This version of the form is not currently in use and is provided for reference only. Download this version of

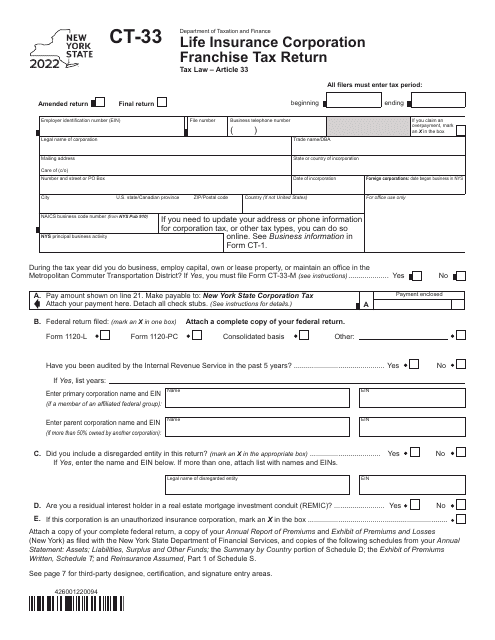

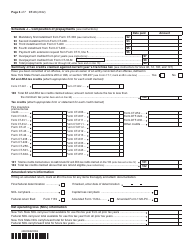

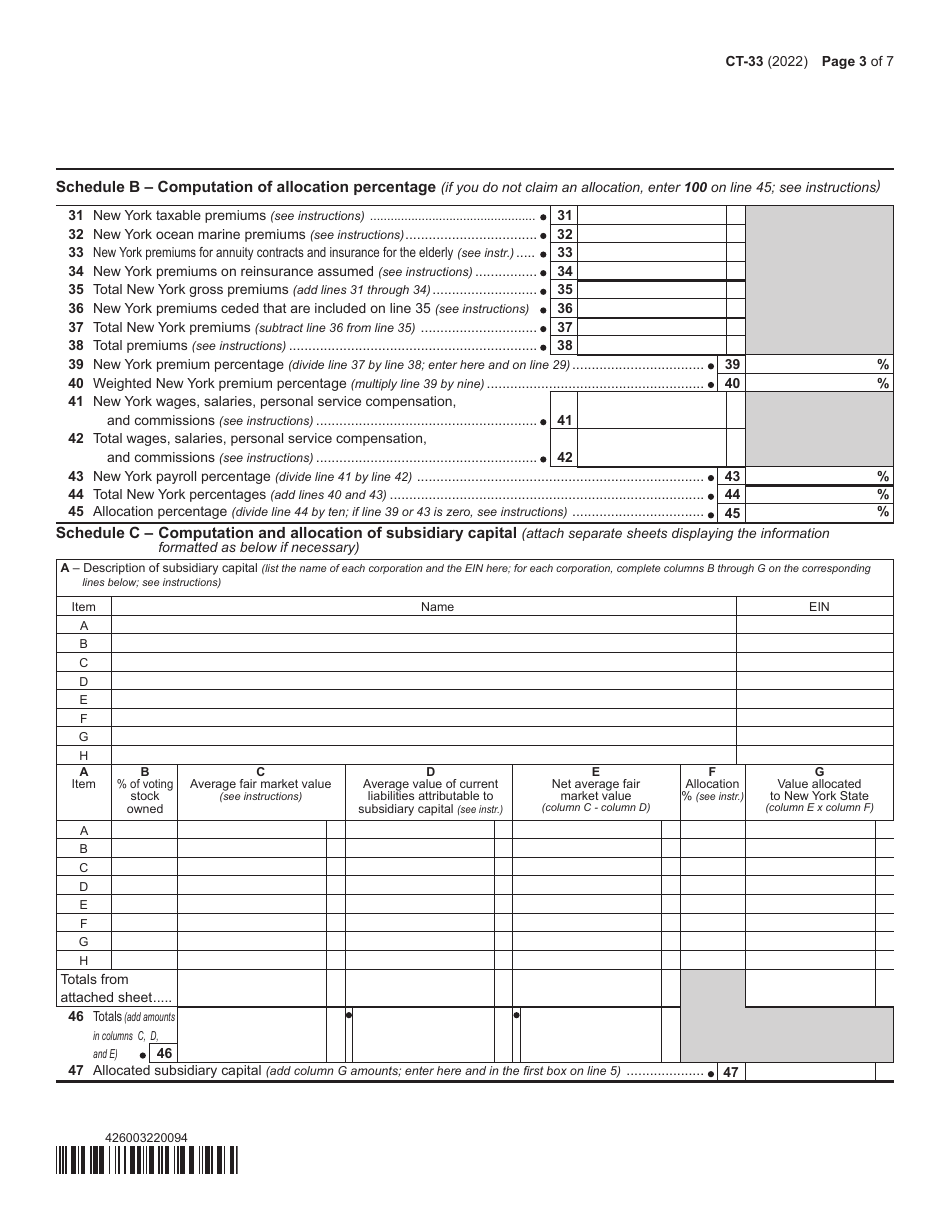

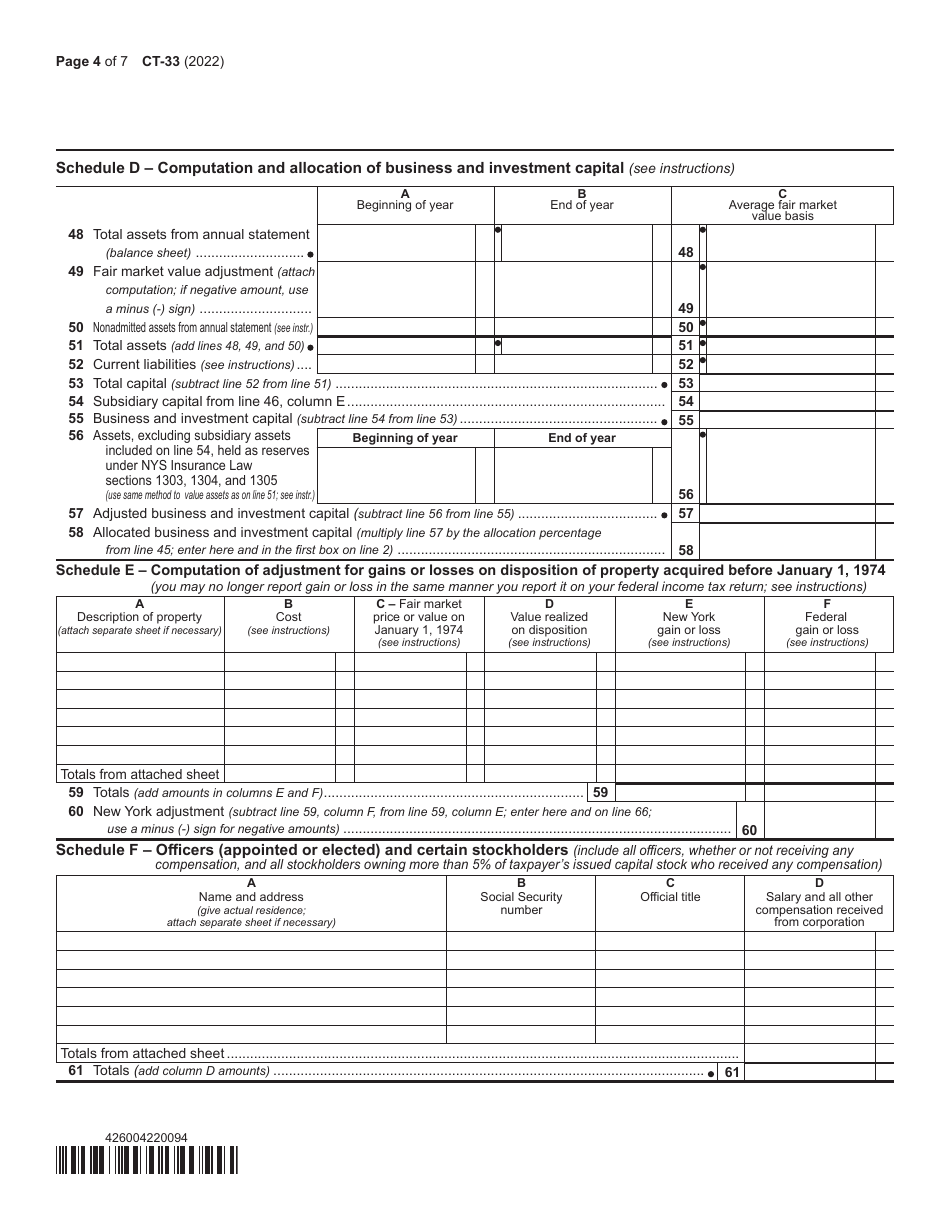

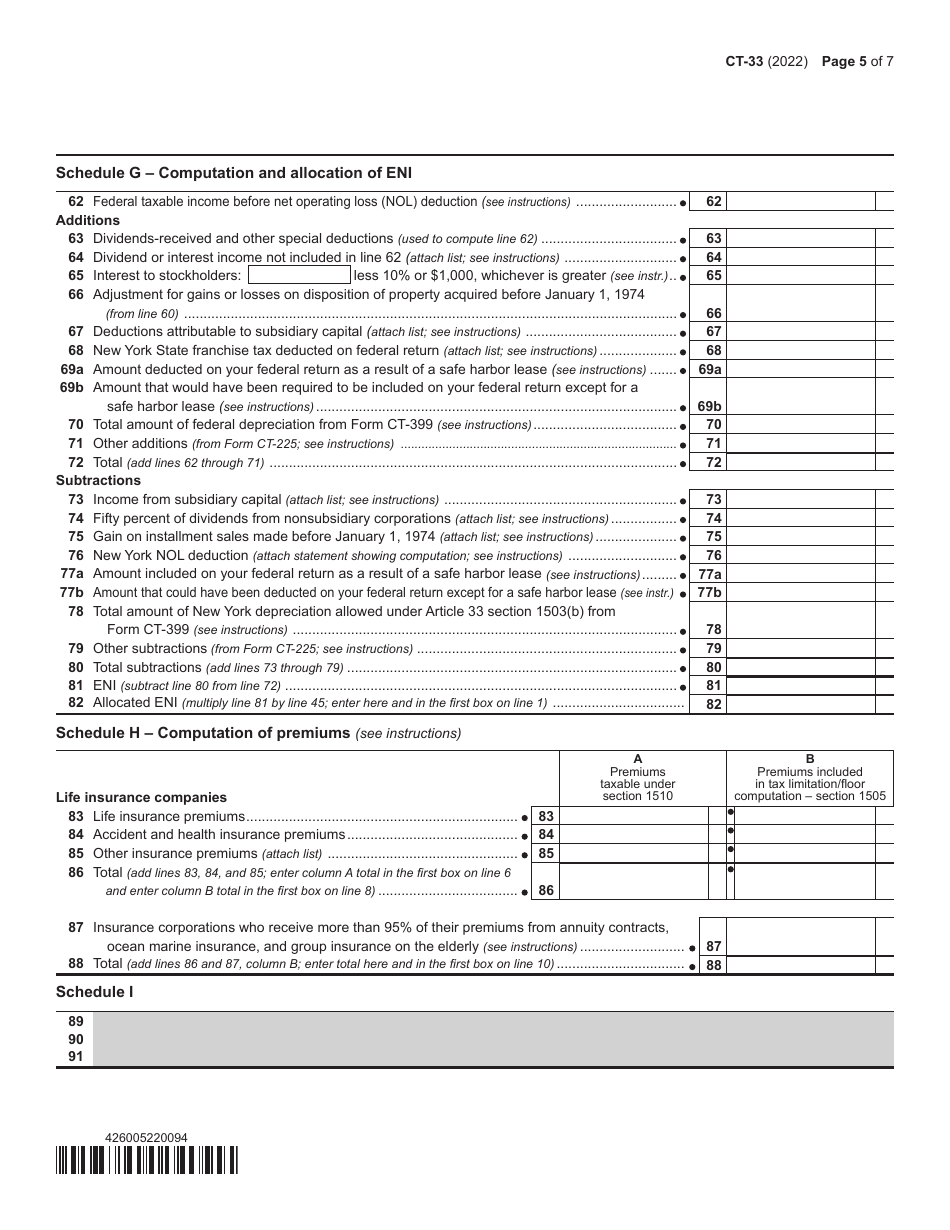

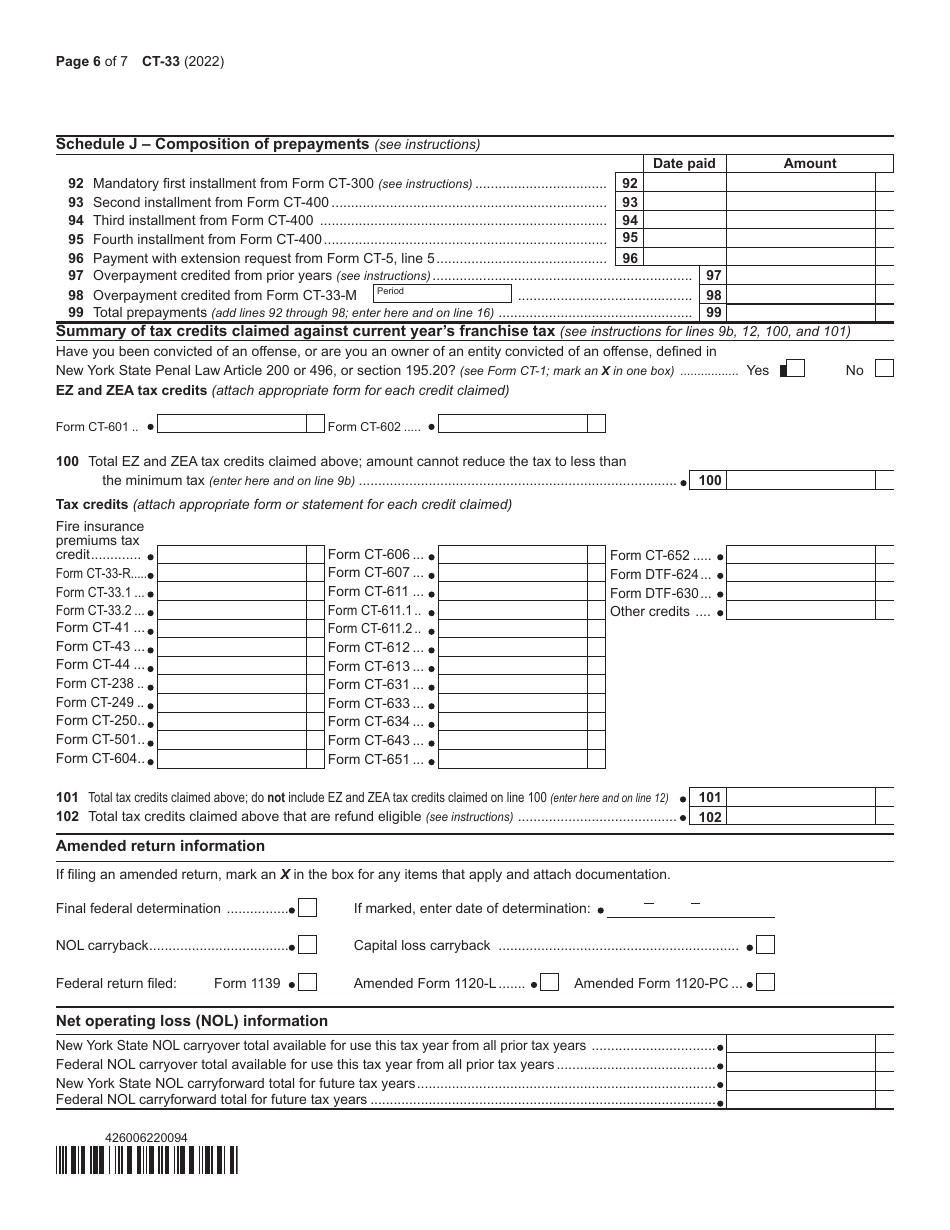

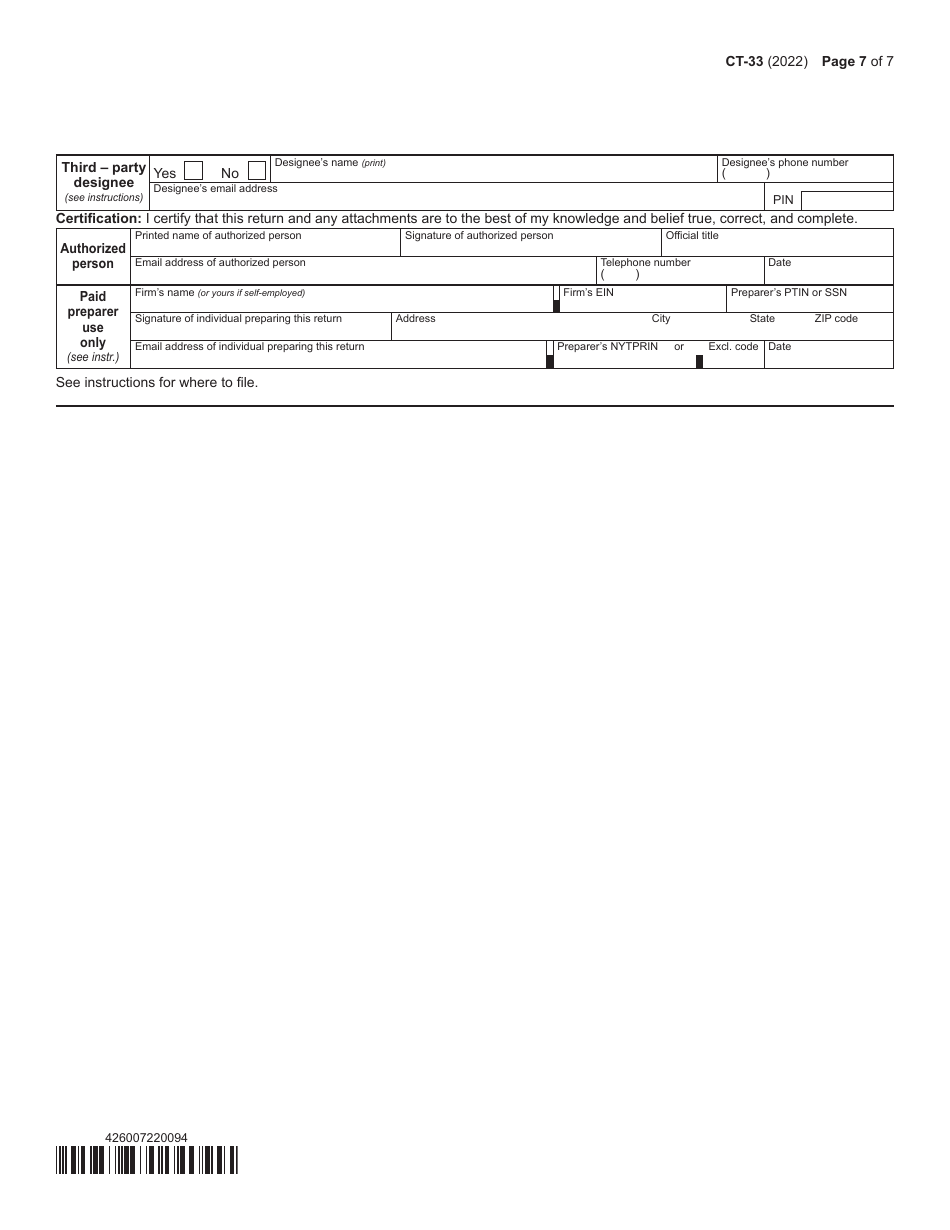

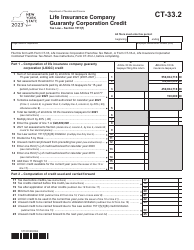

Form CT-33

for the current year.

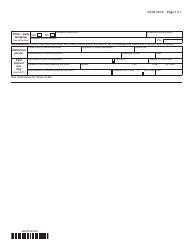

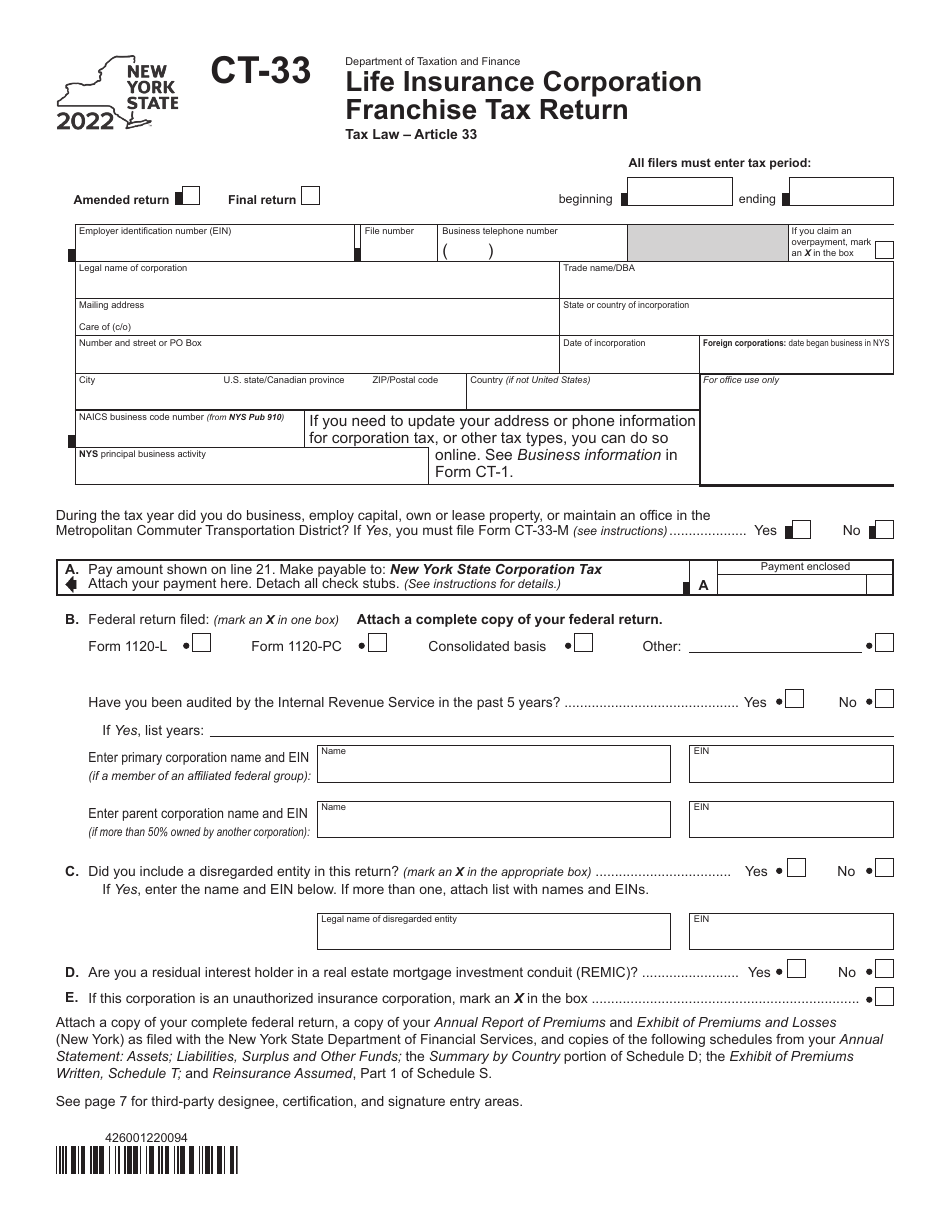

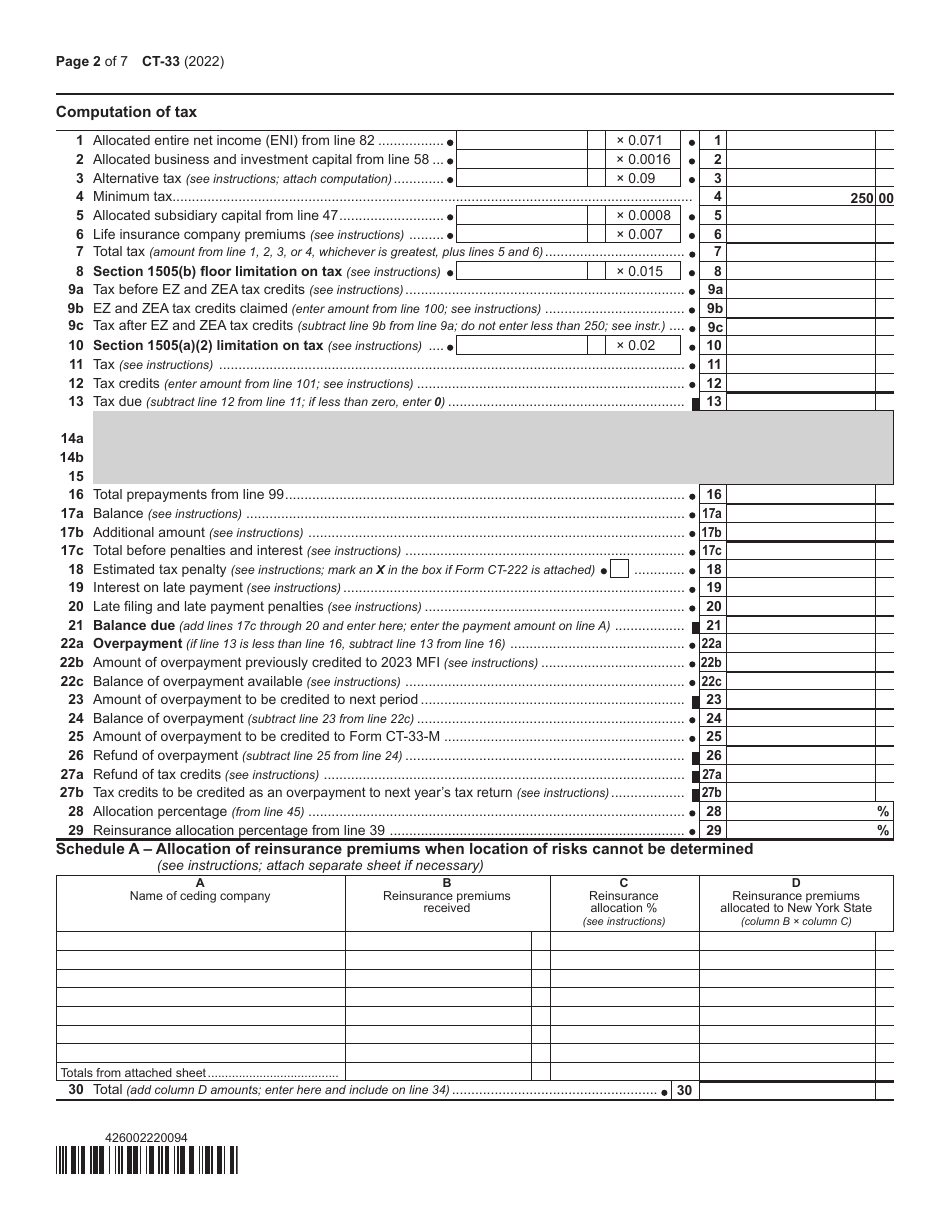

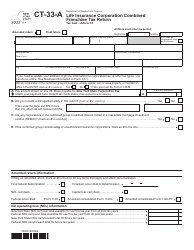

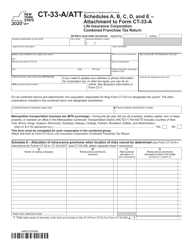

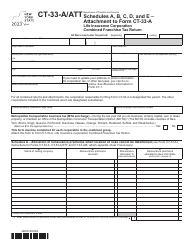

Form CT-33 Life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33?

A: Form CT-33 is the Life Insurance CorporationFranchise Tax Return for companies operating in New York.

Q: Who needs to file Form CT-33?

A: Life insurance corporations operating in New York need to file Form CT-33.

Q: What is the purpose of Form CT-33?

A: Form CT-33 is used to calculate and report the franchise tax owed by life insurance corporations in New York.

Q: When is Form CT-33 due?

A: Form CT-33 is typically due on March 15th of each year.

Q: Are there any penalties for not filing Form CT-33?

A: Yes, failure to file Form CT-33 on time may result in penalties and interest.

Q: Are there any exemptions or deductions available on Form CT-33?

A: Yes, there are certain exemptions and deductions available for life insurance corporations on Form CT-33.

Q: Can I e-file Form CT-33?

A: Yes, electronic filing is available for Form CT-33.

Q: Is Form CT-33 also required in other states?

A: No, Form CT-33 is specific to life insurance corporations operating in New York.

Q: Is there a fee for filing Form CT-33?

A: No, there is no fee required for filing Form CT-33.

Q: Can I amend Form CT-33 if I made a mistake?

A: Yes, you can file an amended Form CT-33 to correct any errors or omissions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.