This version of the form is not currently in use and is provided for reference only. Download this version of

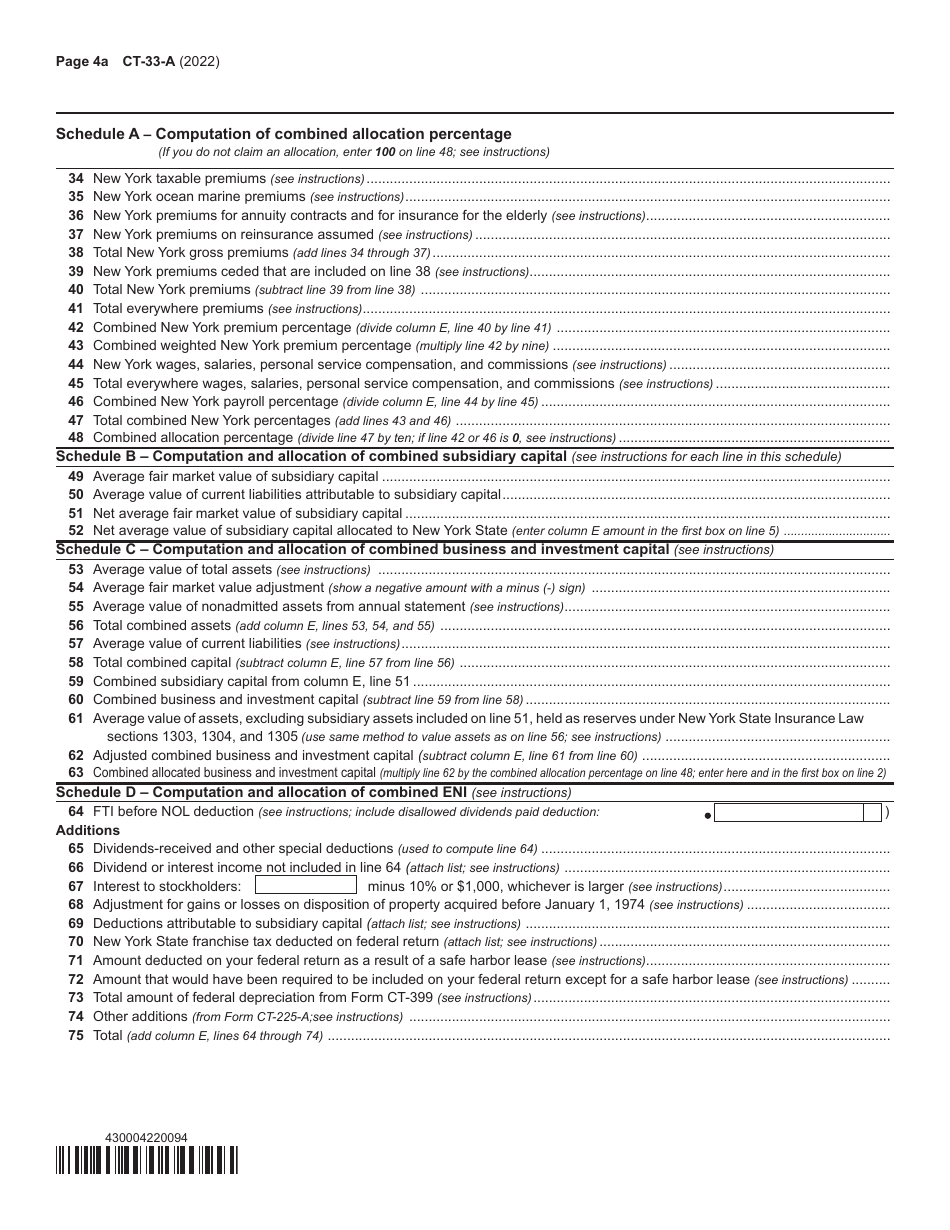

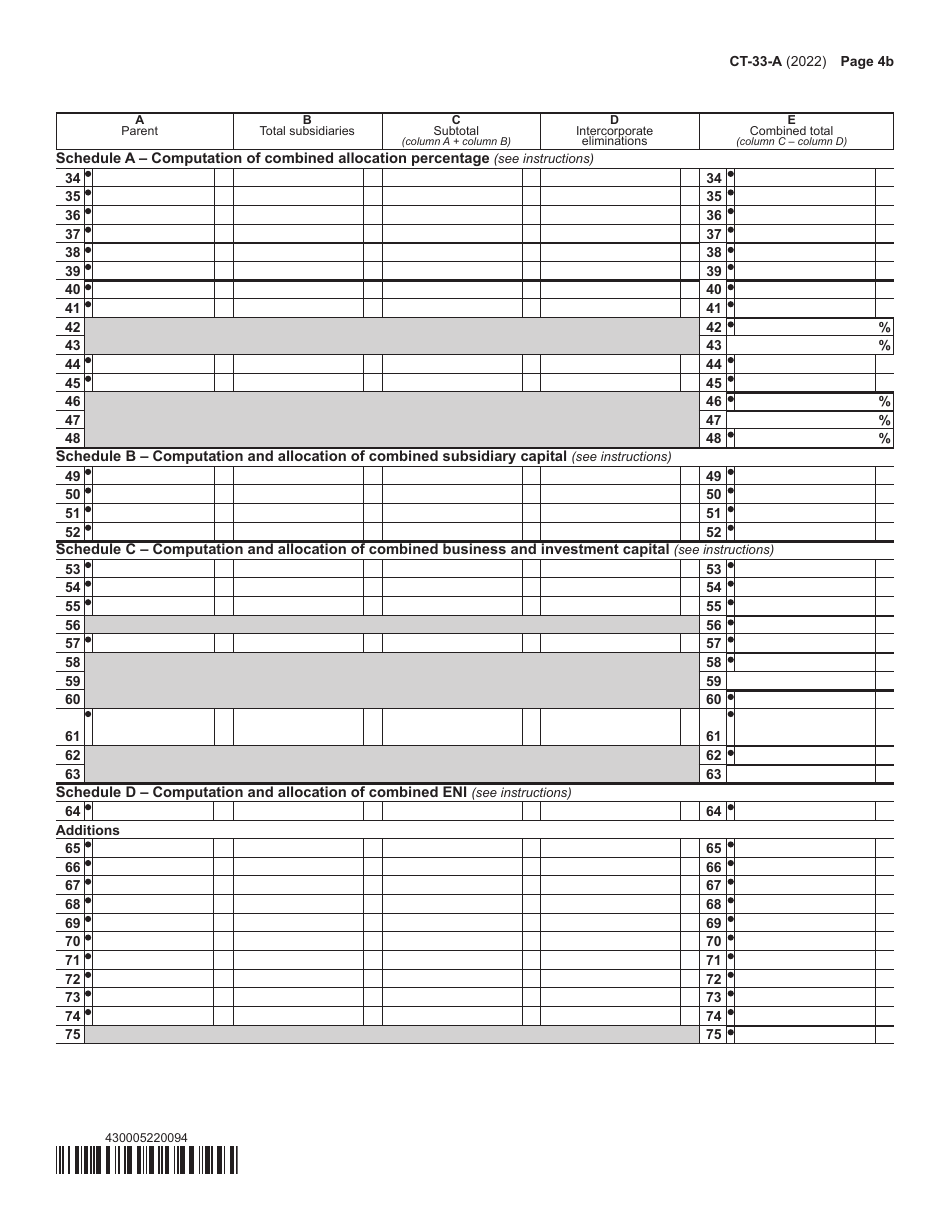

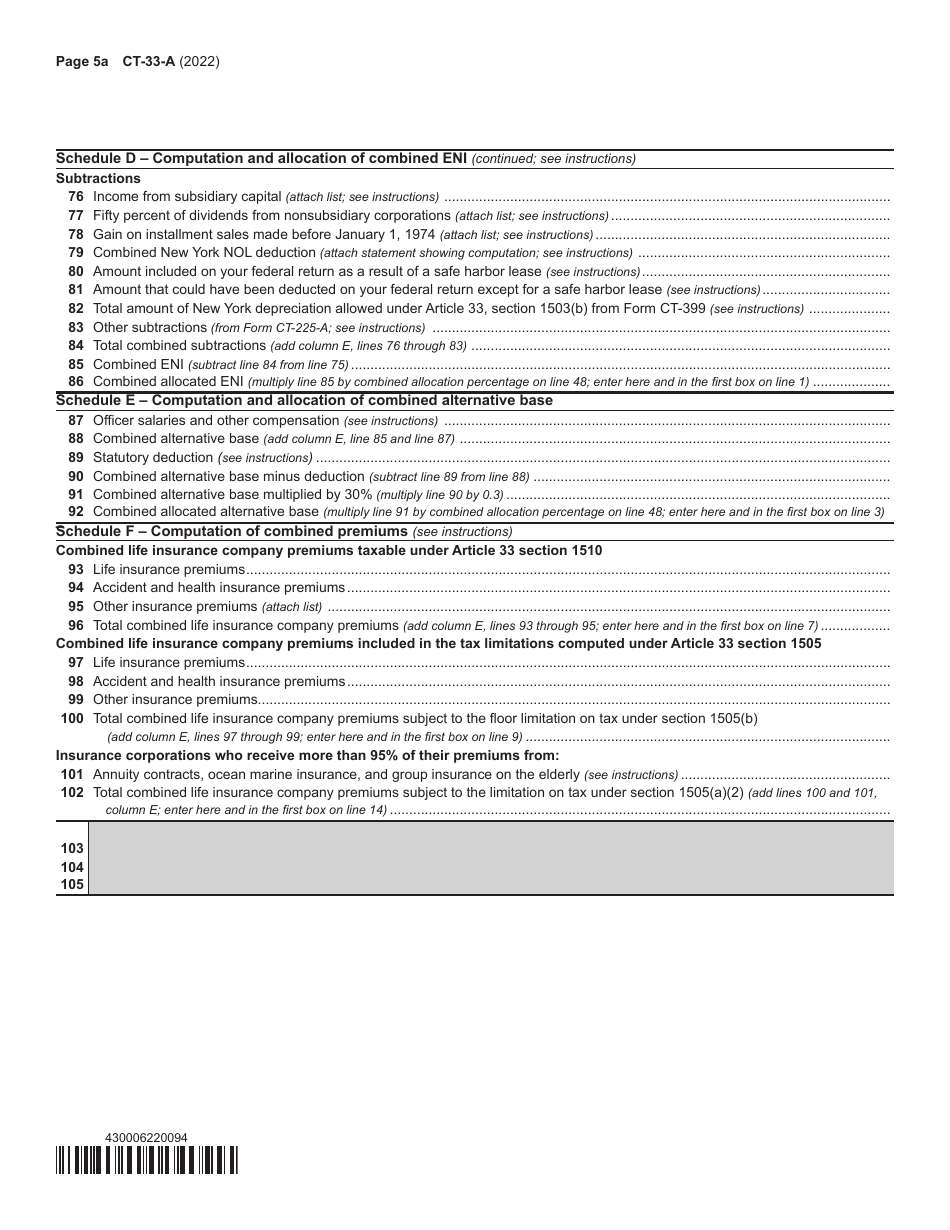

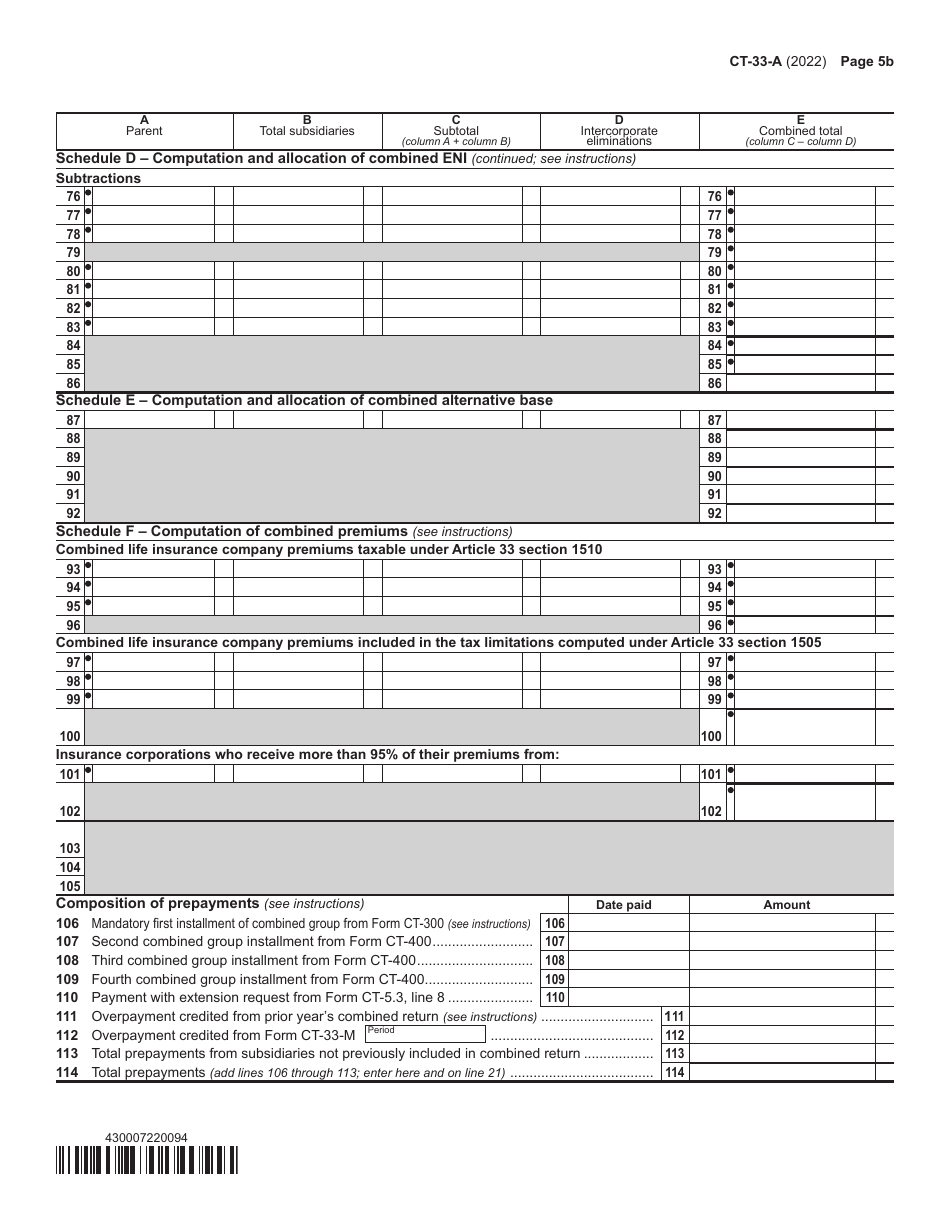

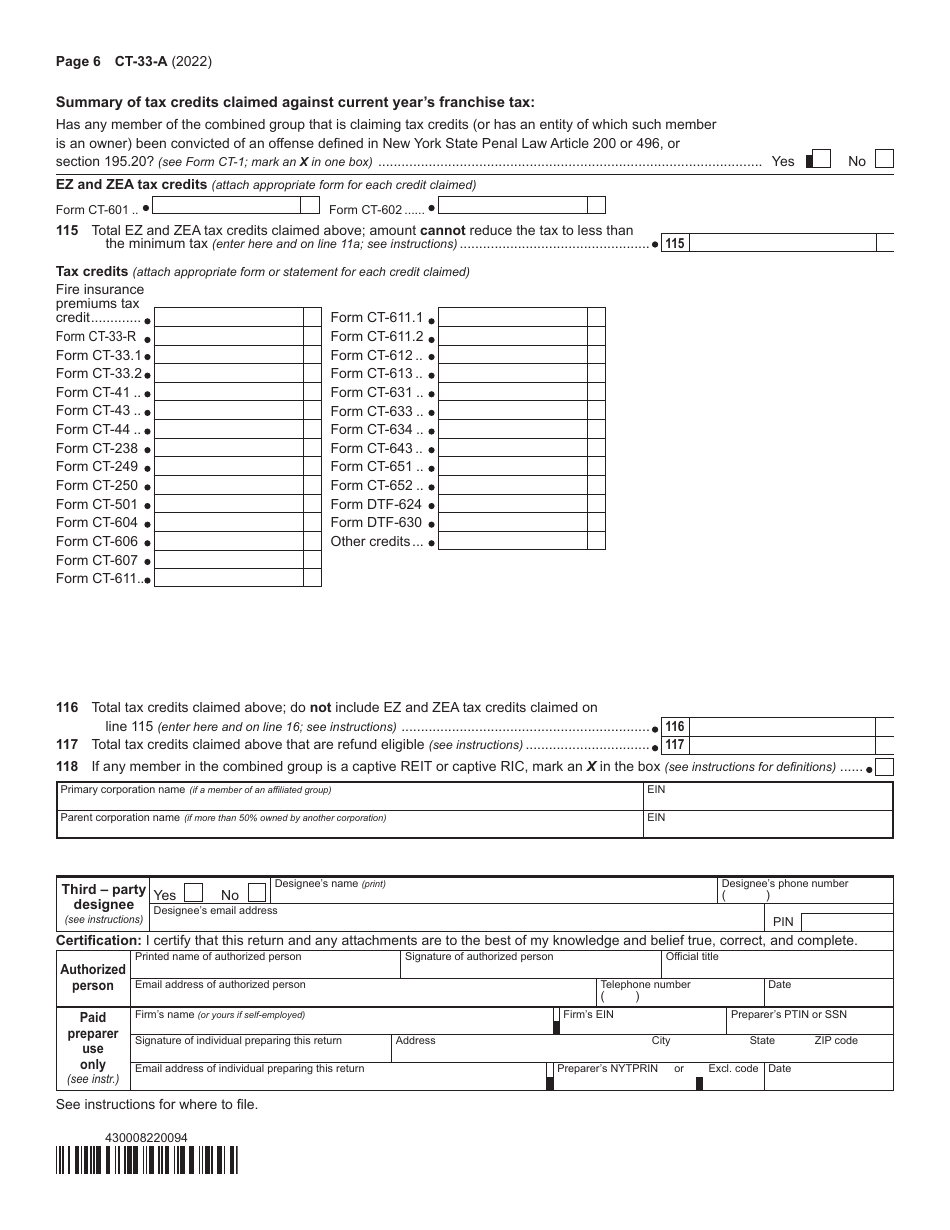

Form CT-33-A

for the current year.

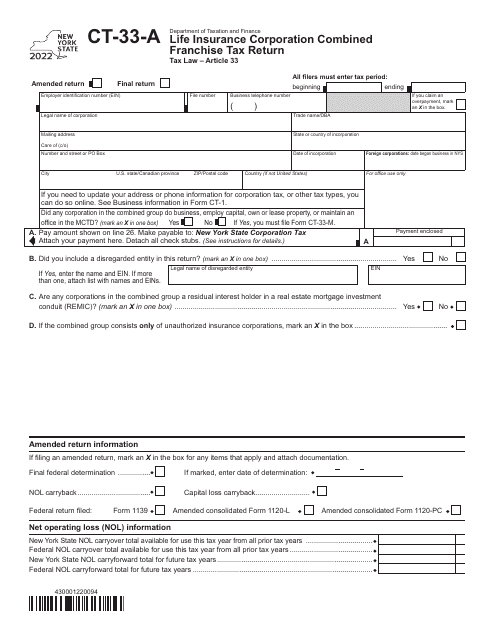

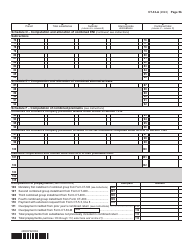

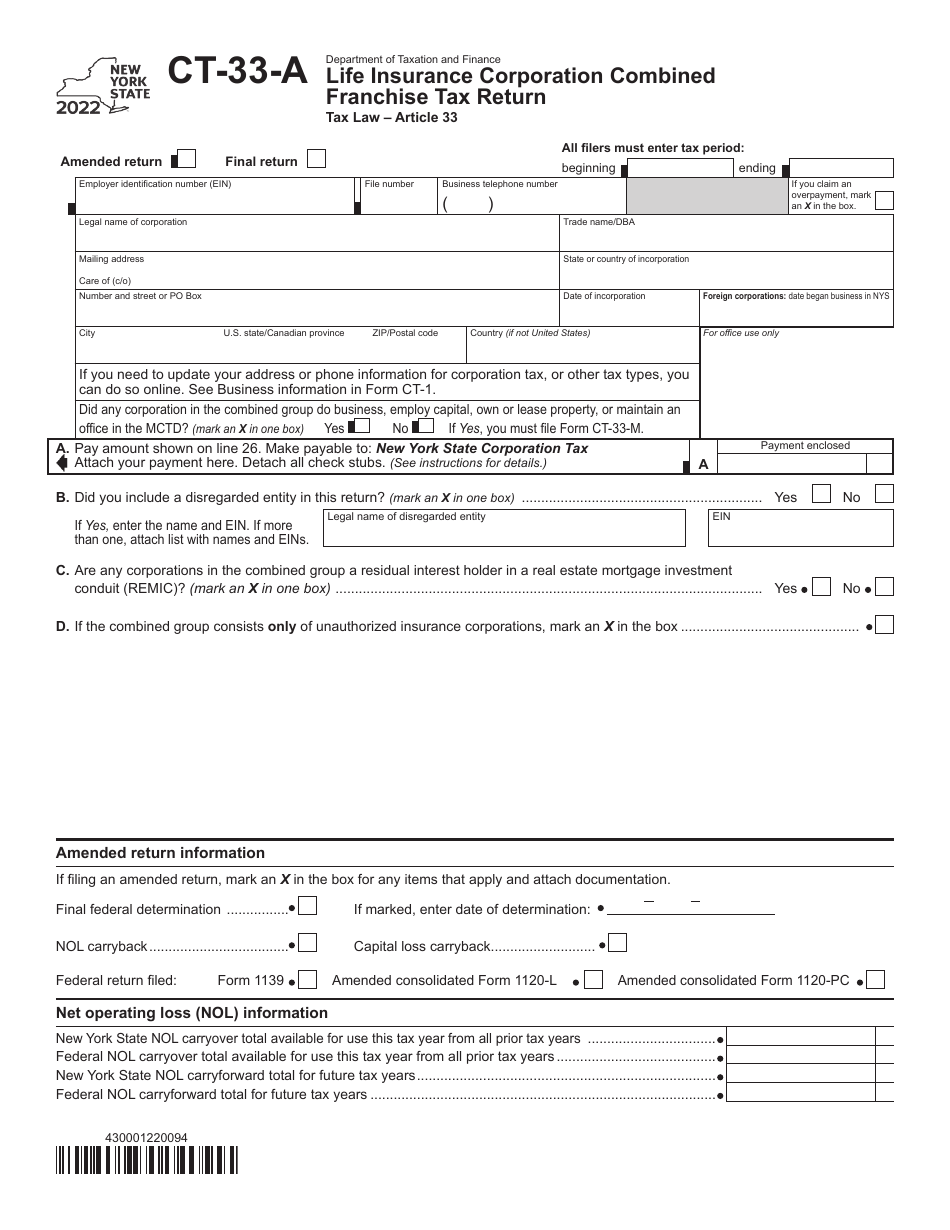

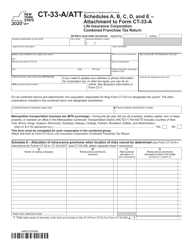

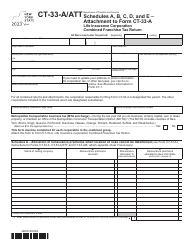

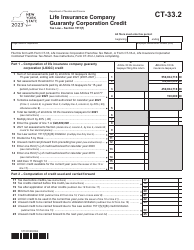

Form CT-33-A Life Insurance Corporation Combined Franchise Tax Return - New York

What Is Form CT-33-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-A?

A: Form CT-33-A is the Life Insurance Corporation Combined Franchise Tax Return in New York.

Q: Who needs to file Form CT-33-A?

A: Life insurance corporations in New York are required to file Form CT-33-A.

Q: When is Form CT-33-A due?

A: Form CT-33-A is due on the 15th day of the third month following the close of the corporation's tax year.

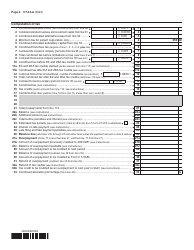

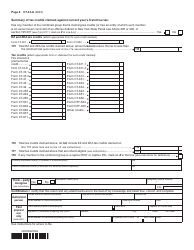

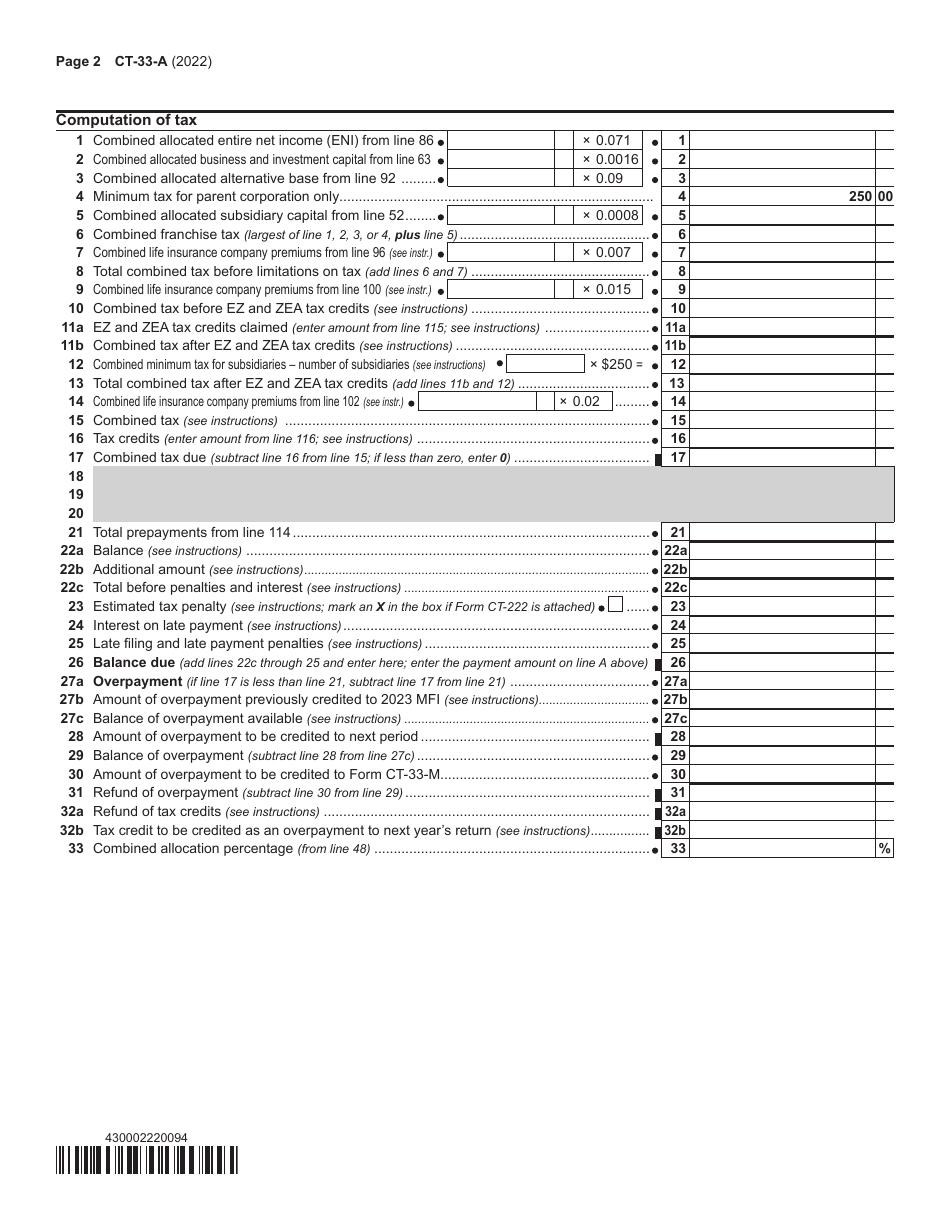

Q: What information do I need to complete Form CT-33-A?

A: You will need details about your corporation's income, deductions, and other relevant financial information.

Q: Are there any penalties for late filing of Form CT-33-A?

A: Yes, there are penalties for late filing, so it's important to submit your return on time.

Q: Can I file Form CT-33-A electronically?

A: Yes, you can file Form CT-33-A electronically using the New York State efiling system.

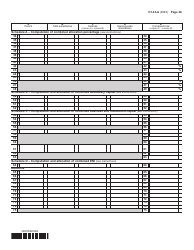

Q: Do I need to include any supporting documents with Form CT-33-A?

A: Yes, you may need to include supporting schedules and documentation, depending on the complexity of your tax situation.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.