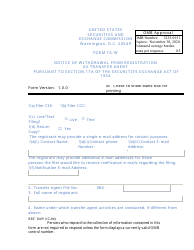

This version of the form is not currently in use and is provided for reference only. Download this version of

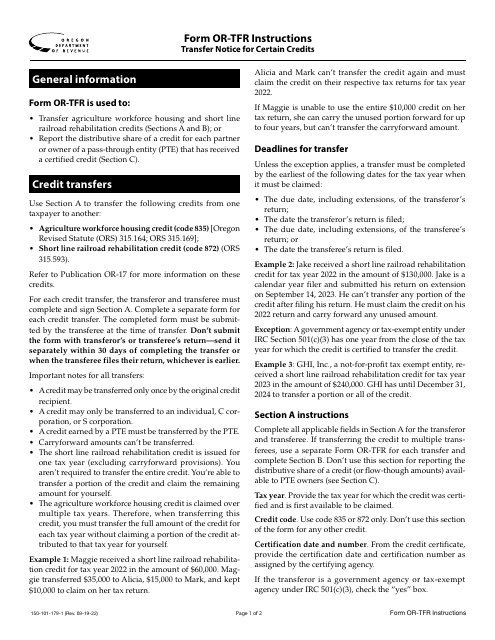

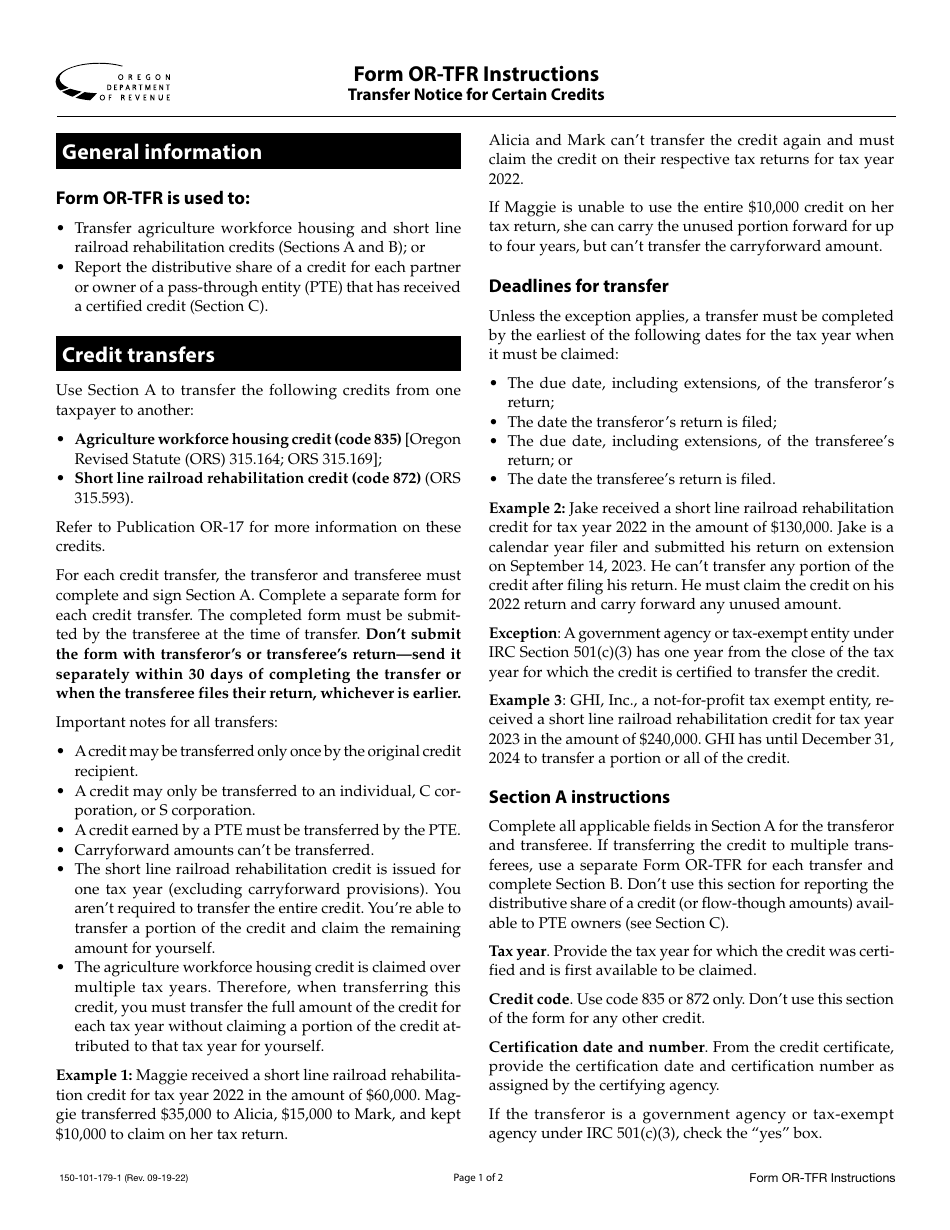

Instructions for Form OR-TFR, 150-101-179

for the current year.

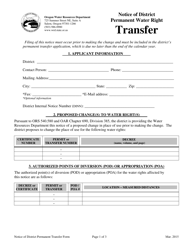

Instructions for Form OR-TFR, 150-101-179 Transfer Notice for Certain Credits - Oregon

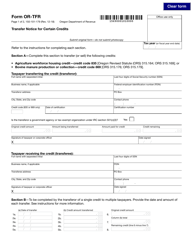

This document contains official instructions for Form OR-TFR , and Form 150-101-179 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-179 (OR-TFR) is available for download through this link.

FAQ

Q: What is Form OR-TFR?

A: Form OR-TFR is the Transfer Notice for Certain Credits in Oregon.

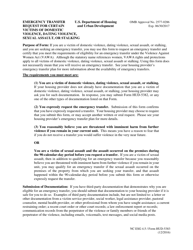

Q: What is the purpose of Form OR-TFR?

A: The purpose of Form OR-TFR is to transfer certain tax credits in Oregon.

Q: Who needs to file Form OR-TFR?

A: Anyone who wishes to transfer certain tax credits in Oregon needs to file Form OR-TFR.

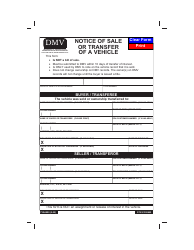

Q: What credits can be transferred using Form OR-TFR?

A: Form OR-TFR can be used to transfer credits like the Research Expense Credit, the Excise Tax Credit, and the Renewable Energy Development Grants Credit, among others.

Q: Is there a deadline for filing Form OR-TFR?

A: Yes, there is a deadline for filing Form OR-TFR, which is usually the same as your income tax return deadline.

Q: Can Form OR-TFR be filed electronically?

A: Yes, Form OR-TFR can be filed electronically using the Oregon Department of Revenue's e-file system.

Q: What happens after I file Form OR-TFR?

A: After you file Form OR-TFR, the Oregon Department of Revenue will review your transfer request and notify you of any adjustments or changes.

Q: Are there any fees associated with filing Form OR-TFR?

A: No, there are no fees associated with filing Form OR-TFR.

Q: Can I amend a previously filed Form OR-TFR?

A: Yes, you can amend a previously filed Form OR-TFR by submitting a new form with the correct information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.