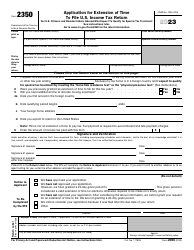

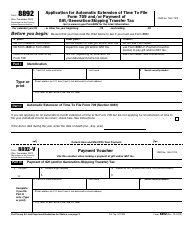

This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-40-EXT (150-101-165)

for the current year.

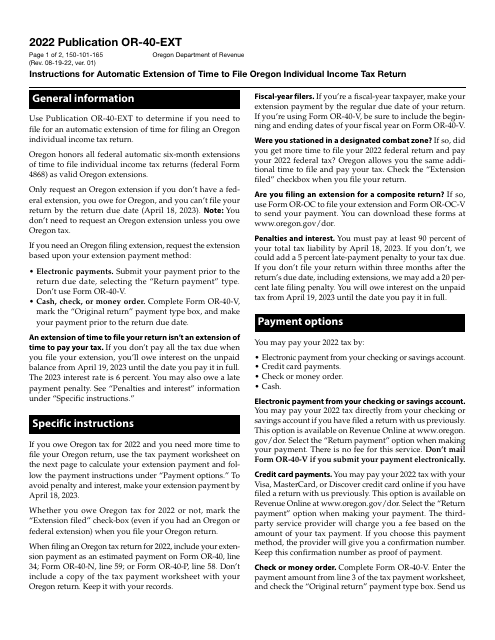

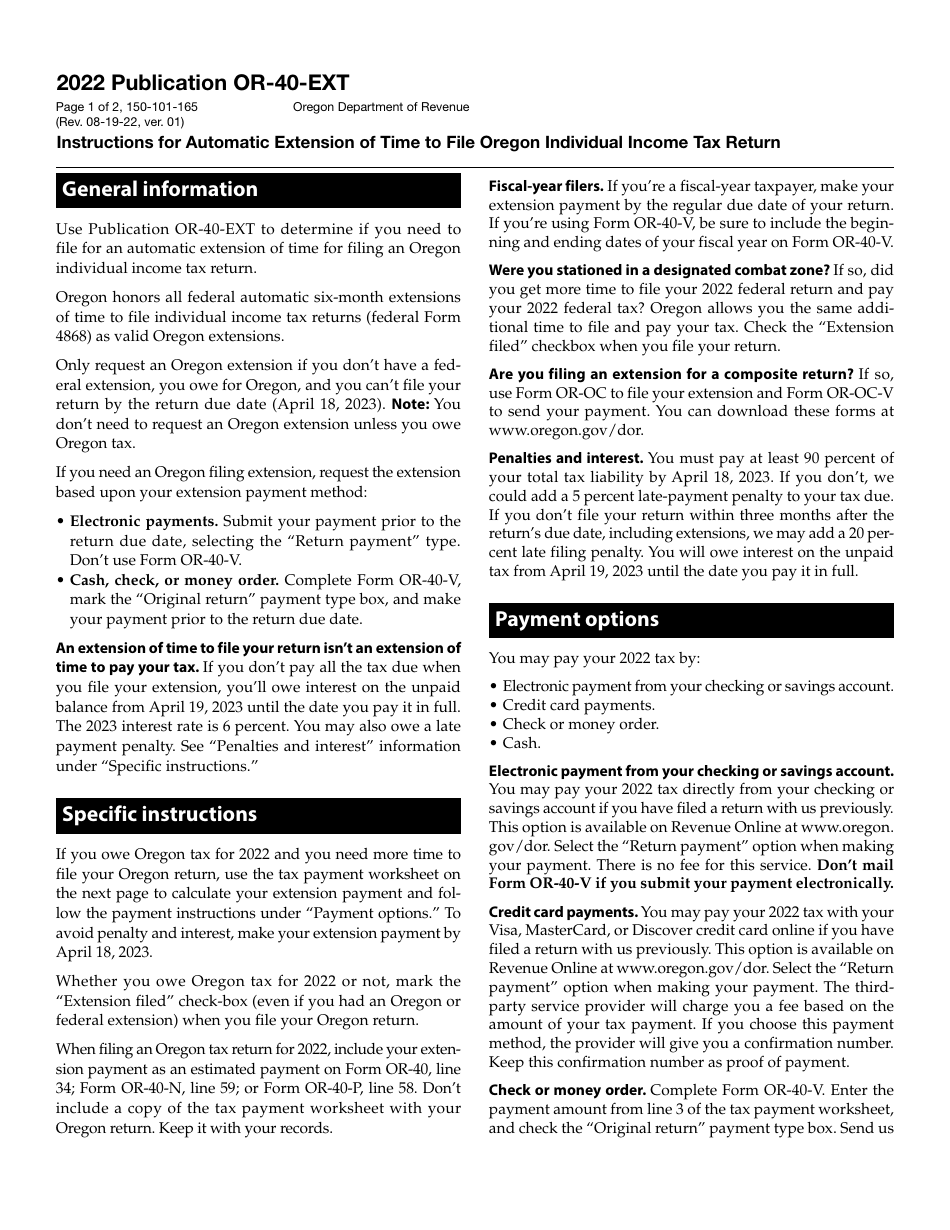

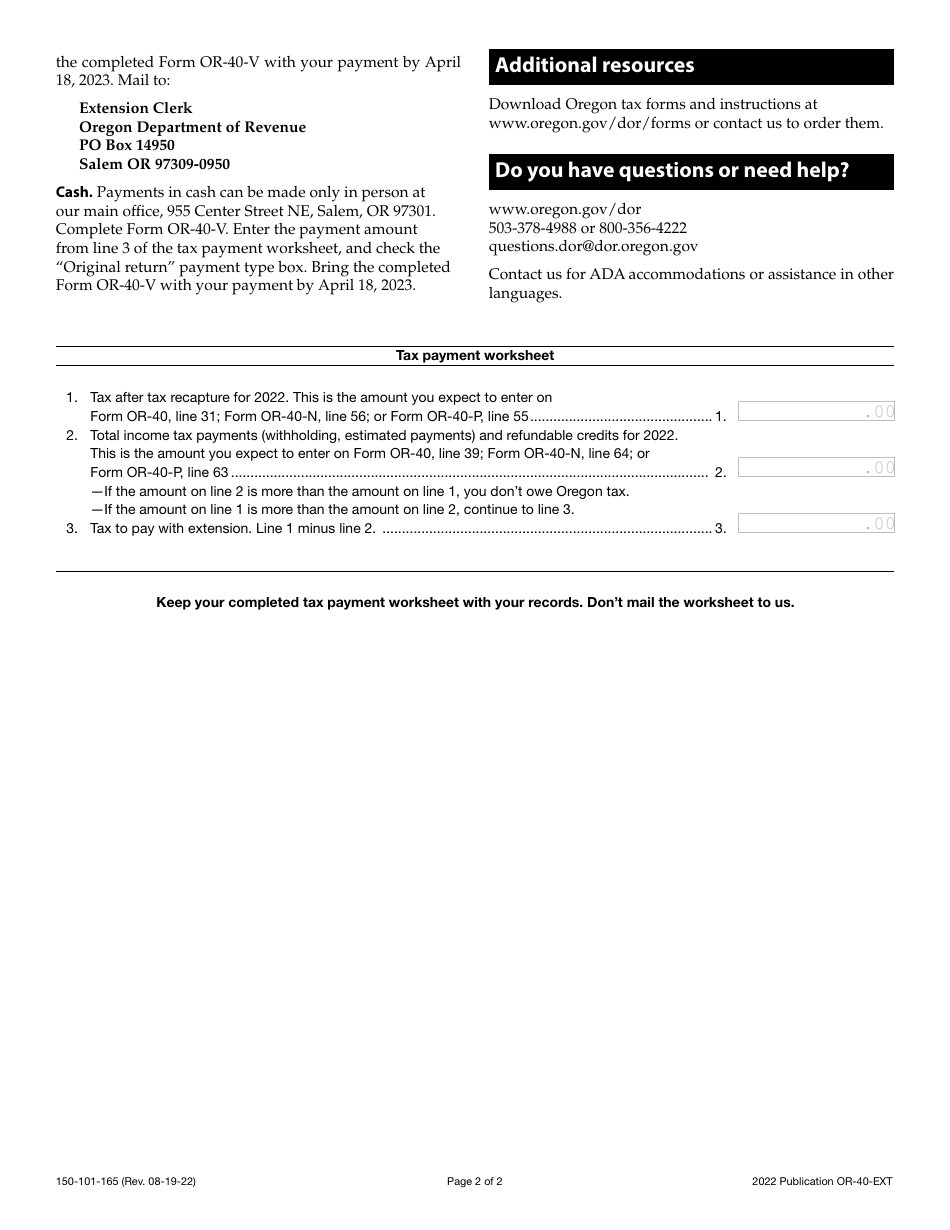

Form OR-40-EXT (150-101-165) Instructions for Automatic Extension of Time to File Oregon Individual Income Tax Return - Oregon

What Is Form OR-40-EXT (150-101-165)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-40-EXT?

A: Form OR-40-EXT is the form used to request an automatic extension of time to file an Oregon Individual Income Tax Return.

Q: Who can use Form OR-40-EXT?

A: Any resident or nonresident individual who needs additional time to file their Oregon Individual Income Tax Return can use Form OR-40-EXT.

Q: When is the deadline to file Form OR-40-EXT?

A: Form OR-40-EXT must be filed by the original due date of the individual income tax return, which is usually April 15th.

Q: How long is the automatic extension granted by Form OR-40-EXT?

A: Form OR-40-EXT grants an automatic extension of six months, extending the filing deadline to October 15th.

Q: Is there a penalty for filing Form OR-40-EXT?

A: No, there is no penalty for filing Form OR-40-EXT as long as you pay the full amount of tax owed by the original due date.

Q: Do I need to submit any payment with Form OR-40-EXT?

A: No, you do not need to submit any payment with Form OR-40-EXT. However, any taxes owed must be paid by the original due date to avoid penalties and interest.

Q: Can I e-file Form OR-40-EXT?

A: No, Form OR-40-EXT cannot be e-filed. It must be submitted by mail to the Oregon Department of Revenue.

Q: What should I do if I need more time beyond the six-month extension?

A: If you need more time beyond the six-month extension granted by Form OR-40-EXT, you must contact the Oregon Department of Revenue to request additional time.

Q: Can I use Form OR-40-EXT to extend the payment deadline?

A: No, Form OR-40-EXT is only for extending the filing deadline. Any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Details:

- Released on August 19, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-40-EXT (150-101-165) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.