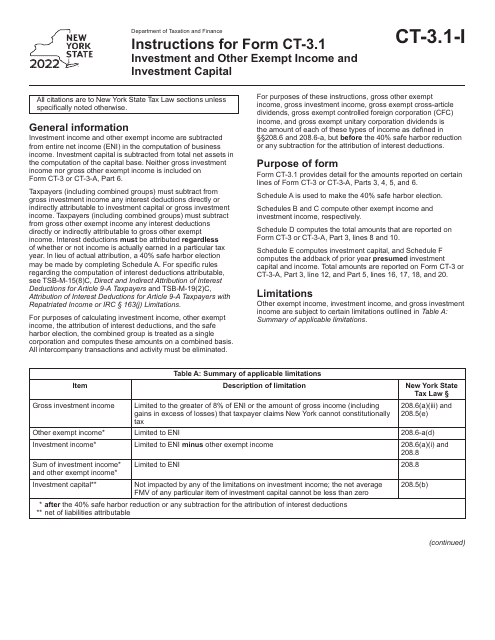

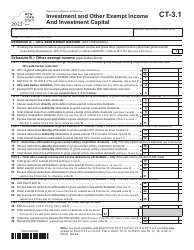

Form CT-3.1 Investment and Other Exempt Income and Investment Capital - New York

What Is Form CT-3.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-3.1?

A: Form CT-3.1 is a tax form used in New York to report investment and other exempt income and investment capital.

Q: Who needs to file Form CT-3.1?

A: Taxpayers in New York who have investment and other exempt income and investment capital need to file Form CT-3.1.

Q: What should be reported on Form CT-3.1?

A: Form CT-3.1 is used to report income from investments and other exempt sources, as well as information about investment capital.

Q: When is the deadline for filing Form CT-3.1?

A: The deadline for filing Form CT-3.1 in New York is generally on or before the due date for filing the corresponding New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.