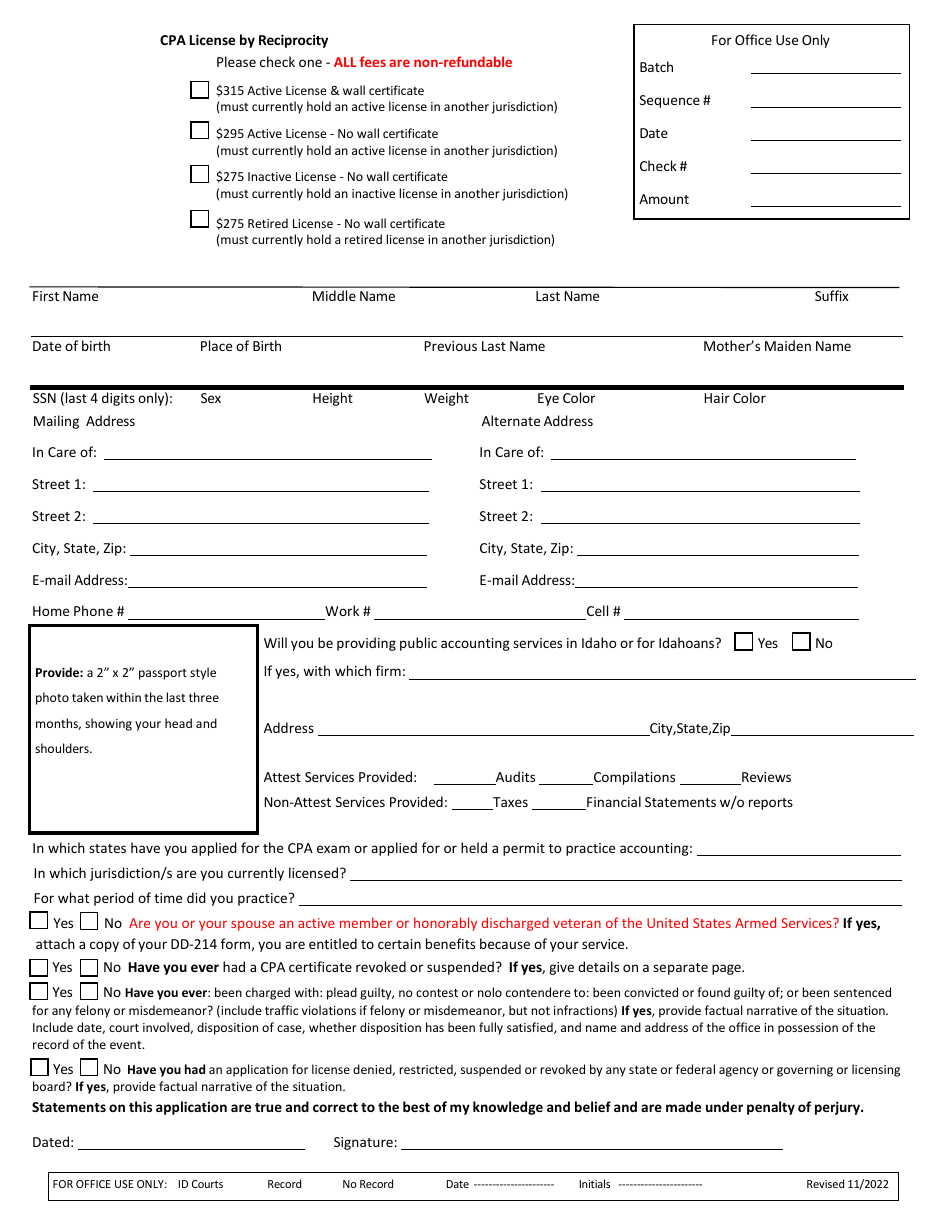

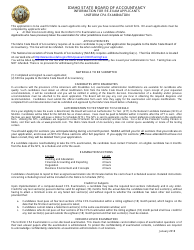

CPA License by Reciprocity Application - Idaho

CPA License by Reciprocity Application is a legal document that was released by the Idaho State Board of Accountancy - a government authority operating within Idaho.

FAQ

Q: What is a CPA license by reciprocity?

A: A CPA license by reciprocity allows licensed CPAs from other states to obtain a license in Idaho without having to take the entire CPA exam again.

Q: Who is eligible for a CPA license by reciprocity in Idaho?

A: CPAs who are already licensed and in good standing in another state may be eligible for a CPA license by reciprocity in Idaho.

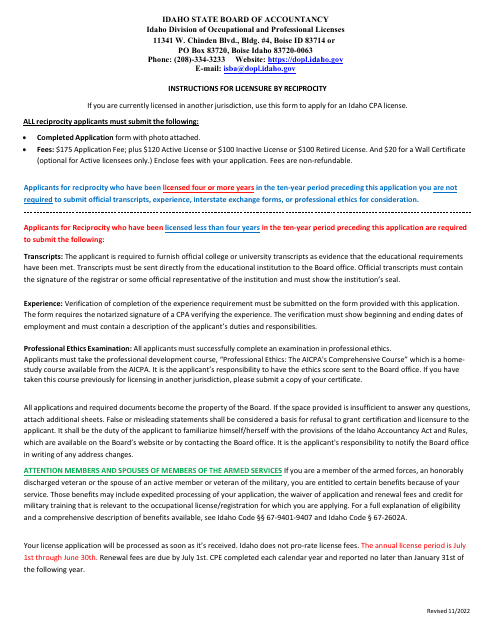

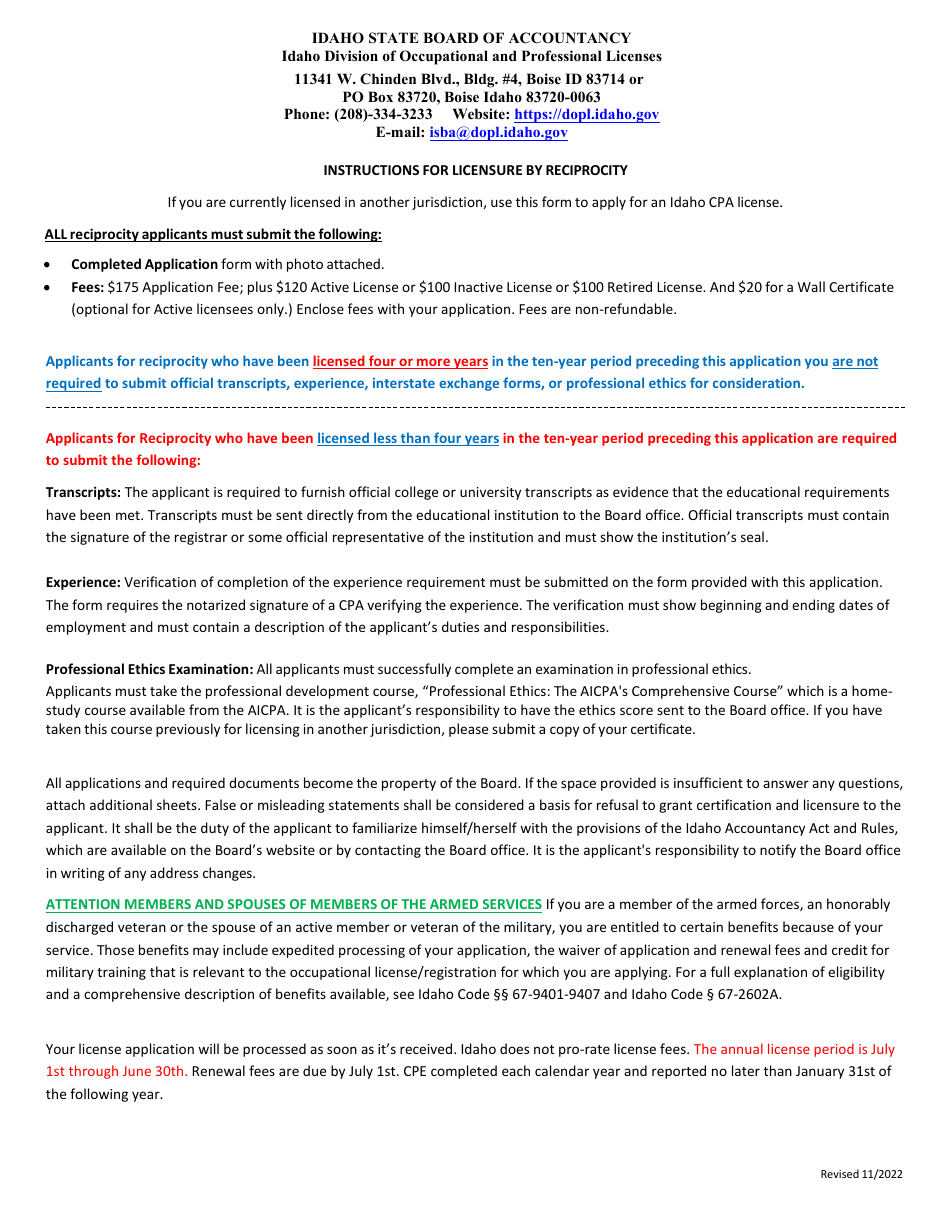

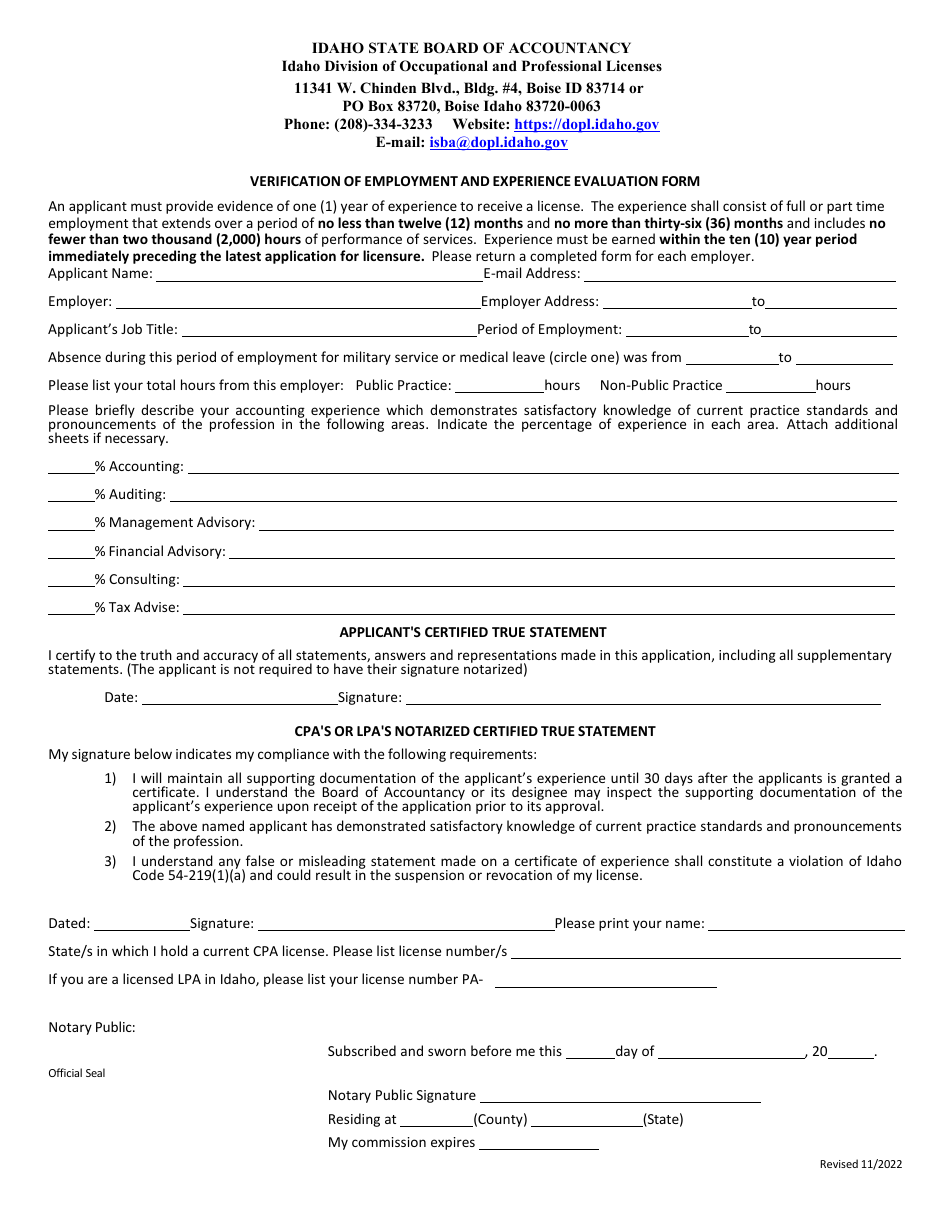

Q: What are the requirements for a CPA license by reciprocity in Idaho?

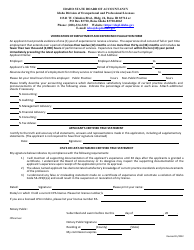

A: The requirements may vary, but typically include having an active CPA license in another state, meeting the education and experience requirements, and passing an ethics exam.

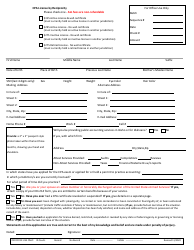

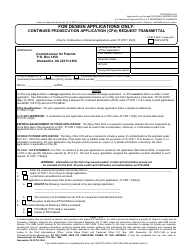

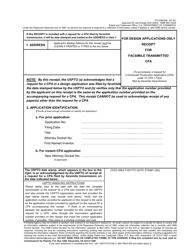

Q: How do I apply for a CPA license by reciprocity in Idaho?

A: You can apply by submitting an application to the Idaho State Board of Accountancy, providing the necessary documentation and fees, and meeting all the eligibility requirements.

Q: How long does the CPA license by reciprocity application process take in Idaho?

A: The processing time for a CPA license by reciprocity application in Idaho can vary, but it may take several weeks to months.

Q: Is there a fee for the CPA license by reciprocity application in Idaho?

A: Yes, there is typically a fee associated with the CPA license by reciprocity application in Idaho. The amount may vary.

Q: What if I don't meet all the requirements for a CPA license by reciprocity in Idaho?

A: If you don't meet all the requirements, you may still have options such as taking additional coursework or obtaining additional experience to fulfill the requirements.

Q: Can I practice as a CPA in Idaho with a license by reciprocity?

A: Yes, once you have obtained a CPA license by reciprocity in Idaho, you are eligible to practice as a CPA in the state.

Q: How often do I need to renew my CPA license in Idaho?

A: CPA licenses in Idaho typically need to be renewed every two years.

Q: What are the continuing education requirements for maintaining a CPA license in Idaho?

A: CPAs in Idaho are required to complete a certain number of continuing education hours, which may include courses in ethics, accounting, auditing, and other relevant topics.

Form Details:

- Released on November 1, 2022;

- The latest edition currently provided by the Idaho State Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Idaho State Board of Accountancy.