This version of the form is not currently in use and is provided for reference only. Download this version of

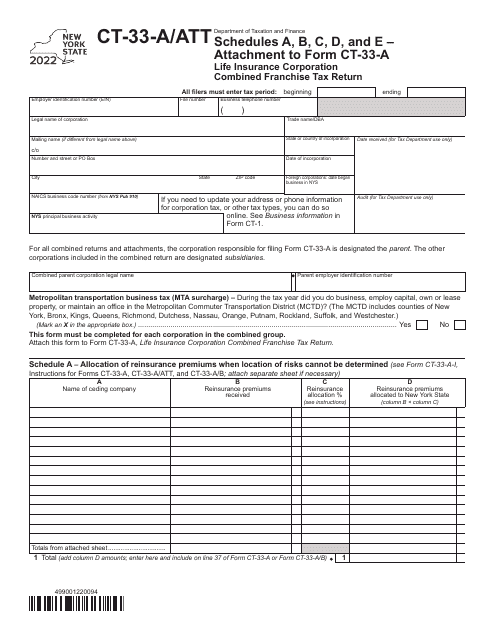

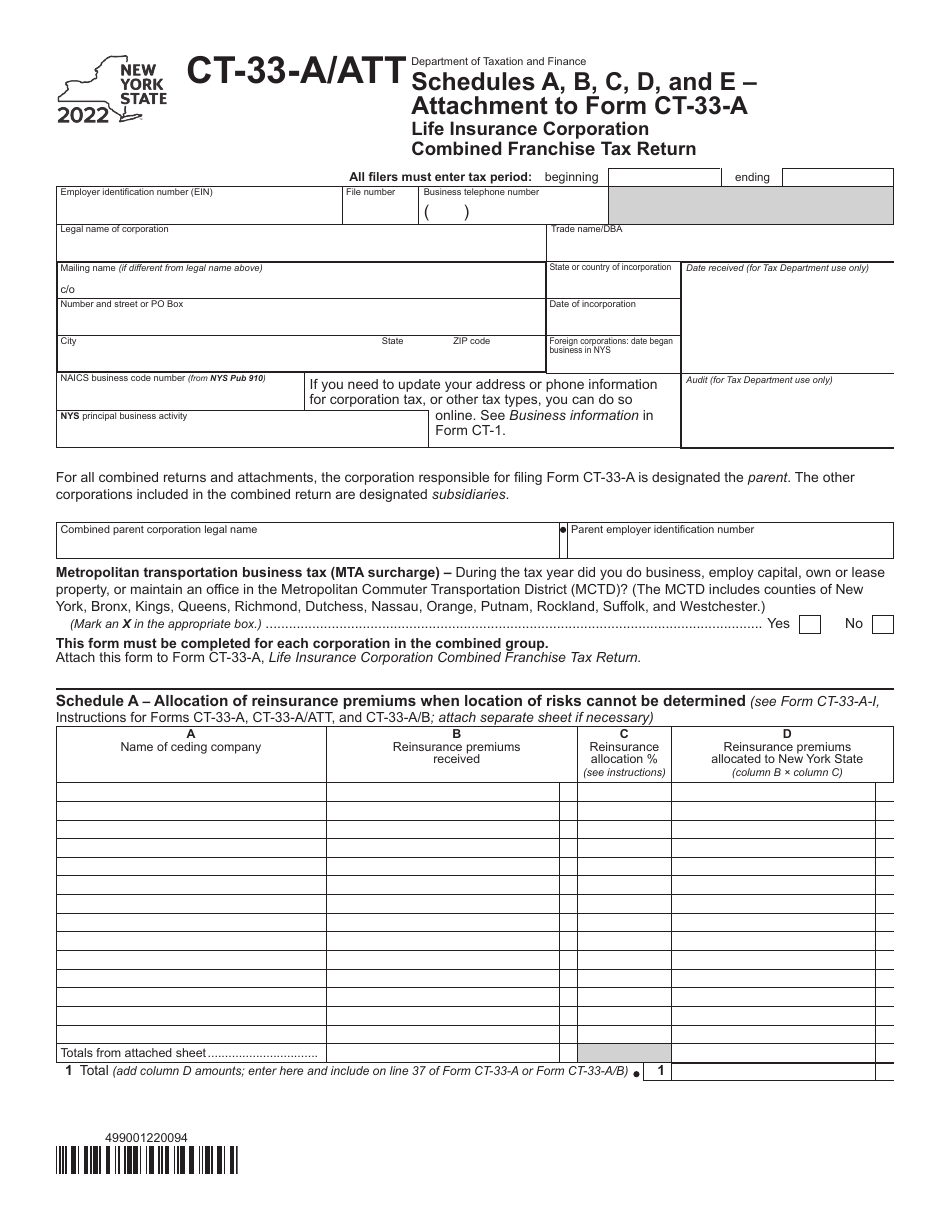

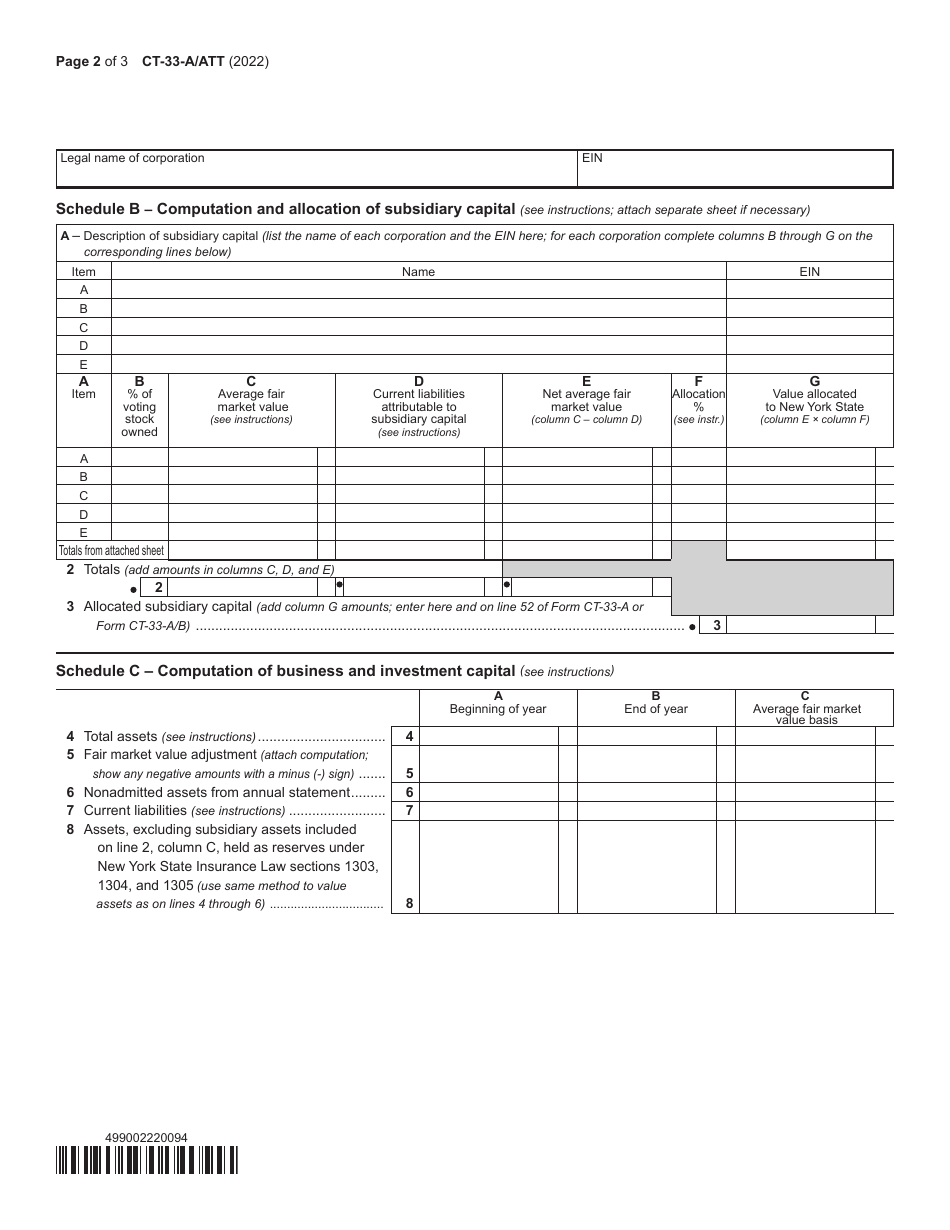

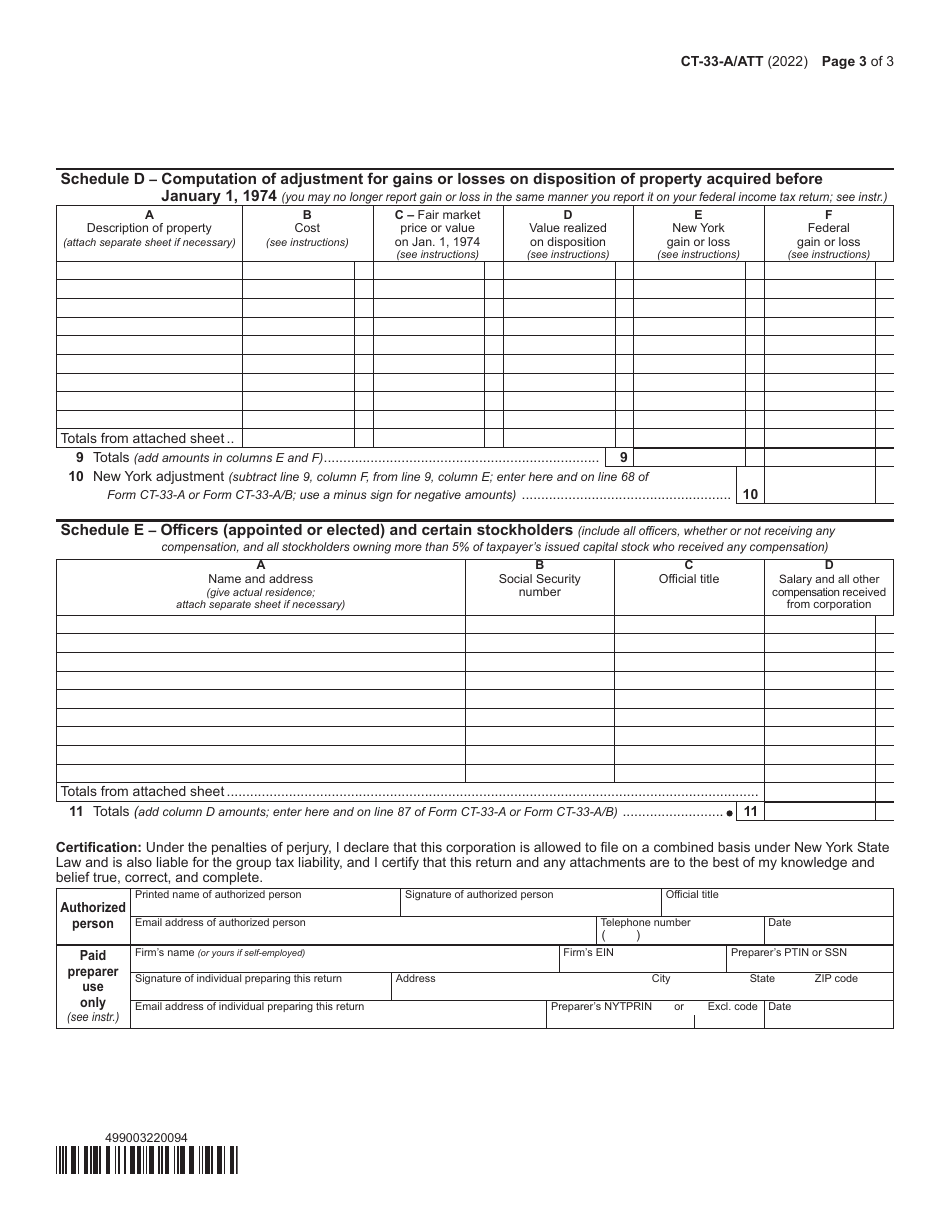

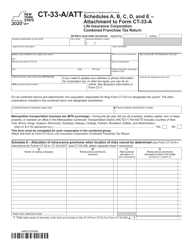

Form CT-33-A/ATT Schedule A, B, C, D, E

for the current year.

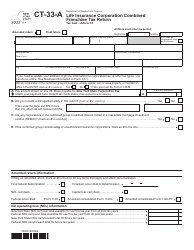

Form CT-33-A / ATT Schedule A, B, C, D, E Life Insurance Corporation Combined Franchise Tax Return - New York

What Is Form CT-33-A/ATT Schedule A, B, C, D, E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-33-A/ATT?

A: Form CT-33-A/ATT is the Life Insurance Corporation Combined Franchise Tax Return for New York.

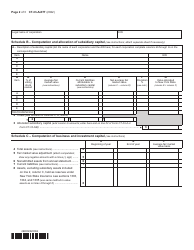

Q: What are Schedule A, B, C, D, and E?

A: Schedule A, B, C, D, and E are different sections of the Form CT-33-A/ATT where specific information needs to be provided.

Q: What is the purpose of Form CT-33-A/ATT?

A: The purpose of Form CT-33-A/ATT is to report and calculate the franchise tax owed by life insurance corporations in New York.

Q: Who needs to file Form CT-33-A/ATT?

A: Life insurance corporations operating in New York need to file Form CT-33-A/ATT.

Q: When is the deadline to file Form CT-33-A/ATT?

A: The deadline to file Form CT-33-A/ATT is generally March 15th following the close of the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-A/ATT Schedule A, B, C, D, E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.