This version of the form is not currently in use and is provided for reference only. Download this version of

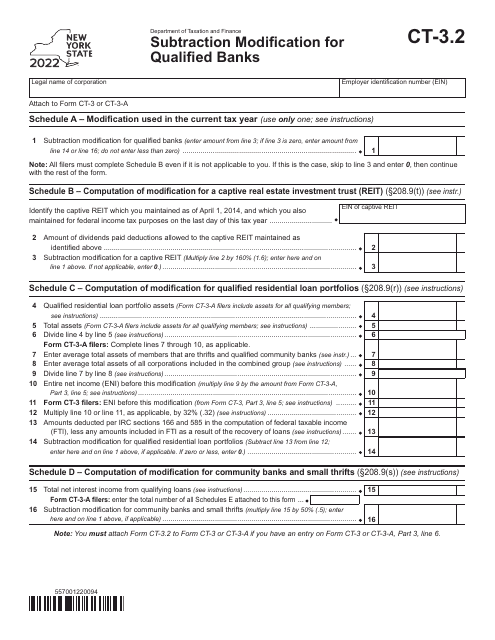

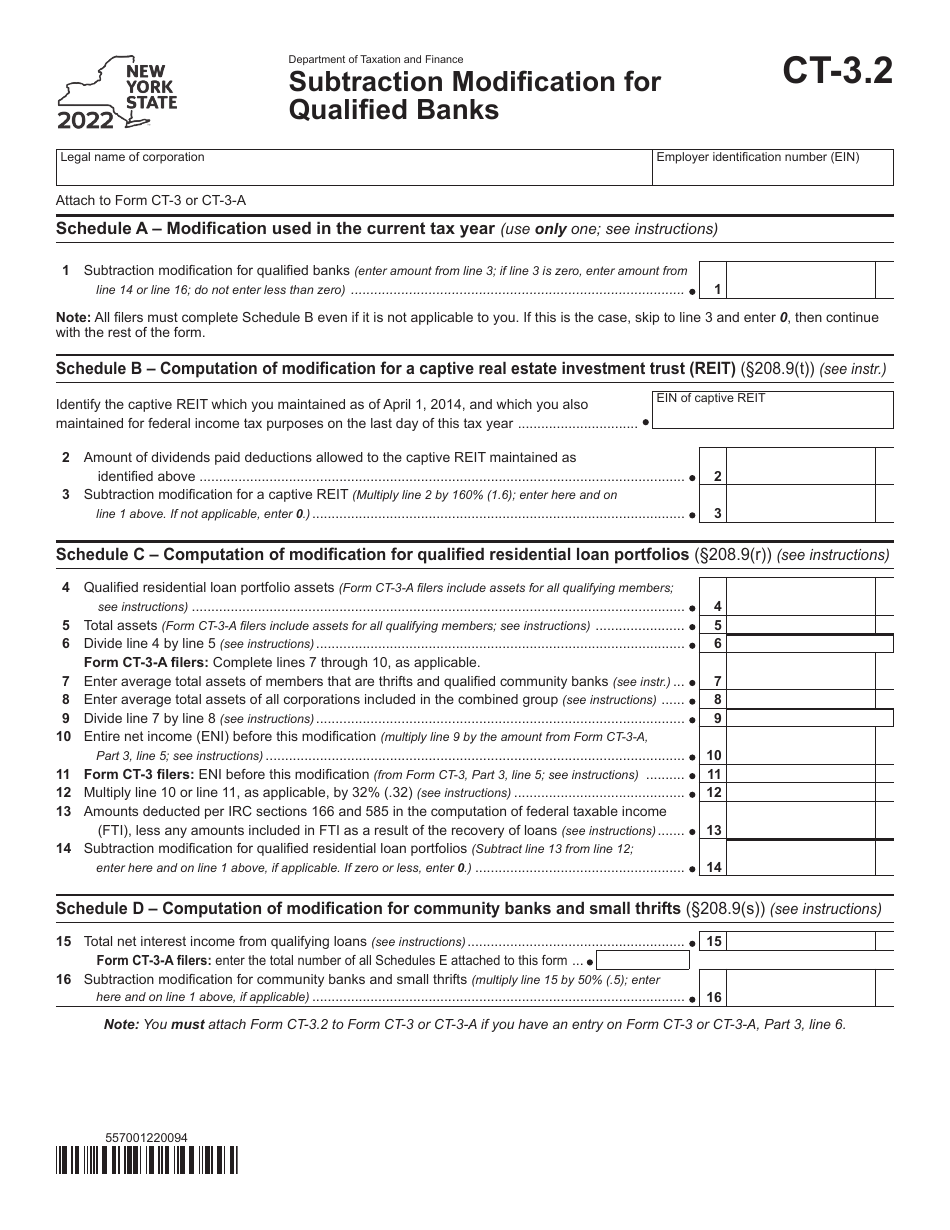

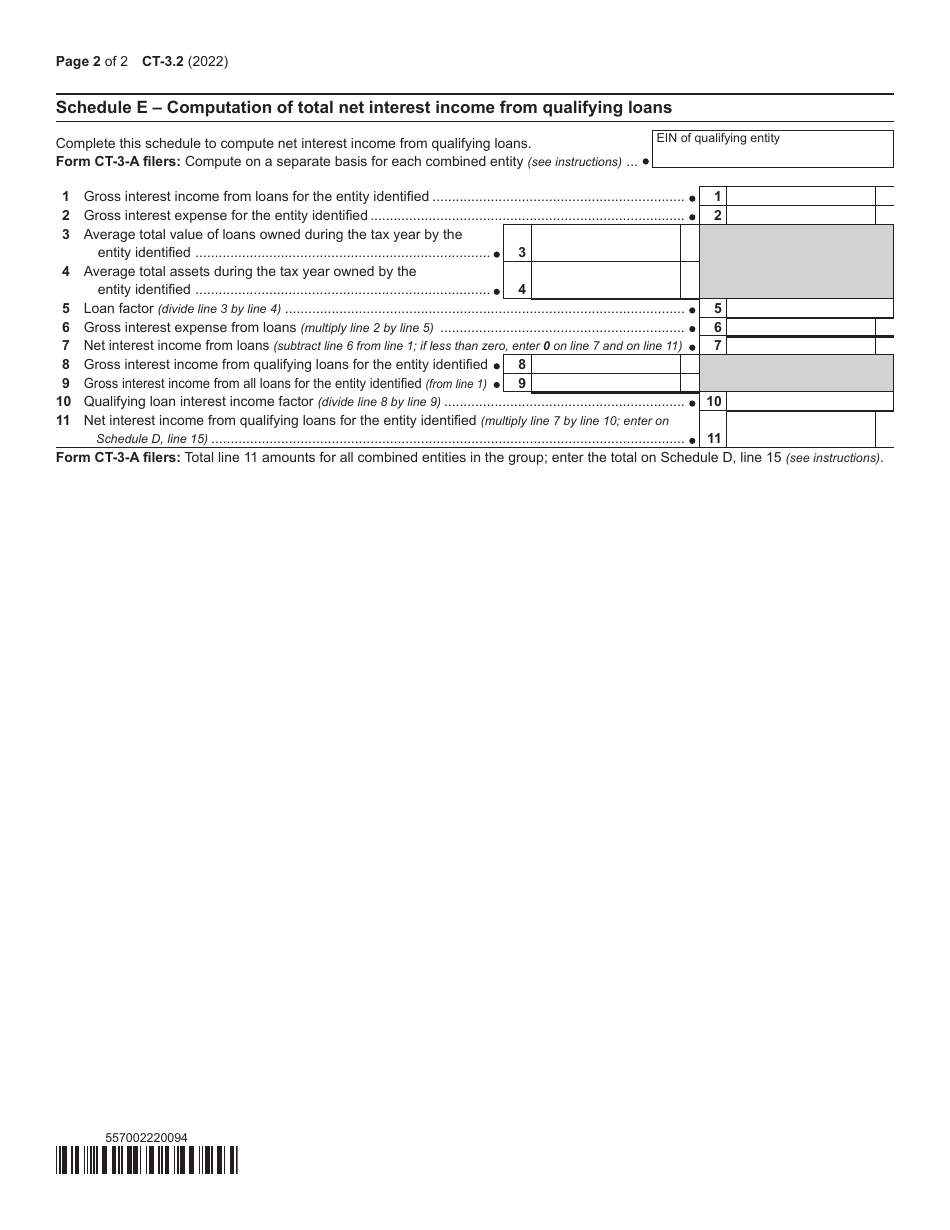

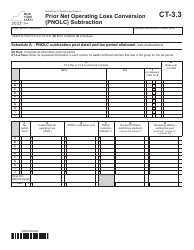

Form CT-3.2

for the current year.

Form CT-3.2 Subtraction Modification for Qualified Banks - New York

What Is Form CT-3.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.2?

A: Form CT-3.2 is a tax form for Qualified Banks in New York.

Q: What is a Subtraction Modification?

A: A Subtraction Modification is an adjustment made to your taxable income.

Q: Who needs to file Form CT-3.2?

A: Qualified Banks in New York need to file Form CT-3.2.

Q: What is the purpose of Form CT-3.2?

A: The purpose of Form CT-3.2 is to calculate the subtraction modification for Qualified Banks.

Q: How do I fill out Form CT-3.2?

A: You need to provide the required information about your qualified bank activities in New York and calculate the appropriate subtraction modification.

Q: When is the deadline to file Form CT-3.2?

A: The deadline to file Form CT-3.2 is usually on or before April 15th of the following year.

Q: Are there any penalties for late filing of Form CT-3.2?

A: Yes, there may be penalties for late filing of Form CT-3.2. It is important to file the form on time to avoid penalties.

Q: Do I need to attach any documents with Form CT-3.2?

A: You may need to attach supporting documents, such as schedules and statements, depending on your specific situation. Check the instructions provided with the form.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.