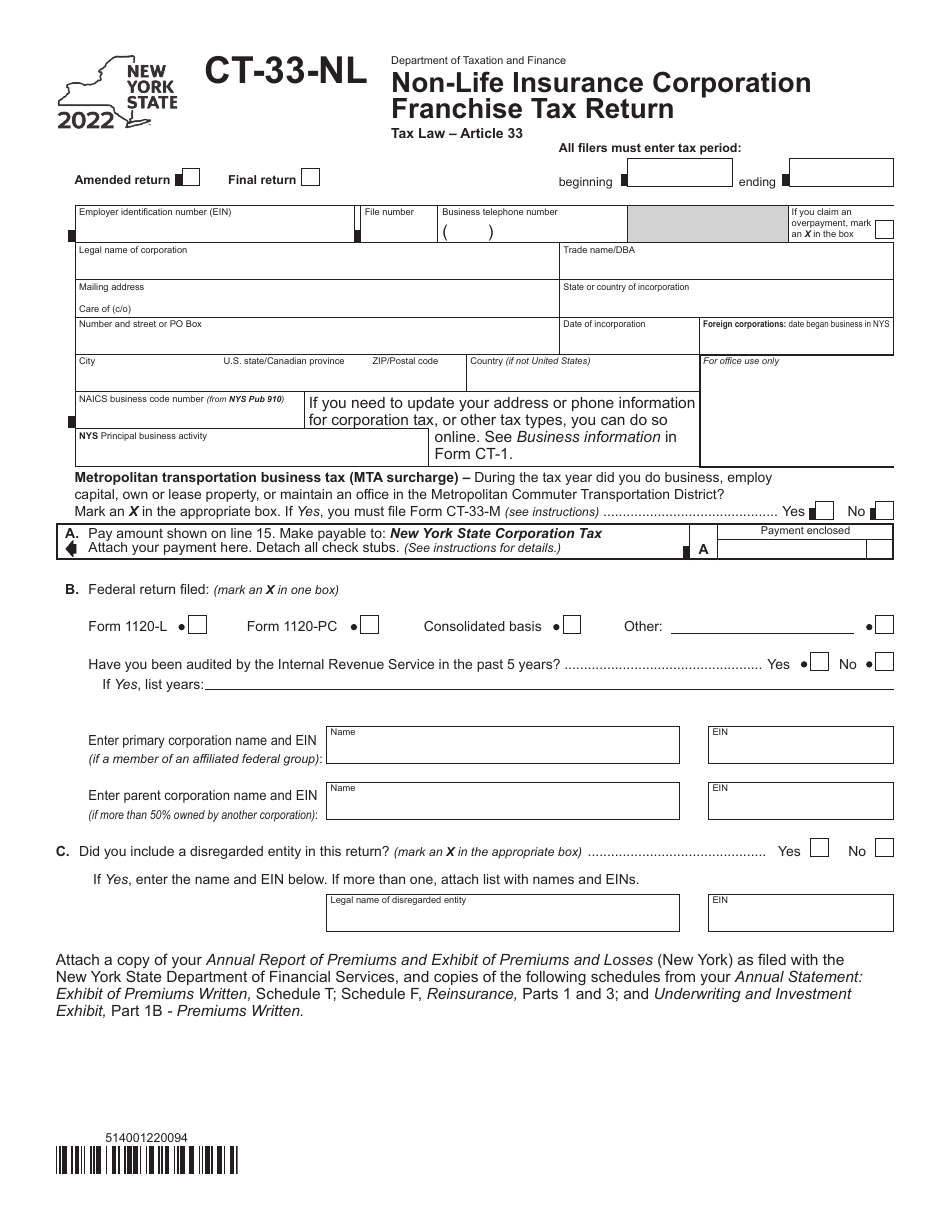

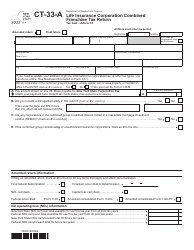

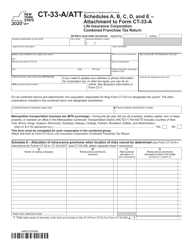

Form CT-33-NL Non-life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33-NL?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-NL?

A: Form CT-33-NL is the Non-life Insurance CorporationFranchise Tax return specifically for corporations in the insurance industry in New York.

Q: Who needs to file Form CT-33-NL?

A: Non-life insurance corporations operating in New York are required to file Form CT-33-NL.

Q: What is the purpose of Form CT-33-NL?

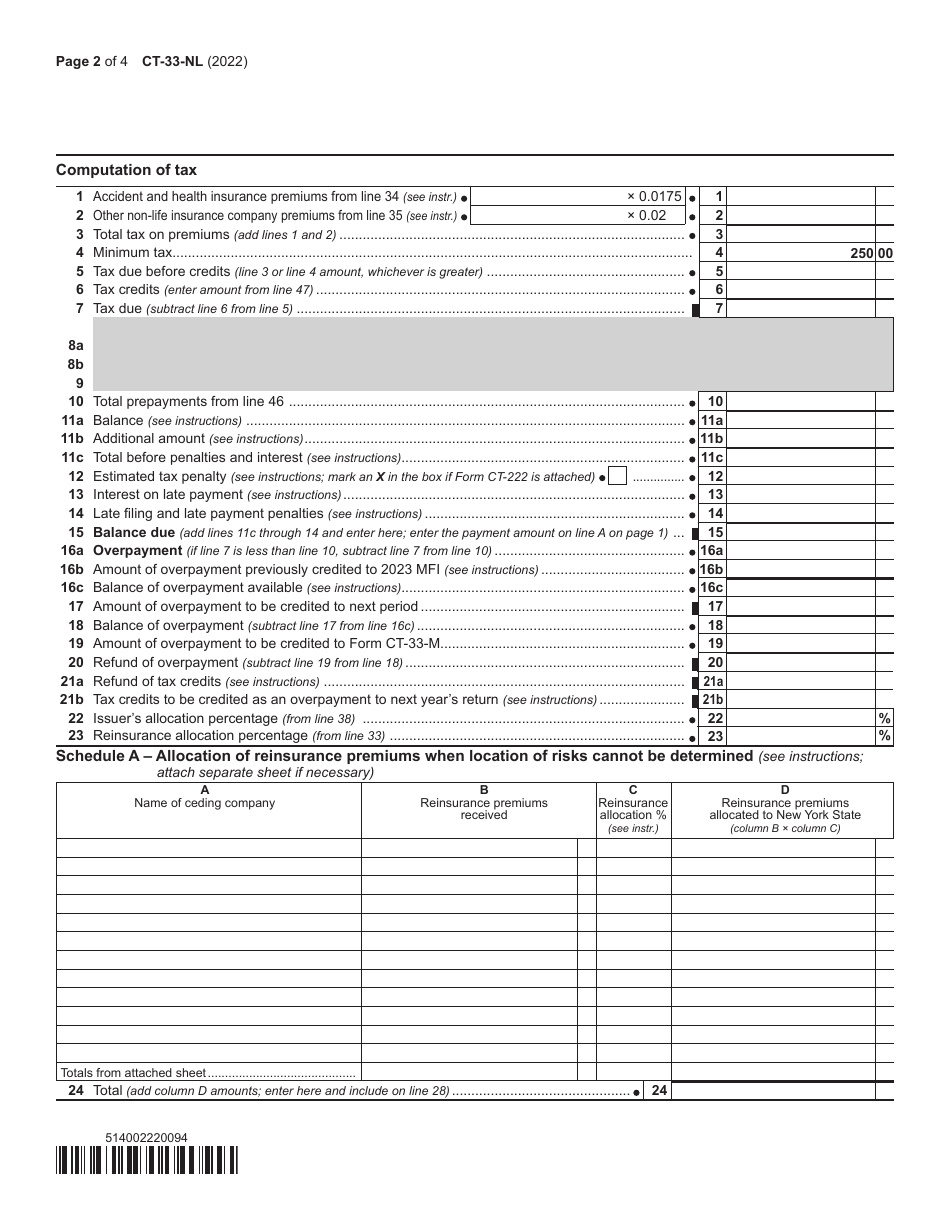

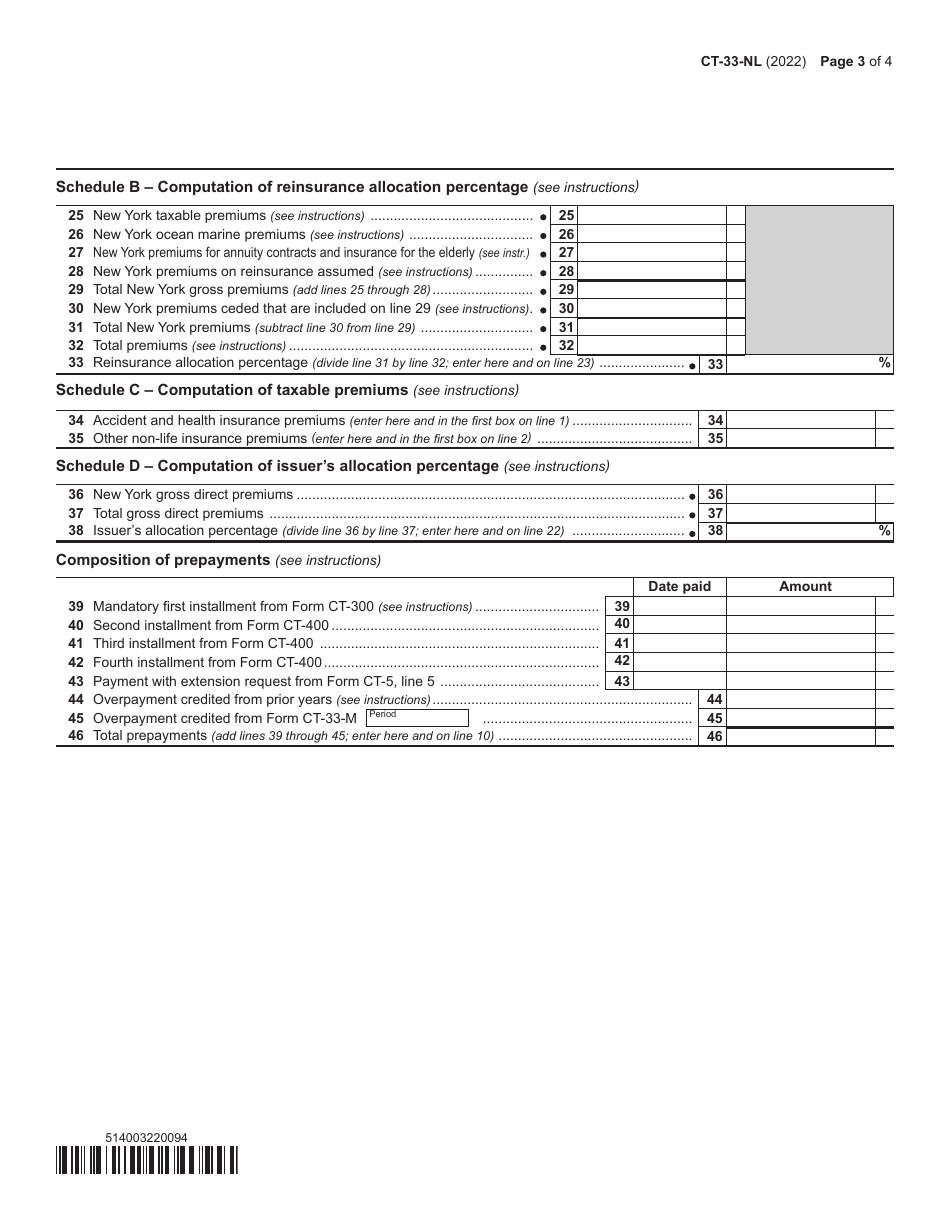

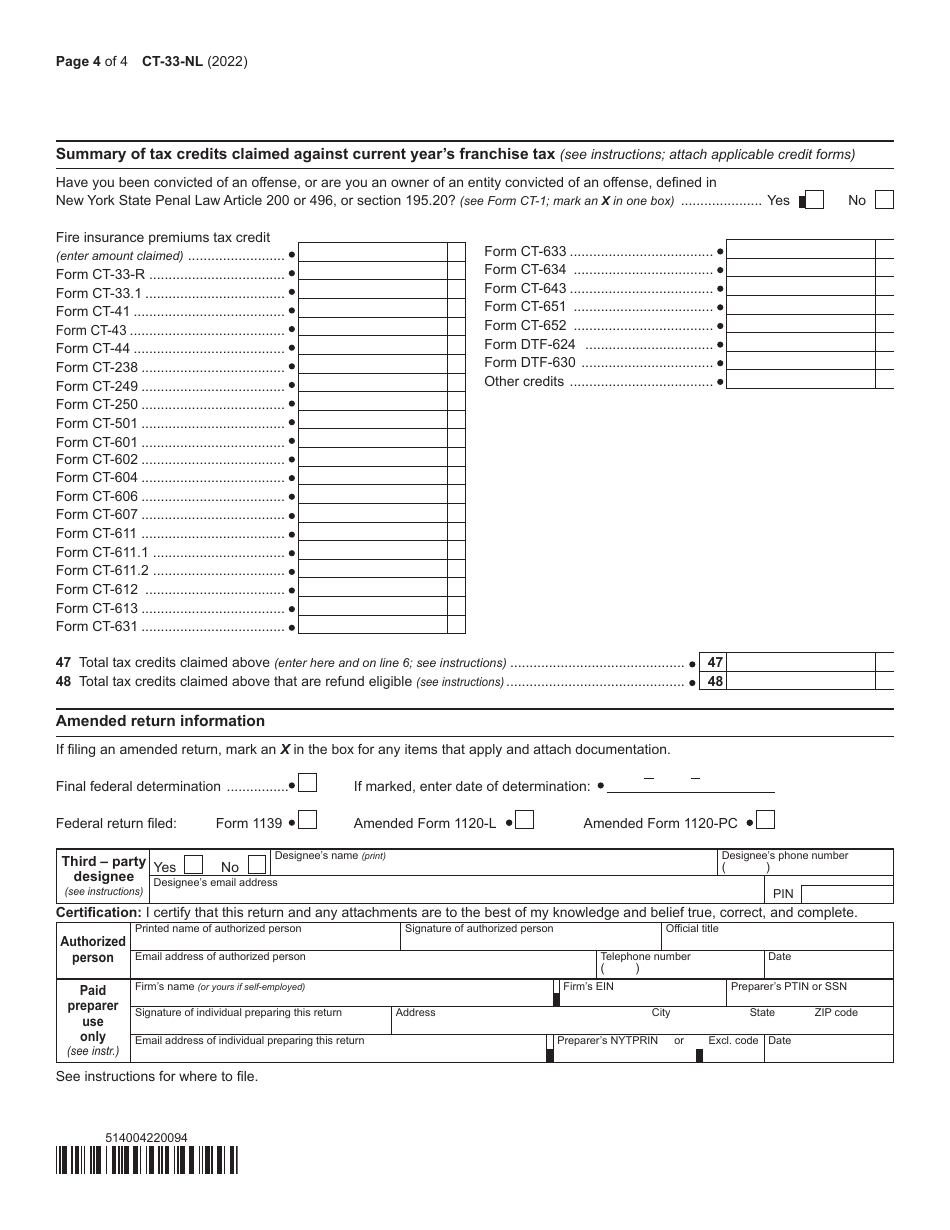

A: Form CT-33-NL is used to calculate and report the franchise tax owed by non-life insurance corporations in New York.

Q: When is the deadline for filing Form CT-33-NL?

A: The deadline for filing Form CT-33-NL is generally on or before the fifteenth day of the third month following the close of the corporation's tax year.

Q: What are the consequences of not filing Form CT-33-NL?

A: Failure to file Form CT-33-NL or filing it late can result in penalties and interest charges imposed by the tax authority.

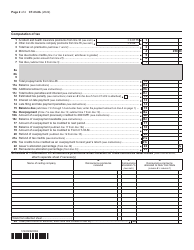

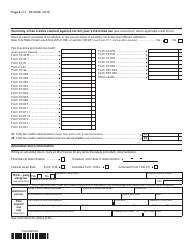

Q: What information is required to complete Form CT-33-NL?

A: Form CT-33-NL requires information such as the corporation's income, deductions, and tax credits, as well as details about its non-life insurance activities.

Q: Are non-life insurance corporations subject to any other taxes in New York?

A: In addition to the franchise tax, non-life insurance corporations may also be subject to other taxes, such as the New York State and New York City corporate income taxes.

Q: Is there a fee for filing Form CT-33-NL?

A: There is no fee for filing Form CT-33-NL.

Q: Can I request an extension to file Form CT-33-NL?

A: Yes, extensions to file Form CT-33-NL can be requested, but the tax liability must still be paid by the original due date.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-NL by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.