This version of the form is not currently in use and is provided for reference only. Download this version of

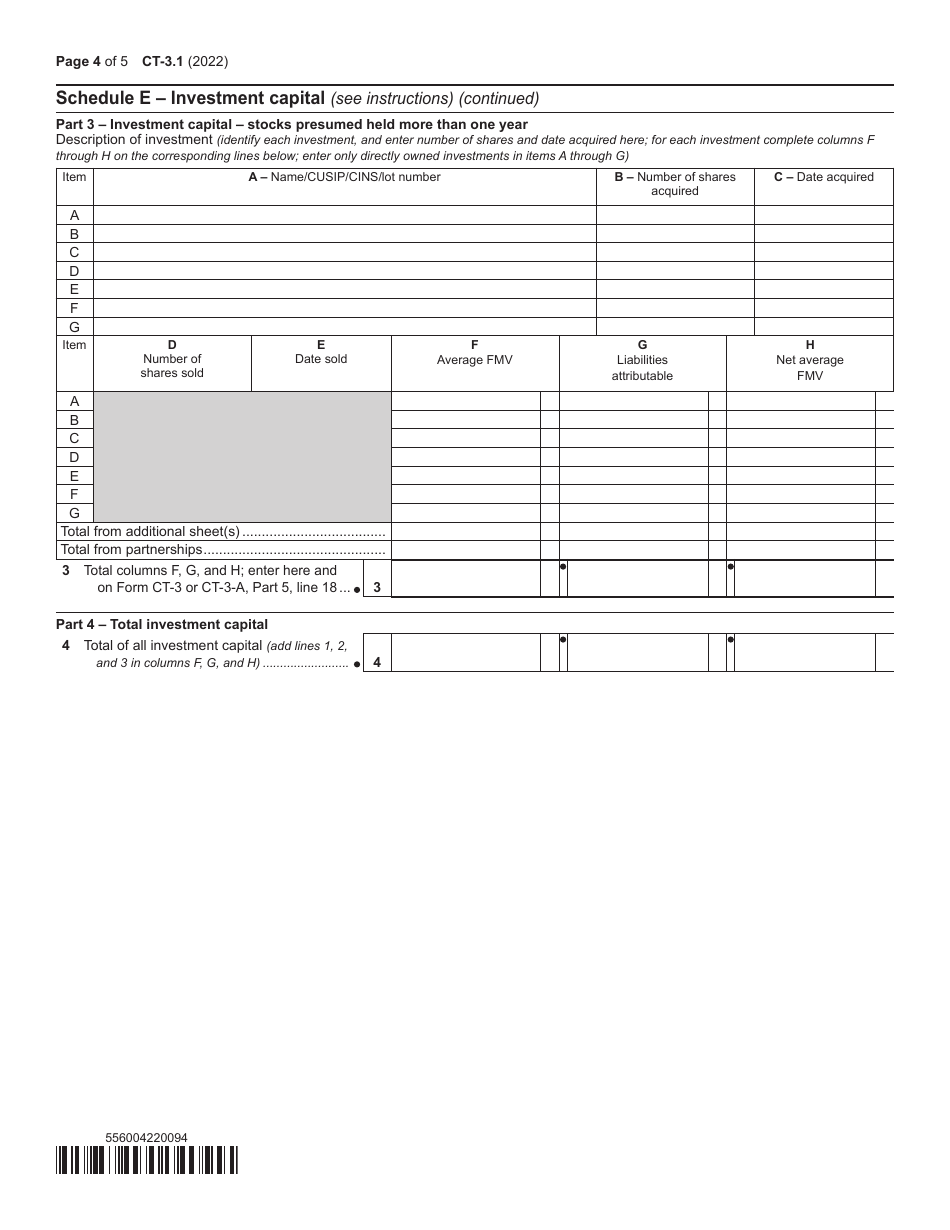

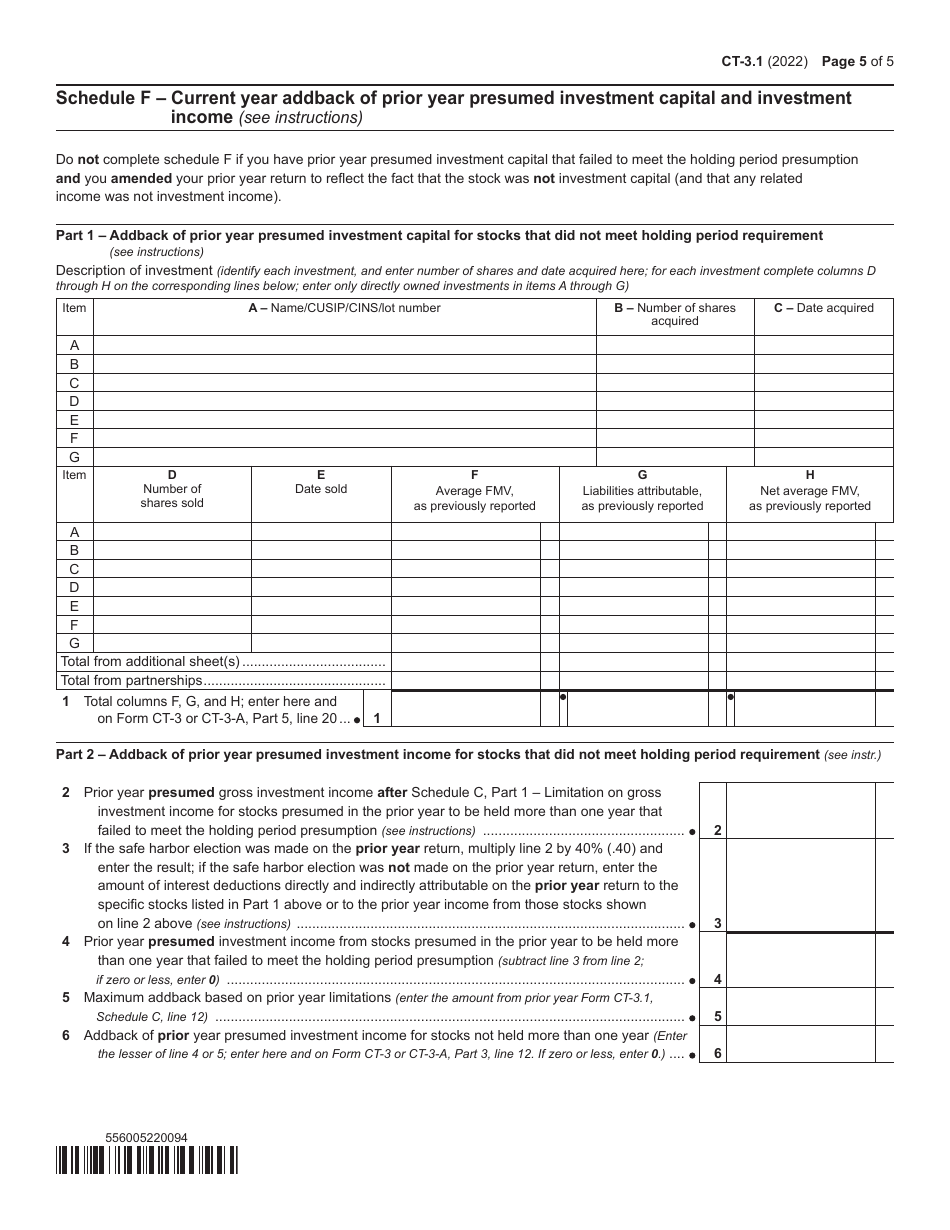

Form CT-3.1

for the current year.

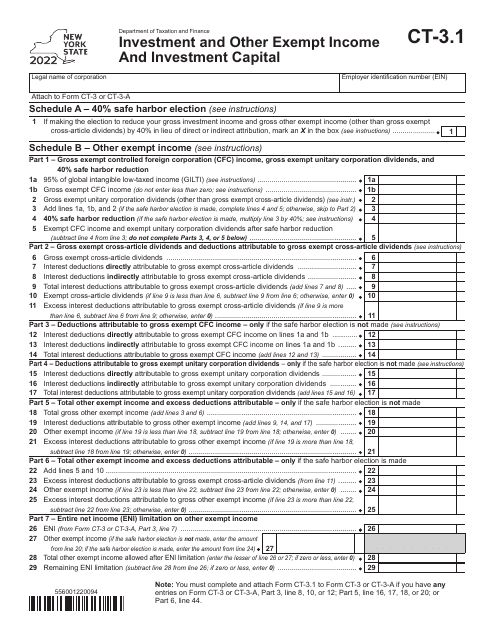

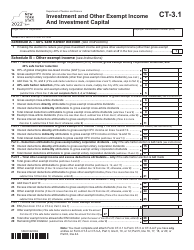

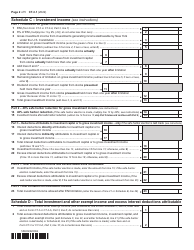

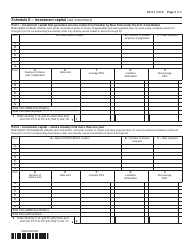

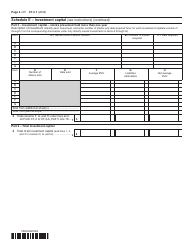

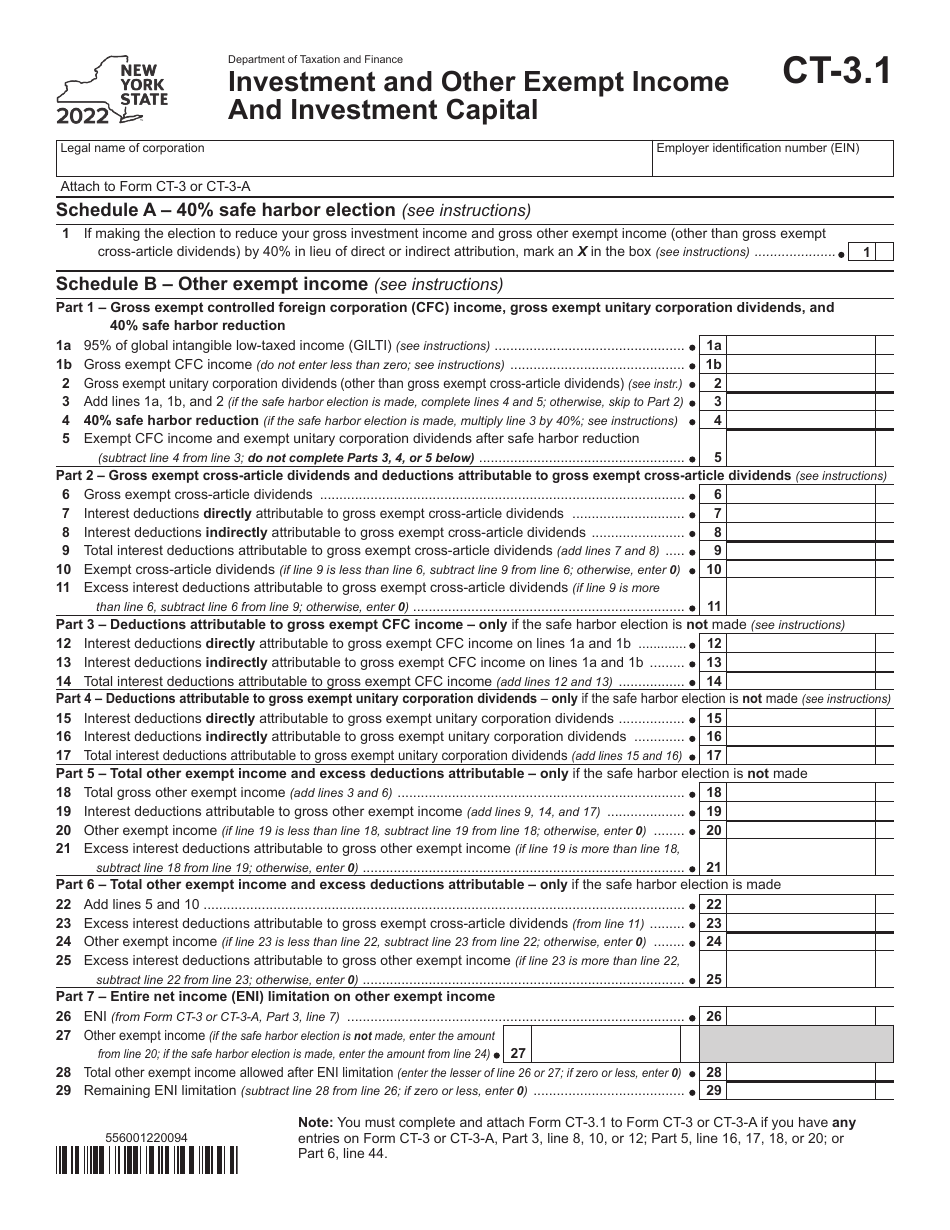

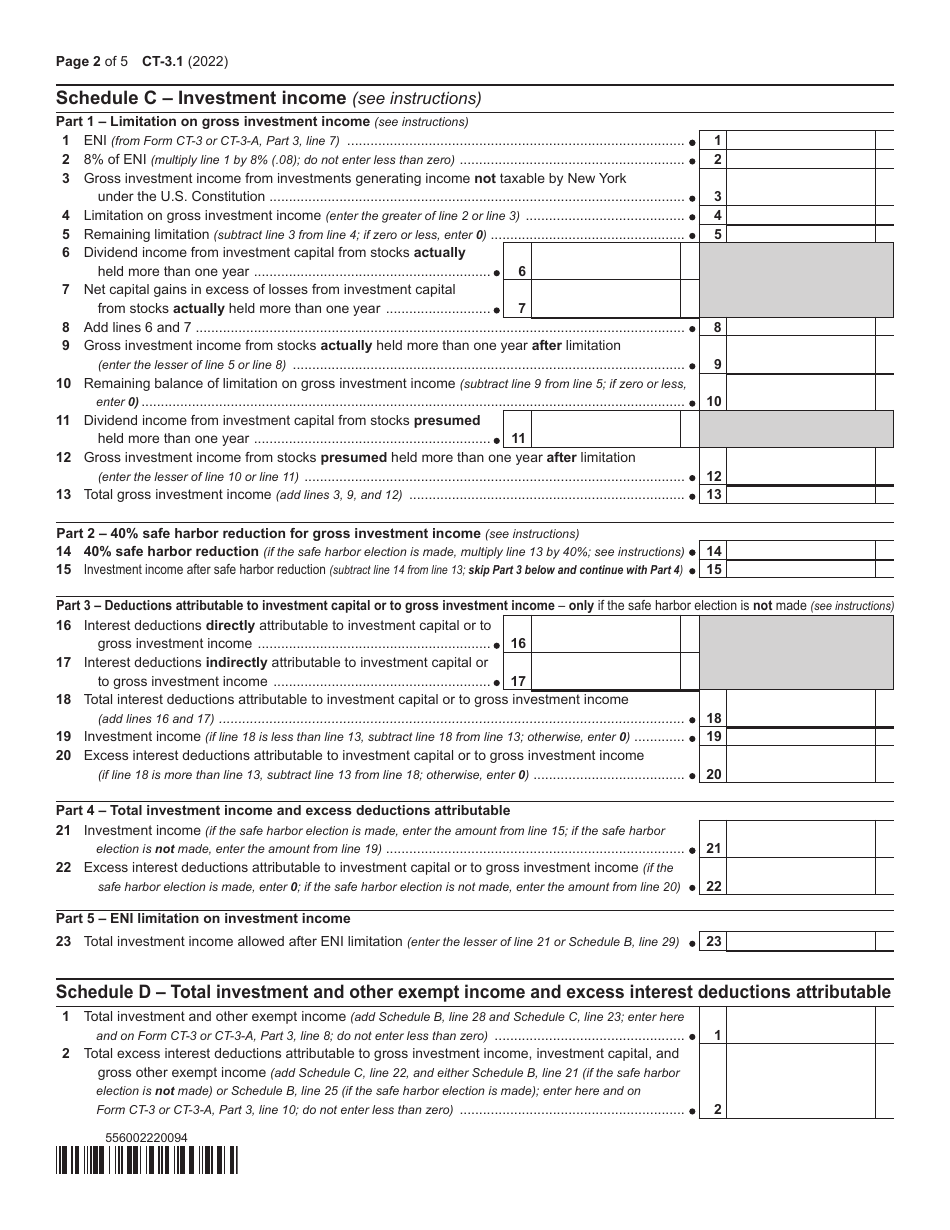

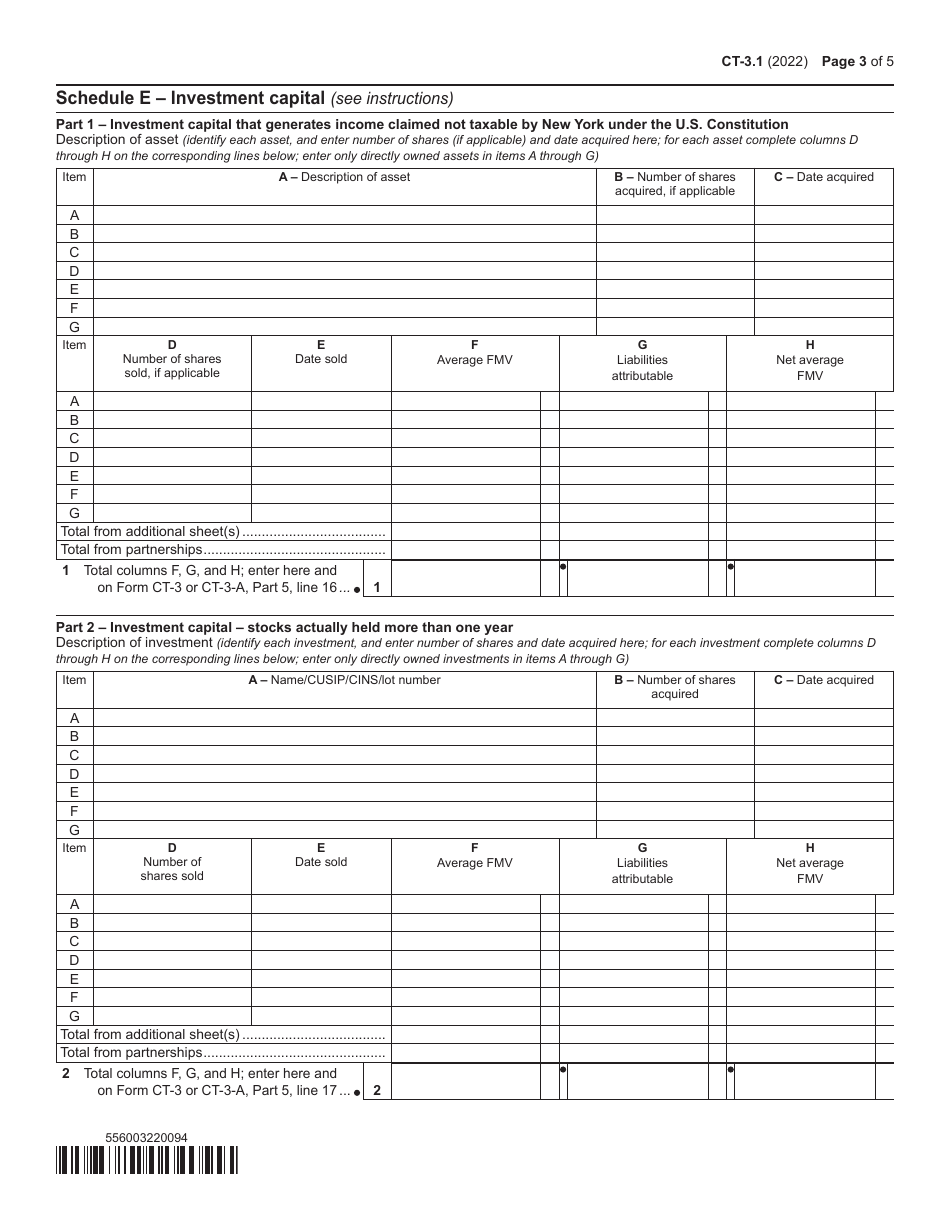

Form CT-3.1 Investment and Other Exempt Income and Investment Capital - New York

What Is Form CT-3.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-3.1?

A: Form CT-3.1 is a tax form used in New York to report investment and other exempt income and investment capital.

Q: Who needs to file Form CT-3.1?

A: Certain businesses and individuals in New York who have investment and other exempt income and investment capital need to file Form CT-3.1.

Q: What is considered investment and other exempt income?

A: Investment and other exempt income includes interest, dividends, capital gains, and certain other types of income that are exempt from taxation.

Q: What is investment capital?

A: Investment capital refers to the total value of investments held by a business or individual.

Q: Is Form CT-3.1 the same as Form CT-3?

A: No, Form CT-3.1 is a separate form specifically for reporting investment and other exempt income and investment capital.

Q: When is the deadline for filing Form CT-3.1?

A: The deadline for filing Form CT-3.1 varies depending on the taxpayer's filing status, but it is generally due on or before the extended due date of the corresponding income tax return.

Q: Are there any penalties for not filing Form CT-3.1?

A: Yes, failure to file Form CT-3.1 may result in penalties and interest charges.

Q: Can Form CT-3.1 be filed electronically?

A: Yes, Form CT-3.1 can be filed electronically using the New York State Department of Taxation and Finance's electronic filing systems.

Q: Do I need to attach any other documents to Form CT-3.1?

A: In some cases, additional supporting documentation may need to be attached to Form CT-3.1, such as schedules or statements related to specific types of income or investments.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.