This version of the form is not currently in use and is provided for reference only. Download this version of

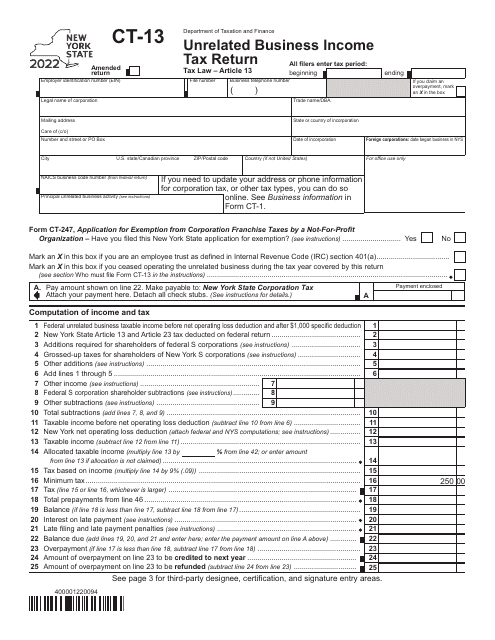

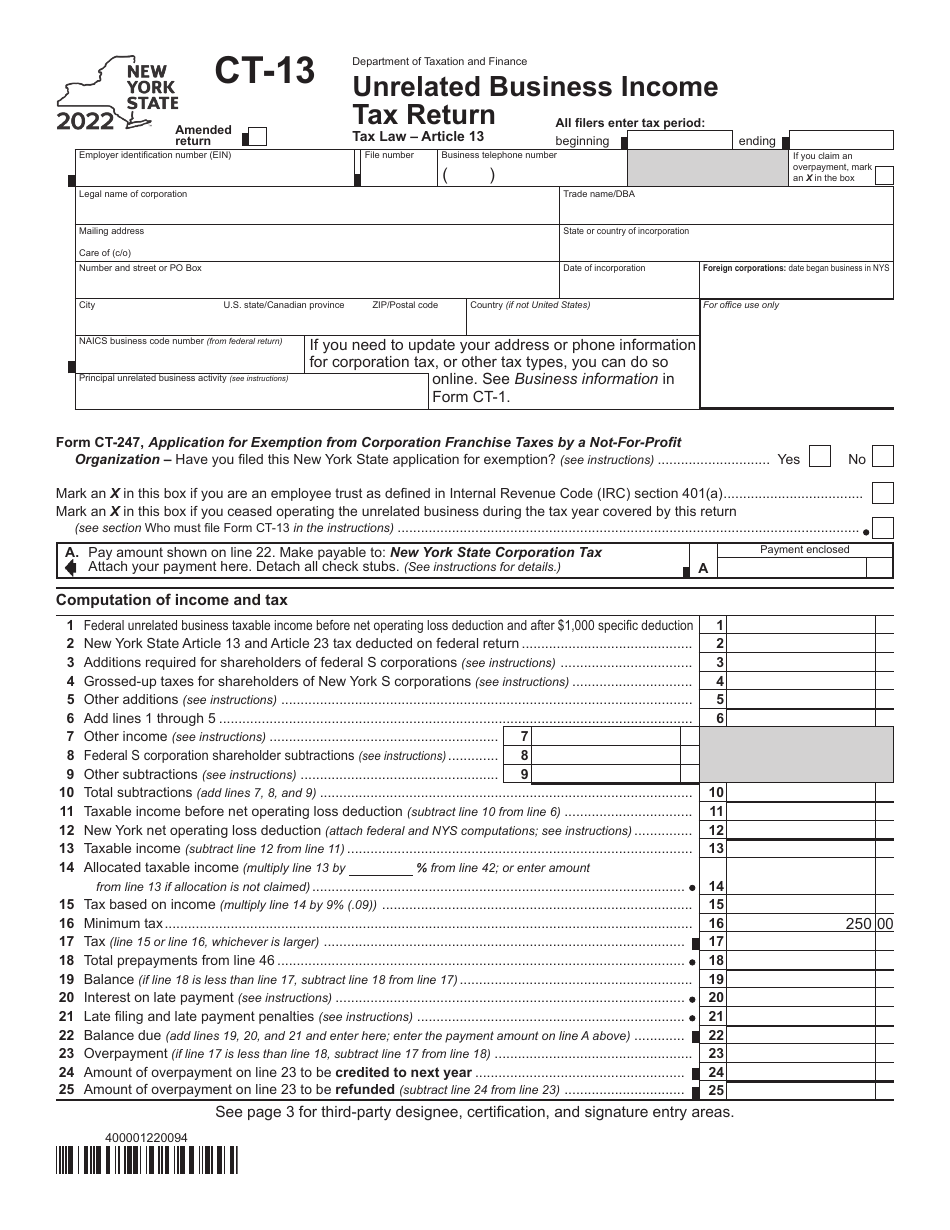

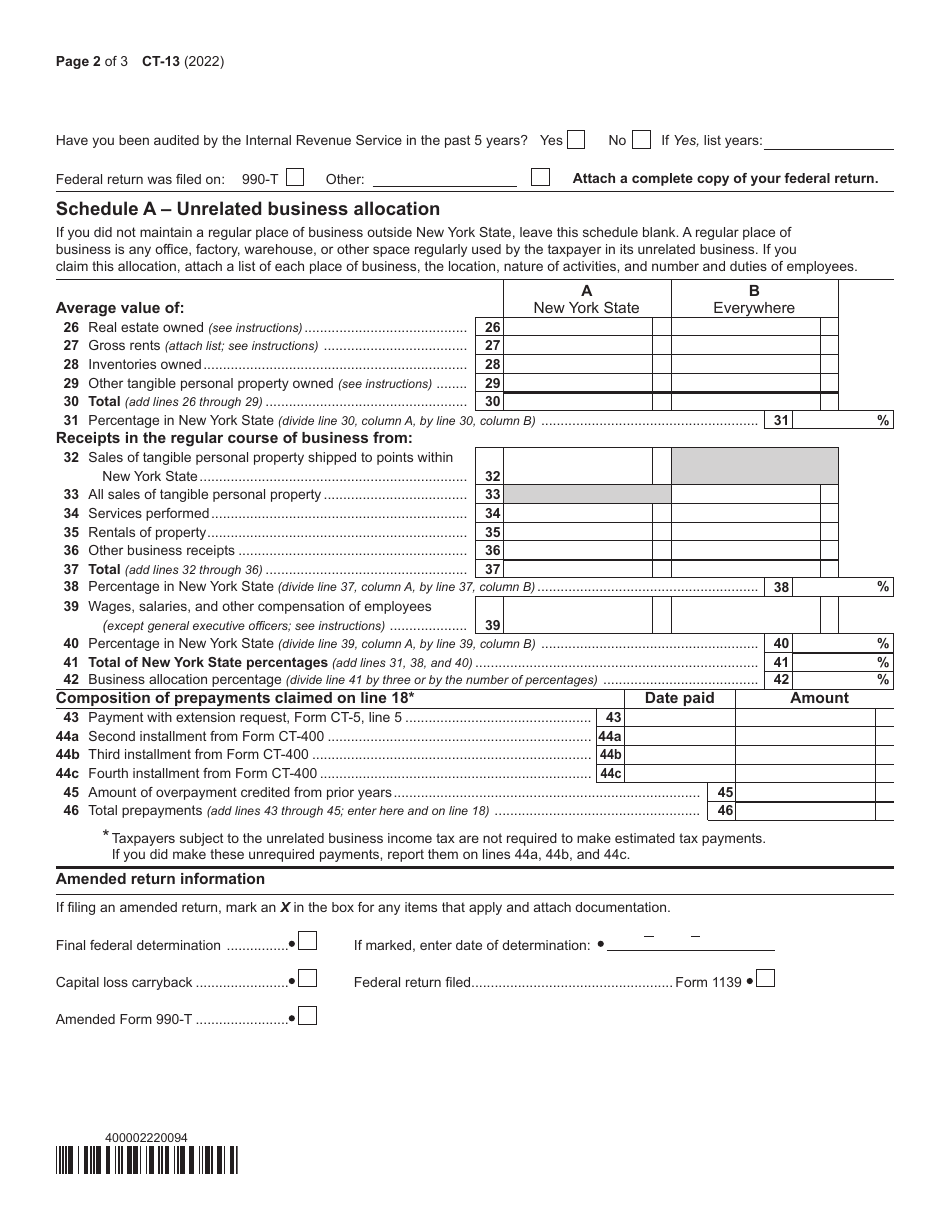

Form CT-13

for the current year.

Form CT-13 Unrelated Business Income Tax Return - New York

What Is Form CT-13?

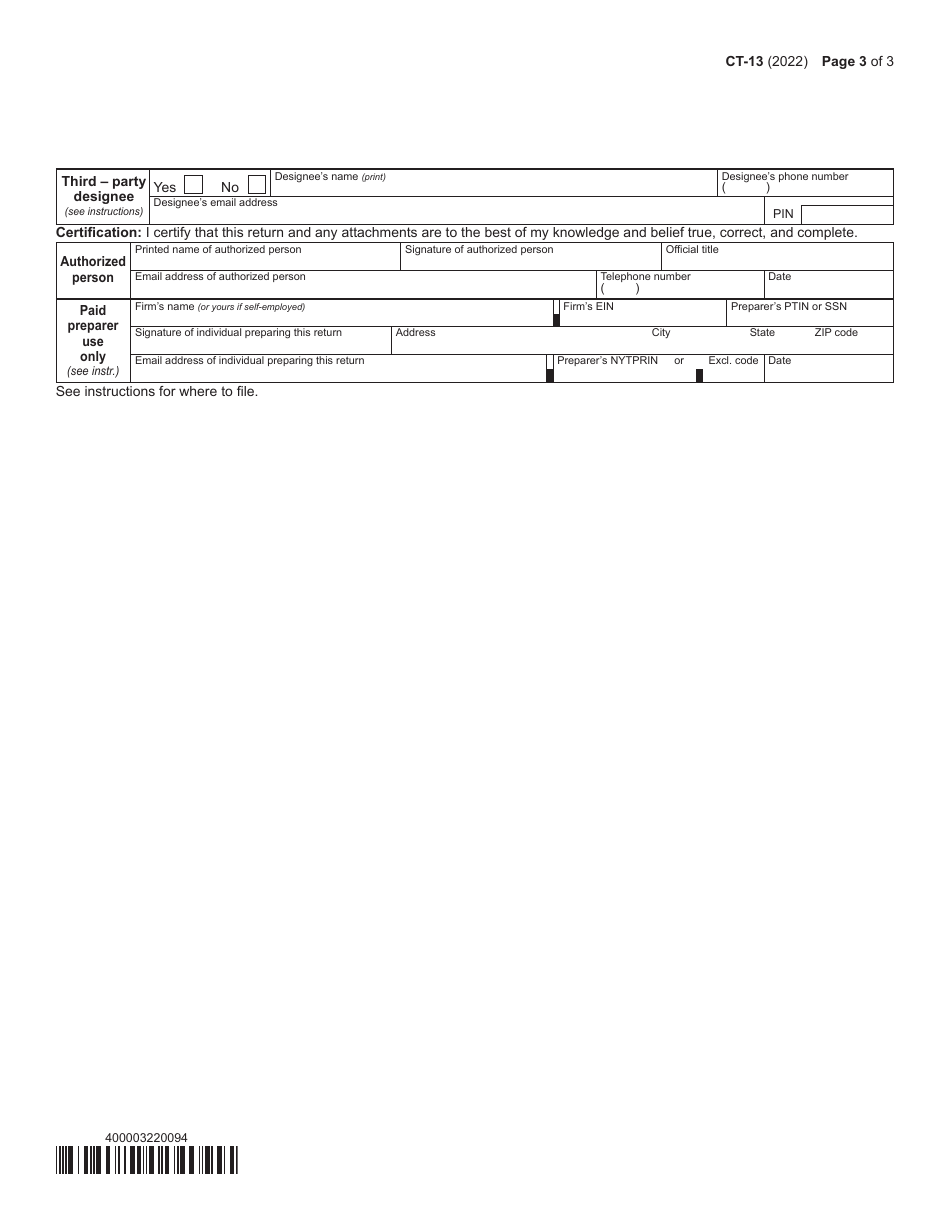

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-13?

A: Form CT-13 is the Unrelated Business Income Tax Return specifically for businesses in the state of New York.

Q: Who needs to file Form CT-13?

A: Nonprofit organizations in New York that have unrelated business income and meet certain criteria must file Form CT-13.

Q: What is unrelated business income?

A: Unrelated business income refers to income generated by a nonprofit organization through activities that are not related to its exempt purpose.

Q: How do I determine if I need to file Form CT-13?

A: You need to file Form CT-13 if your nonprofit organization has unrelated business income of $1,000 or more in New York.

Q: When is the deadline to file Form CT-13?

A: Form CT-13 must be filed by the 15th day of the 5th month after the close of your organization's fiscal year.

Q: Is there a penalty for late filing of Form CT-13?

A: Yes, there is a penalty for late filing of Form CT-13. The penalty is based on the amount of tax due and the number of months the return is late.

Q: Can Form CT-13 be filed electronically?

A: No, currently Form CT-13 cannot be filed electronically. It must be filed by mail.

Q: Are there any exceptions to filing Form CT-13?

A: Certain organizations are exempt from filing Form CT-13, including churches, certain educational institutions, and certain governmental organizations.

Q: What should I include when filing Form CT-13?

A: When filing Form CT-13, you should include a copy of your federal Form 990-T, schedules, and any other supporting documents related to your unrelated business income.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-13 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.