This version of the form is not currently in use and is provided for reference only. Download this version of

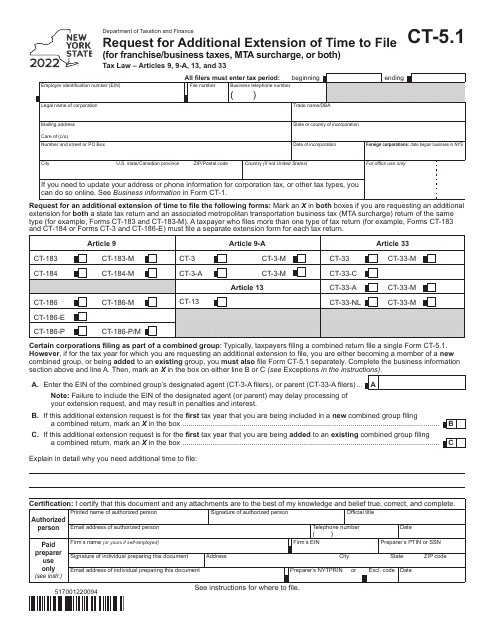

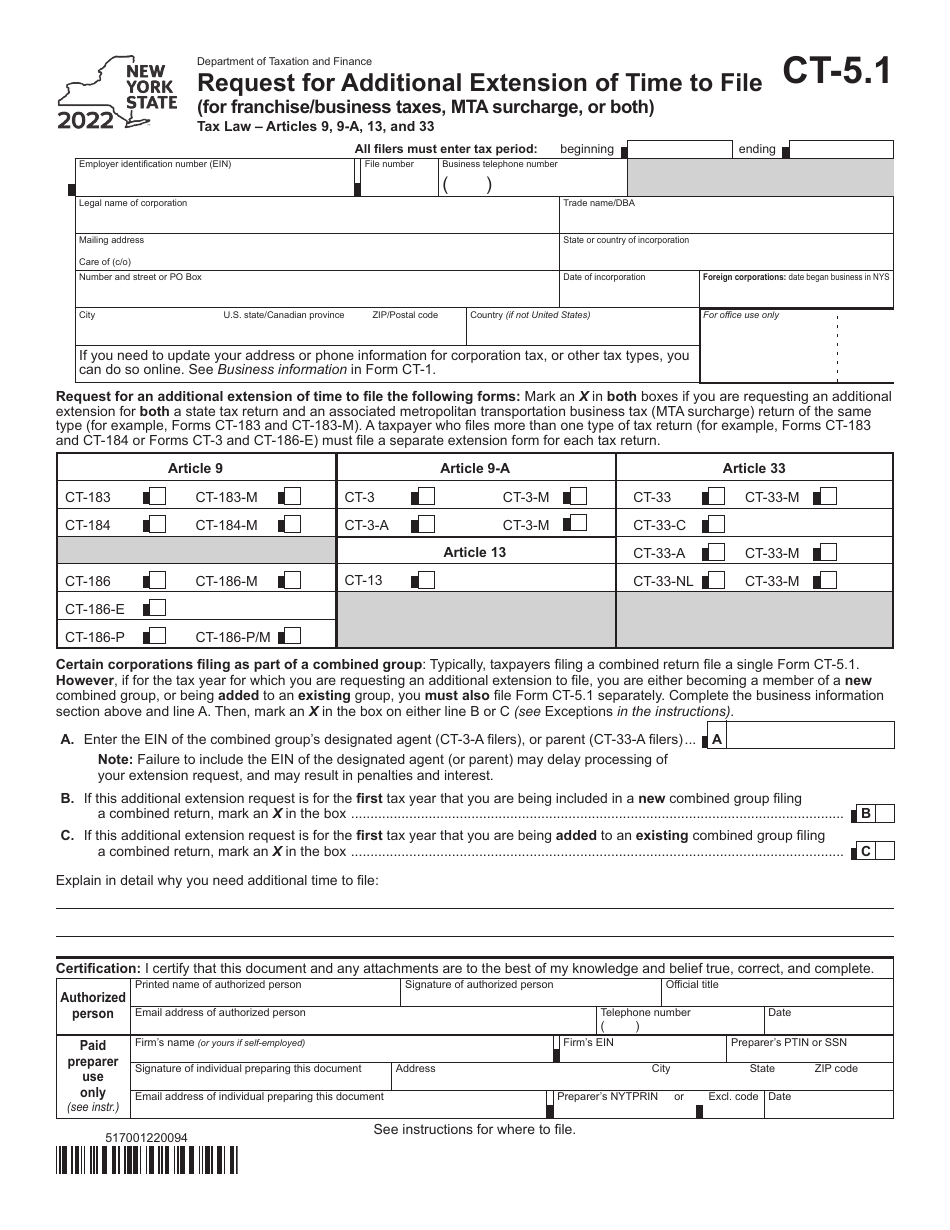

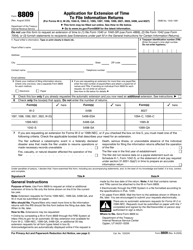

Form CT-5.1

for the current year.

Form CT-5.1 Request for Additional Extension of Time to File (For Franchise / Business Taxes, Mta Surcharge, or Both) - New York

What Is Form CT-5.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-5.1?

A: Form CT-5.1 is a request for additional extension of time to file for franchise/business taxes, MTA surcharge, or both in New York.

Q: Who is required to file Form CT-5.1?

A: Individuals or businesses that need additional time to file their franchise/business taxes or MTA surcharge in New York.

Q: What is the purpose of Form CT-5.1?

A: The purpose of Form CT-5.1 is to request an extension of time to file for franchise/business taxes, MTA surcharge, or both in New York.

Q: How do I file Form CT-5.1?

A: Form CT-5.1 can be filed electronically or by mail. Instructions for filing are provided on the form itself.

Q: What is the deadline for filing Form CT-5.1?

A: The deadline for filing Form CT-5.1 is the same as the deadline for filing your franchise/business taxes or MTA surcharge in New York.

Q: Is there a fee for filing Form CT-5.1?

A: No, there is no fee for filing Form CT-5.1.

Q: Can I request multiple extensions using Form CT-5.1?

A: Yes, you can request multiple extensions of time to file using Form CT-5.1.

Q: Will filing Form CT-5.1 automatically grant me an extension?

A: No, the extension request is subject to approval by the New York State Department of Taxation and Finance.

Q: Is there a penalty for filing Form CT-5.1 late?

A: Yes, there may be a penalty for filing Form CT-5.1 late. It is important to file the form before the deadline.

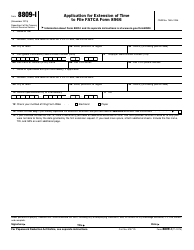

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-5.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.