This version of the form is not currently in use and is provided for reference only. Download this version of

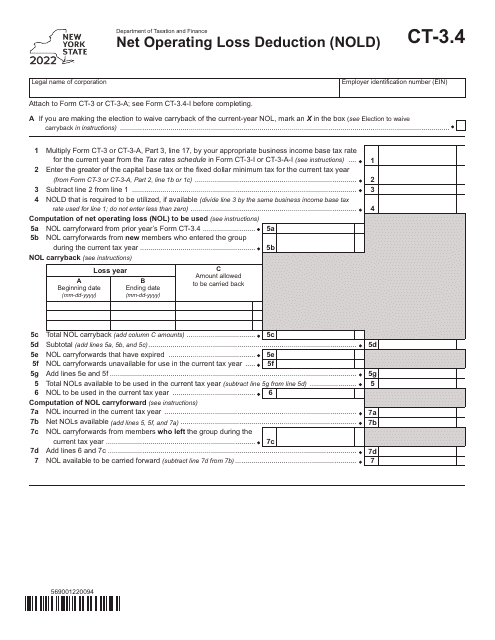

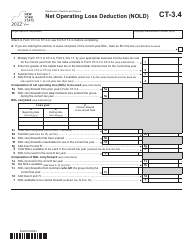

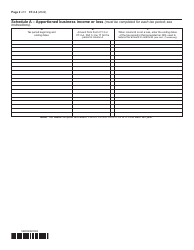

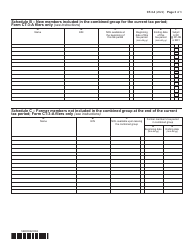

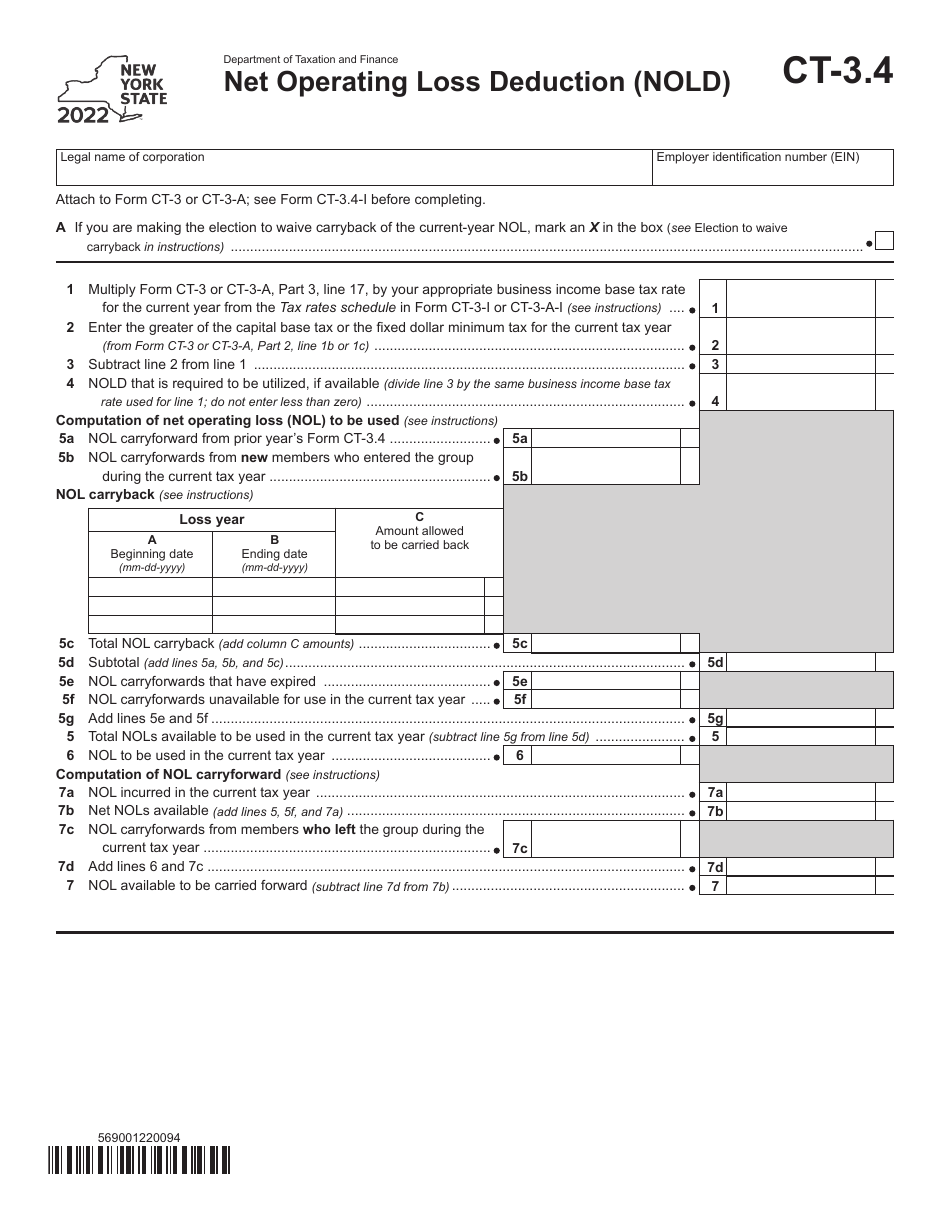

Form CT-3.4

for the current year.

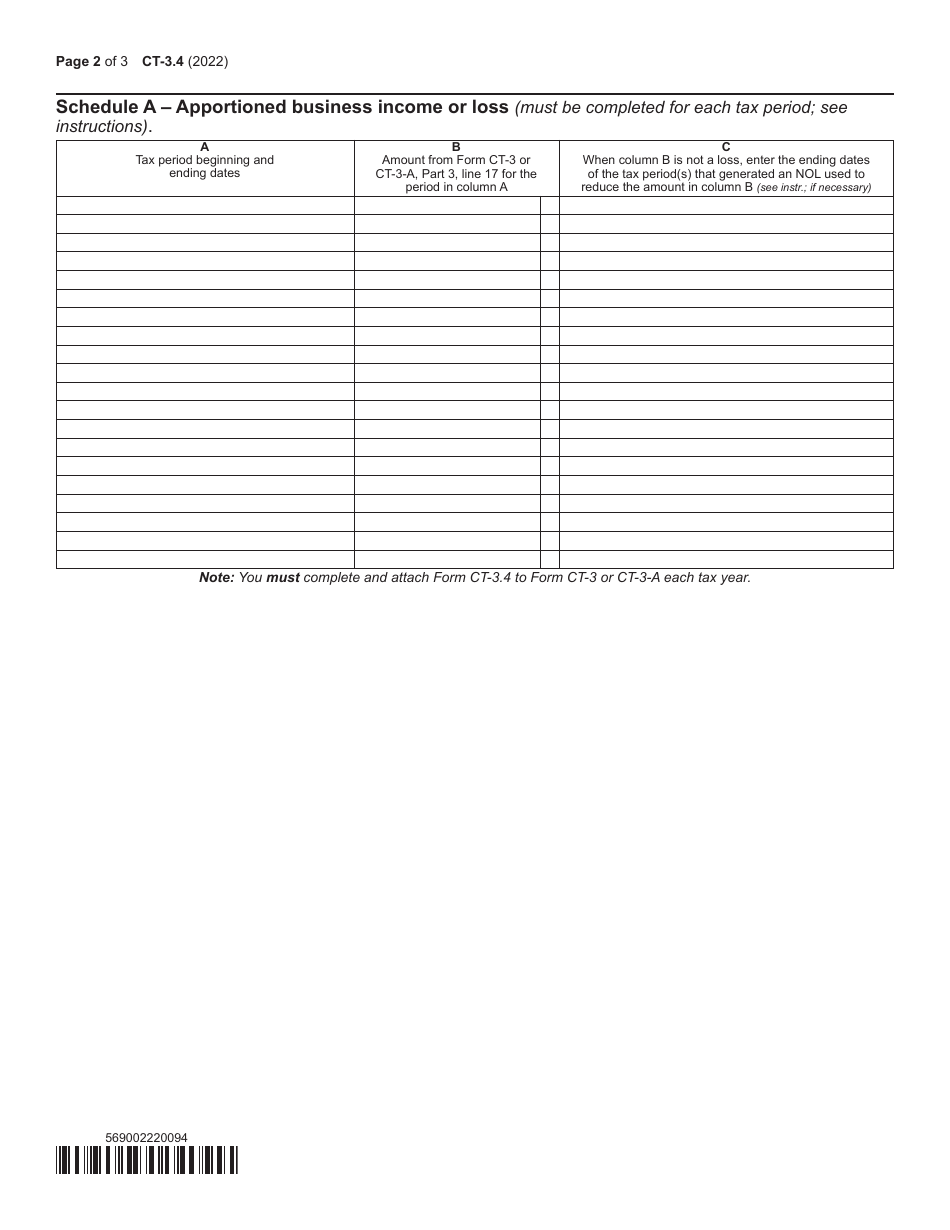

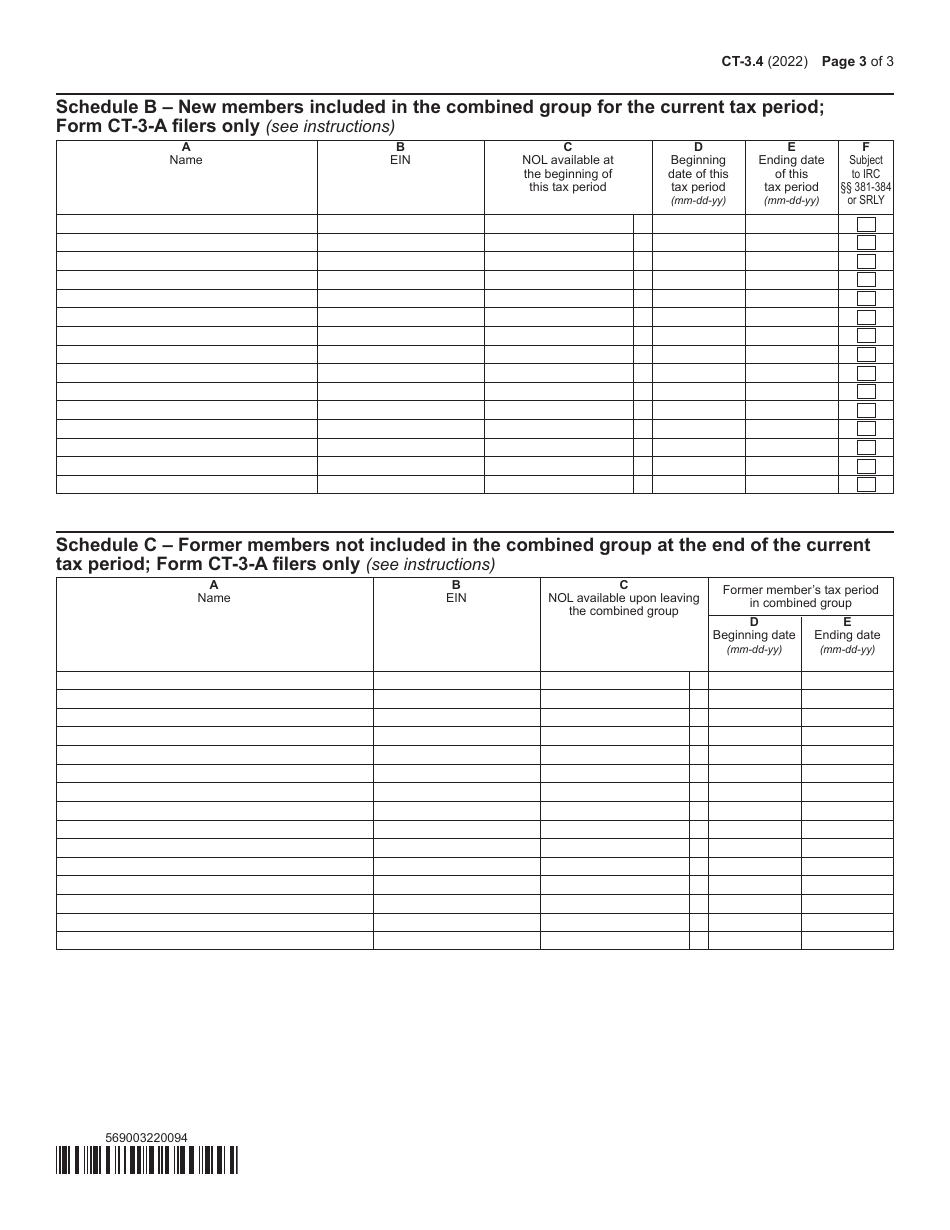

Form CT-3.4 Net Operating Loss Deduction (Nold) - New York

What Is Form CT-3.4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.4?

A: Form CT-3.4 is a form used for the Net Operating Loss Deduction (Nold) in New York.

Q: What is the Net Operating Loss Deduction (Nold)?

A: The Net Operating Loss Deduction (Nold) allows businesses to offset their current year's taxable income by deducting past operating losses.

Q: Who uses Form CT-3.4?

A: Form CT-3.4 is used by businesses in New York to claim the Net Operating Loss Deduction (Nold).

Q: What does the Net Operating Loss Deduction (Nold) do?

A: The Net Operating Loss Deduction (Nold) allows businesses to reduce their taxable income by deducting losses from previous years.

Q: Are there any limitations to the Net Operating Loss Deduction (Nold)?

A: Yes, there are limitations on the amount of net operating losses that can be deducted in a given year.

Q: When is Form CT-3.4 due?

A: The due date for Form CT-3.4 varies depending on the fiscal year of the taxpayer. Please refer to the instructions provided with the form.

Q: What happens if I don't file Form CT-3.4?

A: Failure to file Form CT-3.4 or claiming an improper Net Operating Loss Deduction (Nold) can result in penalties and interest.

Q: Can I carry forward unused Net Operating Loss Deductions (Nolds) to future years?

A: Yes, unused Net Operating Loss Deductions (Nolds) can be carried forward to future years, subject to certain limitations.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.