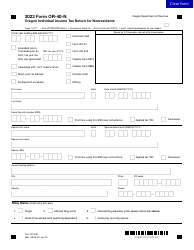

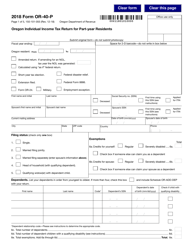

This version of the form is not currently in use and is provided for reference only. Download this version of

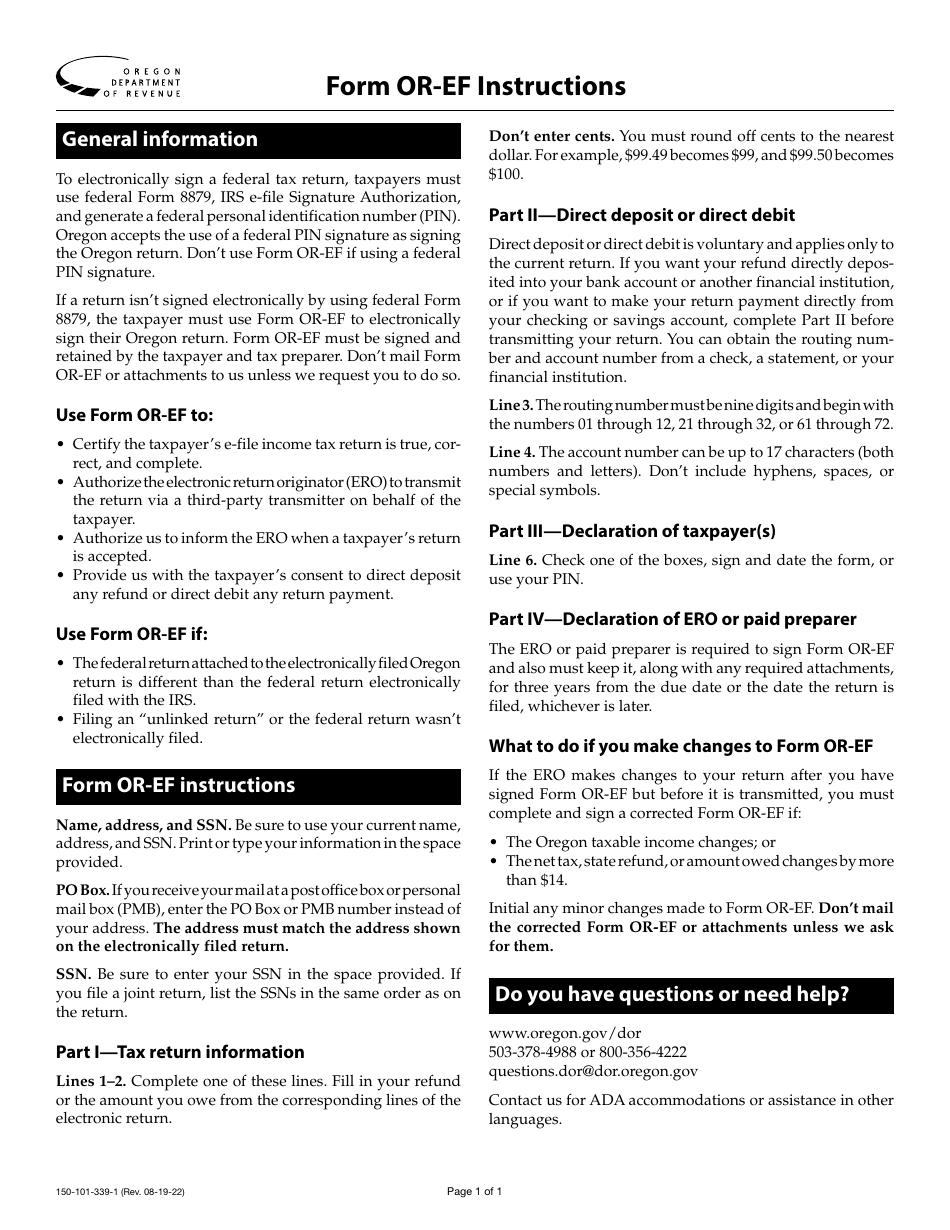

Instructions for Form OR-EF, 150-101-339

for the current year.

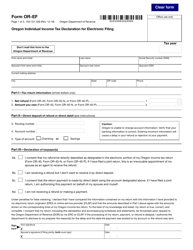

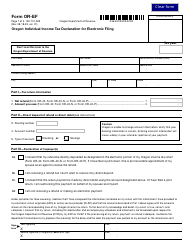

Instructions for Form OR-EF, 150-101-339 Oregon Individual Income Tax Declaration for Electronic Filing - Oregon

This document contains official instructions for Form OR-EF , and Form 150-101-339 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-339 (OR-EF) is available for download through this link.

FAQ

Q: What is Form OR-EF?

A: Form OR-EF is the Oregon Individual Income Tax Declaration for Electronic Filing.

Q: Who needs to file Form OR-EF?

A: Any Oregon resident who is required to file an individual income tax return and prefers to file electronically needs to file Form OR-EF.

Q: What is the purpose of Form OR-EF?

A: Form OR-EF is used to declare and report all income earned by an individual in Oregon for the purpose of electronic filing of their state income tax return.

Q: When is the deadline for filing Form OR-EF?

A: The deadline for filing Form OR-EF is the same as the deadline for filing your Oregon state income tax return, which is typically April 15th.

Q: Is there a fee for filing Form OR-EF?

A: No, there is no fee for filing Form OR-EF. It is a free service provided by the Oregon Department of Revenue.

Q: What attachments are required with Form OR-EF?

A: You may be required to attach certain forms and documents, such as W-2s or 1099s, depending on your individual tax situation. Refer to the instructions for Form OR-EF for more information.

Q: Can I file Form OR-EF for a joint return?

A: Yes, you can file Form OR-EF for a joint return if you meet the eligibility requirements.

Q: Can I file Form OR-EF if I owe taxes?

A: Yes, you can still file Form OR-EF if you owe taxes. However, you must pay any balance due by the tax filing deadline to avoid penalties and interest.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.