This version of the form is not currently in use and is provided for reference only. Download this version of

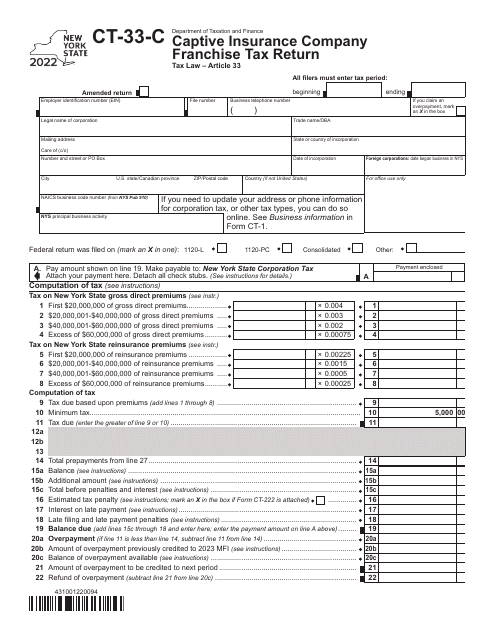

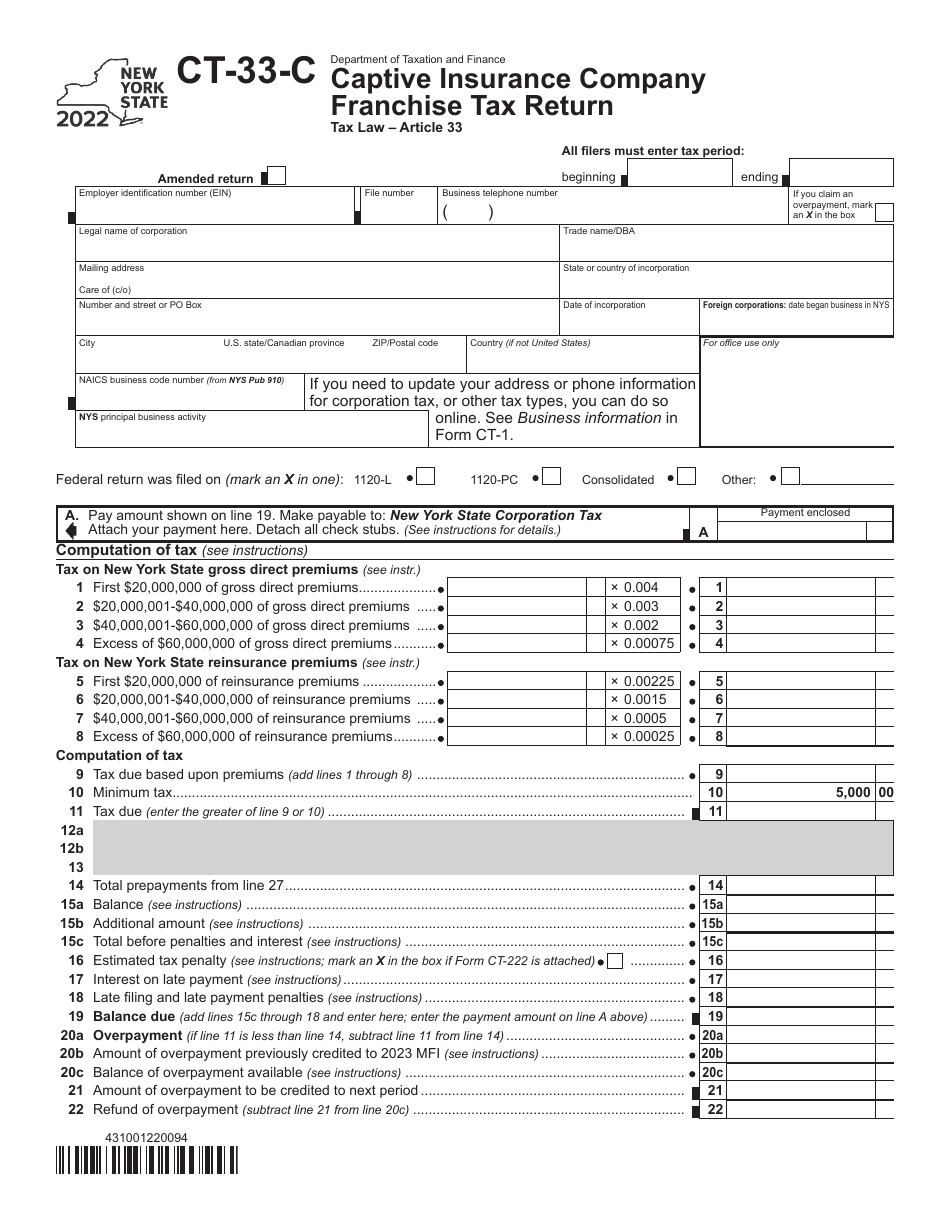

Form CT-33-C

for the current year.

Form CT-33-C Captive Insurance Company Franchise Tax Return - New York

What Is Form CT-33-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-C?

A: Form CT-33-C is the Captive Insurance CompanyFranchise Tax Return in New York.

Q: Who needs to file Form CT-33-C?

A: Captive insurance companies in New York need to file Form CT-33-C.

Q: What is the purpose of Form CT-33-C?

A: Form CT-33-C is used to report and pay franchise tax by captive insurance companies in New York.

Q: When is Form CT-33-C due?

A: Form CT-33-C is due on or before March 15th of each year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form CT-33-C, including interest charges.

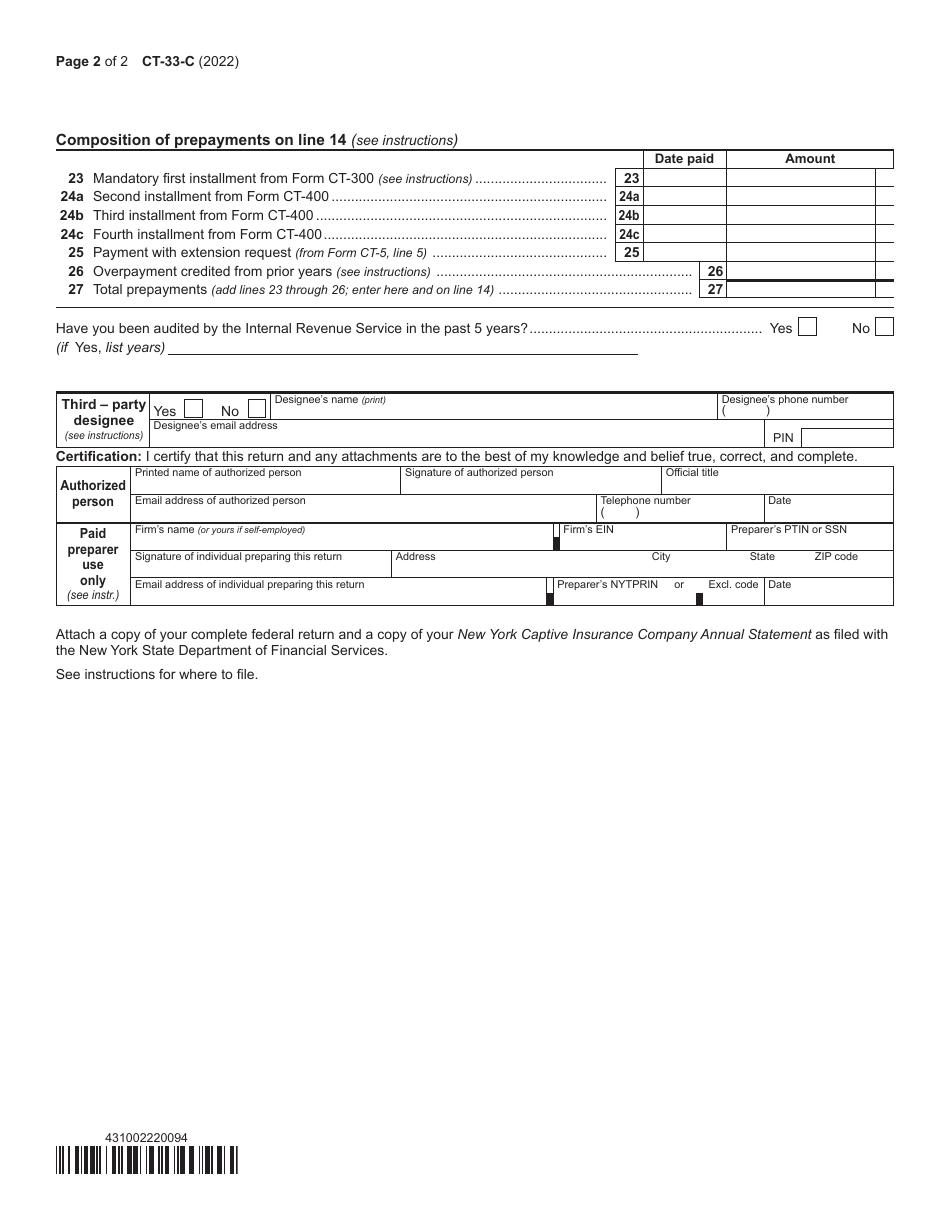

Q: What supporting documents are required with Form CT-33-C?

A: You may need to include additional schedules and documentation, such as a copy of your federal tax return.

Q: Can Form CT-33-C be filed electronically?

A: No, Form CT-33-C cannot be filed electronically, it must be filed by mail.

Q: Is there an extension available for filing Form CT-33-C?

A: Yes, you may request an extension of time to file Form CT-33-C.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.