This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-33-R

for the current year.

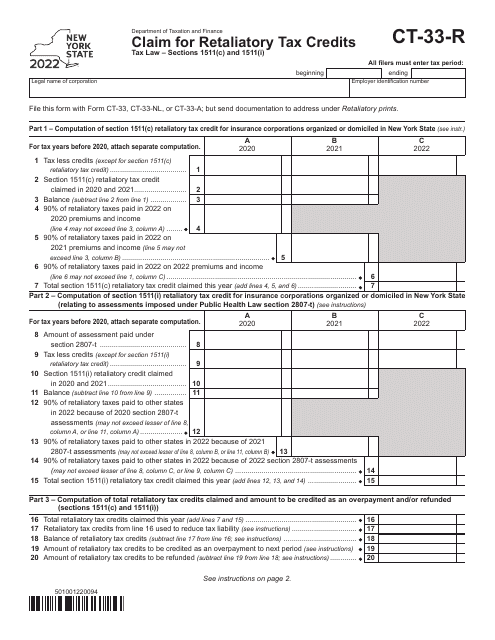

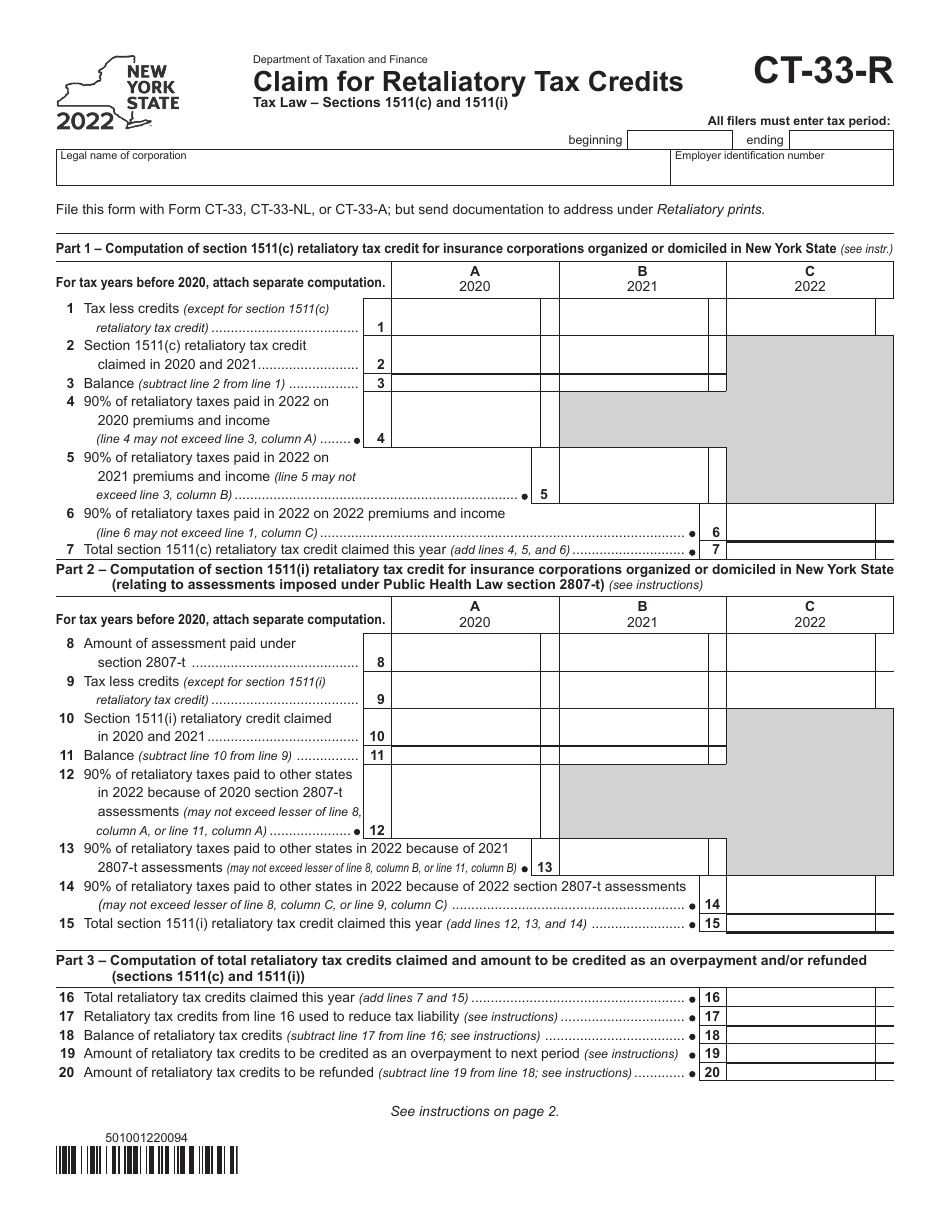

Form CT-33-R Claim for Retaliatory Tax Credits - New York

What Is Form CT-33-R?

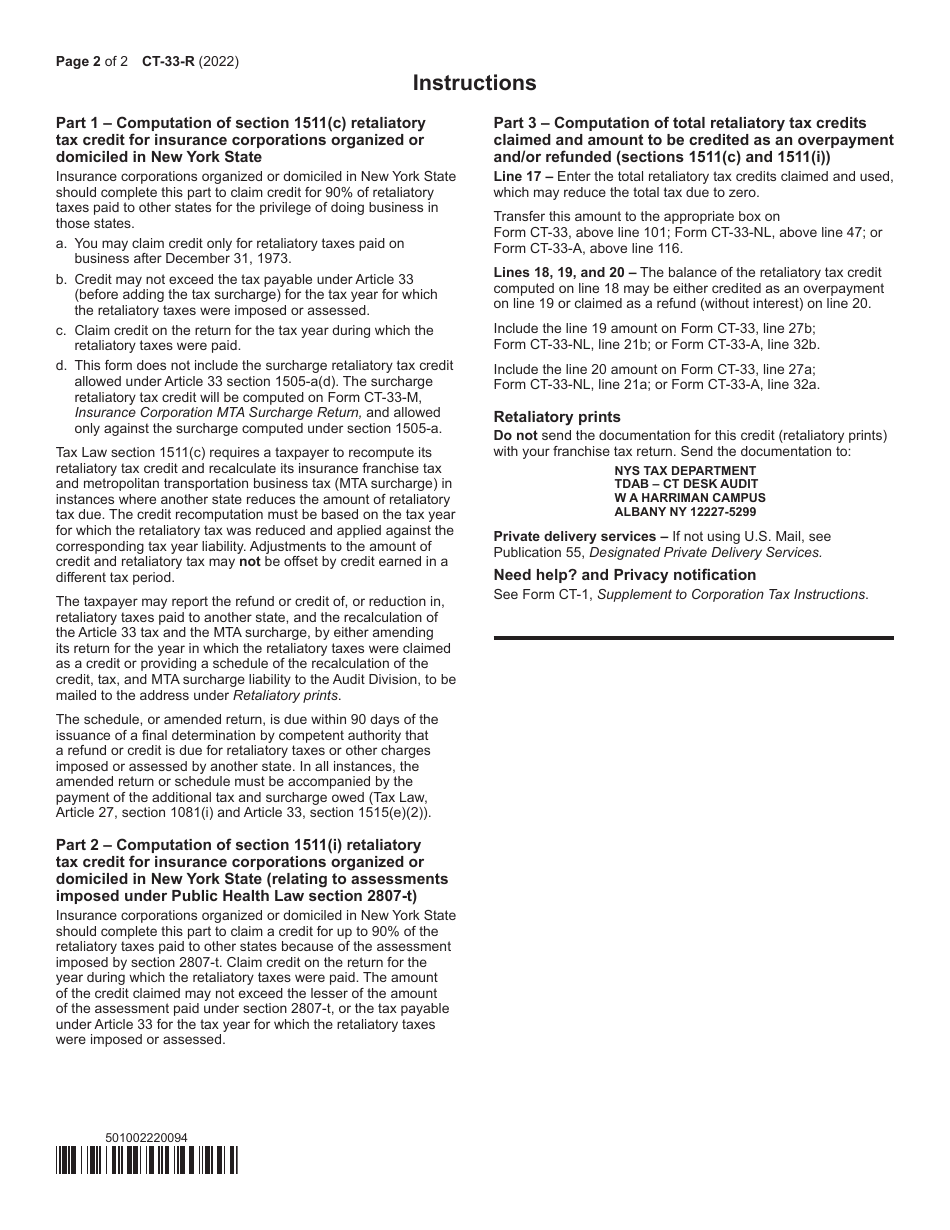

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-33-R?

A: Form CT-33-R is a claim for retaliatory tax credits in New York.

Q: Who can use Form CT-33-R?

A: Form CT-33-R can be used by insurance companies that are subject to retaliatory taxes in New York.

Q: What are retaliatory taxes?

A: Retaliatory taxes are additional taxes imposed on out-of-state insurance companies by a state in response to similar taxes imposed by the insurance company's home state.

Q: What is the purpose of Form CT-33-R?

A: The purpose of Form CT-33-R is to claim tax credits to offset the amount of retaliatory taxes paid by insurance companies in New York.

Q: How do I fill out Form CT-33-R?

A: To fill out Form CT-33-R, you will need to provide information about your insurance company, the amount of retaliatory taxes paid, and any other required supporting documentation.

Q: When is Form CT-33-R due?

A: Form CT-33-R is generally due on the same date as the insurance company's New York franchise tax return.

Q: Are there any penalties for late filing of Form CT-33-R?

A: Yes, there may be penalties for late filing of Form CT-33-R, including interest charges on any unpaid retaliatory taxes.

Q: Can I claim a refund if I overpaid retaliatory taxes?

A: Yes, if you overpaid retaliatory taxes, you can claim a refund by filing an amended Form CT-33-R.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-R by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.