This version of the form is not currently in use and is provided for reference only. Download this version of

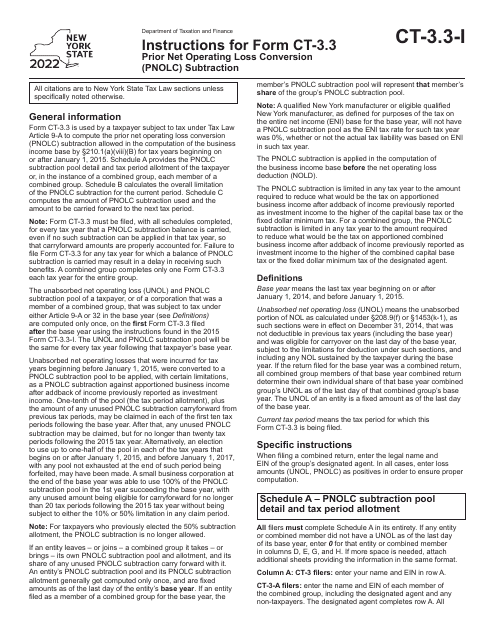

Instructions for Form CT-3.3

for the current year.

Instructions for Form CT-3.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York

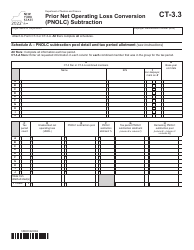

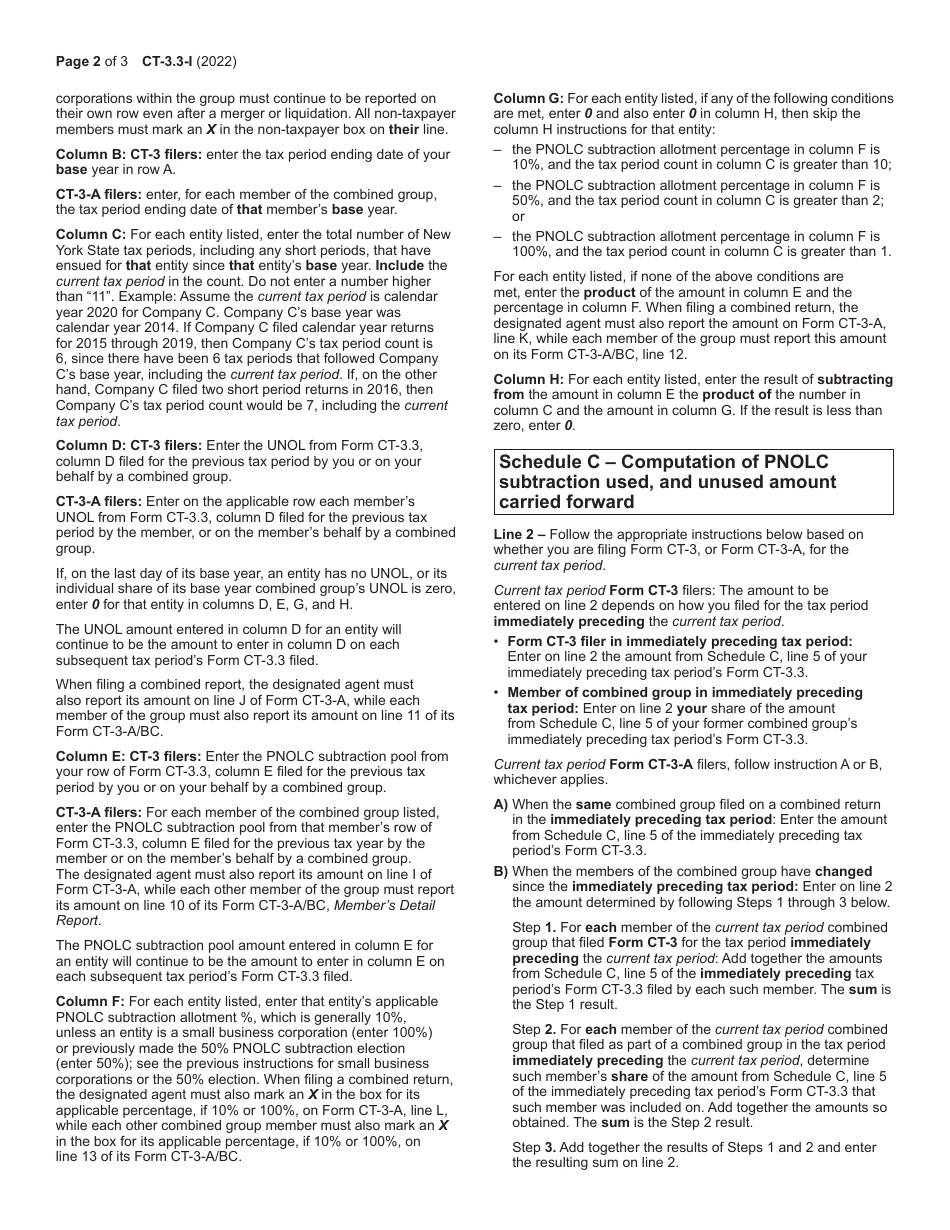

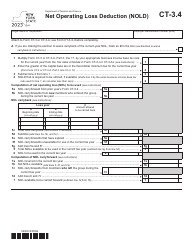

This document contains official instructions for Form CT-3.3 , Prior Net Operating Loss Conversion (Pnolc) Subtraction - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-3.3 is available for download through this link.

FAQ

Q: What is Form CT-3.3?

A: Form CT-3.3 is a tax form used for the Prior Net Operating Loss Conversion (PNOLC) Subtraction in New York.

Q: What is the purpose of Form CT-3.3?

A: Form CT-3.3 is used to calculate and claim the Prior Net Operating Loss Conversion (PNOLC) Subtraction on corporate tax returns.

Q: Who needs to file Form CT-3.3?

A: Corporations that have a net operating loss (NOL) in a previous taxable year and want to carry it forward as a subtraction on their New York corporate tax return need to file Form CT-3.3.

Q: When is the deadline to file Form CT-3.3?

A: The deadline to file Form CT-3.3 is the same as the due date for the New York corporate tax return, which is generally on or before the 15th day of the fourth month following the close of the tax year.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.