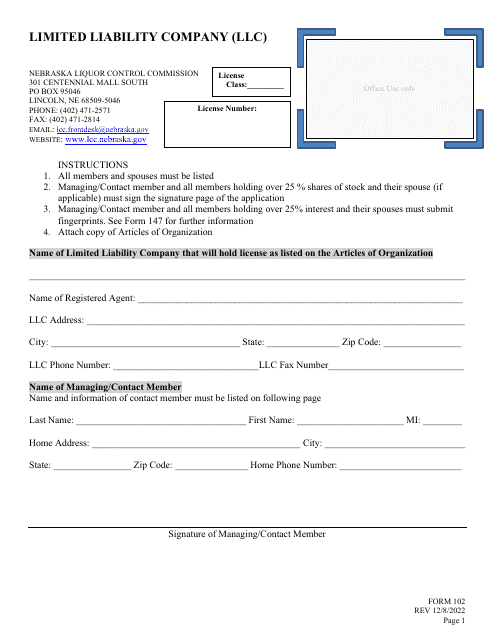

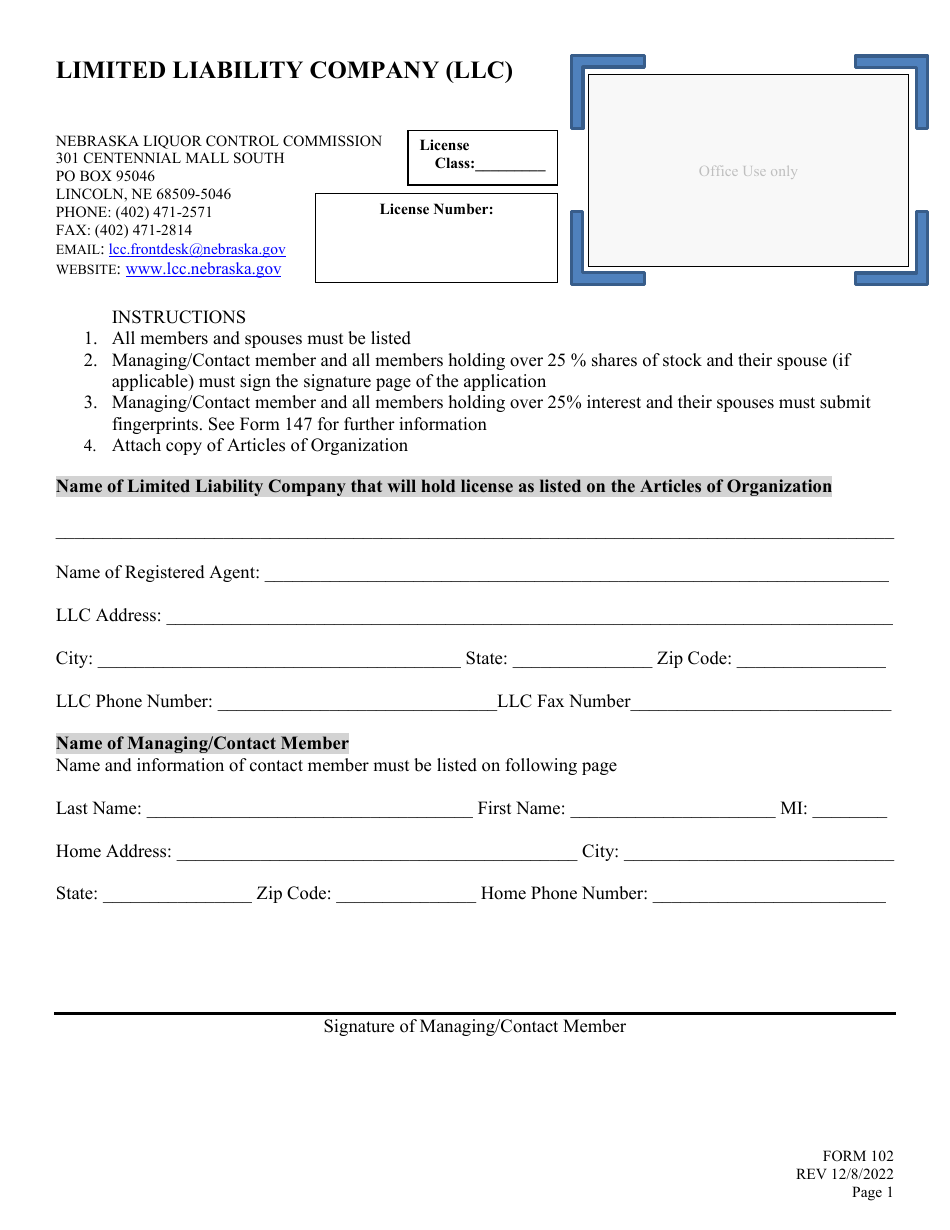

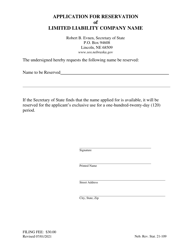

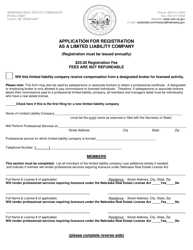

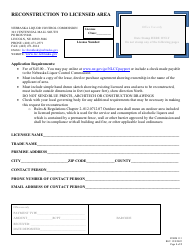

Form 102 Application for Liquor License - Limited Liability Company (LLC) - Nebraska

What Is Form 102?

This is a legal form that was released by the Nebraska Liquor Control Commission - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 102?

A: Form 102 is the application for a liquor license for Limited Liability Companies (LLCs) in Nebraska.

Q: Who needs to fill out Form 102?

A: LLCs in Nebraska that want to apply for a liquor license need to fill out Form 102.

Q: What is the purpose of Form 102?

A: The purpose of Form 102 is to apply for a liquor license as an LLC in Nebraska.

Q: Are there any fees associated with Form 102?

A: Yes, there are fees associated with Form 102. The exact amount depends on the type of license being applied for.

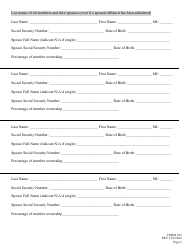

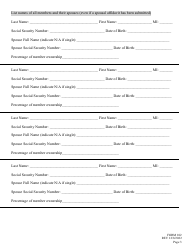

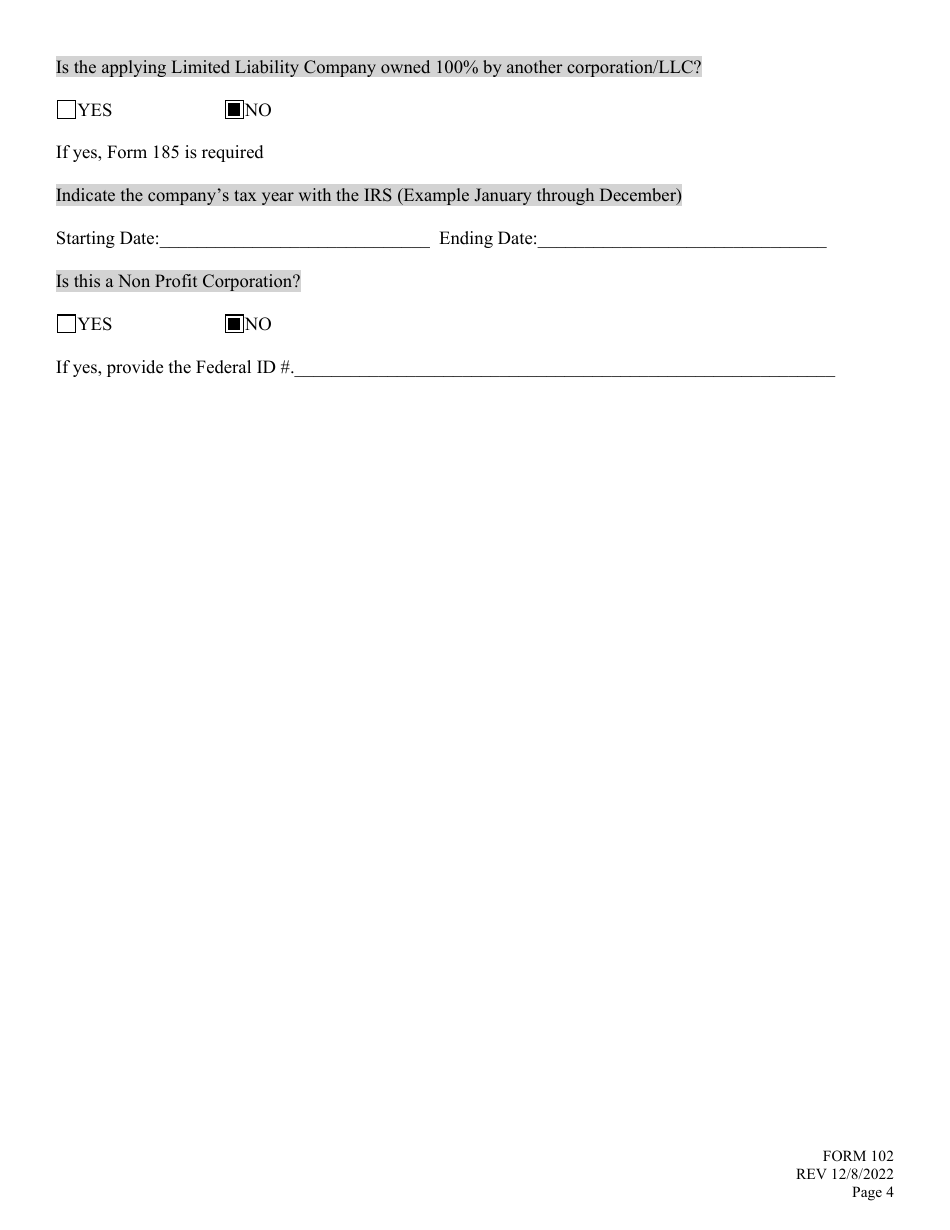

Q: What supporting documents are required with Form 102?

A: Supporting documents may include the LLC's articles of organization, a copy of the lease or ownership of the premises, and the LLC's tax ID number.

Q: How long does it take to process Form 102?

A: The processing time for Form 102 can vary, but it typically takes several weeks to months to complete the entire application process.

Q: Can an LLC operate without a liquor license?

A: No, an LLC in Nebraska cannot legally sell or serve alcohol without a valid liquor license.

Q: What happens after submitting Form 102?

A: After submitting Form 102, the Nebraska Liquor Control Commission will review the application and may request additional information or schedule an inspection.

Q: Are there any restrictions or regulations for liquor licenses in Nebraska?

A: Yes, there are various restrictions and regulations for liquor licenses in Nebraska, including age restrictions, hours of operation, and compliance with state laws.

Form Details:

- Released on December 8, 2022;

- The latest edition provided by the Nebraska Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 102 by clicking the link below or browse more documents and templates provided by the Nebraska Liquor Control Commission.