This version of the form is not currently in use and is provided for reference only. Download this version of

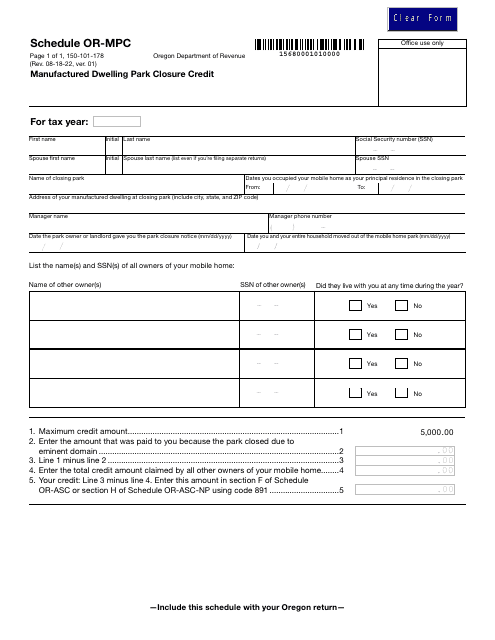

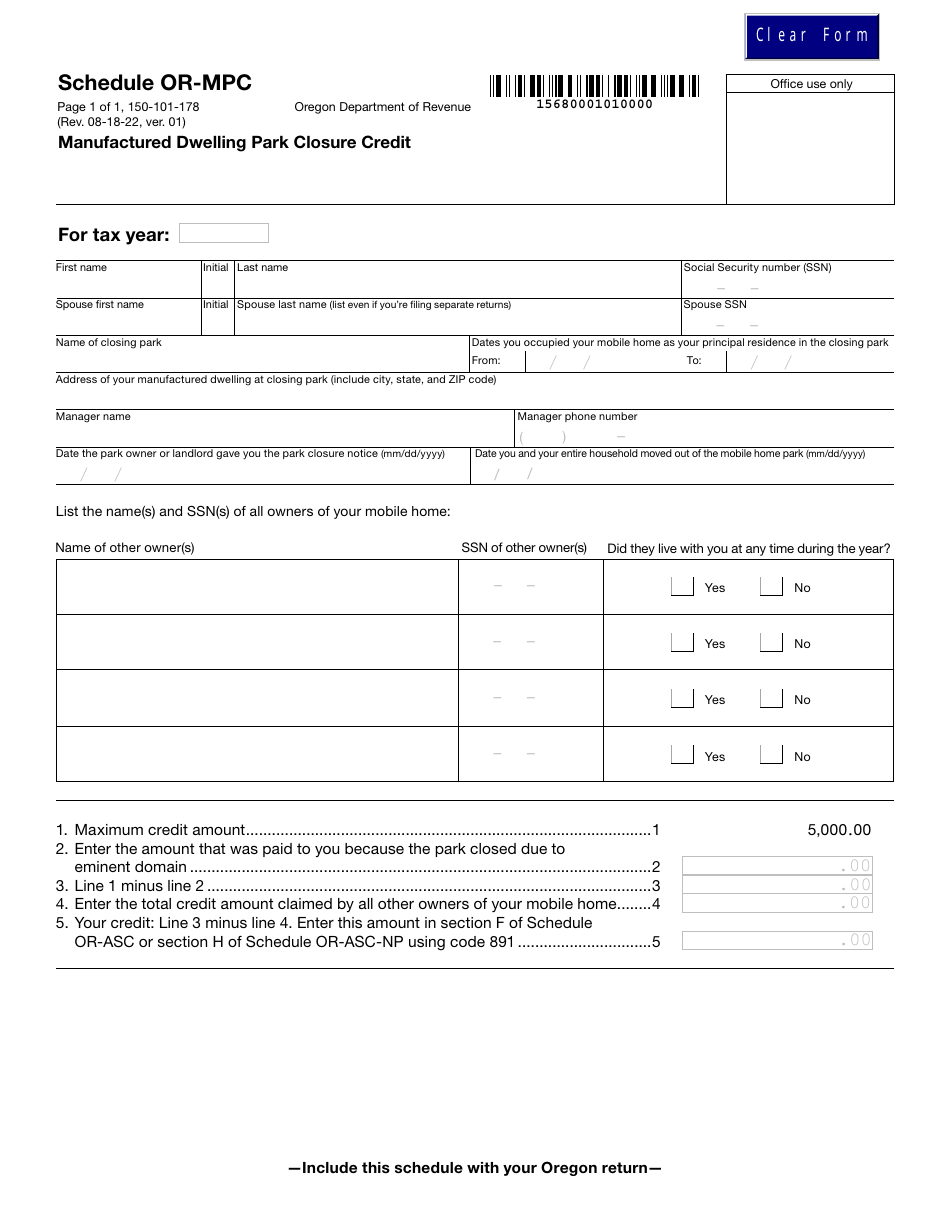

Form 150-101-178 Schedule OR-MPC

for the current year.

Form 150-101-178 Schedule OR-MPC Manufactured Dwelling Park Closure Credit - Oregon

What Is Form 150-101-178 Schedule OR-MPC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-178?

A: Form 150-101-178 is a schedule used in Oregon for claiming the Manufactured Dwelling Park Closure Credit.

Q: What is the Manufactured Dwelling Park Closure Credit?

A: The Manufactured Dwelling Park Closure Credit is a tax credit available in Oregon for the closure of a manufactured dwelling park.

Q: Who can claim the Manufactured Dwelling Park Closure Credit?

A: The credit can be claimed by the owner of a manufactured dwelling park that is being closed.

Q: What is the purpose of the Manufactured Dwelling Park Closure Credit?

A: The purpose of the credit is to provide financial assistance to park owners for the cost of closing a manufactured dwelling park.

Q: How is Form 150-101-178 used?

A: Form 150-101-178 is used to calculate and claim the Manufactured Dwelling Park Closure Credit in Oregon.

Form Details:

- Released on August 18, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-178 Schedule OR-MPC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.